- Pivot & Flow

- Posts

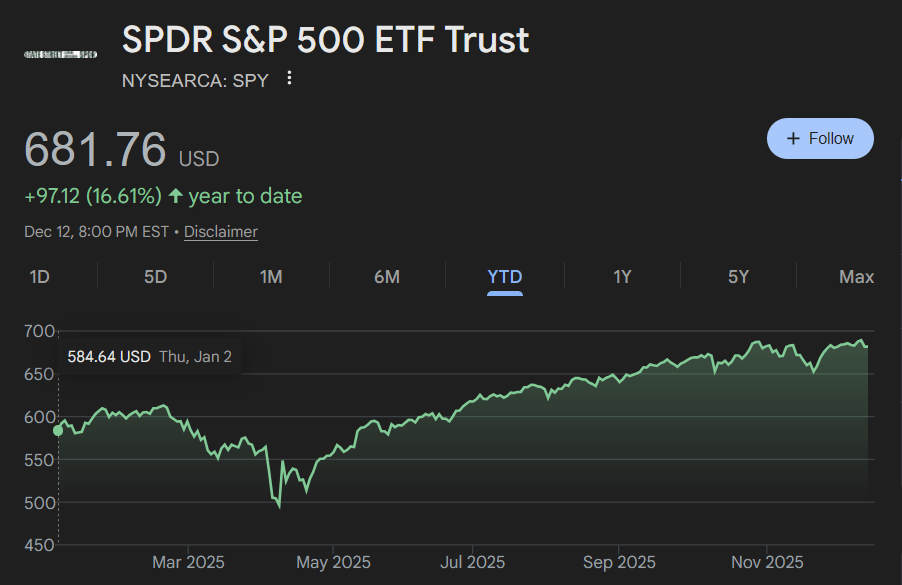

- The S&P 500 Isn’t in a Bubble.

The S&P 500 Isn’t in a Bubble.

It’s still in a Weighting Problem.

Happy Sunday

Here's another "bubble boy rant" from yours truly.

I'm developing a mental framework for how I'm currently viewing this market, and I want to share it. There's a ton of fear right now about the AI bubble and overvaluations across the board. These are valid concerns for folks who have 80% of their net worth in the stock market.

When your portfolio is basically seven tech tickers in a trench coat, the temptation is to declare we've entered 1999 again.

To me though, this doesn't look like a broad-market bubble. It looks like a narrow leadership trade with a massive weight in your index fund.

That distinction matters, because it changes the risk from "everything is fake and will go to zero" to "a few giants are priced for greatness and could still get re-rated down."

Let's dig in…

There are two markets hiding inside one index

Most people say "the S&P 500" like it's a single thing. It isn't. It's two different movies playing on the same screen.

Movie #1: The cap-weighted S&P 500 is the one you own in most index funds. The biggest companies get the biggest vote. If the top names move, the whole index moves.

Movie #2: The equal-weight S&P 500 gives every company one vote. It's closer to "how are the average stocks doing?"

Right now, those two movies have different plots.

The pattern looks like this:

Equal-weight valuations: a bit above normal

Cap-weight valuations: noticeably above normal

The "market is expensive" argument is mostly a "mega-caps are expensive" argument.

When someone says "everything is in a bubble," ask them a mildly annoying question:

Do you mean the median stock, or do you mean the seven names that are basically the index?

When that gap is wide, you have concentration risk.

"It's just like the dot-com bubble!" (Not really.)

Dot-com wasn't just "tech got expensive." It was a market that would fund anything with a URL and a pulse companies with no profits, no durable business, no path to either.

Today's market leaders are none of those things. They're some of the most profitable businesses on Earth with huge revenue bases, sticky distribution, real margins, and multiple products that would each be real companies on their own.

That doesn't mean they can't be overvalued. It means the downside is more likely to be valuation gravity than business model extinction. In 2000, a lot of stuff died because it never lived. Today, the more plausible pain trade is great companies priced too optimistically, delivering merely great results instead of god-tier results.

The overlooked point: the MAG 7 aren't "AI companies" (yet)

Most of the cash these companies generate still comes from the same engines they've had for years: cloud, ads, devices, enterprise software, marketplaces, subscriptions. Even if AI monetization takes longer than expected, gets commoditized faster, or costs more than anyone wants to admit, these firms don't suddenly become pumpkins at midnight.

AI doesn't need AGI to matter financially. If it simply makes organizations a little faster, leaner, and better at converting attention into revenue, that's real economics. AI might be real and the stocks might still be priced for too much perfection.

Today’s Sponsor

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

The actual risk isn't fake revenue. It's the price you paid.

You don't need fraud for stocks to drop 40%. You just need expectations to come down.

If a company is priced for growth staying unusually high, margins staying unusually high, competition politely staying away, and capex turning into profits quickly, then the bear case doesn't have to be "collapse." It can be "normal."

"Normal" can still be brutal, because the market stops paying premium multiples when the story gets less exciting. These companies can keep winning and still disappoint investors.

AI can be genuinely useful, making organizations incrementally better, and still not justify current multiples if the payoff is evolutionary rather than revolutionary.

"If AI cools off, we'll just rotate." Maybe. But don't imagine a smooth handoff.

The optimistic version goes like this:

Mega-cap tech cools → money rotates into the rest of the market → the index stays fine → everyone feels smart.

Sometimes that happens. But the more common real-world version is messier:

Mega-cap tech sells off → the index sells off (because weights) → risk appetite drops → people raise cash → then rotation happens, later, at a worse price, after everyone's already angry/spicy.

Rotation is possible. Just don't confuse "possible" with "automatic."

What I'm actually saying

I don't buy the "market is in a bubble" take. Yes, the frothy sweet cold foam is concentrated. The leaders are profitable, durable businesses, not dot-com vaporware.

We're running a high-concentration, high-expectations setup where a re-rating of a few names can pull down the headline index without any fraud, without any catastrophe, and without anyone being "wrong" about AI long-term.

Remember those two movies? The gap between cap-weighted and equal-weighted performance is your actual risk indicator.

When that gap is wide, you don't have diversification. You have concentration risk.

The question isn't "Is AI real?" The question is: how much perfection is already in the price, and how much of your "diversification" is actually one crowded trade?

Stay curious 🙂

- John