- Pivot & Flow

- Posts

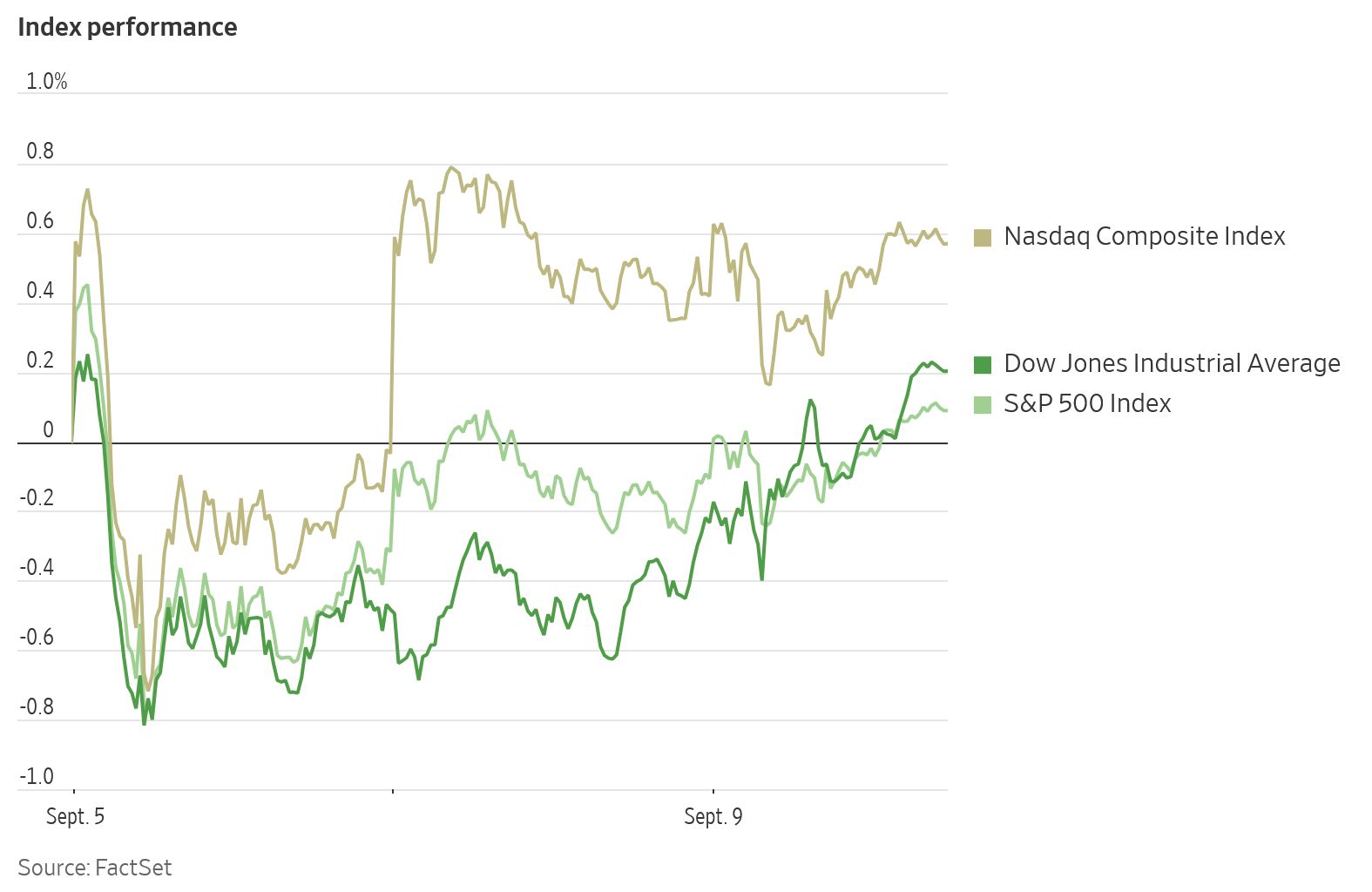

- September 9th Market Overview

September 9th Market Overview

September 9th Market Overview (no fluff)

Happy Tuesday

Market is seeing buyers lean in despite a 900k-job revision, rate cut odds carrying more weight than the payroll math. AI compute got another anchor contract from Nebius and Microsoft, and Apple’s iPhone day really kept megacap tech in focus.

Under the hood, small caps lagged.

Let's dig in...

Today's Big Picture

Jobs revision and the rate path

The BLS cut 911,000 jobs from the 12 months through March, dropping the average pace to roughly 71,000 per month from 147,000. That's the largest revision on record and confirms what many suspected about labor market weakness. Markets now expect Fed cuts next week, but this week's inflation data will decide how aggressive they get. Bond yields went up despite the weak jobs news, so Thursday's CPI matters.

Copper consolidation

Anglo American and Teck $TECK agreed to merge into a top-5 copper producer of about 1.2 million tons a year. Anglo holders get 62.4%, Teck gets 37.6%, plus a $4.5B special dividend before closing. The timing works as everyone wants exposure to copper and critical materials.

AI infrastructure steps up

Nebius $NBIS signed a multi-year, multi-billion dollar deal to provide GPU capacity to Microsoft $MSFT. The contract supports their new Vineland, NJ data center launching later this year, with the deal itself backing the financing. Other AI infrastructure stocks moved higher on the news.

P.S. You’re’ making better decisions from reading this.

A few readers help support it. Consider becoming a Premium Subscriber and supporting the daily overview.

I’m currently building a “members only” scanner that will be free to all premium subs.

Market Overview

U.S. Stock Indexes

Stock Spotlight

Nebius $NBIS ( ▲ 16.56% )

Multi-year AI infrastructure deal with Microsoft. Services will run from a new Vineland, NJ data center later this year, with financing tied to the contract. Goldman Sachs says this opens doors to more deals with big cloud companies.

UnitedHealth Group $UNH ( ▲ 3.02% )

About 78% of Medicare Advantage members should be in 4-star or higher plans for 2027. Reaffirmed 2025 earnings outlook. Higher star ratings mean better government payments.

Teck Resources $TECK ( ▲ 2.86% )

Merging with Anglo American to create a top-5 copper producer. Anglo holders get 62.4%, Teck gets 37.6%. Plus a $4.5B special dividend before closing.

CoreWeave $CRWV ( ▲ 20.5% )

Launched a venture fund to invest in AI companies. Expands beyond just providing GPUs to actually backing AI startups.

Big Name Updates

Apple $AAPL ( ▲ 0.8% )

Unveiled the iPhone 17 lineup, including a thinner "iPhone Air" at $999, with the base model at $799 and the entry Pro at $1,099 after cutting the cheaper storage option. The Air is basically a preview of the foldable iPhone coming next year. Evercore thinks Apple can keep getting paid by Google for search placement.

Tesla $TSLA ( ▲ 3.5% )

Introduced "Megablock," a 20 MWh energy storage unit with 25-year life and 91% efficiency. Planning 50 GWh annual production starting late 2026. Could generate around $14B in annual sales from Tesla's most profitable business.

Nvidia $NVDA ( ▲ 7.87% )

Got H20 licenses for several key customers in China. Removes the uncertainty around selling chips internationally under current export rules.

Meta $META ( ▼ 1.31% )

Bank of America started coverage with a Buy ahead of the Sep 17 Connect conference. Expects reveals of new smart glasses, gesture control, and updated developer tools.

Other Notable Company News

Boeing $BA ( ▲ 2.57% )

FAA said no decision yet on lifting the 38-per-month cap on 737 MAX production. Oversight remains in place following the January 2024 mid-air emergency. Boeing hopes to seek approval to move to 42 per month in coming months.

Energy Fuels $UUUU ( ▲ 8.32% )

Its U.S.-mined rare earth oxide passed quality tests with South Korea's largest EV motor maker. About 1.2 tonnes of oxide made roughly 3 tonnes of magnets for about 1,500 EVs. White Mesa Mill is the only U.S. facility that can do this processing.

Fluor $FLR ( ▲ 4.34% )

Won a defense contract spot that lets it compete for orders worth up to $3.5B over 10 years.

Serve Robotics $SERV ( ▲ 16.16% )

Bought two tech companies for $5.75M to improve its delivery robots. Adding faster streaming tech as it scales to 2,000 robots with Uber Eats.

GEMI space Station $GEMI ( ▲ 14.63% )

Reiterated an IPO price range of $17–19 and plans to list on Nasdaq under ticker GEMI.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year sits near 4.085%, with yields firming ahead of PPI and CPI. This reflects sensitivity to inflation prints after the jobs revision. A cooler CPI supports cuts and duration. The counterintuitive move higher despite weak employment data suggests traders are more focused on inflation than growth right now.

Policy Watch

Jobs data politics

BLS benchmark revision removed 911,000 jobs from April 2024–March 2025 totals. The White House plans a report on BLS methodology after President Trump fired the agency head in August.

Fed expectation

Recent data bolstered expectations for a rate cut at next week's meeting. Markets now key off CPI to gauge the path beyond September.

Bank of Japan

Leaning toward slightly reducing super-long JGB purchases in Oct–Dec and expected to keep rates unchanged on Sep 19. The central bank sees a chance for rate hikes later this year despite political uncertainties.

Tariff refunds

A Supreme Court outcome on tariff legality could trigger refunds that Treasury estimated could reach $750B to $1T if lower courts' rulings on illegal trade levies are upheld.

Today’s Sponsor

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

What to Watch

Inflation data this week

PPI Wednesday, CPI Thursday. These numbers decide if the Fed cuts 25 or 50 basis points next week. A hot CPI reading could flip the whole easing narrative and cause serious volatility.

Fed meeting next week

Markets expect cuts but the press conference will show how aggressive they plan to get. Powell's language on the labor market weakness will set the tone for the rest of the year.

Nebius follow-through

The Microsoft deal validates the AI infrastructure space. Watch if other big cloud companies start signing similar deals - that's when you know the theme has legs.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.