- Pivot & Flow

- Posts

- September 30th Market Overview

September 30th Market Overview

September 30thMarket Overview (no fluff)

Happy Tuesday

Markets closed out September up over 3% in a month that usually drops. I’m making a note of that on my desk. Washington is arguing over a shutdown at midnight that nobody seems worried about.

I bought some VXX just in case things get a bit more dicey on that front this week into next.

Consumer confidence hit lowest reading since April. Construction jobs at eight-year lows. But the S&P keeps climbing. Price beats headlines every time until it doesn't.

I'm in a very skeptical mindset right now, inclined to believe a red October is in our future but for now I'll follow the price action.

Let's dig in...

Today's Big Picture

AI orders, not promises

CoreWeave signed a $14.2 billion multi-year deal to supply AI cloud infrastructure to Meta Platforms.The deal validates the compute arms race these companies are buying servers, chips, and power capacity right now. Nvidia supply forecasts jumped on the news.

Shutdown risk meets data blackout

The government likely shuts down at midnight after talks stalled over healthcare subsidies covering 22 million Americans. House Speaker Mike Johnson said he's "skeptical" a deal gets done.

The Bureau of Labor Statistics will halt all reports during a shutdown, Friday's jobs report won't release. Consumer confidence dropped to 94.2, the lowest since April, with labor market assessments falling for the ninth straight month. The Fed's October meeting now faces thinner data.

Drug pricing gets a White House deal

Pfizer CEO Albert Bourla appeared at the White House to announce lower drug costs across the company's portfolio. The deal includes a three-year tariff exemption in exchange for expanding U.S. manufacturing and cutting Medicaid prices. Healthcare stocks moved higher on the news.

Market Overview

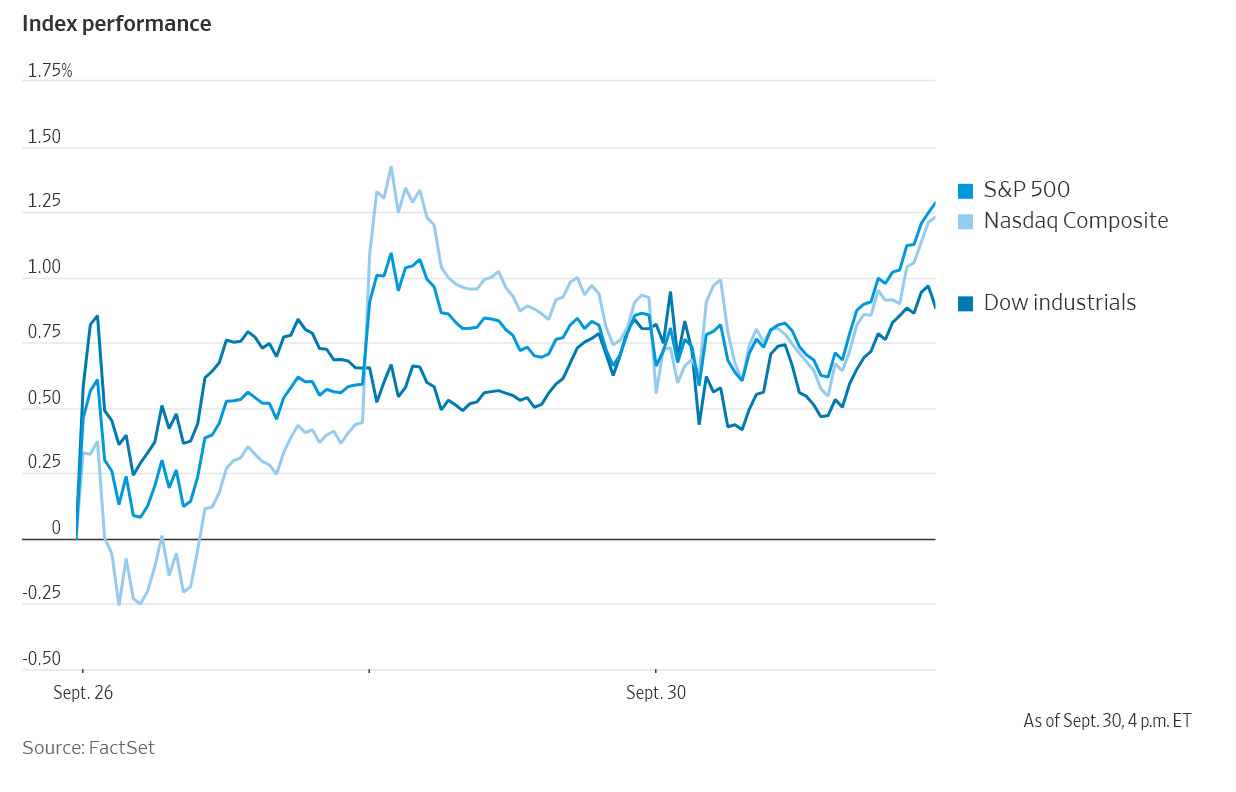

Index Performance

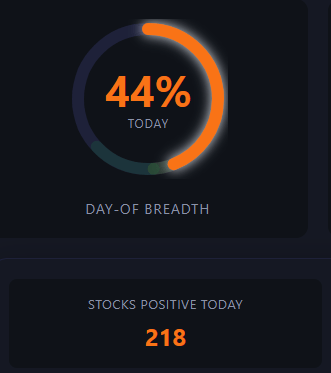

preview of today’s Market Health Dashboard

Stock Spotlight

Pfizer $PFE ( ▼ 0.78% )

White House deal: lower drug costs, three-year tariff exemption for expanding U.S. manufacturing. Moved the whole pharma sector.

Intel $INTC ( ▼ 1.14% )

18A chip yields stalled at 50-55%. Panther Lake may slip to Q2 2026. May outsource 60-70% of next-gen production to TSMC $TSM.

Etsy $ETSY ( ▲ 8.39% )

Pulled back after Monday's 16% pop on OpenAI partnership. BTIG raised target to $81 on agentic commerce potential.

Wolfspeed $WOLF ( ▼ 2.1% )

Exited bankruptcy with debt cut 70%. Silicon carbide chip supply continues.

Big Name Updates

Nvidia $NVDA ( ▲ 1.02% )

KeyBanc raised supply forecasts—up 90% for 2025. Rack shipments track to 30,000 this year, 50,000+ next year.

Tesla $TSLA ( ▲ 0.03% )

Canaccord upgraded to buy, $490 target on improving deliveries. Gen-3 humanoid robot debuts by year-end.

Meta Platforms $META ( ▲ 1.69% )

$14.2 billion AI cloud deal with CoreWeave $CRWV validates compute spending scale.

Spotify $SPOT ( ▲ 1.09% )

CEO Daniel Ek steps down January 1. Goldman downgraded to neutral—forward growth priced in.

Alphabet $GOOGL ( ▲ 4.01% )

Developing Android AI PCs for 2026 with Gemini integration.

Other Notable Company News

Exxon Mobil $XOM ( ▼ 2.44% )

cutting 2,000 jobs. Chevron $CVX and ConocoPhillips $COP also slashing workforce as crude slumps 13% this year.

Robinhood $HOOD ( ▲ 0.61% )

Prediction Markets crossed 4 billion contracts, 2 billion in Q3.

Shopify $SHOP ( ▲ 1.94% )

OpenAI integration could boost GMV share with 70M ChatGPT users.

UiPath $PATH ( ▼ 3.66% )

partnerships with OpenAI, Snowflake, Nvidia.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield hovered near 4.157% with choppy trading as shutdown odds climbed.

Yields fell for a third straight quarter on softer jobs data

If the shutdown drags past two weeks, the Fed may lack key data for its October 28 meeting.

Policy Watch

Shutdown at midnight

House Speaker Mike Johnson said he's "skeptical" a deal gets done. The dispute: enhanced ACA premium tax credits covering 22 million Americans. The Bureau of Labor Statistics will halt all reports—Friday's jobs report won't release.

Fed divided on pace

Boston Fed's Susan Collins wants to keep policy "modestly restrictive" despite the recent cut. Fed Vice Chair Philip Jefferson warned job growth has slowed and unemployment could edge higher. The division matters for the next rate decision.

Tariffs hit housing

New tariffs on lumber (10%) and kitchen cabinets (25%) start October 14. UBS says these add roughly $1,000 to building an average home. Total Trump tariff impact on homebuilding now sits at approximately $8,900 per unit.

Chip production fight

Commerce Secretary Howard Lutnick pushed Taiwan to achieve a "50-50" split in semiconductor production with the U.S. Taiwan currently makes over 90% of the world's advanced chips.

Today’s Sponsor

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

What to Watch

Friday's jobs report (if government stays open)

August payrolls came in at 22,000 , close to turning negative. If the report releases Friday, a negative print would validate Fed concerns about labor market softening and could push rate cut expectations higher. If the government shuts down, the report gets delayed and removes a major catalyst.

Shutdown duration

History says shutdowns under two weeks have minimal market impact—the S&P 500 typically gains 3.2% during funding standoffs. But if this one stretches past two weeks, economic drag starts showing up and data blackout becomes a real problem for the Fed's October 28 meeting.

Watch for signs Democrats and Republicans are actually negotiating.

Pharma sector momentum

Pfizer $PFE ( ▼ 0.78% ) got a three-year tariff exemption for expanding U.S. manufacturing and cutting drug prices. That creates a playbook other pharma companies can follow. Watch for headlines or unusual volume in AbbVie $ABBV, Merck $MRK, or Amgen $AMGN if one announces similar discussions, the whole sector moves again.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.