- Pivot & Flow

- Posts

- September 24th Market Overview

September 24th Market Overview

September 24thMarket Overview (no fluff)

Happy Wednesday

Markets pulled back again today. FINRA is potentially killing the $25k day trading rule. About time honestly, will def push some more volume into stuff other then bluechip and tech imo.

China's throwing more money at Ai. Housing numbers were way better than expected too, which is kinda wild given where rates are. Hopefully stop the fed cuts schedule but it could potentially stall it depending on the inflation numbers we get on Friday.

Let's dig in...

Today's Big Picture

AI spending questions mount as China pushes forward

OpenAI looked into leasing Nvidia chips instead of buying them outright to cut costs. But Alibaba went the opposite direction, boosting its AI spending beyond the original $53 billion plan and launching its biggest model yet with over 1 trillion parameters. Chinese tech stocks climbed on the news, showing Beijing won't back down in the AI race.

FINRA scrapping the $25,000 day trading barrier

FINRA approved killing the rule that's blocked small traders since 2001. Instead of needing $25,000 to day trade, your limits will now be based on margin requirements for your actual positions. More leverage means you need more cash as collateral. This opens up active trading to millions who were locked out by the flat $25,000 wall. Robinhood jumped on the news.

Home sales crush expectations

New home sales hit 800,000 in August, the best since early 2022 and way above what economists expected. The housing market was supposed to be cooling down, but buyers came back strong heading into fall. Homebuilders and the iShares U.S. Home Construction ETF $ITB ( ▲ 0.55% ) both moved higher on the surprise.

Market Overview

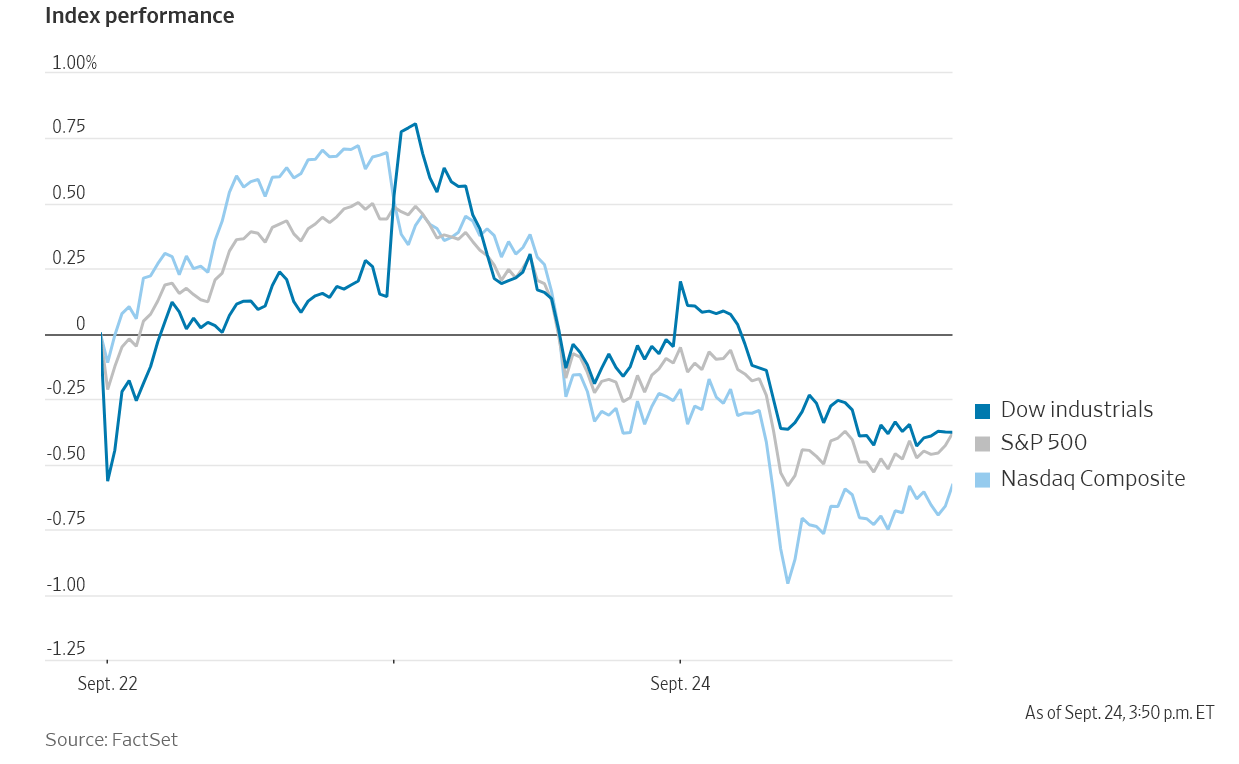

U.S. Stock indexes, past three sessions

Stock Spotlight

Alibaba $BABA ( ▲ 0.12% )

boosted AI spending past its original $53 billion plan and launched Qwen3-Max, its biggest model yet. Chinese tech stocks climbed across U.S. markets as investors saw Beijing doubling down against Western AI competition.

Lithium Americas $LAC ( ▼ 2.17% )

day's biggest winner after reports that Trump officials want up to a 10% stake in the company while reworking its $2.26 billion government loan. The Nevada mine will be the biggest lithium source in the Americas.

Micron Technology $MU ( ▲ 2.59% )

beat sales estimates and raised guidance for next quarter. The memory chip maker said supply is tight and demand for high-end chips that power AI systems keeps growing strong into next year.

Big Name Updates

Nvidia $NVDA ( ▲ 1.02% )

dropped as investors worried about the AI spending cycle. Are chip companies basically funding their own customers? Reports that OpenAI might lease chips instead of buying them didn't help ease those concerns.

Oracle $ORCL ( ▼ 5.4% )

plans to sell bonds that don't come due until 2065 to raise around $15 billion for general business needs. The stock fell for the second day as investors question how much these AI investments will actually pay off.

Amazon $AMZN ( ▲ 2.56% )

upgraded at Wells Fargo while AWS teamed up with SAP to offer cloud services in Europe that keep government data local. The German launch targets clients who need strict data controls.

Tesla $TSLA ( ▲ 0.03% )

moved higher while most other big tech names stayed flat or fell. The stock keeps going its own way instead of following the broader tech weakness.

Other Notable Company News

ServiceNow $NOW ( ▼ 2.89% )

got upgraded at Morgan Stanley. Analysts like its steady subscription business and strong cash flow even as some worry about AI competition.

General Motors $GM ( ▲ 0.05% )

earned a Buy rating at UBS. The bank thinks profit margins in North America can get back to 8-10% despite higher costs from tariffs.

Adobe $ADBE ( ▼ 0.23% )

got downgraded at Morgan Stanley because its AI tools aren't making money as fast as expected.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield stayed around 4.15% as traders wait for Thursday's jobs and GDP data. Oracle's $ORCL ( ▼ 5.4% ) massive bond sale added more supply to an already busy week for corporate debt.

Everyone's really watching Friday's inflation numbers to see if the Fed has room to cut rates again.

Policy Watch

Trading rule overhaul

FINRA killed the $25,000 day trading minimum and replaced it with margin-based limits. The SEC still needs to sign off, but this could bring millions of new traders into options and active trading.

Europe trade deal

The U.S. cut auto tariffs on European cars from 27.5% to 15%, with the official paperwork hitting Thursday. This is part of bigger trade talks that also cover steel and aluminum tariffs.

Energy policy shift

The administration is sending $13 billion in unused green energy subsidies back to Treasury. Trump also pushed European allies to stop buying Russian oil, which helped lift energy prices this week.

Fed and government funding

Powell said rates are still "moderately restrictive" but left the door open for more cuts

A canceled meeting with congressional leaders keeps shutdown fears alive

Big economic data coming: jobless claims and GDP on Thursday, inflation numbers Friday

Today’s Sponsor

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

What to Watch

Friday's inflation numbers

The PCE reading will tell us if the Fed can keep cutting rates. A softer number means more cuts ahead, which would boost stocks and hurt the dollar. A hot reading kills the rate cut story.

SEC approval of the trading rule change

If they approve killing the $25,000 minimum, expect a flood of new retail traders and higher options volume. Robinhood $HOOD and other retail brokers would benefit immediately.

Any updates from Freeport's Indonesian mine

The Grasberg shutdown could tighten copper supply. Watch for any timeline on when operations restart - it'll move copper prices and mining stocks.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.