- Pivot & Flow

- Posts

- September 11th Market Overview

September 11th Market Overview

September 11th Market Overview (no fluff)

Happy Thursday

On a heavy day for the country, markets still hit new highs across all indices. Jobs are getting weaker → unemployment claims jumped to the highest since 2021… but inflation wasn't terrible.

The weird thing is bad jobs news helped stocks because it means the Fed will probably (definitely) cut rates next week.

Let's dig in...

Today's Big Picture

Markets hit records as jobs weaken, inflation stays manageable

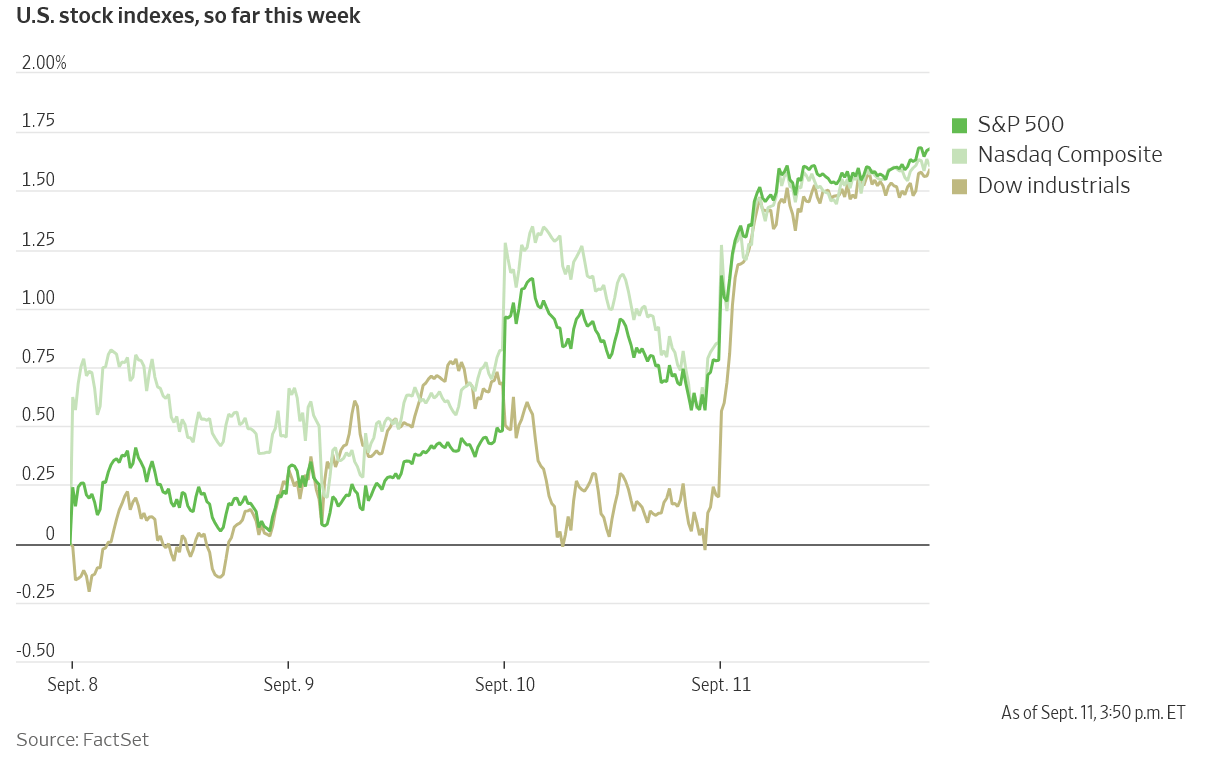

All three major indexes reached fresh highs today. Weekly jobless claims spiked to 263,000 - the highest reading since October 2021 and well above the 235,000 forecast. August inflation came in at 0.4% monthly versus 0.3% expected, but the annual rate hit 2.9% right on target. Core inflation held steady at 3.1% annually.

Fed gets clear signal to start cutting rates

Initial jobless claims jumping to 263,000 combined with job revisions showing 1.2 million fewer jobs created over the past 16 months gives the Federal Reserve strong justification to cut rates next week. Markets are pricing in a quarter-point cut with near certainty. Some warn a half-point cut could signal deeper economic problems and spook investors.Treasury yields break key level as rate cuts come into view

The 10-year Treasury yield briefly dropped below 4% for the first time since April as bond traders positioned for lower rates ahead. This technical break signals a major shift in market expectations and could fuel more equity gains, especially in rate-sensitive growth stocks. The move also supported broad market participation with 31 S&P 500 names hitting new 52-week highs.

P.S. You’re’ making better decisions from reading this.

A few readers help support it. Consider becoming a Premium Subscriber and supporting the daily overview.

I’m currently building a “members only” breadth scanner that will be free to all premium subs.

Market Overview

U.S. Stock Indexes

Stock Spotlight

Opendoor Technologies $OPEN ( ▲ 3.83% )

Had its best day ever after naming Shopify executive Kaz Nejatian as CEO and bringing back co-founder Keith Rabois as chairman. Retail investors have been pushing for changes for months. Nejatian gets up to 81.7 million shares if he hits performance targets.

Warner Bros. Discovery $WBD ( ▲ 2.24% )

Jumped on reports that Paramount Skydance wants to buy the whole company with cash. Another media deal in a sector that's been struggling.

Micron Technology $MU ( ▲ 3.08% )

Climbed after Citi kept its buy rating and bumped the price target to $175. They think the company will beat expectations when it reports September 23 earnings, mostly because data centers need more memory chips.

Oracle $ORCL ( ▲ 4.65% )

Gave back some gains after yesterday's massive rally. JPMorgan says retail traders were selling to lock in profits after the company reported $455 billion in future business.

Big Name Updates

NVIDIA $NVDA ( ▲ 7.87% )

Got upgraded to buy by DA Davidson with a $210 target. They think AI demand will keep growing through 2026.

Apple $AAPL ( ▲ 0.8% )

Got downgraded to neutral by the same firm. They weren't impressed with the new products. Also, Apple is making its own chips instead of buying from Broadcom $AVGO.

Amazon $AMZN ( ▼ 5.56% )

Became a Morgan Stanley top pick with a $300 target. They think grocery delivery could drive big growth.

Advanced Micro Devices $AMD ( ▲ 8.28% )

Got downgraded to hold by Erste Group. They're worried about thin profit margins and think the stock is too expensive.

Other Notable Company News

Centene $CNC ( ▼ 3.66% )

Gained after sticking with its 2025 earnings forecast and saying Medicare ratings look good.

Kroger $KR ( ▲ 1.25% ) Raised its outlook after beating estimates. The company is eating tariff costs instead of raising prices for customers.

Figure Technology Solutions $FIGR ( ▲ 3.33% )

Opened at $36 on its first day of trading, well above the $25 IPO price. It's a crypto company that does home equity loans.

Delta Air Lines $DAL ( ▲ 7.98% )

Fell after keeping its earnings guidance the same - no upside surprise there.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield dropped below 4% during the day before ending near 4.02%. The 2-year yield fell to 3.54% as traders bet on rate cuts coming soon.

Lower rates helped growth stocks and small caps, which are more sensitive to borrowing costs

If the 10-year stays below 4%, that could bring more money into stocks

Policy Watch

Fed cuts coming

A quarter-point rate cut next week looks like a lock after today's jobs and inflation data. Some worry that a half-point cut would signal the economy is in worse shape than people think.

Senate vote Monday

Stephen Miran gets his confirmation vote to join the Fed just before next week's rate decision. If he gets in, he'll have a vote on rates immediately.

Trade fights heating up

August customs duties hit a record $30.1 billion

Mexico is planning tariffs up to 50% on Chinese cars and hundreds of other products

Commerce Secretary says deals with Taiwan and Switzerland are possible, but India needs to stop buying Russian oil first

Energy and railroads

Interior Secretary made it clear that offshore wind is dead under this administration - too expensive and unreliable, he says.

Meanwhile, a new railroad regulator pick suggests the government wants

Union Pacific $UNP ( ▲ 0.47% ) and

Norfolk Southern $NSC ( ▲ 0.3% ) to merge.

Today’s Sponsor

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

What to Watch

Fed meeting Next Week

The rate decision and economic projections will set the tone for markets through year-end. Watch how big the first cut is and what they signal for the rest of 2025. If the 10-year Treasury stays below 4%, that could fuel more stock buying.

Jobs data next week

Another jump in jobless claims would give the Fed even more reason to cut aggressively. Rate-sensitive growth stocks are especially vulnerable to changes in the Fed's path.

Micron earnings September 23

Citi thinks the company will beat expectations on data center memory demand. The results will move the whole semiconductor sector and give clues about NVIDIA $NVDA and Advanced Micro Devices $AMD.

Oracle's massive backlog T

he company has $455 billion in future business lined up, but can they actually turn that into revenue growth? The reported OpenAI deal raises questions about whether the math really works.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.