- Pivot & Flow

- Posts

- (Probably) The Greatest Tech Investment Ever.

(Probably) The Greatest Tech Investment Ever.

How Warren Buffett Made The Greatest Public Market Tech Investment Ever

Happy Sunday and good evening

In 1967 Warren Buffet wrote "I know as much about semiconductors as I do about the mating habits of the chrzaszcz [a Polish beetle]."

This same man announced earlier this year that he is retiring at the end of this year just after making $127 billion on Apple stock. The cosmic irony is too good not to unpack.

Warren Buffett will retire and pass over the CEO title of Berkshire Hathaway to Greg Abel at the end of the year (Warren will stay on as Chair, a position his son Howard will take on after him).

The 94-year old investing legend made the announcement at the company's annual general meeting (AGM) in Omaha back in may, leading to a standing ovation from 20,000 Berkshire acolytes.

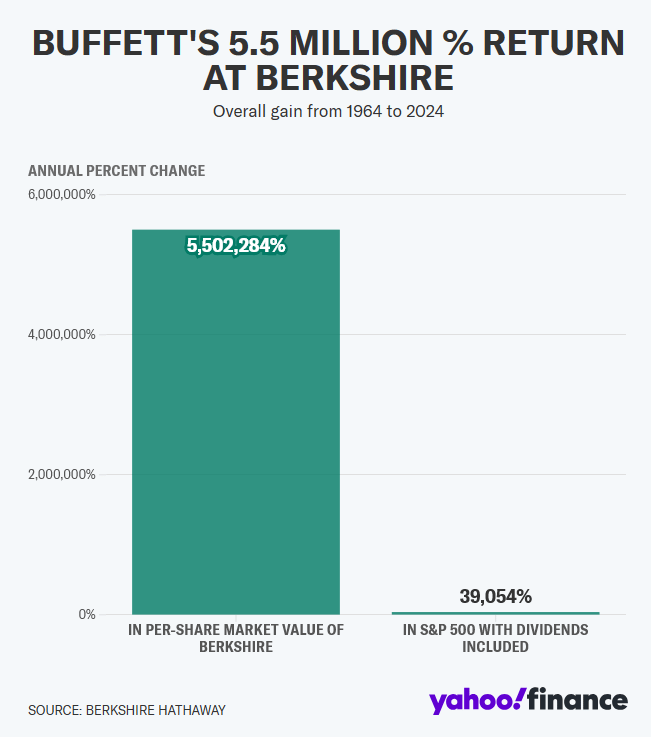

The Oracle of Omaha is hanging up his spreadsheets as the greatest investor and capital allocator in history. He fully took over the textile manufacturer Berkshire Hathaway in 1965 and turned it into a $1.1 trillion conglomerate over the next 60 years. From 1965 through 2024, Berkshire Hathaway delivered a return of +5,502,284% compared to the S&P 500 benchmark performance of +39,054%.

Anyone could quickly recite his greatest hits: buy when others are fearful, time in market beats timing the market, price is what you pay but value is what you get.

As with any advice, it's all context dependent.

The reality is that no one is going to ever repeat Buffett's performance at his scale any time soon. He figured out the US stock market when other participants were fairly unsophisticated, then rode the economic tailwind of the richest nation to ever exist with an ever-expanding capital market.

My favorite takeaway from Buffett's career is Berkshire's $160B+ Apple bet.

^I really went down the rabbit hole after being criticized for posting this headline tweet a few years ago.

Anytime you say "the best" or "the greatest" on Twitter, you're inviting disagreement.

Objections to Buffett as the "best tech investor ever" fell into a few buckets:

1) "there are better tech bets";

2) "Buffett has historically sucked at tech investing"

3) "don't judge investments by absolute-dollar gains"; and

4) "your tweets suck".

These were all good points.

The details: Berkshire Hathaway started building its Apple position in 2016 and plowed $36B into the company by the end of 2018. That stake reached a peak of $178B in December 2023 (~6% of Apple), at which point Berkshire had already sold $13B+ of AAPL and was booking insane Apple dividends of $700m+ a year. In 2024, Berkshire sold 2/3rd of its Apple stake for an estimated $90B and its remaining position is currently worth ~$60B.

Taking together the realized gains ($13B + $90B) and unrealized gain ($60B), Berkshire hit $163B on that OG $36B bet…so a gain of $127B.

The numbers aren't even the best part.

For me, it's the incredible irony of Buffett being the person that made the "greatest public market tech investment".

Why? Because you could not find someone less tech-y than Buffett:

He doesn't have a computer in his office and has sent single-digit emails in his life

He didn't get his first iPhone until 2018

He made the Apple investment when he was 86-years old

He avoided tech investments for decades despite being BFF with Bill Gates

He (unsurprisingly) didn't come up with the trade

So, how did Buffett pull off his best bet 51 years into his career?

Why Buffett Shunned Tech

Buffett has popularized many investing concepts, including "the circle of competence". He first wrote about the idea in Berkshire Hathaway's 1996 shareholder letter:

"What an investor needs is the ability to correctly evaluate selected businesses. Note that word 'selected': You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital."

Buffett's circle of competence includes banks, insurance, newspapers, consumer goods, and things I regularly ate at 3am after clubbing at University (Cherry Coke and cheeseburgers).

However, Buffett claimed to never grasped tech and has been very open about his ignorance:

As far back as 1967 he said "I know as much about semiconductors or integrated circuits as I do of the mating habits of the chrzaszcz [a Polish beetle]. We will not go into businesses where technology is way over my head."

In 1996: "many companies in high-tech businesses or embryonic industries will grow much faster in percentage terms…But I would rather be certain of a good result than hopeful of a great one."

At Berkshire's 2012 AGM: he'd never buy Apple or Google because he "just didn't know how to value them."

Before Apple, his most notable tech plays were both duds:

Microsoft: Despite decades of friendship with Bill Gates, Buffett never invested in Microsoft, citing board conflicts when Gates joined Berkshire in 2004.

IBM: In 2011, Buffett thought Big Blue had strong enterprise lock-in effects. He was very wrong and a $10.7B bet ended down at least 20% (Berkshire unloaded by 2018).

Other Big Tech: Buffett also whiffed on Amazon ("I was too dumb to realize") and Google ("we blew it").

Meeting Todd Combs and Ted Weschler

For nearly half-a-century, Buffett and Charlie Munger were responsible for all of Berkshire's investments. As the calendar turned to the 2000s, they started thinking about successors and eventually hired two hedge fund managers: Todd Combs and Ted Weschler.

Buffett valued them for "ability and character" and their voracious reading appetite. Munger described himself as "a book with legs" while Buffett said that Combs and Weschler were the "only two guys we could find that read as much as we did."

Combs joined in 2010 after cold-calling Munger for breakfast. Weschler joined in 2012 after winning Buffett's charity lunch auction twice for $5.25m total.

Each man was given $2B initially (now they manage ~$30B) with full autonomy to make investments without checking in first.

Ultimately, Combs and Weschler convinced Buffett to pull the trigger on Apple.

Buffet, Combs, and Weschler

The Case for Apple

Berkshire opened its Apple position in 2016, almost a decade after the release of the first iPhone.

By the end of 2018, Buffett had piled into the trade with Berkshire owning 255m shares, at a cost of $36B (average price of $35 per share post-split).

How did Combs and Weschler convince Big Daddy Buffett — who doesn't have a computer and wouldn't even use his first iPhone until 2018 — to go all-in on Apple?

While tech is out of Buffett's circle, there is another key business attribute that is very much within his competence: understanding monopolies and moats.

Buffett loves them! By 2016, Apple's monopoly 9 years into the iPhone era was quite easy to grok. Weschler explained the rationale in a 2016 interview:

"Once you are fully invested in the [Apple] App ecosystem and you have got your thousands of photographs up in the cloud and you are used to the keystrokes and functionality and where everything is, you become a sticky consumer."

Apple's monopoly is the iPhone and its surrounding ecosystem. A year earlier in 2015, Apple had 569m iPhone users. Today, there are 1.4B active iPhone users plus 280m+ Watches and 550m+ AirPods. The App Store gross revenue has grown from $20B to $103B.

According to the Wall Street Journal's Greg Zuckerman, Combs had also identified Apple using a Buffett stock screen: reasonable P/E multiple, 90% confidence in higher earnings over five years, and 50% confidence in 7%+ annual earnings growth.

Buffett triangulated his lieutenants' research, then backed up the Brinks truck and shovelled $36B into Apple by 2018. That year, he told CNBC: "Apple has an extraordinary consumer franchise. You are very, very, very locked in, at least psychologically and mentally, to the product you are using. [iPhone] is a very sticky product."

Buffet about to get into his $APPL position

Apple was also large enough to absorb Berkshire's massive cash pile. By 2020, Buffett was saying that the iPhone-maker is "probably the best business I know in the world."

Today’s Sponsor

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Tim Cook Cold Calls Buffett

Tim Cook took over as Apple CEO in August 2011. About a year into the job, he gave Buffett a call seeking advice on what to do with Apple's growing cash pile.

Here's how it went down, per Cook:

"I'd been in the CEO spot maybe a year or so, we had a growing amount of cash, we had crossed the $100B mark. When I don't have experience with something, I make a list of the people that I think that are the smartest people that I can contact to get advice.

Warren was on the top of the list. I get his number, I call out in Omaha, and I wasn't sure that he'd take the call. But he took the call, and I had a great conversation with him. He was very clear to me, he said 'let me just cut through it, if you believe that your stock is undervalued, you should buy your stock.'"

Under Cook, Apple started repurchasing shares in 2012. Since then, Apple has done over $700B in buybacks.

The buyback program — which Buffett helped to kickstart — has been massively beneficial for Berkshire as explained in his 2020 annual report:

"Berkshire's investment in Apple vividly illustrates the power of repurchases. Berkshire now owns 5.4% of Apple. That increase was costless to us, coming about because Apple has continuously repurchased its shares."

In 2022, Buffett told Bloomberg Businessweek: "Tim may not be able to design a product like Steve [Jobs] but Tim understands the world to a degree that very, very few CEOs I've met over the past 60 years could match."

At the 2025 AGM, Buffett doubled down:

"I'm somewhat embarrassed to say that Tim Cook has made Berkshire a lot more money than I've ever made [for] Berkshire Hathaway. Steve picked Tim to succeed him, and he really made the right decision."

Without the Apple ownership, Berkshire Hathaway would have underperformed the S&P 500 instead of outperforming the benchmark.

Ranking The Greatest Tech Investments

ball park #’s

Like any "greatest" debate, we need criteria to judge the best tech investments. I'd use a minimum gain of $50B as the first filter:

Big Tech M&A:

Facebook acquiring Instagram for $1B in 2012 (now worth ~$600B)

Google acquires YouTube for $1.65B in 2006 (now worth ~$550B)

Insane VC Checks:

Naspers invested $32m into Tencent in 2001 (26% stake now worth ~$100B)

Masayoshi Son invested $20m into Alibaba and made $72B

Public Market Bets:

Apple: Buffett's 4.5x gain on $36B investment

Arm: Masa again - $32B acquisition in 2016, now worth $122B (up $78B)

On a percentage basis, Buffett's 4.5x gain on Apple is much less impressive than Facebook, Google, Tencent or Alibaba. But Berkshire has had $100B+ in cash since 2013 and it's extremely hard to find deals that move the needle at such size.

The "narrative" variable still gets me: Warren "I've sent single-digit emails and didn't own an iPhone until 2018" Buffett executing the best public market tech trade ever.

Verdict: Buffett's Apple deal is the greatest public market tech investment ever. The irony dial is turned to 11. But the Big Tech M&A and China VC deals are more impressive on ROI basis.

Calling the Apple Top (?)

One more part of the Buffett Apple trade that takes it to the next level: he sold the majority of his AAPL shares — $90B in 2024 — at basically the exact right time. Berkshire was sitting on a record $350B in cash as of early 2025, during ongoing global tariff disputes and potential recession.

The timing looks incredibly prescient following (at least) three massive Apple challenges:

Trade war pawn: Major exposure to US-China tensions

Antitrust pressure: Government clampdown on iPhone App Store monopoly

Innovation flop: Vision Pro disaster and fumbled Apple Intelligence rollout

Apple's SVP Eddy Cue recently said in a Google antitrust case that "you may not need an iPhone in 10 years from now as crazy as that sounds…AI is creating new opportunities for new entrants."

Cannibalizing the iPhone — the greatest-selling consumer product ever with 2+ billion units sold — is a much different proposition than cannibalizing the iPod.

For all of Buffett's praise of Cook, the Apple CEO has spent 14 years squeezing every drop out of the iPhone ecosystem and those decisions are biting back: offshoring to China delivered scale but hurt resilience; buybacks were attractive but maybe should have gone to R&D; App Store fees maximized cash flow but angered partners and regulators.

Buffett is leaving Berkshire at what may very well be a peak for the conglomerate. While Greg Abel is extremely competent, there's no world where he grows the company 5,500,000% over the next 60 years. Berkshire is already worth $1.1T and closely tied to the US economy.

The days of "someone in the 1970s that read a magazine article about Buffett and put $1000 into Berkshire and is now worth 8-figures" is over.

Salute to the Oracle...what an incredible 60-year run.

Stay curious 🙂

- John