- Pivot & Flow

- Posts

- October 7th Market Overview

October 7th Market Overview

October 7thMarket Overview (no fluff)

Happy Tuesday

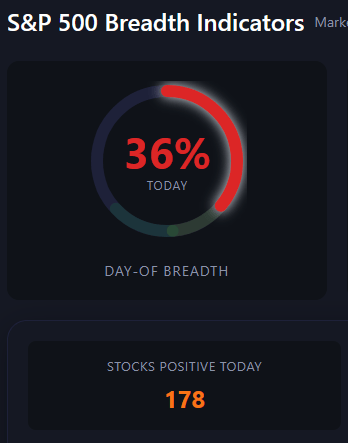

S&P 500 snapped its 7 day green streak, with our day of Breadth indicator looking nasty. The longer time frames with this thing helps me hedge/lower risk more then any other thing I’ve ever used.

I think two things drove today

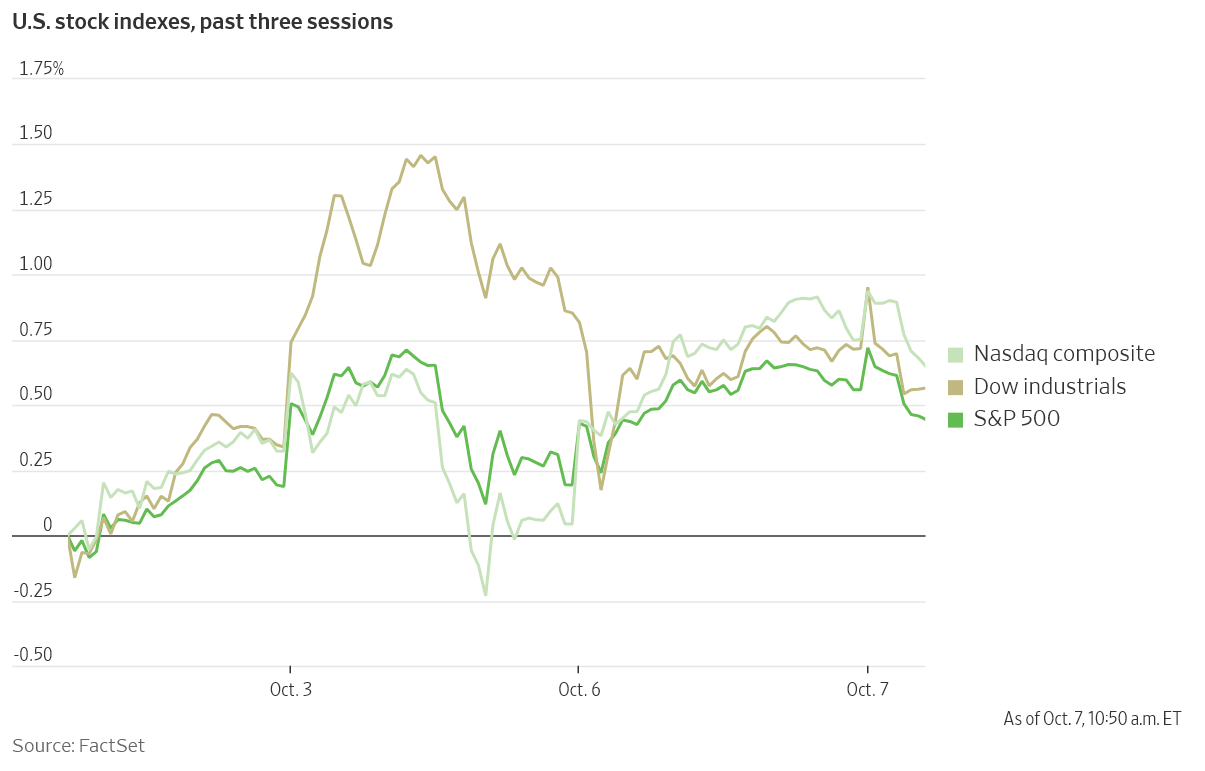

A shutdown-induced data blackout pushing investors toward havens, and questions about AI profitability after Oracle's cloud margins came under scrutiny.

Add trade noise with Canada, and you've got a choppy red session.

Let's dig in...

Today's Big Picture

Gold Breaks $4,000 as Investors Ditch Treasurys

Gold futures hit $4,000 per troy ounce. Central banks bought 415 tons in the first half. Western investors poured record amounts into gold ETFs in September. Gold is now the primary safe haven instead of Treasurys—that's where confidence stands on U.S. deficits. Goldman sees $4,900 by late 2026.

AI Profitability Problem Meets AI Growth Story

Oracle lost $100 million last quarter renting Nvidia's chips with cloud margins lighter than hoped. Dell raised long-term sales targets. AMD sealed a potential $100 billion OpenAI deal with share warrants. Revenue is real, profits are still a question mark.

White House Writing Checks for Critical Minerals

Trilogy Metals tripled after the White House took a 10% stake for $36.5 million and approved Alaska road construction. The administration is rewriting mineral supply chains with direct investments. Upstream producers win, tariff-exposed users lose.

Market Overview

Index Performance

Stock Spotlight

Trilogy Metals $TMQ ( ▲ 6.83% )

tripled after the White House took a 10% stake for $36.5 million and approved Alaska road construction. Second similar deal in a week after Lithium Americas.

Advanced Micro Devices $AMD ( ▼ 1.58% )

rose on OpenAI warrants worth up to 10% of equity tied to chip deployment milestones. Wall Street sees a path to $300.

AppLovin $APP ( ▲ 1.62% )

fell on SEC probe into data collection. Analyst warns near-term volatility from investigation and short sellers.

Big Name Updates

Oracle $ORCL ( ▼ 5.4% )

fell after reports it lost $100 million last quarter renting Nvidia's chips with cloud margins below estimates. The AI rental economics aren't working yet.

Dell $DELL ( ▲ 2.7% )

doubled long-term growth targets to 7-9% annual sales through 2030 and 15% earnings growth. Shares faded but AI infrastructure demand is clear.

Tesla $TSLA ( ▲ 0.03% )

fell after unveiling Model Y under $40,000 and Model 3 around $37,000. Not mass-market pricing and investors wanted Roadster updates.

Ford $F ( ▲ 1.67% )

dropped on a September fire at a New York aluminum plant supplying 40% of auto industry sheet. F-150 production disrupted for months, hitting Ford's profit engine ahead of earnings.

Other Notable Company News

Constellation Brands $STZ ( ▲ 1.15% )

beat estimates despite tariff pressure. Now expects $90 million in tariff costs this year versus earlier $20 million estimate.

Intercontinental Exchange $ICE ( ▼ 0.07% )

in talks to invest $2 billion in Polymarket at $9 billion valuation. Largest traditional finance bet on crypto prediction markets.

Amkor Technology $AMKR ( ▼ 0.83% )

broke ground on Arizona packaging facility with CHIPS Act backing and Apple, Nvidia, TSMC as partners. Onshore packaging is the bottleneck.

Iris Energy $IREN ( ▼ 7.65% )

secured AI cloud contracts for Nvidia Blackwell GPUs. Over 11,000 of 23,000 GPUs contracted, targeting $225 million annual revenue by late 2025 and over $500 million by Q1 2026.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields fell as the shutdown stretched the data blackout. The 10-year sits at 4.135%.

The market is acting strange. Normally during government stress you'd see a bigger rally in Treasurys as investors pile into the traditional safe haven. Instead, gold is getting the flows. This reflects real concern about U.S. deficits and fiscal policy.

Goldman Sachs' Robert Kaplan called gold's rally to $4,000 "a red light that we ought to be paying attention to."

Policy Watch

Government Shutdown Day Seven

Senate failed again to pass a funding bill. Trump said back pay for furloughed workers "depends on who we're talking about." Jobs report delayed, more data postponed. Active duty military won't get paychecks if this extends past mid-October—Goldman sees that as the forcing event.

Trump Meets Canada on Tariffs

Trump met Canadian Prime Minister Carney about relief on autos, steel, and aluminum. Trump imposed 35% tariffs on Canadian imports earlier this year. He's open to separate deals with Canada and Mexico instead of renegotiating the three-way agreement. Immediate impact on auto supply chains and aluminum costs.

Today’s Sponsor

You’ve Hit Capacity. Now What?

You built your business by saying yes to everything. Every detail. Every deadline. Every late night.

But now? You’re leading less and managing more.

BELAY’s eBook Delegate to Elevate pulls from over a decade of experience helping thousands of founders and executives hand off work — without losing control. Learn how top leaders reclaim their time, ditch the burnout, and step back into the role only they can fill: visionary.

It’s not just about scaling. It’s about getting back to leading.

The ceiling you’re feeling? Optional.

What to Watch

Fed Minutes Wednesday, Powell Thursday

Minutes drop 2pm Wednesday, Powell speaks Thursday. With the data blackout, any color on how the Fed is navigating this matters.

Treasury Auctions Tomorrow and Thursday

10-year notes tomorrow, 30-year bonds Thursday. First auctions since shutdown began. Real test of demand with gold as primary safe haven instead of Treasurys.

Military Pay Deadline October 15

If 1.3 million active duty members miss paychecks, political pressure forces a deal. Watch for funding tied to healthcare negotiations.

Ford Earnings Later This Month

Aluminum supply disruption from the New York plant fire could impact F-150 production guidance.

Thanks for reading 🙂

- John

Today’s Sponsor

Free, private email that puts your privacy first

Proton Mail’s free plan keeps your inbox private and secure—no ads, no data mining. Built by privacy experts, it gives you real protection with no strings attached.

Note: This newsletter is intended for informational purposes only.