- Pivot & Flow

- Posts

- October 3rd Market Overview

October 3rd Market Overview

October 3rd Market Overview (no fluff)

Happy Friday

The disconnect isn't subtle anymore.

Markets hit records. Shutdown day three.

Goldman's CEO predicts a drawdown within two years (wtf does that even man)

The current market pattern is clear: ignore everything, buy everything. The Fed has no jobs data. Farmers are in need of bailouts. Valuations are stretched. None of it matters until it does.

Small-caps made new highs.

One thing is reassuring though…. very strong breadth data showing on our day of indicator.

Today’s breadth data

Let's dig in...

Today's Big Picture

Markets Hit Records While Government Stays Shut

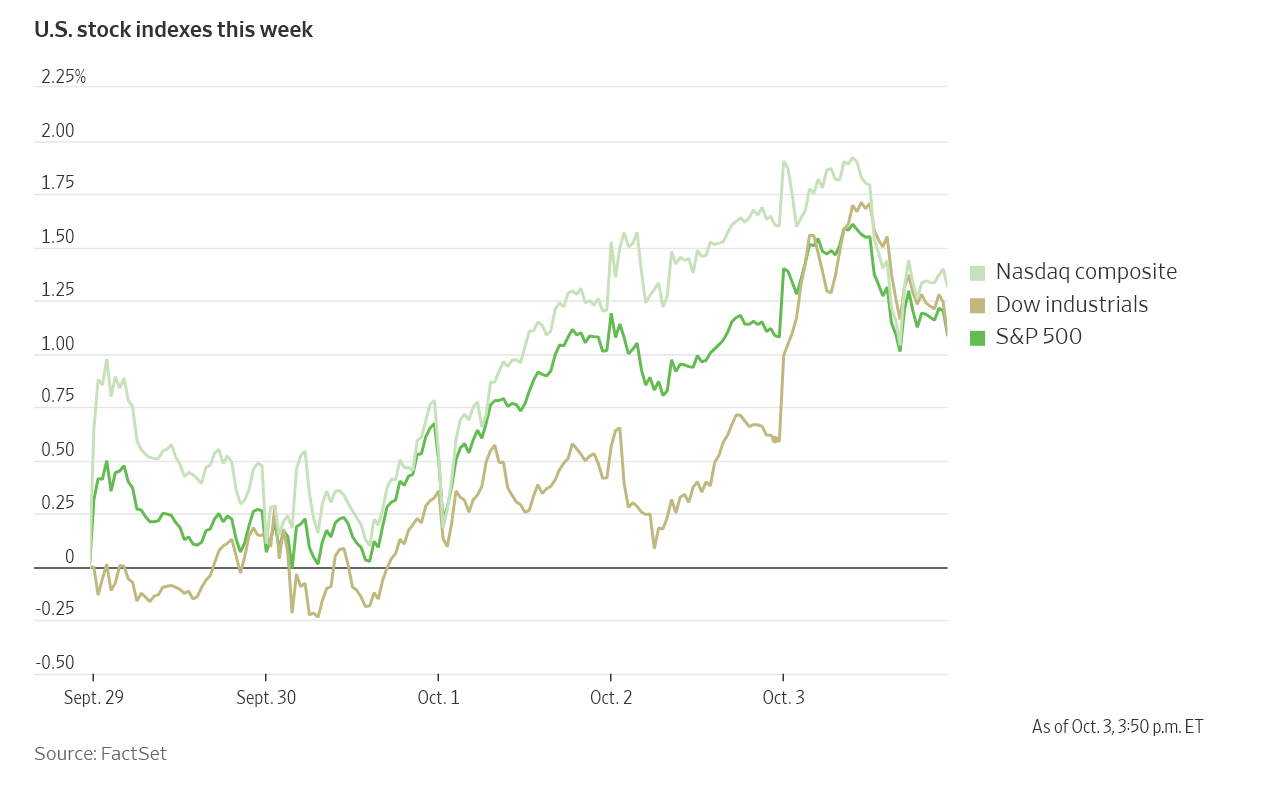

The three major indexes closed at record highs on day three of the shutdown. The September jobs report is stuck until the government reopens, leaving the Fed to make its October rate decision without fresh employment data. Bettors now see a 70% chance this drags past 10 days. Meanwhile the ISM services index hit 50.0—dead center between growth and contraction.

Goldman CEO: Market Pullback Coming in Next Two Years

David Solomon doesn't expect this party to last. Speaking at Italian Tech Week, he said a drawdown in the next 12-24 months wouldn't surprise him. "Markets run in cycles, and whenever we've historically had a significant acceleration in a new technology that creates a lot of capital formation, you generally see the market run ahead of the potential," he said. Leon Cooperman recently called big-tech valuations "ridiculously high." -

Solomon's comparison? The dotcom bubble.

China Export Rules Hit Applied Materials for $710 Million

Applied Materials took a $710 million revenue hit from new U.S. export restrictions—$110 million this quarter and $600 million next fiscal year. The kicker: Huawei just got caught using TSMC components in their AI chips. More semiconductor companies are about to feel this pain.

Market Overview

Index Performance

Stock Spotlight

Fair Isaac $FICO ( ▼ 0.17% )

delivered the S&P 500's best performance Thursday, jumping after announcing a program that lets mortgage lenders buy credit scores directly, cutting out middlemen Experian, Equifax, and TransUnion.

Palantir Technologies $PLTR ( ▲ 0.26% )

fell after media reports revealed problems with a battlefield communications network the company is developing.

Johnson & Johnson $JNJ ( ▼ 1.79% )

new record close after Wells Fargo upgraded the stock to overweight and raised its price target to $212 from $170.

Apple $AAPL ( ▲ 1.54% )

traded near its all-time closing high as demand for iPhone 17 models continues, though Jefferies downgraded the stock to Underperform with a $205 price target citing concerns about iPhone 18 Pro pricing.

Applied Materials $AMAT ( ▲ 1.5% )

dropped on the $710 million revenue hit from China export restrictions.

Big Name Updates

Nvidia $NVDA ( ▲ 1.02% )

saw its multibillion-dollar AI chip deal with the United Arab Emirates remain stuck nearly five months after announcement. Regulatory hurdles continue stalling the May deal.

Tesla $TSLA ( ▲ 0.03% )

posted UK sales up slightly to 8,038 units in September. The company set a global sales record last quarter but shares have fallen as investors view the tax credit bump as temporary.

Amazon $AMZN ( ▲ 2.56% )

got a price target boost from Goldman Sachs to $275 from $240. Goldman highlighted underappreciated growth in AWS and advertising heading into Q3 earnings later this month.

Chevron $CVX ( ▼ 0.46% )

dealt with a fire at the El Segundo refinery near LAX, which supplies roughly 20% of Southern California's gasoline and 40% of its jet fuel. The fire was contained and crude futures edged higher.

Google $GOOGL ( ▲ 4.01% )

announced a $4 billion investment to build a data center in West Memphis—its first in Arkansas—creating thousands of jobs.

Other Notable Company News

Reddit $RDDT ( ▲ 2.77% )

got a reiteration of outperform rating from Citizens with a $200 price target. Logged-in U.S. users monetize at over 10 times the rate of logged-out users.

Broadcom $AVGO ( ▼ 0.4% )

and Micron Technology $MU ( ▲ 2.59% )

rose after OpenAI's Asia dealmaking tour with Samsung and SK Hynix boosted optimism for AI chip demand.

Quantum computing stocks

$QBTS ( ▼ 6.81% )

$RGTI ( ▼ 4.1% )

notched double-digit weekly gains. Rigetti Computing and Quantum Computing each jumped more than 27% this week, while D-Wave Quantum rose about 23%.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield ticked up to 4.124%, rising several basis points as markets priced in continued Fed rate cuts despite mixed economic signals.

Key points:

Wells Fargo Investment Institute noted prospects for further rate cutting have cemented the rally in stocks

Priced-for-perfection credit markets are concealing signs of excess, including sudden bankruptcies and growing defaults

The Fed faces challenges with limited visibility into labor market conditions ahead of its October 29 meeting

Policy Watch

Government Shutdown Deepens

With little visible progress toward breaking the Trump-Democrat impasse, the shutdown drags into the weekend. President Trump threatened massive federal layoffs Thursday, calling it an "unprecedented opportunity" to cut agencies. Treasury Secretary Scott Bessent warned of hits to GDP, growth, and working America. The Congressional Budget Office estimates 750,000 federal workers furloughed each day.

Bettors on prediction market Kalshi now see a 70% chance the shutdown lasts more than 10 days, up from about 45% when it began Wednesday. Some are placing longshot wagers that the impasse will become the longest in history—surpassing the 34-day closure during Trump's first term.

Trump weighing farmer bailout

at least $10 billion as tariffs crush ag exports. Same playbook as first term when soybean buyers disappeared and required $23 billion in bailouts. Also floating $1,000-$2,000 taxpayer rebates funded by tariff revenues.

Canada Trade Talks

Canadian Prime Minister Mark Carney will travel to Washington early next week for meetings including with President Trump. Carney's government has shifted strategy from seeking a broad economic pact to more targeted sector relief on steel and cars.

Today’s Sponsor

Free, private email that puts your privacy first

A private inbox doesn’t have to come with a price tag—or a catch. Proton Mail’s free plan gives you the privacy and security you expect, without selling your data or showing you ads.

Built by scientists and privacy advocates, Proton Mail uses end-to-end encryption to keep your conversations secure. No scanning. No targeting. No creepy promotions.

With Proton, you’re not the product — you’re in control.

Start for free. Upgrade anytime. Stay private always.

What to Watch

OPEC+ meets Sunday

to decide November production levels. Speculation about output increases already knocked oil down over 7% this week. Any surprise hold or cut reverses that fast.

Shutdown developments over the weekend

Senate reconvenes but little progress expected. Each additional week delays more economic data and increases Q4 GDP uncertainty. Markets have been ignoring it so far, but that won't last forever.

Tech earnings ramp up

Amazon reports late October. S&P 500 earnings growth has held around 11% for two years, but Solomon's AI warning and stretched valuations make this season critical for justifying current prices.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.