- Pivot & Flow

- Posts

- October 31st Market Overview

October 31st Market Overview

October 3st Market Overview (no fluff)

Happy Friday 🎃

Markets closed October strong after Amazon finally answered the question: when does AI spending become AI revenue?

I think we just watched the market stop rewarding promises and start rewarding results. AWS is growing back above 20% YoY.

Four Fed officials now openly oppose this week's rate cut, making December look a lot less certain.

Lets dig in…

Today's Big Picture

Amazon Proves AI Spending Works

AWS re-accelerated past 20-growth for the first time since 2022. The company added 3.8 gigawatts of data center capacity in 12 months - more than any competitor. AI demand is accelerating, not slowing. This answers what Meta and Microsoft couldn't this week: when does spending become revenue?

Big Tech Floods Debt Markets for AI

Since September: Oracle sold $18 billion in bonds and raised $38 billion in loans. Meta sold $30 billion in bonds plus $27 billion private. Microsoft's earnings showed OpenAI burned over $12 billion last quarter. Altman doesn't care if they burn $50 billion annually. Debt investors are starting to care.

Fed Rate Cut Faces Growing Opposition

Four Fed officials now oppose this week's cut. Kansas City's Schmid dissented. Dallas's Logan said it was wrong. Cleveland's Hammack would have dissented. Atlanta's Bostic supported it but he's "uncomfortable." December just became a real question mark.

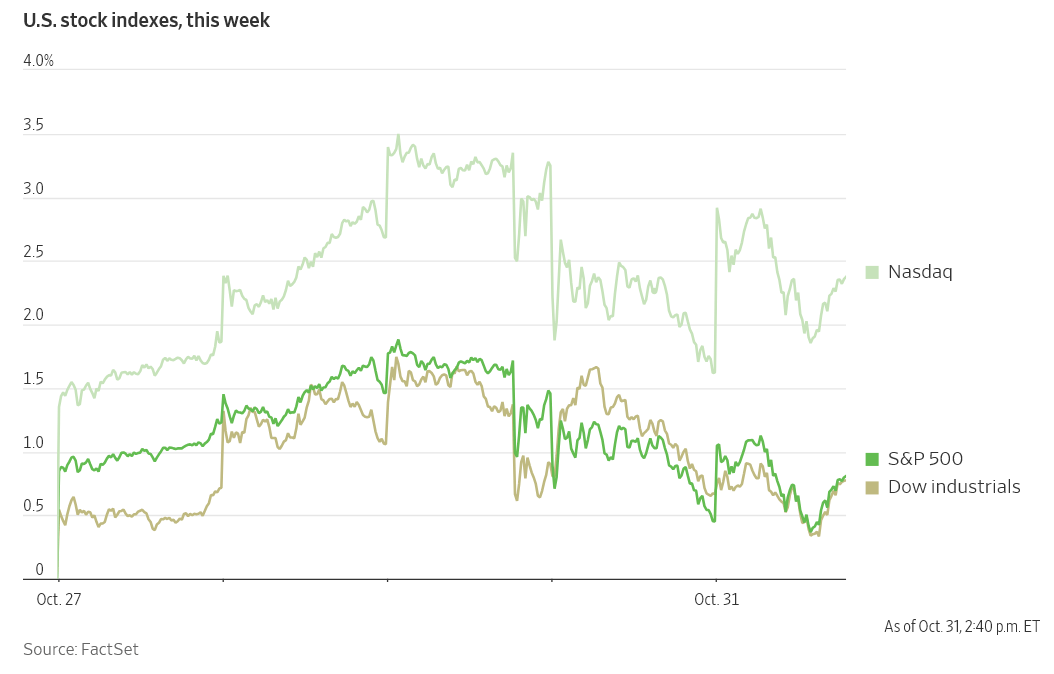

Market Overview

Index Performance

OK, so the new tool is the company credit score aka the financials fundamental check-up.

Its hard to see but it was outvoted as the winner

Company Credit Score

Enter a ticker. It analyzes the latest SEC filings and gives you a 5-point breakdown of the company's financial health plus a score from 0-100. Quick way to understand if a company is solid or shaky financially.

Both will be released. Company Credit Score comes first. Available to all premium members.

This is about 98% finished from my end, will start releasing specific reports on popular tickers next week before full release.

Stock Spotlight

Amazon $AMZN ( ▼ 5.56% )

hit a record high after earnings. The custom Trainium chip is fully subscribed and grew 150-quarter-over-quarter. AWS signed several October deals already larger than all of Q3.

Apple $AAPL ( ▲ 0.8% )

posted record sales with iPhone 17 demand "off the chart" per CEO Tim Cook. Multiple models remain supply constrained. The catch: operating expenses will grow faster than revenue next quarter as AI spending ramps.

Advanced Micro Devices $AMD ( ▲ 8.28% ) is wrapping up its best month since January 2001 with gains over 58-in October.

Big Name Updates

Netflix $NFLX ( ▲ 1.65% )

announced a 10-for-1 stock split effective November 17, bringing shares from $1,089 down to roughly $110.

Warner Bros Discovery $WBD ( ▲ 2.24% )

jumped on reports Netflix is exploring a bid for the studio and streaming business.

Nvidia $NVDA ( ▲ 7.87% )

signed deals with Samsung and Hyundai to deploy over 250,000 chips across South Korea. The company is also putting up to $1 billion into AI startup Poolside.

Exxon Mobil $XOM ( ▲ 2.03% )

and Chevron $CVX both posted lower earnings but beat estimates. Both are ramping production despite oil near $60. Chevron hit record output of 4.1 million barrels daily from the Hess acquisition.

Other Notable Company News

Reddit $RDDT ( ▼ 7.43% )

crushed estimates with revenue up 68-year-over-year. Morgan Stanley called it "scary good growth."

Cloudflare $NET ( ▲ 6.23% )

beat estimates with revenue growth accelerating to 31-for the second straight quarter.

Getty Images $GETY ( ▲ 7.27% ) signed a multi-year licensing deal with Perplexity AI.

Intel $INTC ( ▲ 4.87% )

is in talks to buy AI chip startup SambaNova.

Palantir $PLTR ( ▲ 4.53% )

sued two former employees claiming they stole data to build competing AI firm Percepta.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year yield held near 4.096 while traders repriced December rate cut odds from 91-down to 69-in one week. The bond market is picking sides: hawks who want to hold rates versus the 10-member majority that voted for this week's cut.

Policy Watch

The Fed

The rate cut passed 10-2, but opposition runs deeper.

Kansas City Fed President Jeffrey Schmid dissented, saying policy isn't restrictive given "surging business investment, high stock prices, and easy corporate borrowing."

Dallas Fed President Lorie Logan said the cut was wrong. Inflation is "too high" and labor markets are only "cooling slowly."

Cleveland Fed President Beth Hammack would have dissented if she had a vote.

Atlanta Fed President Raphael Bostic supported the cut but said he's "increasingly uncomfortable" as rates move closer to neutral.

Fiscal & Trade

President Trump and Chinese President Xi Jinping agreed to a one-year trade truce in South Korea. China bought at least four U.S. soybean cargoes totaling 250,000 tons after the summit.

Mexico extended the November 1 tariff deadline by several weeks.

Government Shutdown - Day 31

Federal Judge John McConnell ordered the administration to tap emergency SNAP funds Friday, blocking the November 1 suspension. The ruling affects 42 million Americans.

Active-duty military paychecks and ACA open enrollment both hit November 1 deadlines.

Today’s Sponsor

Institutional-Grade Opportunities for HNW Investors

Long Angle is a private, vetted community connecting high-net-worth entrepreneurs and executives with institutional-grade alternative investments. No membership fees.

Access top-tier opportunities across private equity, credit, search funds, litigation finance, energy, hedge funds, and secondaries. Leverage collective expertise and scale for better terms.

Invest alongside pensions, endowments, and family offices. With $100M+ invested annually, secure preferential terms unavailable to individual investors.

What To Watch

December Fed Meeting

Market odds of a cut dropped from 91-to 69-in one week. Four officials now publicly oppose easier policy. Powell's "far from a done deal" comment looks prescient. I'm watching if more hawks speak out.

OPEC+ Production Sunday

The cartel meets after raising output in October with oil near $60. Do they defend prices by cutting or defend market share by holding? U.S. shale is pumping aggressively either way.

AI Revenue Justification

Amazon proved AI spending generates revenue today. Now Microsoft, Meta, and Google need to show their hundreds of billions in commitments will pay off. The market just changed the game from "who spends most" to "who earns most."

Berkshire Hathaway Earnings

Focus on cash deployment from the record pile and whether Buffett added positions during recent volatility.

Thanks for reading 🙂

- John

Today’s Sponsor

Like Moneyball for Stocks

The data that actually moves markets:

Congressional Trades: Pelosi up 178% on TEM options

Reddit Sentiment: 3,968% increase in DOOR mentions before 530% in gains

Plus hiring data, web traffic, and employee outlook

While you analyze earnings reports, professionals track alternative data.

What if you had access to all of it?

Every week, AltIndex’s AI model factors millions of alt data points into its stock picks.

We’ve teamed up with them to give our readers free access for a limited time.

The next big winner is already moving.

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Note: This newsletter is intended for informational purposes only.