- Pivot & Flow

- Posts

- October 27th Market Overview

October 27th Market Overview

October 27th Market Overview (no fluff)

Happy Monday

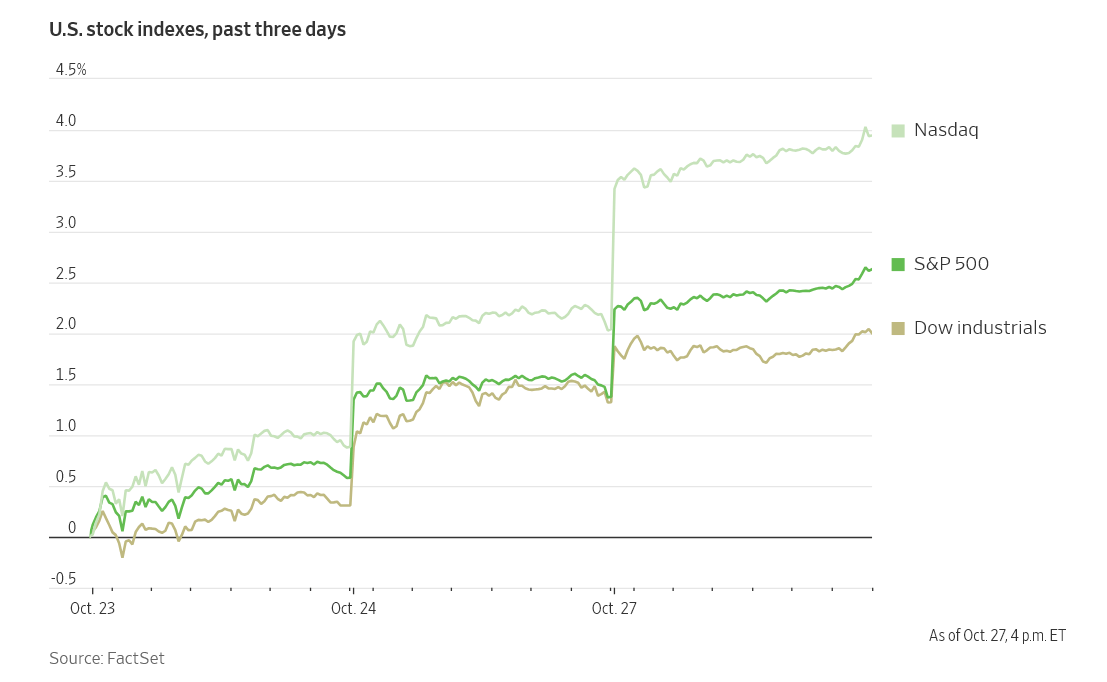

Markets ripping into new records on close betting the China deal is done.

-China said they "reached consensus on key trade issues"

-Trump said he thinks they'll "come away with a deal"

-Bessent said the 100% tariff threat is “off the table”

Formal announcement Thursday. I think we're pricing perfection today but we will see.

Let's dig in...

Today's Big Picture

U.S.-China Deal Appears Imminent

Both countries are saying a trade agreement is near after talks wrapped up over the weekend. Formal announcement expected Thursday when Trump and Xi meet. The deal shelves the threat of additional U.S. tariffs, and China agrees to delay its rare earth export controls. Market is betting this actually happens.

Argentina’s Market Surge on Milei Win

President Javier Milei won his midterm elections decisively. The Argentine stock index climbed sharply, along with the U.S.-listed ETF. This gives Milei the political capital to push his free-market reforms, which have Trump administration backing. Investors betting the reforms stick.

Qualcomm Enters AI Chip Battle

Qualcomm $QCOM ( ▲ 0.76% ) is moving into high-end AI chips, going head-to-head with Nvidia $NVDA. This is a huge strategic shift for a company that’s been mobile-first for decades. I think this gets interesting when we see actual benchmarks.

Market Overview

Index Performance

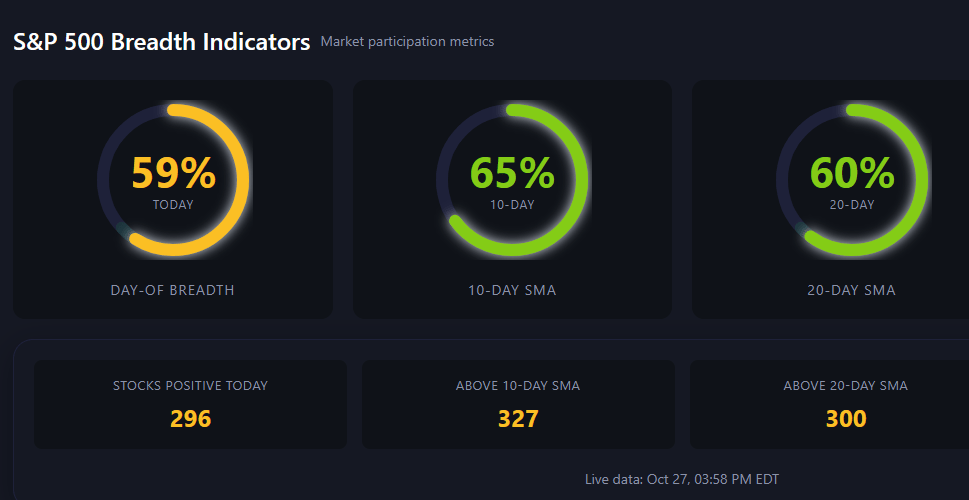

Breadth elevated and consolidated for a week straight - longest run since early May. Setting up for a rubber band move off Thursday's China meeting.

Upgrade to premium and get → Market Health dashboard

Stock Spotlight

Qualcomm $QCOM ( ▲ 0.76% )

will supply its new AI accelerator chips to Saudi Arabia's Humain venture, which is building out a major AI network. First real customer win for the new chip line.

Novartis $NVS ( ▲ 1.6% )

agreed to buy Avidity Biosciences $RNA ( ▲ 0.11% ) for about $12 billion in cash at $72 per share. Big bet on RNA-based therapies.

Big Name Updates

Apple $AAPL ( ▲ 0.8% )

is reportedly in talks with SpaceX about using Starlink for future iPhones. Separately, the company plans to add paid search ads to Apple Maps. Satellite connectivity has been a slow burn—this could accelerate it.

Tesla $TSLA ( ▲ 3.5% )

got a shoutout from Trump, who called Elon Musk "a very capable guy" and added "I suspect I'll always like him." Politics aside, the regulatory tailwinds for Tesla are real.

Microsoft $MSFT ( ▲ 1.9% )

is facing allegations in Australia over how it communicated subscription price changes after bundling Copilot into its software. Watch for regulatory scrutiny to spread beyond Australia.

Other Notable Company News

Palantir $PLTR ( ▲ 4.53% )

hit a new all-time high after Poland's Defence Ministry signaled intent to work with the company.

Honeywell $HON ( ▲ 1.94% )

was upgraded by RBC, which sees the planned company breakup as a positive catalyst.

OpenAI got final approval from SoftBank for the remaining $22.5 billion of its planned $30 billion investment round.

Mastercard $MA ( ▼ 0.57% )

and PayPal $PYPL ( ▲ 1.3% ) are partnering on a new payment platform designed for AI agents. Early days, but this is where payments infrastructure is headed.

Huntington Bancshares $HBAN ( ▲ 1.31% )

is buying Cadence Bank $CADE in a $7.4 billion stock deal. Regional bank consolidation continues.

American Water Works $AWK ( ▼ 1.07% )

and Essential Utilities $WTRG ( ▼ 0.72% ) are merging to create a $40 billion utility company. Scale matters in regulated industries.

MercadoLibre $MELI ( ▼ 3.18% )

moved higher after Brazil's President Lula called his recent talks with Trump "surprisingly good." Latin America trade relations warming up.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The real action was in foreign currencies today. The Argentine peso and Chinese yuan both strengthened against the dollar on their respective political developments. U.S. bond market was quiet ahead of the Fed meeting this week. Traders waiting for Wednesday.

Policy Watch

The Fed

FOMC meeting this week is widely expected to deliver another rate cut. More interesting: Treasury Secretary Scott Bessent confirmed the five finalists for next Fed Chair:

Kevin Hassett

Kevin Warsh

Christopher Waller

Michelle Bowman

Rick Rieder

The market isn't pricing this in yet. Different candidates would mean very different policy approaches.

Trade

While the China deal looks close, Trump increased tariffs on Canada by an additional amount. The White House also announced new agreements with Thailand, Malaysia, Cambodia, and Vietnam to secure rare earth supplies. The China deal matters most, but the Canada tension is worth tracking.

International

Japan's new Prime Minister is reportedly considering purchasing about 100 Ford F-150s for government use as a goodwill gesture. Small symbolic move, but these details matter in diplomacy.

Today’s Sponsor

Final Days to Invest: Every City’s a Potential Surf Destination

Topgolf revolutionized golf by turning it into a social, tech-driven game for anyone. And they’ve made billions in annual revenue doing it. Surf Lakes is applying that same model to surfing, and investors can still join them until 10/30 at 11:59 PM PT.

Their patented tech creates 2,000 ocean-quality rides per hour, anywhere in the world, across all skill levels.

It’s a $65B surf tourism market opportunity. They’ve already sold 8 tech licenses, plus their own commercial parks are underway.

3x world champ Tom Curren and surf icon Mark Occhilupo have joined as ambassadors and shareholders. Even actor Chris Hemsworth has praised Surf Lakes.

You have until October 30th at 11:59 PM PT to invest in Surf Lakes.

This is a paid advertisement for Surf Lakes’ Regulation CF offering. Please read the offering circular at https://invest.surflakes.com

What To Watch

Trump-Xi Meeting Thursday

This is where the trade deal gets announced or signed if it's real. Watch for specifics on enforcement mechanisms. Past deals have failed on implementation.

Big Tech Earnings Avalanche

Huge week for market-moving reports. Alphabet, Amazon, Apple, Meta, and Microsoft all report between Wednesday and Thursday. AI spending, cloud growth, and forward guidance will move markets more than the actual quarters.

Fed Decision Wednesday

The rate cut is priced in. What matters is Powell's language on the pace of future cuts and any signals about ending quantitative tightening. If he suggests slowing down, rates will react.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.