- Pivot & Flow

- Posts

- October 1st Market Overview

October 1st Market Overview

October 1st Market Overview (no fluff)

Happy Wednesday

Shutdown: meaningless.

Jobs: collapsing.

Market: new highs.

The system optimizes for what you measure. Right now it's measuring rate cuts, not employment.

Let's dig in...

Today's Big Picture

1. Government shuts down, jobs collapse, Fed cuts locked in

Private payrolls dropped 32,000 in September when economists expected a gain. August got revised from positive to negative. The Labor Department shut overnight—Friday's jobs report won't come out if the closure drags. Traders see certainty the Fed cuts rates on October 29th. The 10-year yield fell to 4.108%.

2. Pharma jumps on White House drug deal

The White House launched TrumpRx.gov with Pfizer getting a three-year tariff exemption for domestic manufacturing and selling drugs directly to consumers at steep discounts. Won't help most Americans with insurance but could matter for the 27 million uninsured. Investors are betting Eli Lilly and Merck strike similar deals.

3. Nike beats but tariff costs are climbing

Nike crushed earnings. The company raised its tariff-cost forecast to $1.5 billion for the fiscal year from $1 billion three months ago. Tariffs added $445 million to costs last quarter. The turnaround is real but getting expensive.

Market Overview

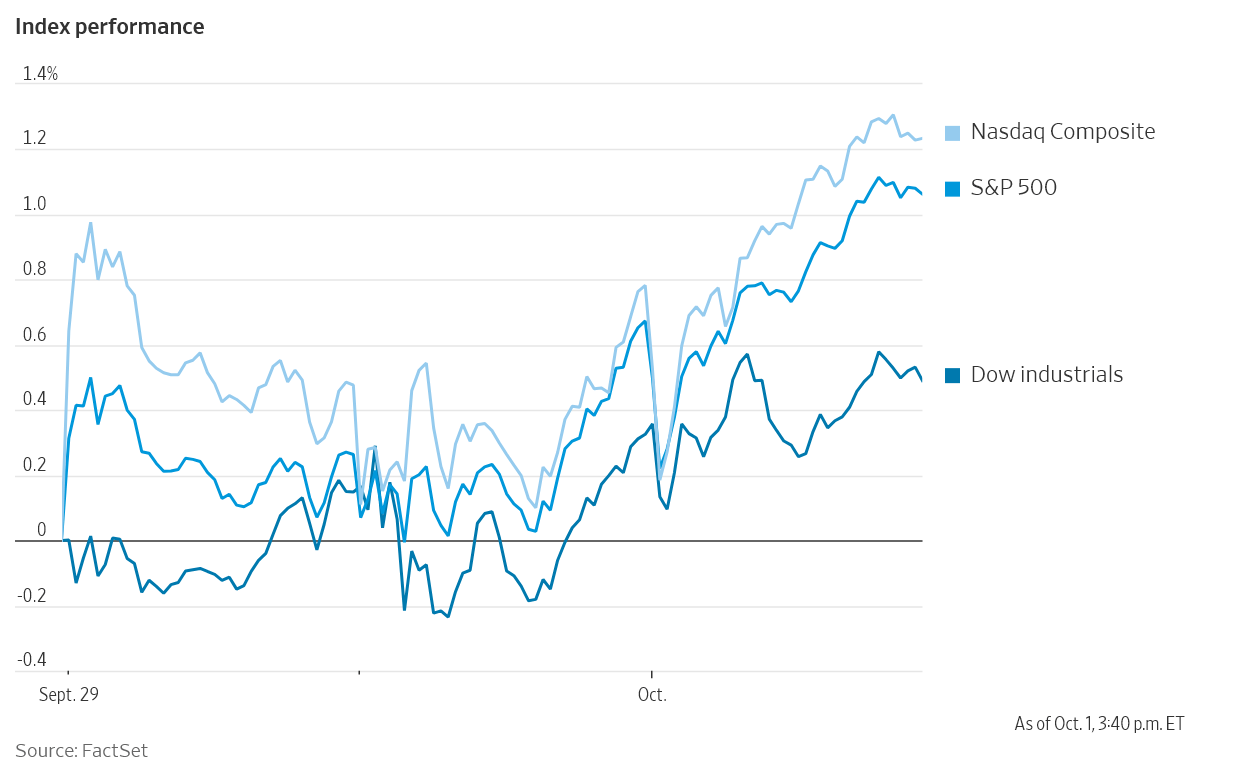

Index Performance

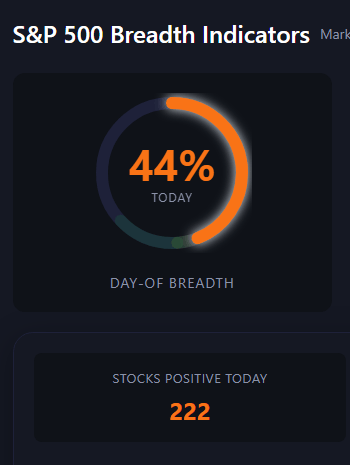

According to Market Health Dashboard, today’s rally is pretty fluffy (worth noting)

Stock Spotlight

Pfizer $PFE ( ▼ 0.78% )

Follow-through after Tuesday's move. The three-year tariff exemption came in exchange for domestic manufacturing commitments and participation in TrumpRx. Investors are looking for similar deals at peers.

Nike $NKE ( ▼ 0.32% )

Revenue hit $11.72 billion and EPS came in at $0.49. Gross margin landed at 42.2%. The company lifted its fiscal-year tariff-cost forecast to $1.5 billion. Wholesale grew 7% while Nike Direct fell 4%. Management said progress won't be linear as the turnaround builds.

Lithium Americas $LAC ( ▼ 2.17% )

The Department of Energy plans a 5% equity stake in the company and a separate 5% stake in its Thacker Pass project in Nevada. Energy Secretary Chris Wright told Bloomberg the government wants to ensure lithium gets mined and refined domestically. The company is also negotiating a $2.3 billion federal loan alongside General Motors.

AES $AES ( ▲ 0.92% )

BlackRock's Global Infrastructure Partners is near a $38 billion takeover of the renewable and thermal power producer, according to Financial Times reporting.

Big Name Updates

Berkshire Hathaway $BRK.B ( ▲ 0.25% ) and Occidental Petroleum $OXY ( ▲ 0.6% )

In talks about a $10 billion sale of Occidental's OxyChem petrochemical business, per the Wall Street Journal. If it closes, it would be Warren Buffett's largest deal since buying Alleghany in 2022.

Meta Platforms $META ( ▲ 1.69% )

Will use conversations with its AI chatbot to personalize ads and content shown to users. The announcement drew criticism from privacy advocates.

Ford $F ( ▲ 1.67% )

Third-quarter sales grew 8.2% driven by electric vehicles and large SUVs. EV sales jumped 30.2% to reach a new quarterly record above 30,600 units.

Microsoft $MSFT ( ▼ 0.31% )

CEO Satya Nadella is relinquishing some duties to focus more on technical work, especially AI. Judson Althoff will helm the company's commercial business.

Other Notable Company News

Conagra Brands $CAG ( ▼ 1.18% )

Fiscal first-quarter revenue, adjusted EBITDA, and earnings per share all beat Wall Street estimates. The Duncan Hines and Vlasic owner reaffirmed its full-year outlook.

Hims & Hers $HIMS ( ▼ 1.2% )

Downgraded to Underperform at Bank of America with a $28 price target. The analyst cited weakening September sales trends and tougher year-over-year comparisons for GLP-1 products in the back half of 2025.

IBM $IBM ( ▲ 0.34% ) and Advanced Micro Devices $AMD ( ▼ 1.58% )

Struck a multi-year deal with AI firm Zyphra. IBM Cloud will host a large cluster of AMD Instinct MI300X GPUs for training foundation models. First full-stack AMD training platform at scale on IBM Cloud.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Yields fell across the curve after the weak jobs data. The 10-year dropped to 4.108%, the 2-year to 3.547%, and the 30-year to 4.702%. Traders positioned for rate cuts.

Gold hit fresh records at $3,886.50 on political uncertainty and dollar weakness. Silver climbed nearly 2%.

Policy Watch

Government shutdown

Funding lapsed overnight. About 750,000 federal workers face daily furloughs. Vice President Vance said layoffs could start in days if the closure drags, though he expects a short shutdown. Fitch said no near-term rating impact but called out political dysfunction.

Federal Reserve

Futures price 100% odds of a cut at the October 28-29 meeting

Data blackout from the shutdown complicates near-term guidance

Supreme Court let Fed Governor Lisa Cook keep her job pending January arguments

Trade policy

Trump will direct tariff revenue to farmers as China withholds soybean purchases

EU planning 50% steel tariffs above quotas to match U.S. levels

Next Russia-U.S. talks set for end of autumn per Tass

Today’s Sponsor

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

What to Watch

Pharma deals beyond Pfizer - Merck, Eli Lilly, or Amgen could announce similar tariff exemptions paired with TrumpRx participation. Watch for White House announcements that could move the sector.

Shutdown resolution - If it ends quickly, Friday's jobs report could still drop with a short delay. If it drags past a few days, expect increased volatility as traders lose their primary data point heading into the Fed meeting.

Berkshire-Occidental deal progress - A $10 billion OxyChem sale would be Buffett's biggest move since 2022. Watch for regulatory filings that signal the deal is advancing.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.