- Pivot & Flow

- Posts

- October 17th Market Overview

October 17th Market Overview

October 17th Market Overview (no fluff)

Happy Friday

Trump called the China tariffs "not sustainable" and that's all the market needed. Fear is loud but short lived when liquidity is high and cash is flowing into assets.

Not a bad way to head into the weekend.

Let's dig in...

Today's Big Picture

The Bank Scare Was a Head Fake?

Moody's head of global private credit told CNBC there's no evidence of a systemic credit problem. Thursday's drop in banks like Zions and Western Alliance was an overreaction to a few specific bad loans, not widespread trouble. Banks borrowed $8.35 billion from the Fed's standing repo facility Thursday. Friday morning was quiet.

Trump Walks Back Tariff Threat

President Trump called the 100% tariff threat "not sustainable," removing a major piece of uncertainty. Treasury Secretary Bessent scheduled to speak with Chinese Vice Premier He Lifeng Friday evening. Trump confirmed he still expects to meet with President Xi at month's end. Markets climbed on the news.

Trump Targets weight loss Drug Prices

The President said Ozempic's cost could be $150 or "much lower." Direct shot at Novo Nordisk $NVO and Eli Lilly $LLY pricing models.

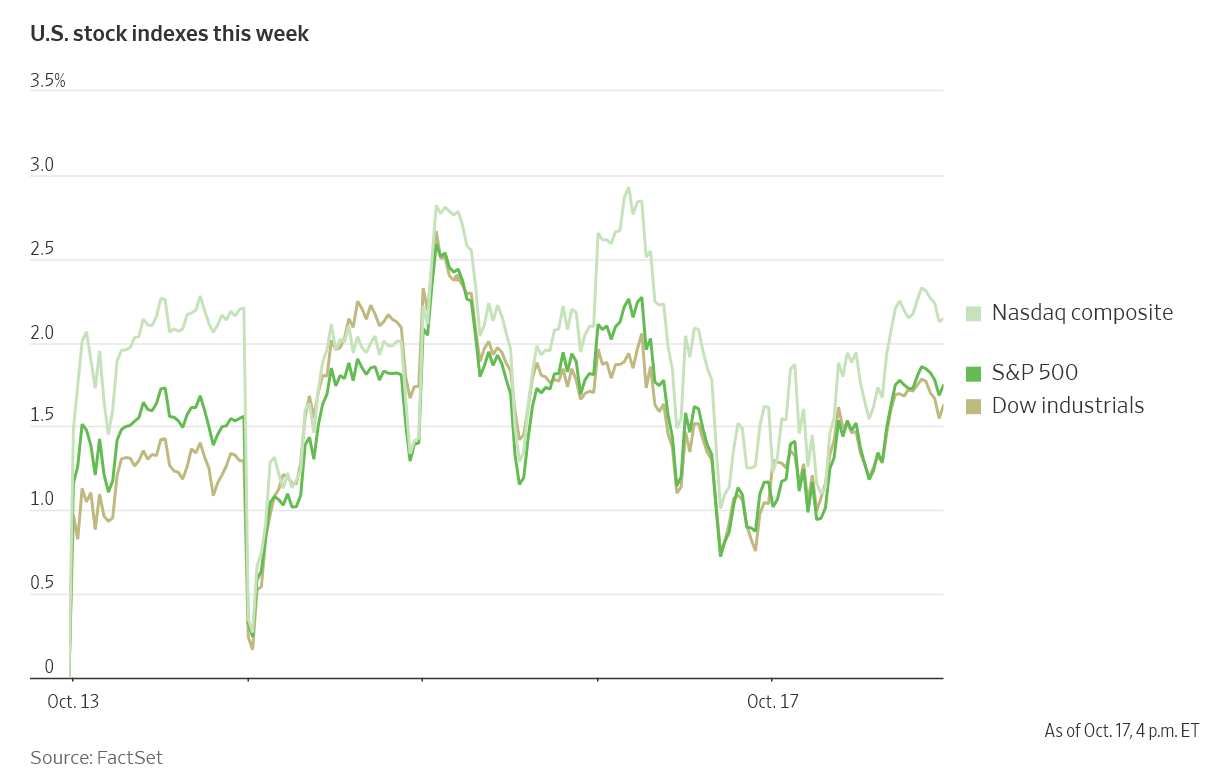

Market Overview

Index Performance

Broad participation on today’s rally, strong Friday close.

Upgrade to premium and get → Market Health dashboard

Stock Spotlight

Oracle $ORCL ( ▲ 1.59% )

fell after giving its long-term financial outlook at its AI World conference. Revenue expected to grow annually over five years. Worst day since January despite a cloud deal with Meta.

AST SpaceMobile $ASTS ( ▼ 10.52% )

fell after Barclays downgraded to underweight, calling the valuation "excessive." Stock has more than doubled this month after the Verizon deal to provide space-based cellular service starting in 2026.

American Express $AXP ( ▼ 1.29% )

beat on profit and revenue. Cardholders spent more and card fees climbed.

Zions Bancorp $ZION ( ▼ 1.27% )

climbed after Baird upgraded the stock. The firm said Thursday's drop was disproportionate to the $50 million charge-off on two bad loans.

Jefferies Financial $JEF ( ▼ 0.7% )

rose after Oppenheimer upgraded the stock. The bank fell sharply Thursday over its exposure to bankrupt auto-parts maker First Brands.

Big Name Updates

Fifth Third Bancorp $FITB ( ▼ 1.72% )

beat earnings despite raising its credit loss provision to $197 million. Charge-off ratio worsened but profit still rose.

Truist Financial $TFC ( ▼ 1.28% )

posted higher profit and revenue on strong investment banking, trading, and wealth fees.

Tesla $TSLA ( ▼ 0.1% )

reports Wednesday. Schwab clients buying the dip. CEO confirmed xAI involvement and said AI computing demand has climbed over the past six months.

Deere $DE ( ▼ 3.8% )

upgraded to buy by UBS. The firm expects ag fundamentals to bottom out, with 2026 the last down year before recovery in 2027.

Other Notable Company News

Interactive Brokers $IBKR ( ▼ 1.59% )

beat with 57 cents per share versus 54 cents expected. Revenue also beat. Stock fell anyway.

AppFolio $APPF ( ▲ 0.87% )

climbed after KeyBanc upgraded to overweight with a $285 target.

United Airlines $UAL ( ▼ 5.03% )

missed revenue estimates at $15.2 billion. Company expects Q4 to improve as travel demand picks up.

Progyny $PGNY ( ▼ 0.96% )

fell after White House announced plans to expand IVF access.

Interfor $IFSPF ( ▼ 1.16% )

will deepen lumber production cuts on weak demand.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield climbed back above 4% as Thursday's fear faded. VIX hit 27 early Friday then retreated to 21. Dollar recovered from yesterday's weakness.

Banks borrowed $8.35 billion from the Fed's repo facility Thursday but Friday morning was quiet - funding stress is easing.

Policy Watch

Fed

Fed officials back a rate cut later this month. Governor Christopher Waller said the central bank should "move with care" afterward given strong growth but weaker labor market signals.

Banks borrowed $8.35 billion Thursday through the Fed's standing repo facility - unusual outside quarter-ends. Friday morning was quiet, suggesting the financial system is under less stress.

Fiscal & Trade

Trump called the 100% China tariffs "not sustainable." Treasury Secretary Bessent scheduled to speak with Chinese Vice Premier He Lifeng Friday evening. Both moves calmed nerves.

Trump met with Ukrainian President Zelensky Friday. Said he'd rather end the war than send Tomahawk missiles to Ukraine.

Government Shutdown

Shutdown drags into another week

State data show federal worker unemployment claims have climbed this month

Goldman compiling its own jobless claims from state data - they show claims actually fell last week

Army Corps of Engineers pausing $11 billion in projects

International

Hong Kong's Hang Seng fell, biggest drop since April. European banks dropped hard on spillover from U.S. regional bank concerns. Deutsche Bank fell sharply.

Today’s Sponsor

Thousands of Investors Are Backing This Cocktail Bar’s Major Expansion

On New Year’s Eve in 2006, 24-year-old David Kaplan opened the first Death & Co as a “blink and you’ll miss it” cocktail bar in Manhattan’s East Village.

The bars welcome more than 10,000 visitors each week and the company is on track to do $20M this year.

No surprise, considering they’re listed in “The World’s 50 Best Bars” and their cocktail book was the first drinks book to ever win the James Beard Award for “Book of the Year.”

Building off their iconic Death & Co brand, they have their sights set on a new frontier: building a global hospitality business.

With the company projecting 5.5X revenue growth in just four years, scaling 200% faster than leading hospitality brands, investors see a unique opportunity.

That’s why 3,000+ people have invested in Death & Co already. But the investment opportunity ends on Oct. 30.

This is a paid advertisement for Death & Company’s Regulation A offering. Past performance is not indicative of future results. Please read the offering circular at invest.deathandcompany.com.

What To Watch

CPI Report

September inflation report drops Friday, October 24th. Key input for Fed's next rate decision. Michigan consumer sentiment same day.

Earnings Ramp Up

90 S&P 500 companies report next week. Monday: Zions after this week's chaos. Tuesday: Netflix, Coca-Cola, General Motors, Lockheed Martin, Texas Instruments. Wednesday: Tesla, IBM, AT&T. Thursday: Intel, Ford, T-Mobile. Friday: Procter & Gamble.

China Trade Developments

Bessent-He call Friday evening could determine if November 1st tariffs happen. Trump-Xi meeting still on for month's end.

Thanks for reading 🙂

- John

Today’s Sponsor

Most coverage tells you what happened. Fintech Takes is the free newsletter that tells you why it matters. Each week, I break down the trends, deals, and regulatory shifts shaping the industry — minus the spin. Clear analysis, smart context, and a little humor so you actually enjoy reading it.

Note: This newsletter is intended for informational purposes only.