- Pivot & Flow

- Posts

- October 16th Market Overview

October 16th Market Overview

October 16th Market Overview (no fluff)

Happy Thursday

The VIX jumped, the ten-year broke below four, and money ran to safety and China said they are going to start selling flying cars next year.

One cockroach is never just one.

Markets gave back early gains after regional banks started admitting what their loan books actually look like. Zions wrote off $50 million, Western Alliance disclosed fraud, and suddenly everyone remembered Jamie Dimon's line from earlier this week: "When you see one cockroach, there are probably more."

Let's dig in...

Today's Big Picture

Regional Banks Getting Rattled

Zions $ZION took a $50 million hit on two bad loans. Western Alliance $WAL sued a borrower for fraud. Auto lenders Tricolor and First Brands already went bankrupt with similar issues. Jamie Dimon called it Monday: “when you see one cockroach, there are probably more.”

TSMC (re)Confirms The AI Boom Is Real

Taiwan Semiconductor $TSM ( ▼ 1.0% ) posted record profit and raised full-year guidance to mid-thirties growth. CEO said AI demand is stronger than three months ago and the numbers are insane. North America is now seventy-six percent of revenue.

Flight to Safety Accelerates: Gold and Bonds Flashing Warning Signs

Gold hit a new record and silver practically tapped $53, its first record since 1980. Ten-year yields broke below four.

Investors are rotating out of risk and into anything that isn't tied to the banking system or government promises.

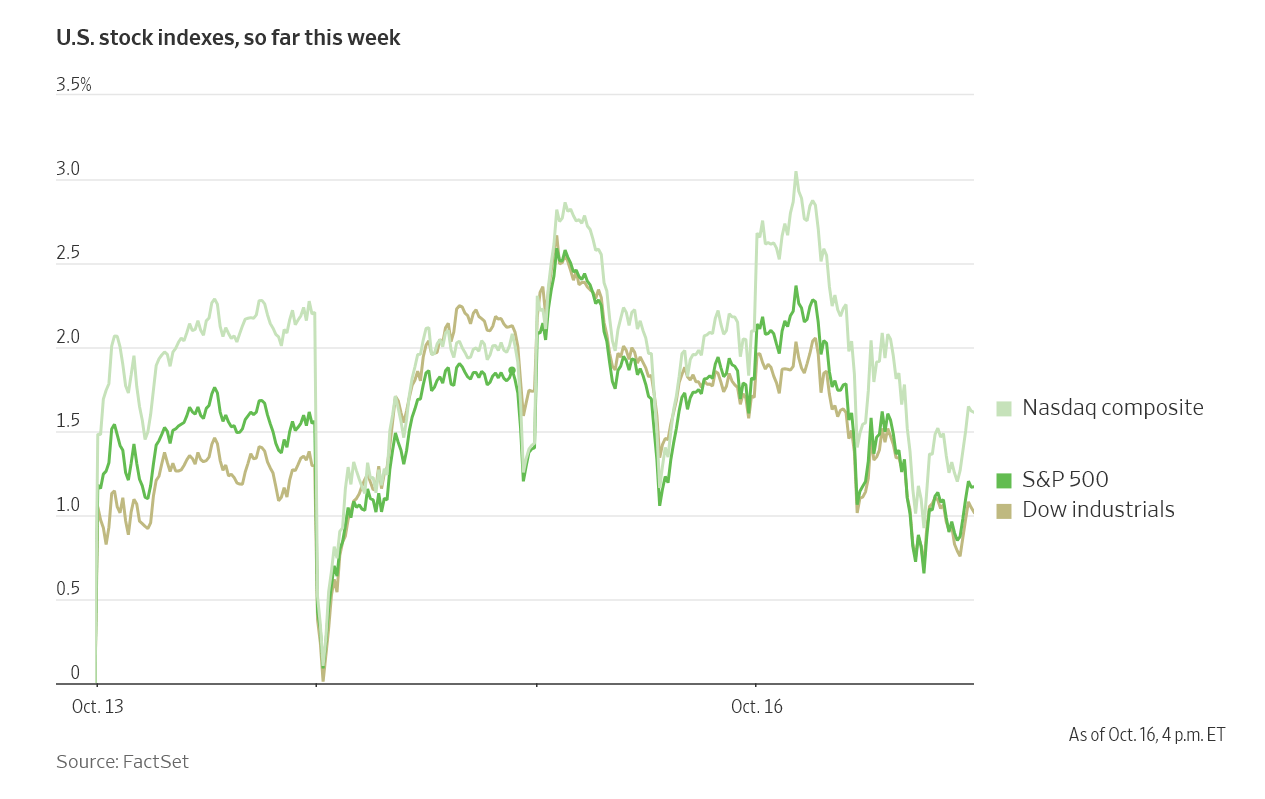

Market Overview

Index Performance

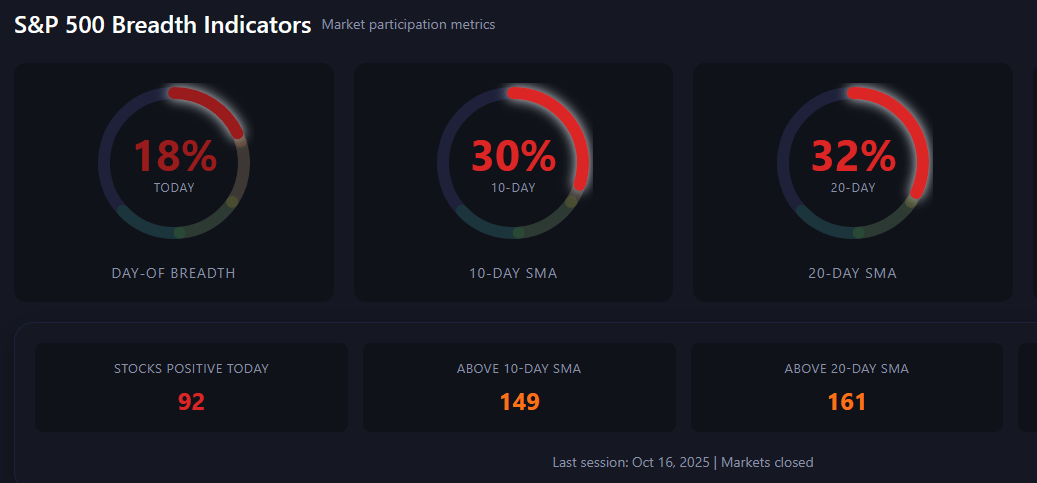

I’ll save the 200 day indicator for just the premium members today, that’s the biggest hedge signal I have and the reason I created this tool.

Upgrade to premium and get → Market Health dashboard

Stock Spotlight

J.B. Hunt $JBHT ( ▼ 3.64% )

having its best day since January 1998. Earned $1.76 per share on $3.05 billion revenue. Street expected $1.46 and $3.03 billion. Intermodal operating income climbing.

Charles Schwab $SCHW ( ▼ 0.66% )

posted record profit of $2.36 billion and record revenue of $6.14 billion. A third of new clients this year are Gen Z. Launching Bitcoin and Ethereum spot trading first half of 2026.

Hewlett Packard Enterprise $HPE ( ▼ 0.37% )

getting hammered. Projects slower growth next year after strong growth this year. Wall Street isn't buying it.

Big Name Updates

Salesforce $CRM ( ▲ 4.3% )

targeting $60 billion revenue by fiscal 2030, above the $58 billion Street estimate. Expects double-digit organic growth annually through 2030. Announced $7 billion in buybacks over six months.

United Airlines $UAL ( ▼ 5.03% )

fell after revenue missed at $15.2 billion. Guides Q4 earnings between $3 and $3.50 per share. American Airlines $AAL and Delta Air Lines $DAL dropped in sympathy.

F5 $FFIV ( ▼ 0.87% )

getting crushed after disclosing a nation-state actor breached its systems. Bloomberg sources called it potentially catastrophic.

Nestlé $NSRGY ( ▼ 1.17% )

had its biggest one-day gain since 2008. Beat on Q3 sales and announced 16,000 job cuts over two years.

Other Notable Company News

Snap-on $SN ( ▼ 0.75% )

rallied after beating on earnings. Posted $5.02 per share on $1.19 billion revenue as auto parts demand improved.

American Electric Power $AEP ( ▼ 1.11% )

secured $1.6 billion DOE loan to upgrade 5,000 miles of transmission lines. Data centers driving power demand.

Taiwan Semiconductor $TSM ( ▼ 1.0% )

working with Amkor $AMKR in Arizona because Amkor's schedule is earlier and TSMC wants to hit customer timelines.

Alphabet $GOOGL ( ▼ 0.74% )

built a 27 billion parameter model for cancer research that significantly boosted antigen presentation in tests.

Micron $MU ( ▼ 0.93% )

getting price target raises. UBS to $245, Citi to $240 calling DRAM demand unprecedented.

Apple $AAPL ( ▼ 0.85% )

lost its Siri AI search team leader to Meta $META.

Jack in the Box $JACK ( ▼ 0.2% )

selling Del Taco for $115 million. Paid $575 million in 2021. Massive haircut.

XPeng $XPEV ( ▲ 1.05% )

claims it will mass-produce flying cars next year.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The ten-year yield broke below four for the first time since mid-September as banking worries drove money into Treasuries. The two-year yield hit three point four one, lowest since September 2022. Tomorrow's $22 billion thirty-year auction will test whether this flight to safety has legs.

Policy Watch

Fed

Christopher Waller endorsed a rate cut this month but said the Fed needs to "move with care" after that. Growth looks strong but the labor market looks weak. Something's gotta give. The government shutdown isn't helping by delaying the September jobs report. This is the last week Fed officials can speak before the October 28-29 meeting blackout.

Government Shutdown Week three. Still no economic data from federal agencies. The Fed is making decisions in the dark.

Fiscal & Trade

Treasury Secretary Scott Bessent says the U.S. is close to wrapping up a trade deal with South Korea

South Korea's Kospi hit a record today with Hyundai and Kia leading on the news

Trump said India will stop buying Russian crude. India said that's not how energy policy works

Trump meets Putin in Budapest this week to discuss Ukraine before talking to Zelensky on Friday

International

German Chancellor Friedrich Merz wants a pan-European stock exchange to compete with the U.S. and Asia.

Today’s Sponsor

This Technology Makes Every City a Potential Surf Destination

Topgolf revolutionized golf by turning it into a social, tech-driven game for anyone. And they’ve made billions in annual revenue doing it. Surf Lakes is applying that same model to surfing. Their patented tech creates 2,000 ocean-quality rides per hour, anywhere in the world, across all skill levels.

Surf tourism is a $65B global industry, yet fewer than 1% of people live near real waves. Licenses sold across the U.S. and Australia, with plans for a first commercial park in the works.

3x world champ Tom Curren and surf icon Mark Occhilupo have joined as ambassadors and shareholders. Even actor Chris Hemsworth has praised Surf Lakes.

You have until October 30th at 11:59 PM PT to invest in Surf Lakes.

This is a paid advertisement for Surf Lakes’ Regulation CF offering. Please read the offering circular at https://invest.surflakes.com

What To Watch

Zions Earnings Monday Zions $ZION

reports Q3 on October 20. First full look at the $60 million credit loss provision. The market wants to know if this is isolated or the start of something bigger.

Travelers Tomorrow

Travelers $TRV reports, another read on insurance after Progressive missed earlier this week.

Credit Market Contagion

The real story is what we don't see yet. Tricolor and First Brands exposed loose lending in private credit. Jamie Dimon's cockroach comment has everyone asking: what else is out there?

Economic Data Blackout

Consumer inflation data pushed to October 24. Retail sales and wholesale inflation stuck indefinitely. We're trading blind on the actual economy.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.