- Pivot & Flow

- Posts

- November 7th Market Overview

November 7th Market Overview

November 7th Market Overview (no fluff)

Happy Friday

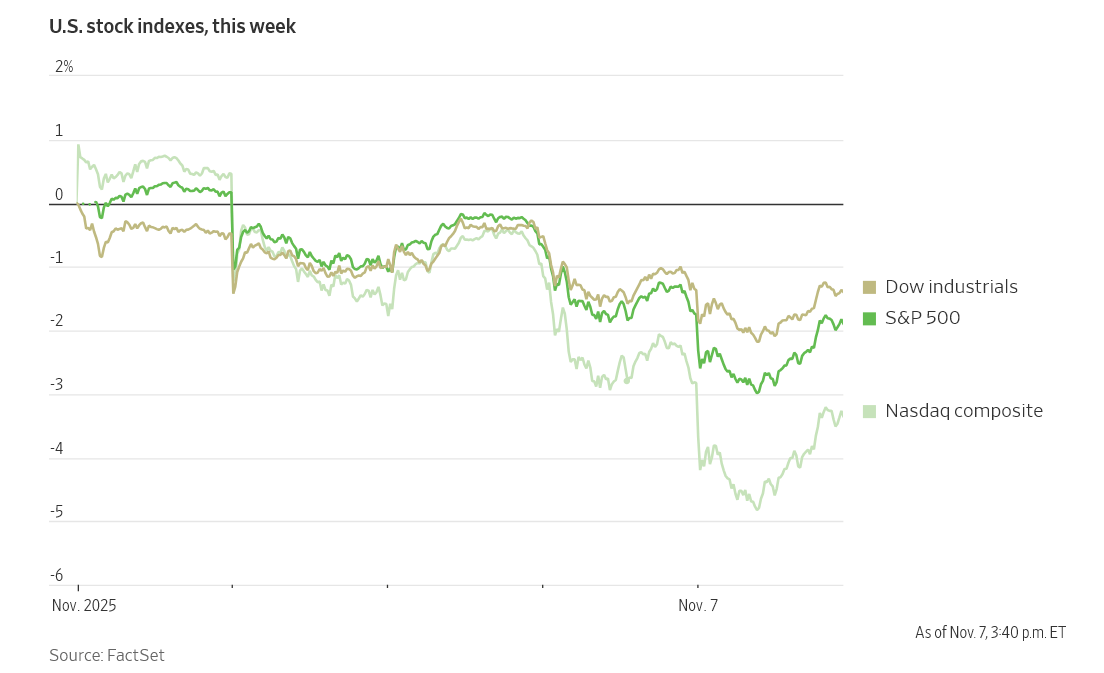

Markets bounced after Democrats floated a shutdown deal, but consumer sentiment just crashed to levels we haven't seen since 2022. Tech kept bleeding. The rally today was political hope, not economic reality.

I think we're pricing optimism the fundamentals don't support yet.

Let's dig in...

Today's Big Picture

Shutdown's Economic Bite

Consumer sentiment crashed to 50.3, near the all-time low from 2022's inflation crisis. The FAA is cutting ten percent of flights at 40 airports because air traffic controllers are working without pay. We've missed two straight months of jobs data. This isn't a DC problem anymore.

AI Stocks Cool Off

The Nasdaq is headed for its worst week since April. Nvidia down over 9 percent, AMD down nine percent, Oracle tracking nine percent losses. Valuations got stretched and now they're correcting. The selling seems orderly, not panicked.

Musk Gets His Payday

Tesla $TSLA shareholders approved Elon Musk's pay package with seventy-five percent support. His voting control jumps from thirteen percent to twenty-five percent. First tranche pays out when Tesla hits $2 trillion market cap - it's at $1.54 trillion now. Stock sold off anyway.

Market Overview

Index Performance

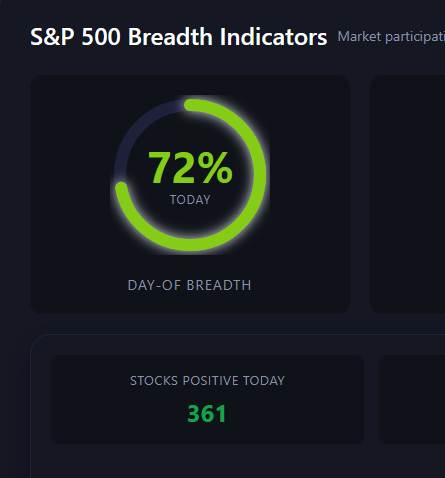

Strong breadth today indicating real hope across the board that govt shutdown is nearing it’s end as well as earning season volatility coming to an end.

If you are a premium member, you can access the market health dashboard at this link.

Stock Spotlight

Take-Two Interactive $TTWO ( ▲ 1.22% )

delayed Grand Theft Auto VI again to November 2026 from May 2026. Second delay. Stock dropped despite beating on revenue.

Archer Aviation $ACHR ( ▲ 12.48% )

disclosed a $650 million stock offering to fund its $126 million Hawthorne Airport acquisition. The air taxi maker was chosen for 2028 LA Olympics. Shares outstanding have grown from 397.5 million to 660.9 million in a year.

Peloton $PTON ( ▲ 5.35% )

posted a surprise profit for the second straight quarter. The company raised full-year adjusted EBITDA guidance to between $425 million and $475 million.

Big Name Updates

Airbnb $ABNB ( ▲ 0.75% )

beat on revenue with $4.1 billion versus $4.08 billion expected and raised fourth-quarter guidance.

Bank of America $BAC ( ▲ 2.89% )

was named a top pick by Morgan Stanley. Price target implies thirty-one percent upside.

Affirm $AFRM ( ▼ 4.02% )

crushed expectations with earnings of 23 cents per share versus 11 cents expected. Revenue of $933 million beat the $883 million estimate.

Expedia $EXPE ( ▲ 2.4% )

raised annual sales outlook. Travel demand is holding up.

Other Notable Company News

Constellation Energy $CEG ( ▲ 5.81% )

earnings missed expectations and the company lowered the top end of its full-year guidance.

Globus Medical $GMED ( ▲ 0.35% )

beat on earnings and revenue, then raised fourth-quarter guidance. Truist and Bank of America both upgraded to buy.

Williams $WMB ( ▼ 0.74% )

shares rose after New York approved a key permit for its natural gas pipeline project from Pennsylvania to Brooklyn, Queens, and Long Island.

DraftKings $DKNG ( ▲ 4.31% )

reported a loss of 52 cents per share versus 42 cents expected. Revenue of $1.14 billion missed the $1.22 billion forecast.

Block $XYZ ( ▲ 4.85% )

missed badly with earnings of 54 cents versus 67 cents expected. Revenue of $6.11 billion came in below the $6.31 billion forecast.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The ten-year Treasury yield hit its highest level in nearly a month. Move reflects growing uncertainty around everything: tariff policy after Wednesday's Supreme Court hearing, government dysfunction, and Federal Reserve direction.

The dollar also hit its highest level since August. Next week's Treasury auctions will show if foreign buyers are still showing up.

Policy Watch

The Fed

Fed Vice Chair Philip Jefferson: "It makes sense to proceed slowly" on rate cuts. He backed last week's cut but rates are now closer to neutral.

New York Fed President John Williams hinted at expanding the balance sheet again to maintain bank reserves. This isn't about monetary policy, it's about financial system plumbing.

Government Shutdown

Senate votes Friday on a stopgap funding measure. Schumer offered Republicans a one-year extension of ACA tax credits in exchange for reopening the government.

The damage is real:

Transportation Secretary cutting flights ten percent at 40 airports (3,500-4,000 daily flights affected)

Over 700 flights already canceled Friday morning

Two months of missing economic data

Tariffs & Trade

Supreme Court heard arguments Wednesday on Trump's tariff authority. Conservative justices showed skepticism. The case could reverse the entire tariff plan.

Chinese exports fell for the first time since February, driven by drops in US sales. Both economies taking hits.

Today’s Sponsor

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

Shares remain $0.81 until Nov 20, then the price changes.

👉 Invest in RAD Intel before the next share-price move.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

What To Watch

Shutdown Deal

Senate votes today on a stopgap measure. Any progress over the weekend moves markets Monday. We're past the point where this is just political theater.

AI Stock Test

Nvidia $NVDA down 9% percent this week. If we see more selling Monday, this is more than a correction.

China Data

Industrial output and retail sales reports next week. With US export sales falling, their internal economy matters more now.

Jobs Blackout

Two months without official employment data. Challenger Gray reported October layoffs hit a 22-year high for the month. When the data finally drops, it won't be pretty.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.