- Pivot & Flow

- Posts

- November 6th Market Overview

November 6th Market Overview

November 6th Market Overview (no fluff)

Happy Thursday

Reality showed up for AI stocks today. Nvidia down $440 billion in three days, Palantir getting hit despite beating.

The market's basically saying "we believe the story, just not at these prices."

We're on day 37 of the shutdown and flying blind without official economic data, which makes these moves feel more uncertain. I’d expect a deal to happen by end of this weekend/next week.

Let's dig in...

Today's Big Picture

1.AI Stocks Get A Reality Check

The big AI names that led the market higher took it on the chin. Nvidia $NVDA has shed $440 billion in market value since Monday, its worst three-day stretch since the DeepSeek selloff. Palantir $PLTR is down about 12% this week despite beating earnings. When companies beat and still fall, the message is clear: prices got ahead of reality a bit.

2.Trump Cuts Deal On Weight-Loss Drugs

Eli Lilly $LLY and Novo Nordisk $NVO agreed to slash GLP-1 drug prices to $245 monthly for Medicare and Medicaid users. Direct-to-consumer pricing drops to $350, targeting $250 within two years. In exchange, Lilly gets tariff protection and fast-track FDA vouchers. This just reset the entire pricing structure for weight-loss drugs.

3.Job Cuts Hit Highest October Level Since 2003

Companies announced plans to cut more than 153,000 jobs last month, nearly triple September’s number. Challenger, Gray and Christmas pointed to cost-cutting and AI adoption as drivers. This is the worst year for announced layoffs since 2009, and we’re flying blind without official government data because of the shutdown.

Market Overview

Index Performance

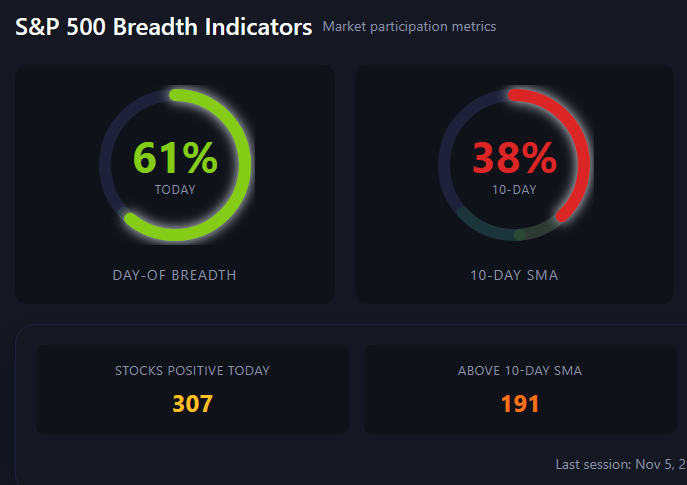

If you are a premium member, you can access the market health dashboard at this link.

Stock Spotlight

CarMax $KMX ( ▲ 3.74% )

fired CEO Bill Nash and slashed its outlook. Comparable-store sales are expected to fall while rival Carvana $CVNA ( ▲ 5.21% ) posts strong growth.

Datadog $DDOG ( ▲ 4.65% )

beat revenue estimates at $886 million versus $853 million expected. Raised full-year guidance.

Snap $SNAP ( ▲ 1.95% )

announced a $500 million buyback and a $400 million deal with Perplexity to integrate AI search into Snapchat. Revenue guidance beat expectations.

AppLovin $APP ( ▲ 8.39% )

revenue hit $1.41 billion versus $1.34 billion expected. Fourth-quarter guidance also topped estimates.

IonQ $IONQ ( ▲ 14.99% )

revenue came in at $39.9 million versus $27 million expected. The quantum computing company raised full-year guidance and hit 99.99% two-qubit gate fidelity.

Big Name Updates

Qualcomm $QCOM ( ▲ 0.76% )

beat earnings but said it expects to lose Apple $AAPL as a modem customer. Losing your biggest customer beat out the good quarterly numbers.

DoorDash $DASH ( ▼ 0.76% )

will spend several hundred million more next year on platform development. Strong results got overshadowed by the spending increase.

Arm Holdings $ARM ( ▲ 11.56% )

revenue hit $1.14 billion versus $1.06 billion expected. Operating margin came in at 41% versus 36% expected.

Salesforce $CRM ( ▲ 0.73% )

fell on AI demand concerns. HubSpot $HUBS also disappointed with its revenue guidance.

Other Notable Company News

Marvell $MRVL ( ▲ 8.18% )

rose on reports SoftBank explored a takeover to merge it with Arm $ARM. Talks stalled but could restart.

SpaceX bought another $2.6 billion in spectrum licenses from EchoStar $SATS on top of the $17 billion deal earlier this year.

Papa John's $PZZA ( ▲ 1.32% )

CEO said the board is "open-minded" about alternatives after Apollo walked away from a takeover bid.

Duolingo $DUOL ( ▲ 4.43% )

fell on light guidance. The company is prioritizing user growth over near-term revenue.

Penn Entertainment $PENN ( ▲ 8.23% )

is ending its ESPN sports-betting deal early. ESPN partnering with DraftKings $DKNG ( ▲ 4.31% ) instead.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields fell with the 10-year dropping to 4.09%. Stock selling drove safe-haven buying. Yields have whipsawed all week as private data reports get more attention during the shutdown. Dollar weakened against the yen and pound.

Policy Watch

Government Shutdown

Day 37 makes this the longest shutdown in U.S. history. The FAA ordered 10% traffic cuts at 40 airports starting Friday. Some lawmakers think a deal could happen this weekend.

Each week shaves 0.1 to 0.2 percentage points off quarterly GDP

No official jobs or inflation data, forcing markets to guess using private reports

Supreme Court Tariffs

Justices across the board questioned Trump's tariff authority Wednesday. The government couldn't cite precedent for using emergency powers to raise revenue through tariffs.

Trump called a potential loss "devastating" but expects to win

No new tariffs while the case is pending

Consensus shifted from toss-up to expecting the tariffs get struck down

Fed Commentary

Chicago Fed President Austan Goolsbee said core inflation at 3.6% and core services near 4% "knocked him for a loop" before the data blackout. Makes rate cuts harder to justify.

International

Bank of England held rates steady, splitting from the Fed's October cut. China lifts its ban on Illumina $ILMN DNA sequencer imports November 10.

Today’s Sponsor

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Shares at $0.81 until Nov 20 — then the price moves. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

What To Watch

Tesla Shareholder Vote

Results from today's annual meeting will reveal whether Elon Musk's compensation package worth up to $1 trillion won approval. Meeting scheduled for 4 PM ET.

Government Shutdown Negotiations

Multiple lawmakers said they're optimistic about ending the shutdown this weekend. Any deal would restore economic data flows and remove the FAA airport restrictions.

Supreme Court Decision Timeline

A ruling on tariffs could come as soon as year-end. If struck down, expect short-term volatility but medium-term relief for trade-exposed sectors.

More Earnings

Airbnb $ABNB, ConocoPhillips $COP, and other major companies report after the close. Watch for commentary about consumer spending and travel demand heading into year-end.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.