- Pivot & Flow

- Posts

- November 5th Market Overview

November 5th Market Overview

November 5th Market Overview (no fluff)

Happy Wednesday

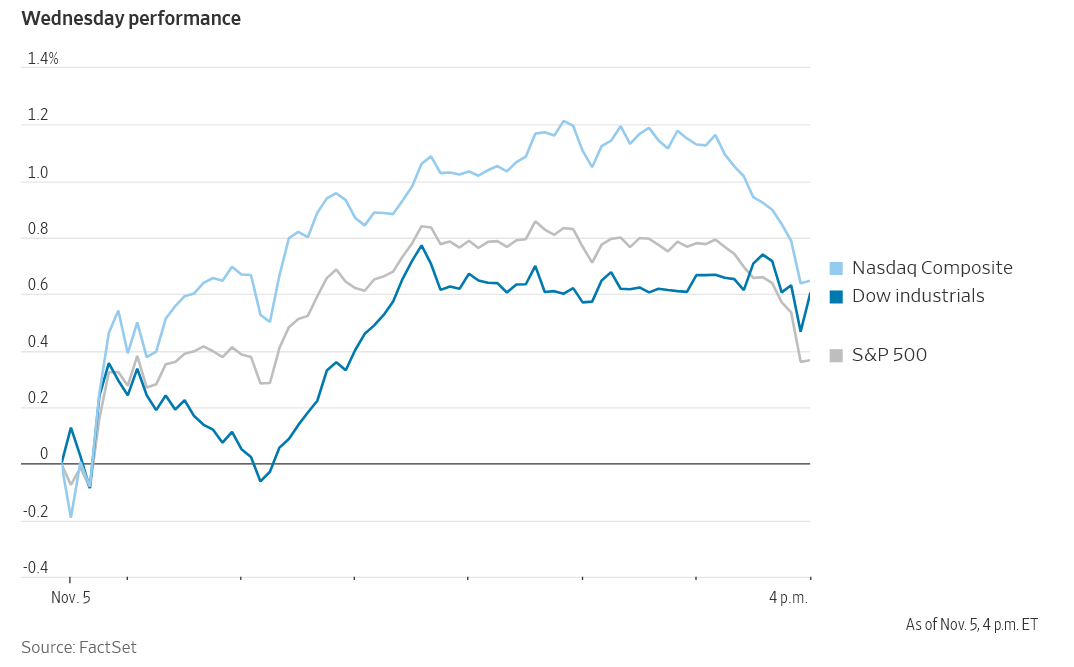

Ok we recovered some from yesterday's sell off. The big story was the Supreme Court hearing on Trump's tariffs, where justices sounded very skeptical of the administration's legal case.

I think we're seeing the market price in the hope of tariffs ending, even as a string of companies today blamed economic damage directly from these tariffs.

Let's dig in...

Today's Big Picture

Supreme Court May Kill Trump's Tariffs

The Supreme Court heard arguments on whether Trump's tariffs are legal. Justices from both sides questioned whether the president has the authority to impose these duties without Congress. Betting markets now give the tariffs only a 30% chance of surviving, down from 50% before the hearing. If the court rules against Trump, the government has to refund billions in duties already collected.

Companies Blame Tariffs for Weakness

$PINS ( ▲ 1.45% ) said large advertisers are pulling back due to margin pressure, with ad pricing down 24 in the quarter. Cava $CAVA cut its forecast, saying tariffs created an "overall fog for the consumer." Axon $AXON missed on profits and pointed directly to tariff constraints. The damage is starting to show up.

An Uneasy Tech Rebound

AI-related stocks bounced back after a tough session, but it wasn't a clean sweep. AMD $AMD turned positive after opening lower despite beating earnings. Super Micro Computer $SMCI fell after missing on results and guidance. I'm watching this closely. The market is getting much more selective about where it places its AI bets.

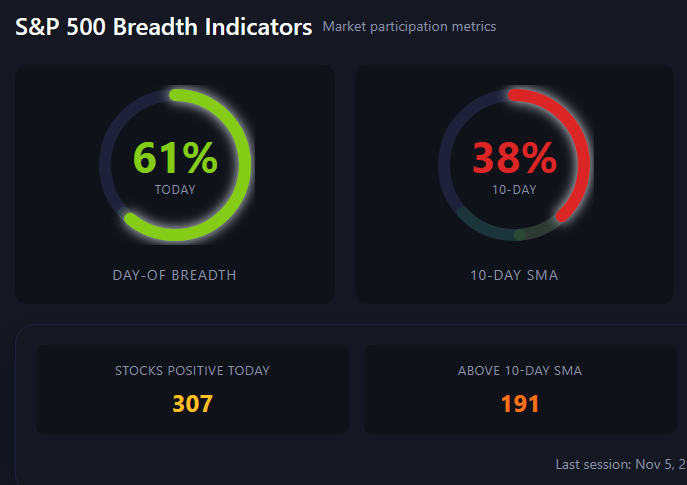

Market Overview

Index Performance

If you are a premium member, you can access the market health dashboard at this link.

Stock Spotlight

Rivian $RIVN ( ▲ 7.79% )

third-quarter results beat estimates. R2 midsize SUV remains on track for 2026 launch. Posted $24 million in gross profit, snapping last quarter's loss.

Unity Software $U ( ▲ 8.19% )

beat third-quarter results and fourth-quarter guidance topped expectations. Video game development tools seeing demand.

Allegiant Travel $ALGT ( ▲ 15.46% )

hiked full-year earnings outlook to above $3 per share versus prior guidance of $2.25.

Tesla $TSLA ( ▲ 3.5% )

rose ahead of Thursday's shareholder meeting. Key vote on Elon Musk's compensation package.

Big Name Updates

Advanced Micro Devices $AMD ( ▲ 8.28% )

beat third-quarter earnings but the stock was choppy. Data center revenue growth has slowed significantly from earlier quarters.

McDonald's $MCD ( ▲ 1.14% )

U.S. same-store sales beat at 2.5 versus 2.2 expected. Earnings missed at $3.22 per share versus $3.32 expected. CEO Chris Kempczinski keeps using "challenging environment" and leaning on the value menu.

Ford $F ( ▲ 0.58% )

and General Motors $GM rose as the Supreme Court appeared skeptical of the administration's tariff arguments.

Oracle $ORCL ( ▲ 4.65% )

recovered from Tuesday's losses, benefiting from AI infrastructure build-out.

Other Notable Company News

Super Micro Computer $SMCI ( ▲ 11.44% )

earnings and revenue fell below analyst expectations. Sixth consecutive quarter of misses.

Robinhood $HOOD ( ▲ 13.95% )

was up ahead of its earnings report due after the bell. The stock is up 280 year-to-date, making it the best performer in the S&P 500. That's a tough setup.

Caterpillar $CAT ( ▲ 7.06% )

rose on hopes tariffs may be rolled back.

Pinterest $PINS ( ▲ 1.45% )

fell sharply as ad pricing declined 24 with large retailers squeezed by tariffs.

Novo Nordisk $NVO ( ▲ 9.92% )

cut its full-year profit and sales forecasts amid fierce competition in the weight-loss drug market. The stock has dropped 50 this year under pressure from Eli Lilly $LLY and compounded copycats.

The RealReal $REAL ( ▲ 4.14% )

upgraded to overweight by KeyBanc. The firm sees secondhand luxury growing three times faster than firsthand through 2030.

Cava $CAVA ( ▲ 8.38% )

cut full-year same-store sales guidance to 3 to 4 from 4 to 6. CFO said consumers aged 25 to 34 are visiting less frequently due to higher unemployment and student loan repayments.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year yield hit 4.15, its highest level in about a month, after better-than-expected economic data. Treasury said it's considering selling more debt in the future, though not anytime soon. That's code for "we need to borrow more money."

Policy Watch

The Fed

Newly appointed Governor Stephen Miran said the Fed should cut rates in December. Chicago Fed President Austan Goolsbee, Fed Governor Lisa Cook, and San Francisco Fed President Mary Daly aren't sure yet.

Miran has voted for bigger rate cuts in both September and November.

Government Shutdown

The shutdown is now the longest in U.S. history at 36 days. Economic hit estimated at $15 billion per week. The BLS jobs report remains delayed with ADP data filling the void.

Tariffs at the Supreme Court

The hearing lasted nearly three hours with justices on both sides skeptical of the administration's argument on broad tariff authority.

Justice Neil Gorsuch, a Trump appointee, posed a hypothetical: Could a future Democratic president impose a 50% tariff on gas-powered cars to deal with climate change? The reply…. "very likely," you could feel the room shift.

Chief Justice John Roberts, Justice Amy Coney Barrett, and Justice Brett Kavanaugh also posed skeptical questions. Kavanaugh asked why no president before Trump had invoked this authority.

Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick attended. Trump skipped it.

Today’s Sponsor

Pelosi Made 178% While Your 401(k) Crashed

Nancy Pelosi: Up 178% on TEM options

Marjorie Taylor Greene: Up 134% on PLTR

Cleo Fields: Up 138% on IREN

Meanwhile, retail investors got crushed on CNBC's "expert" picks.

The uncomfortable truth: Politicians don't just make laws. They make fortunes.

AltIndex reports every single Congress filing without fail and updates their data constantly.

Then their AI factors those Congress trades into the AI stock ratings on the AltIndex app.

We’ve partnered with AltIndex to get our readers free access to their app for a limited time.

Congress filed 7,810 new stock buys this year as of July.

Don’t miss out on direct access to their playbooks!

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

What to Watch

Qualcomm Earnings

The chipmaker $QCOM reports after the close tonight. This is the next big test for the AI trade and whether valuation concerns are contagious beyond the usual suspects.

Tesla Shareholder Meeting

All eyes will be on the vote for Elon Musk's pay package tomorrow. The outcome matters for more than just Tesla. It's a referendum on founder compensation and board independence.

Supreme Court Decision Timeline

No immediate ruling expected on tariffs, but any decision will ripple through trade-exposed sectors. The administration warned it could owe tens of billions in rebates if it loses. Watch industrials, autos, retailers.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.