- Pivot & Flow

- Posts

- November 24th Market Overview

November 24th Market Overview

November 21st Market Overview (no fluff)

Happy Monday

Tech decided to stop bleeding today.

Alphabet added close to $250 billion after launching Gemini 3, but the real story imo is what their infrastructure chief said: they need to double compute capacity every six months just to keep up.

That's why tech rallied harder than anything. Two Fed officials backed a December rate cut which helped the mood.

I'm watching to see if this rally has legs heading into a holiday-shortened week where volume dries up fast. 🦃

Let's dig in...

Today's Big Picture

Google Just Changed the AI Race

Alphabet added $250 billion in market value after launching Gemini 3. Salesforce's CEO publicly said he's ditching ChatGPT for it. Google's infrastructure chief told employees they need to double compute capacity every six months just to keep up. Broadcom rallied because they build the custom chips Google needs. $AVGO ( ▲ 2.54% )

December Rate Cut Back in Play

Two Fed officials backed a rate cut next month. Odds jumped from 42% to 80% in a week. Williams said rates are still too high and need to come down. The Fed won't have October inflation data before they decide, but they're cutting anyway.

Michael Burry Bets Against AI

The guy who called the 2008 crash just shut down his hedge fund and launched a $379-a-year Substack called "Cassandra Unchained" to short AI. Burry doesn't go public unless he's certain. He disappeared for years after 2008. Now he's telling investors to take their money back because he can't beat this market then immediately launching a newsletter to explain why AI is a bubble.

Michael Burry depicted in “The Big Short”

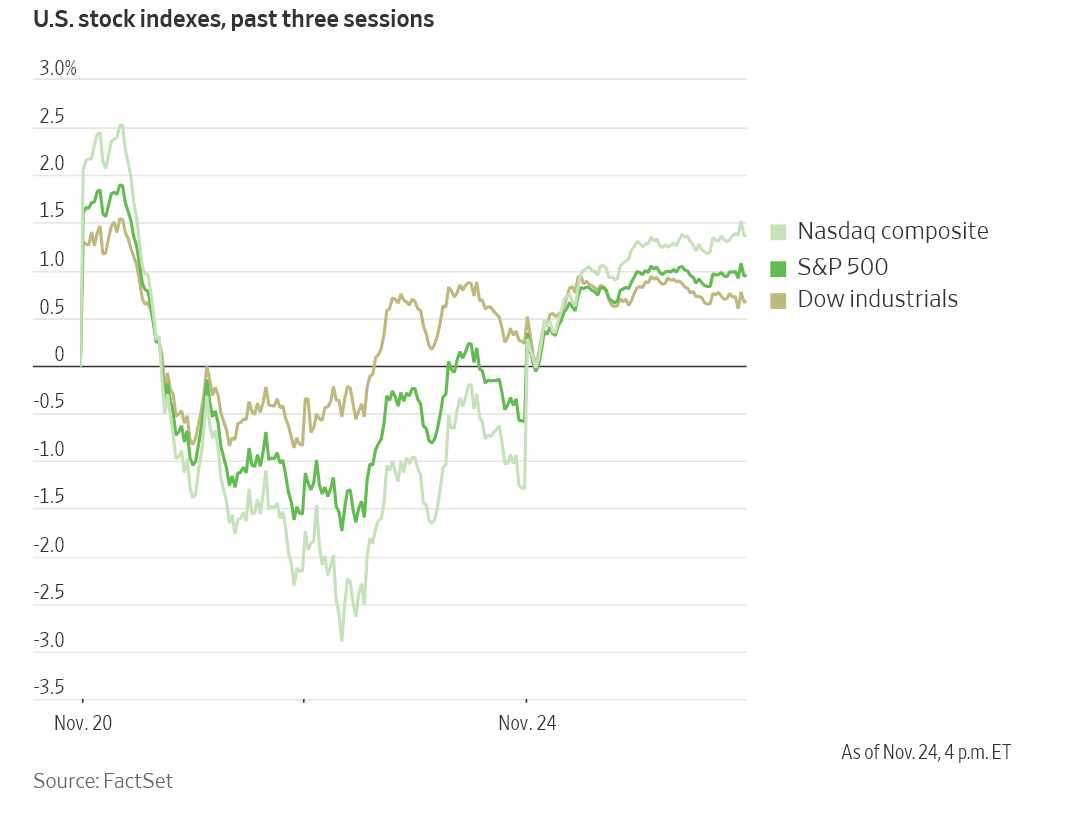

Market Overview

Index Performance

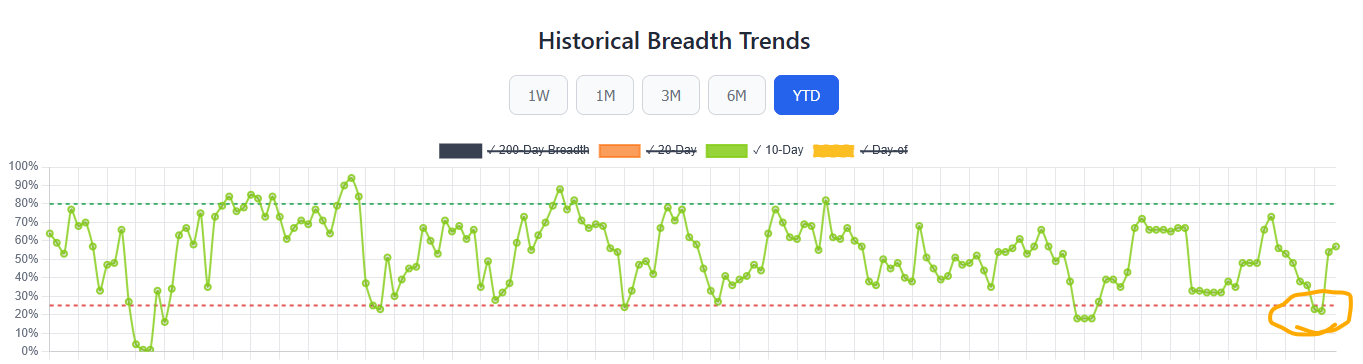

What do you know? This thing is freaky good at finding relative bottoms.

The Market Health Dashboard nailed this bounce setup last week like it has done 6x this year before

Premium members: Watch the 10-day and 20-day breadth crossing back above 25%.

Stock Spotlight

Broadcom $AVGO ( ▲ 2.54% )

rallied harder than anything in tech. They build Google's custom AI chips. Investors see it as a safer bet on Google's AI push.

Tesla $TSLA ( ▲ 1.53% )

climbed after Elon Musk said the company is finalizing its A15 AI chip and starting work on A16. The chips power both Tesla's vehicles and data centers.

Bitcoin $BTC ( ▲ 7.26% )

traded around $89,000 after its worst week since February. Deutsche Bank says it's moving like a tech stock now, not a safe haven. Plus institutional money is leaving.

Alphabet $GOOGL ( ▲ 0.07% )

is $230 billion away from a $4 trillion market cap and closing in on Apple. Warren Buffett's Berkshire bought 17.8 million shares earlier this month. The company last held the number two spot in 2018.

Big Name Updates

Oracle $ORCL ( ▲ 2.35% )

is burning cash on AI infrastructure and plans to issue $65 billion more in bonds over three years. They're rated two notches above junk. If they get downgraded, there isn't enough money available to fund their plans.

Novo Nordisk $NVO ( ▼ 1.7% )

fell after its Alzheimer's drug failed in trials. Over 3,800 people, no results. The stock has lost $470 billion since June 2024.

Amazon $AMZN ( ▲ 0.93% )

ran out of AI capacity this summer and lost customers. Internal docs show they couldn't serve demand. Epic Games moved a $10 million Fortnite project to Google because AWS couldn't handle it.

Tyson Foods $TSN ( ▼ 2.14% )

is closing its Lexington, Nebraska beef plant that processes 5,000 cattle daily. The Amarillo, Texas facility is getting cut from two shifts to one. That's 8% of U.S. beef capacity gone. Beef prices are going higher.

JBS $JBS ( ▼ 1.09% )

rallied because they'll pick up Tyson's lost business.

Other Notable Company News

US Foods $USFD ( ▼ 0.84% )

and Performance Food Group $PFGC called off merger talks. US Foods is buying back $1 billion in stock.

Alibaba $BABA ( ▼ 0.54% )

said its Qwen AI app drew over 10 million downloads in the first week after relaunching.

Carvana $CVNA ( ▲ 2.53% )

upgraded to Outperform at Wedbush with a $400 price target. Analyst says buy the dip despite credit worries.

Oscar Health $OSCR ( ▲ 5.29% )

rallied on reports Trump will extend ACA subsidies for two years.

Baidu $BIDU ( ▼ 0.34% )

upgraded to Overweight at JPMorgan with an $188 price target. Analyst says cloud and AI are taking over.

Grindr $GRND ( ▼ 0.27% )

fell after ending talks to take the company private. Management cited financing uncertainty.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield held at 4.04%. Dollar stayed flat at 97.51. Tuesday we'll see if bonds react to the Fed pivot.

Policy Watch

Fed

Christopher Waller backed a rate cut at the December meeting. He had another interview with Treasury Secretary Scott Bessent about taking over as Fed chair when Powell's term expires in May 2026.

Mary Daly from the San Francisco Fed also backed a December cut. She's worried about the labor market and doesn't think the Fed can get ahead of it.

Government Shutdown

The Bureau of Economic Analysis is skipping the third-quarter GDP release entirely. No date set for when it'll come out.

September PCE inflation data comes out December 5. October CPI is scrapped. November CPI won't come until December 18—after the Fed meets.

Fiscal & Trade

Commerce Secretary Howard Lutnick said the EU must change digital regulations to get lower steel and aluminum tariffs. He wants them to settle cases against Google, Microsoft, and Amazon for what he called "a cool steel and aluminum deal."

Trump's new ACA plan includes a two-year subsidy extension with income caps around 700% of the federal poverty line.

Treasury Secretary Scott Bessent said interest-rate sensitive sectors are in recession but he's confident about 2026. Services are driving inflation now, not imported goods.

Derek Jeter and Adam Levine $AMSS

just helped AMASS Brands raise $27M in a market exploding with growth - non-alc spirits up 8.7% annually, organic wine up 10.4%. They've reserved the $AMSS ticker, did $80M in revenue with 1000% YoY growth*

Check em out below

Today’s Sponsor

Rosé Can Have More Sugar Than Donuts?

No wonder 38% of adults prefer health-conscious beverages. AMASS Brands is raking in sales by tapping into this trend. They’ve earned $80M+, including 1,000% year-over-year

growth, thanks to products like their top-selling zero-sugar rosé. They even reserved the Nasdaq ticker $AMSS. Join celebs like Adam Levine and Derek Jeter as an AMASS investor and get up to 23% bonus shares today.

This is a paid advertisement for AMASS’s Regulation CF offering. Please read the offering circular at https://invest.amassbrands.com

What to Watch

PCE Inflation Data - December 5

The Fed's preferred inflation gauge drops four days before they meet. It's September data, but it's all Powell gets before deciding on a December cut.

Thanksgiving Week Trading

Markets close Thursday, early close Friday at 1 p.m. ET. Volume disappears starting tomorrow. Moves get exaggerated when nobody's trading.

AI Spending Data

Deutsche Bank says AI investment accounted for up to half of GDP growth in the first half of this year. If that spending slows, we're looking at a much weaker economy underneath.

Thanks for reading 🙂

- John

Today’s Sponsor

$57 Billion in NVDA Revenue, 62% YoY Growth. And stocks still fell… What now?

Nvidia just posted a record-breaking quarter… yet the markets dropped. Why?

Experts say that even the top AI earnings couldn’t calm the fear of a potential bubble.

After soaring at the open, the S&P reversed sharply, wiping out over $2T of value in hours.

The “Great Bitcoin Crash of 2025” only wiped out ~$1T by comparison.

Wall Street’s finally asking: What if AI isn’t enough?

So, where can investors diversify when public markets stop making sense?

Now, for members-only → blue-chip art.

It’s not just for billionaires to tie the room together. It’s poised to rebound.

With Masterworks, +70k are investing in shares of multimillion dollar artworks featuring legends like Basquiat and Banksy.

And they’re not just buying. They’re selling too. Masterworks has exited 25 investments so far, including two this month, yielding net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers skip the waitlist:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

Note: This newsletter is intended for informational purposes only.