- Pivot & Flow

- Posts

- November 19th Market Overview

November 19th Market Overview

November 19th Market Overview (no fluff)

Happy Wednesday

Markets drifted higher ahead of Nvidia's earnings tonight, but the more interesting move is Alphabet ripping to an all-time high while AMD, Meta, and most AI names got sold. This isn't the AI trade dying imo, the market's finally making distinctions between companies building the infrastructure and companies actually making money from it today.

The pullback in Nvidia going into this is probably healthy. Resets expectations and gives the stock room to run if they deliver. I’m watching $NVDA ( ▲ 1.02% ) ’s reaction not the numbers that come in off the today’s ER.

Let's dig in...

Today's Big Picture

Nvidia Faces Its Biggest Test Yet

The AI chipmaker reports after the bell with Wall Street expecting revenue growth around mid-fifties and data center sales approaching $49 billion. Options traders are betting on a 7% swing either way through Friday.

October Jobs Data Won't Happen

The BLS confirmed Wednesday they're skipping the standalone October employment report entirely due to the shutdown. October payrolls will roll into the November report on December 16 - six days after the Fed's final meeting of the year. Market immediately repriced December rate cut odds down to one in three. Without fresh labor data, Powell has less ammunition to cut.

AI Trade Is Rotating, Not Dying

Alphabet hit an all-time high while Meta, AMD and most AI names got hammered. This isn't the AI bubble popping - it's money moving from infrastructure plays to the companies actually monetizing AI today. Google's Gemini 3 launch showed tangible product improvement.

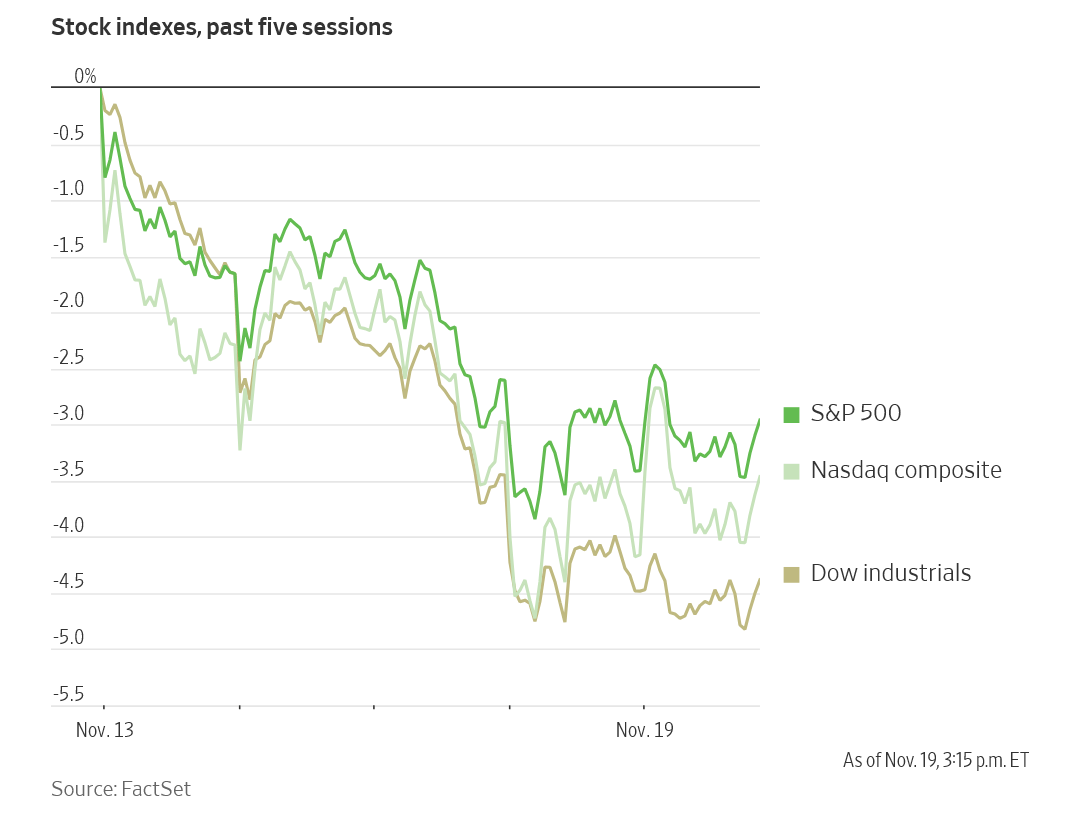

Market Overview

Index Performance

Stock Spotlight

Alphabet $GOOGL ( ▲ 4.01% )

hit an all-time high after launching Gemini 3 on Tuesday. The new AI model handles complex questions better and needs less hand-holding. If shares hold here, Google will overtake Microsoft in total market cap for the first time in seven years.

Nvidia $NVDA ( ▲ 1.02% )

has never missed its revenue forecast since AI chip sales took off in early 2023. CEO Jensen Huang said late last month that AI chip demand will beat the bullish forecasts through 2026.

Lowe's $LOW ( ▲ 0.78% )

rallied after online sales offset the home improvement slump that crushed Home Depot. The company earned $3.06 per share, topping the $2.97 estimate.

RAD Intel

Plans to go public on NASDAQ with backing from Adobe and Fidelity Ventures. The AI marketing platform is up 4,900% in valuation over four years and has reserved ticker symbol $RADI. *Todays Sponsor

Big Name Updates

Tesla $TSLA ( ▲ 0.03% )

received approval for its autonomous rideshare service in Arizona. Meanwhile, Elon Musk told the U.S.-Saudi Investment Forum that "work will become optional" as AI and robotics advance. He says everyone will eventually own an Optimus robot that will "eliminate poverty."

Microsoft $MSFT ( ▼ 0.31% )

is expanding its AI partnership with Nvidia. Azure's new Fairwater facility will run hundreds of thousands of Blackwell GPUs.

Meta $META ( ▲ 1.69% )

lost ground with other AI stocks. An equal-weighted version of the S&P 500 dropped only two points over the same period that Nvidia fell ten points, showing the concentrated nature of this selloff.

Other Notable Company News

MP Materials $MP ( ▼ 5.5% )

rallied after partnering with the U.S. Defense Department and Saudi Arabia's Maaden on a rare earth refinery. Goldman Sachs started coverage with a buy rating and $77 target on control over North America's NdPr production.

Constellation Energy $CEG ( ▲ 1.09% )

gained after landing a $1 billion federal loan to restart the Three Mile Island nuclear reactor. The project costs $1.6 billion total with Microsoft buying the power.

DoorDash $DASH ( ▲ 0.06% )

got upgraded to buy from hold at Jefferies with a $260 target. The firm likes the advertising potential.

Brookfield $BAM ( ▲ 0.98% )

is building a $100 billion AI infrastructure fund with Nvidia and the Kuwait Investment Authority. The fund has $5 billion committed to buy data centers, power plants, and chip facilities.

Block $SQQQ ( ▼ 2.55% )

said gross profit will hit $16 billion by 2028.

Plug Power $PLUG ( ▼ 2.09% )

dropped after announcing a $375 million convertible note offering due 2033.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield hit 4.136. The $22 billion 30-year bond auction hits tomorrow.

Policy Watch

Fed

Last month’s meeting minutes released today show officials split:

Several want a December cut if data cooperates

Many want rates frozen through year-end

Concerns divided between weak jobs and sticky inflation

December rate cut odds dropped to one in three after the BLS killed the October jobs report. Without that data, the Fed goes into its final 2025 meeting blind.

Trump Administration

President Trump said at the U.S.-Saudi Investment Forum that he wants to fire Fed Chairman Jerome Powell: "I'll be honest. I'd like to fire his ass." Treasury Secretary Scott Bessent pushed back, but Trump went after him too: "If you don't get it fixed fast, I'm going to fire your ass."

Trump said Saudi Arabia will invest $600 billion in the U.S., possibly up to $1 trillion. He's working on approving advanced chips for Saudi.

Trade & Economy

The U.S. trade deficit dropped to $59.6 billion in August from $78.2 billion in July as imports cratered. First data release since the shutdown. Trump's tariffs scrambled trade flows all year.

The Trump administration has been secretly working with Russia on a plan to end the Ukraine war, per Axios.

International

China's 10-year yield at 1.81%, barely above Japan's 1.77% - on track to drop below it for the first time ever

South Korea ready to intervene in FX and bond markets after the won hit a 16-year low

The Dutch government handed chipmaker Nexperia back to Chinese owner Wingtech after Beijing eased export curbs

Today’s Sponsor

RAD Intel’s AI platform grew 4,900% in four years—backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, Amazon, and YouTube.

Shares are $0.81 until Nov 20—then the price moves.

Trusted by Fortune 1000 brands like Hasbro, MGM, and Skechers, RAD Intel has 10,000+ investors, $50M+ raised, and its Nasdaq ticker reserved: $RADI. Shares are $0.81 until Nov 20 — then the price moves. The early window is closing fast.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions.. Please read the offering circular and related risks at invest.radintel.ai.

What to Watch

Nvidia Earnings Tonight

Watch the reaction, not the numbers. If they beat and the stock sells off, AI valuations are under fire fast. If they beat and rally, the trade lives.

Delayed September Jobs Report Thursday

The BLS drops September payrolls Thursday morning. One more labor market read before year-end.

Producer Price Index November 25

September PPI hits next Tuesday. Import and export price indexes drop December 3.

Fed Minutes Impact

Watch if today's division creates louder dissent among Fed officials in coming weeks. Powell has a harder job building consensus than the market thinks.

Thanks for reading 🙂

- John

Today’s Sponsor

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Note: This newsletter is intended for informational purposes only.