- Pivot & Flow

- Posts

- November 17th Market Overview

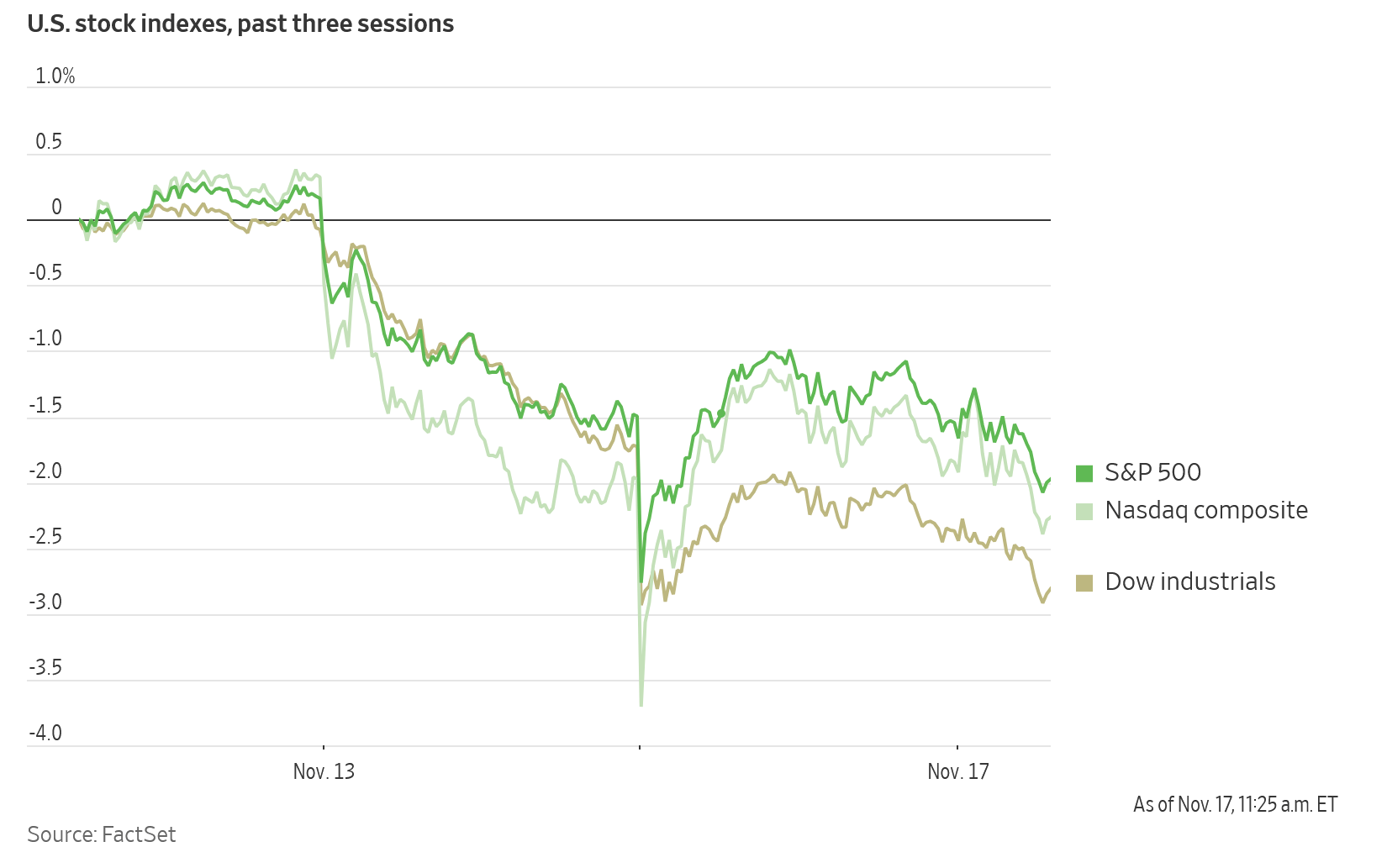

November 17th Market Overview

November 17th Market Overview (no fluff)

Happy Monday

Berkshire bought Alphabet at all-time highs. I don’t think they’re buying growth, they're buying the monopoly moat.

The Fed cut twice this year. The market priced in more.

Now the Fed is pushing back with inflation still not at target and now the job market not looking great.

Everyone's waiting on Nvidia earnings Wednesday, a big test for the AI valuations narrative.

P.S. It’s my niece’s birthday so info from today is all prior to 1pm. Cut me a little slack if something happens in those last 3h.

Let's dig in...

Today's Big Picture

Berkshire Buys Alphabet

Berkshire took a $5 billion position in Alphabet $GOOGL last quarter - 17.8 million shares. When Buffett's managers buy a stock that's already at all-time highs, that's a signal about AI's staying power.

Fed Signals Slower Pace on Cuts

Vice Chair Jefferson said the Fed needs to "proceed slowly" on rate cuts. Market odds of a December cut have collapsed from 90% to under 45% in three weeks.

Nvidia Week Is Here

Nvidia reports Wednesday with $500 billion in orders through 2026. The quarter will be fine. Guidance will either calm or amplify AI spending concerns.

Market Overview

Index Performance

Stock Spotlight

Alphabet $GOOGL ( ▲ 4.01% )

tested all-time highs near $292 on the Berkshire news. The company also launched its Qwen AI app to public beta today.

Albemarle $ALB ( ▲ 0.01% )

and other lithium producers rallied after a major Chinese producer's chairman forecast 30% demand growth in 2026.

Netflix $NFLX ( ▲ 2.17% )

began trading on its new split-adjusted basis today following its 10-for-1 split.

Big Name Updates

Apple $AAPL ( ▲ 1.54% )

Berkshire trimmed its stake by 15%. The company is also accelerating CEO succession planning with hardware chief John Ternus as the leading candidate to replace Tim Cook as early as next year.

Amazon $AMZN ( ▲ 2.56% )

is selling at least $12 billion in bonds today to finance AI infrastructure. The company's data center capacity has doubled since 2022 and should double again by end of 2027.

Tesla $TSLA ( ▲ 0.03% )

now requires U.S.-built cars to have no Chinese parts. Stifel raised its price target to $508 on Optimus robot potential.

Disney $DIS ( ▼ 0.4% ) and Google $GOOGL ( ▲ 4.01% )

ended their two-week standoff. ESPN, ABC and other Disney networks are back on YouTube TV.

Meta $META ( ▲ 1.69% )

opened pop-up stores in LA, Vegas and NYC for its AI glasses.

Other Notable Company News

Nvidia $NVDA ( ▲ 1.02% )

fell ahead of Wednesday's earnings. Peter Thiel sold his entire position in Q3.

E.W. Scripps $SSP ( ▲ 1.09% ) rallied after Sinclair $SBGI ( ▲ 0.34% )

disclosed an 8% stake and acquisition interest.

Bank of America $BAC ( ▲ 0.55% )

saw Berkshire continue trimming. D.R. Horton $DHI dropped after Berkshire exited completely.

Chubb, Domino's Pizza $DPZ and Sirius XM $SIRI all saw Berkshire add shares.

Xpeng $XPEV ( ▼ 0.73% )

beat on earnings but gave weak Q4 guidance. (flying car company)

Novo Nordisk $NVO ( ▼ 2.13% )

slashed Wegovy and Ozempic prices as part of its White House deal to expand Medicare access.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield held around 4.14%. The dollar hit its highest level since August as traders backed off December rate cut bets.

Bitcoin edged up after its biggest weekly drop in months. Thursday's jobs data will be the next catalyst for yields.

Policy Watch

Fed

Vice Chair Jefferson delivered the hawkish message. He said rates are "still somewhat restrictive" but moving closer to neutral. Several officials who backed cuts in September and October now oppose further reductions without clear evidence of labor market weakness or falling inflation. December is a coin flip.

Government Shutdown

The data blackout is ending. The FAA lifted flight restrictions this morning and the delayed September jobs report hits Thursday.

Fiscal & Trade

The White House is working multiple angles to lower consumer prices:

Pharma deals for cheaper drugs

Tariff cuts on food and agricultural products

New offshore drilling approvals

Possible $2,000 rebate and 50-year mortgages

Separately, the U.S. cut tariffs on Switzerland to 15% from 39%.

International

China pulled back fiscal support hard in October. Government spending fell 19% year-over-year - the biggest drop since 2021. Investment declined at an unprecedented rate.

Indonesia will tax gold exports starting next year. Japan's Q3 GDP contracted 1.8% annualized, slightly better than the 2.4% expected.

Today’s Sponsor

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

What To Watch

Nvidia Earnings Wednesday After Close

This is the big one for AI. Can growth justify the run? What does management say about that $500 billion order book? Guidance matters more than the quarter.

September Jobs Report Thursday

First real jobs number since the shutdown. A big beat or miss will shift Fed expectations for December. I'm watching for signs the labor market is weakening faster than the Fed thinks.

Retailer Earnings This Week Home Depot $HD

Tuesday, Target $TGT Wednesday, Walmart $WMT Thursday. Direct read on consumer health heading into holidays.

Fed Minutes Wednesday 2 p.m. ET

October meeting minutes should reveal how divided the Fed really is on December.

Thanks for reading 🙂

- John

Today’s Sponsor

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Note: This newsletter is intended for informational purposes only.