- Pivot & Flow

- Posts

- November 14th Market Overview

November 14th Market Overview

November 14th Market Overview (no fluff)

Happy Friday

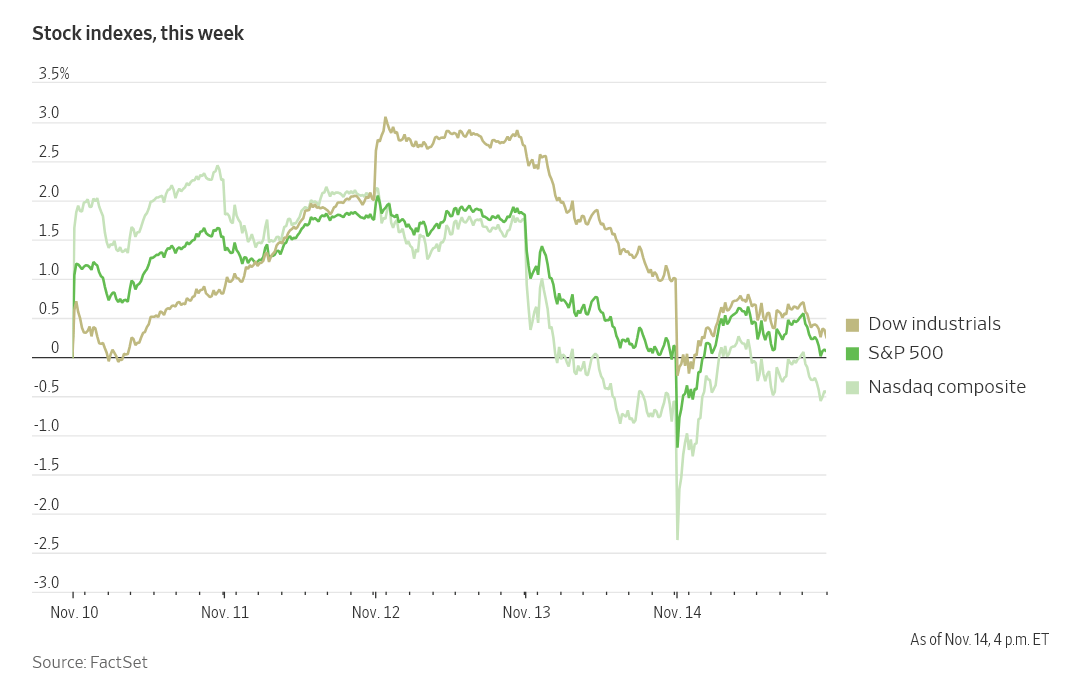

Tech stocks bounced back from yesterday's beating. The dip-buyers keep showing up, but the warning signs keep getting a little louder each week. The Nasdaq flipped green and finished higher after being down nearly 2% early.

Fed rate cut odds collapsed to 50-50 next rate cut and we're still trading near all-time highs. I’m focused on value and momentum in this whipsaw we’ve been caught in.

Let's dig in...

Today's Big Picture

Fed Rate Cut Odds Hit 50-50

December rate cut odds dropped to 50% from 95% a month ago. Kansas City Fed's Schmid said today he sees no reason for additional cuts, calling current policy "only modestly restrictive." Multiple Fed officials signaled hesitation this week. Small-caps and leveraged companies are repricing without the Fed support they expected.

Tech Bounced

Tech stocks that dropped 6% yesterday reversed completely today. Nvidia, Oracle, Palantir all recovered ground. CoreWeave fell 6% in morning trading before finishing positive. David Bahnsen from The Bahnsen Group: "At some point, they won't come back. I don't know that this is the moment, but I do know the moment is overdue and inevitable."

Risk-Off Signals Despite the Rally

Bitcoin dropped below $95,000, down over 20% from October highs above $126,000. VIX climbed above 20 for the first time in weeks. Gold and silver both sold off sharply. Investors are de-risking across crypto and commodities while tech stocks bounce. The behavior doesn't match.

Market Overview

Index Performance

Stock Spotlight

Warner Bros. Discovery $WBD ( ▲ 0.77% )

rose on reports that Paramount, Netflix, and Comcast are preparing bids for the media company. First-round bid deadline is November 20th.

Nvidia $NVDA ( ▲ 1.02% )

reports earnings Wednesday after the close. CEO Jensen Huang said AI computing demand has climbed meaningfully over the past six months.

Applied Materials $AMAT ( ▲ 1.5% )

reported Q4 earnings of $2.17 per share on revenue of $6.8 billion, above expectations of $2.09 and $6.67 billion. Company forecasted higher demand for second half of 2026 but warned China spending may weaken. Shares fell 4% in after-hours trading.

Big Name Updates

Walmart $WMT ( ▼ 1.51% )

fell after announcing CEO Doug McMillon will retire effective February 1st. John Furner, who has run the U.S. business for six years, will succeed him.

Strategy $MSTR ( ▲ 1.24% )

is down more than 17% this week, its worst weekly decline in a year. CEO Michael Saylor said the company is buying Bitcoin at current levels. Stock is trading around $200, near its 52-week low of $194.56.

Eli Lilly $LLY ( ▼ 1.34% )

is approaching a $1 trillion market cap.

JPMorgan Chase $JPM ( ▲ 0.89% )

secured agreements with fintech companies including Plaid, Yodlee, and Morningstar to receive payment for customer data access. The agreements cover more than 95% of data requests to JPMorgan's systems.

Other Notable Company News

Bristol Myers Squibb $BMY ( ▲ 0.6% )

and Johnson & Johnson halted a late-stage trial of a heart-disease drug after analysis found it unlikely to succeed. Bristol shares fell nearly 4%.

Scholar Rock $SRRK ( ▲ 0.63% )

rose 23% after a constructive FDA meeting regarding its biologics license application for a spinal muscular atrophy treatment.

Figure Technology Solutions $FTS ( ▼ 0.34% )

rose 20% after reporting Q3 earnings of 34 cents per share on revenue of $156.4 million, above expectations of 16 cents and $119.4 million.

StubHub $STUB ( ▲ 9.86% )

fell 23% after CEO Eric Baker said the company will not provide guidance for the current quarter. The company will provide 2026 guidance with Q4 results.

Rocket Lab $RKLB ( ▼ 7.47% )

rose about 3% after Blue Origin launched its first NASA mission, deploying two Rocket Lab satellites headed to Mars.

Union Pacific $UNP ( ▲ 1.19% )

faces opposition to its proposed Norfolk Southern merger. Nine Republican state attorneys general wrote to the Surface Transportation Board that the $71.5 billion deal "will result in undue market concentration that stifles competition."

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields rose in anticipation of delayed data releases. The 10-year yield is at 4.151%. Dollar Index at 96.65.

Next week brings the first jobs report since early September on Thursday and October Fed meeting minutes on Wednesday.

September jobs data will be important for the December rate decision.

Policy Watch

Fed

Kansas City Fed President Jeffrey Schmid reiterated his opposition to further rate cuts, saying inflation remains too high and more easing won't help the cooling labor market. Current policy is "only modestly restrictive," according to Schmid.

Market now pricing a December hold as more likely than a cut for the first time in months.

Minutes from the October meeting are due Wednesday at 2 PM ET. The Fed cut rates for a second straight month at that meeting despite internal division.

Trade

The U.S. and Switzerland reached an agreement to reduce tariffs from 39% to 15%. Trade Representative Jamieson Greer said Switzerland will move manufacturing to the U.S., including pharmaceuticals, gold smelting, and railway equipment. The Swiss franc strengthened on the news.

The U.S. also plans to cut levies on coffee and other goods from four Latin American nations. Coffee futures fell for a third straight day.

Geopolitics

Iran seized an oil tanker in the Strait of Hormuz Friday, first such incident in months

Ukrainian drone struck Russian Black Sea port of Novorossiysk, halting oil exports

Natural gas futures declined from Thursday's highs

Today’s Sponsor

Is the AI Bubble About to Burst? (95.2% Accurate Forecast)

NVIDIA officially reports earnings November 19, but you can get a sneak peek right now.

Not just for NVIDIA, but for dozens of public companies.

On Polymarket, the world's largest prediction market (with verified 95.2% accuracy), you can see what top forecasters believe will happen.

Our new Earnings Markets let you:

See real-time odds of NVIDIA beating estimates

Predict what executives will say on earnings calls

Profit directly from being right, regardless of stock price movement

Trade simple Yes/No outcomes instead of complex options

Will Jensen stun Wall Street again?

Or is the AI trade finally cooling off?

Top forecasters are already positioning.

What To Watch (Next week)

September Jobs Report — Thursday

First monthly jobs report since early September releases Thursday morning. Data was collected but not processed during the shutdown. The report will be important for the Fed's December rate decision.

Nvidia Earnings — Wednesday After Close

Nvidia reports earnings Wednesday. CEO Jensen Huang said AI computing demand has climbed meaningfully over the past six months.

Retail Earnings

Home Depot reports Tuesday. Target and Lowe's report Wednesday morning. Walmart reports Thursday. These reports will show consumer discretionary spending heading into the holiday season.

Fed Minutes — Wednesday 2 PM ET

Minutes from the October meeting when the Fed cut rates for a second straight month. The minutes should show details of the internal debate.

Thanks for reading 🙂

- John

Today’s Sponsor

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Note: This newsletter is intended for informational purposes only.