- Pivot & Flow

- Posts

- November 13th Market Overview

November 13th Market Overview

November 13th Market Overview

Happy Thursday

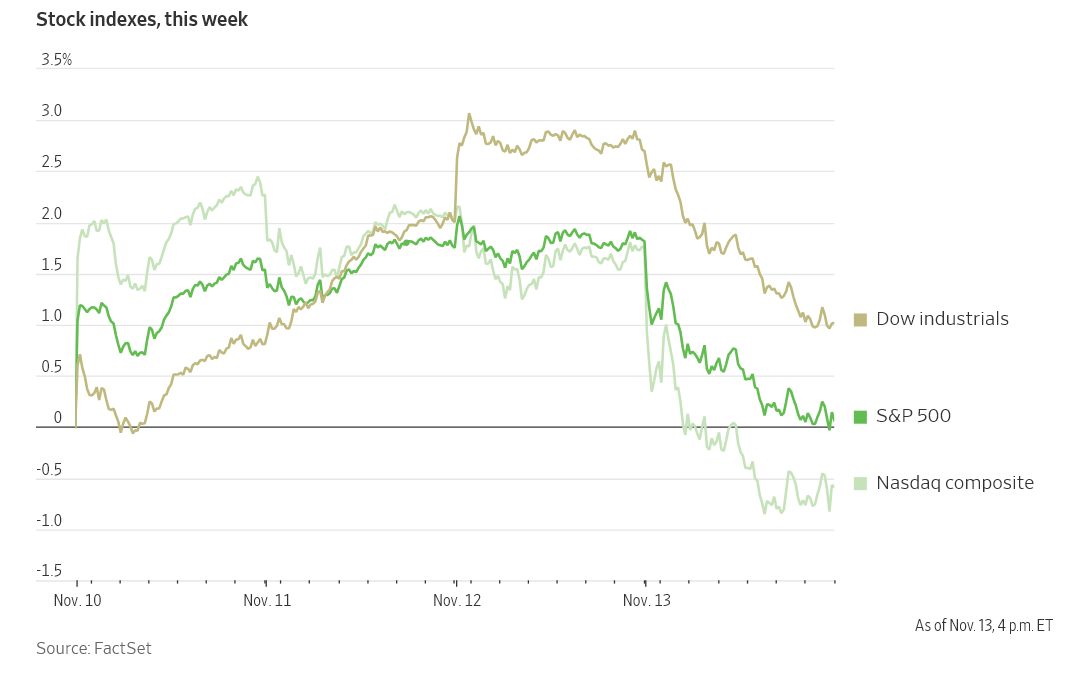

Reality check day. Markets fell 800 points after finally pricing in what the Fed's been signaling all along December's rate cut might not be happening. Odds collapsed from 70% to coin flip in one week. Tech broke 50day support.

I think they've been looking for an excuse to pause and missing October's data is the perfect cover.

Let's dig in...

P.S. RAD INTEL plans to go public and is backed by Adobe and Fidelity, up 4,900% in four years, today’s sponsor. Check them out here.

Today's Big Picture

Rate Cut Odds Collapse, Markets Drop 800 Points

The Dow dropped 800 points. Tech led the selloff with the Nasdaq falling for a third straight day. Bitcoin hit its lowest level since May.

This was broad nine of eleven sectors closed red.

October Jobs and Inflation Data Won't Be Published

Rate cut odds collapsed from 70% last week to 50-50 today. October's unemployment rate won't be published for the first time in 77 years. October's inflation data likely won't be released either. The Fed meets December 10 without knowing what happened in October. I think they're using the blackout as cover to pause.

AI Trade Breaks Down, Nasdaq Loses Key Support

The Nasdaq broke below its 50-day moving average for the first time since April. Investors are dumping the AI trade that worked all year.

Nvidia, Broadcom and Alphabet all fell.

The exception: Cisco, which raised guidance on AI demand and is approaching its dot-com era highs. The market is picking winners now, not buying everything with AI in the pitch deck.

Market Overview

Index Performance

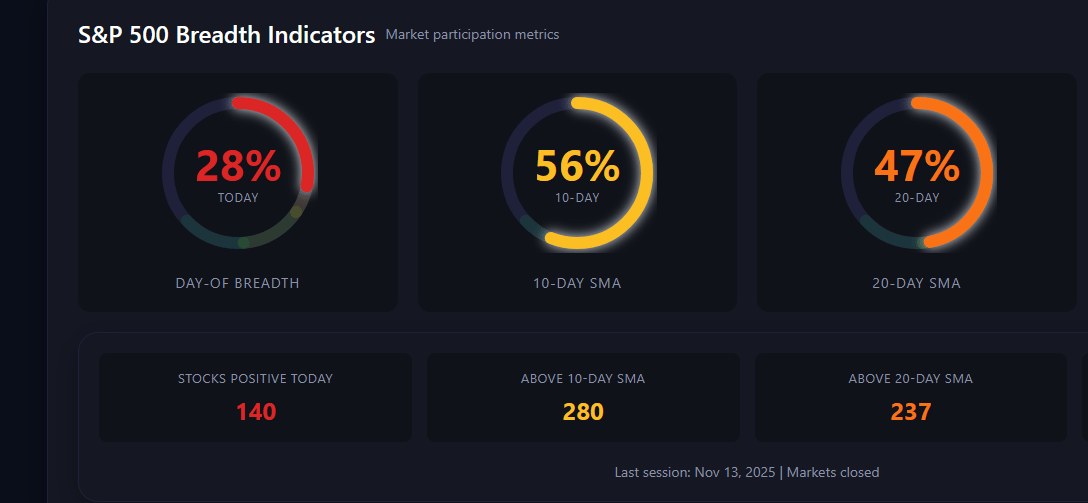

Nasty Breadth and health signals showing on the Market health Dashboard

Stock Spotlight

Walt Disney $DIS ( ▼ 0.4% )

fell after revenue of $22.46 billion missed estimates. Earnings beat but legacy TV and movie business are declining faster than parks and streaming are growing.

Robinhood $HOOD ( ▲ 0.61% )

fell as it launched cash delivery with Gopuff. You can now have cash from your brokerage account delivered to your door for $6.99.

Sealed Air $SEE ( ▲ 0.07% )

jumped on reports that Clayton Dubilier & Rice wants to take the packaging company private.

RAD Intel

Plans to go public on NASDAQ with backing from Adobe and Fidelity Ventures. The AI marketing platform is up 4,900% in valuation over four years and has reserved ticker symbol $RADI. Todays Sponsor

Big Name Updates

Apple $AAPL ( ▲ 1.54% )

cut a deal with Tencent $TCEHY to process WeChat payments for 15% instead of its usual 30% fee. Apple is compromising to stay in China.

Nvidia $NVDA ( ▲ 1.02% )

Blackwell chips ended up in a Jakarta data center for a Shanghai AI startup despite U.S. export limits, per a WSJ investigation. The workaround appears to be the networking equipment that links the chips together.

Microsoft $MSFT ( ▼ 0.31% )

will use OpenAI's custom chip designs to boost its own semiconductor efforts. Full access to what OpenAI is building.

JD.com $JD ( ▲ 0.51% )

beat revenue estimates and saw strong Singles Day momentum. Net income fell as the company spends on expansion.

Other Notable Company News

Micron $MU ( ▲ 2.59% )

got a price target increase to $325 at Morgan Stanley and was named a top pick. Memory chip stocks came under pressure after Japan's Kioxia reported weak results.

Nike $NKE upgraded to overweight at Wells Fargo with a $75 price target.

Planet Fitness $PLNT rose after guiding for 6% to 7% annual club growth through 2028.

Verizon $VZ ( ▲ 1.25% )

plans to cut 15,000 jobs per the WSJ.

Salesforce $CRM ( ▼ 0.07% )

is buying enterprise search startup Doti to upgrade its search capabilities through Slack.

Michael Burry shut down Scion Asset Management, saying his view of value "is not in sync with the markets."

Today’s Sponsor

$1K in NVIDIA Could’ve Made $2.5M — now another early AI breakout is rising fast. RAD Intel helps Fortune 1000 brands predict performance before they spend. Shares just $0.81 until Nov 20.

RAD Intel’s AI platform powers recurring seven-figure contracts across Fortune 1000 brands. Valuation up 4,900%* with $50M+ raised and 10,000+ investors. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon. $0.81/share until Nov 20 — then the price moves.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions.. Please read the offering circular and related risks at invest.radintel.ai.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield rose as rate cut odds collapsed.

Japan's 5-year yield is near its highest since 2008. Demand at today's auction was weaker than last month as traders wait for the Bank of Japan's next rate hike.

Policy Watch

Government Shutdown

Shutdown ended Wednesday, funding runs through January 30

BLS said it "may take time" to catch up on missed data releases

September jobs report expected soon, October likely incomplete or missing entirely

Fed

Rate cut odds fell from 70% to 50-50 in one week

Fed officials signaling caution about cutting in December

Powell called the data gap "driving in the fog"

Trade

Automakers want tariff relief in next year's USMCA renegotiation

Trump said he's considering cutting tariffs on Swiss goods

What to Watch

Applied Materials Earnings Applied Materials $AMAT ( ▲ 1.5% )

reports after the close. The chipmaking equipment maker's results will show if companies are still spending on AI infrastructure or pulling back.

Tech Rotation Continues

Nasdaq broke key support today. Watch if the selloff in Nvidia $NVDA, Broadcom $AVGO, and Alphabet $GOOGL continues or if buyers step in at these levels.

Healthcare Nine-Day Streak Healthcare $XLV ( ▼ 0.28% )

is on pace for its ninth straight day of gains. If it closes positive today, it ties the fund's longest streak since January 2004. This is where money is rotating into.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.