- Pivot & Flow

- Posts

- November 12th Market Overview

November 12th Market Overview

November 12th Market Overview (no fluff)

Happy Wednesday

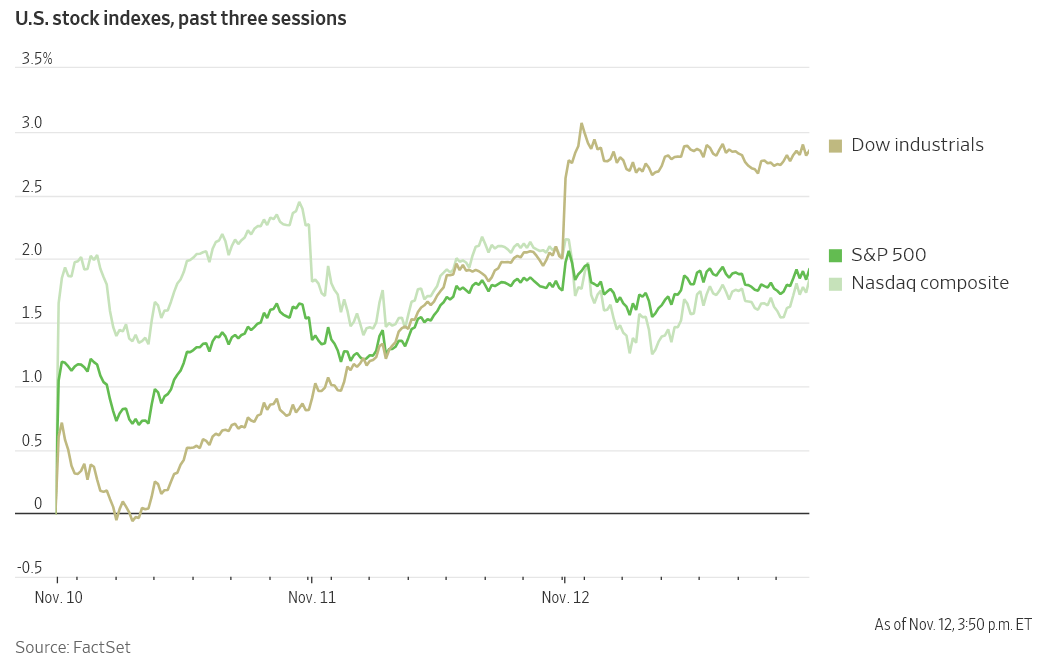

The Dow made a new high today and the House votes to end the 43-day shutdown tonight. Banks loved it, tech hated it.

Tech sold, banks bought. That's what happens when money thinks the economy is stabilizing and AI is overvalued.

Confidence around the dollar is painting a broken picture and I’ll be sending a special newsletter tn on that around 7pm market time.

Let's dig in...

Today's Big Picture

Banks Rip to Records While Tech Bleeds

Major banks hit all-time highs today. Goldman, JPMorgan, Morgan Stanley, Wells, AmEx. The Financial Select SPDR Fund jumped over one percent. Tech went the other way with Oracle and Palantir down even as AMD spiked. Two economies, one market.

Shutdown Ending But October Data Lost….Forever?

The House votes tonight to end the 43-day shutdown. Here's the problem: White House say October's jobs and inflation reports will never be released. The Fed decides on rates December 10th with a giant hole in the data.

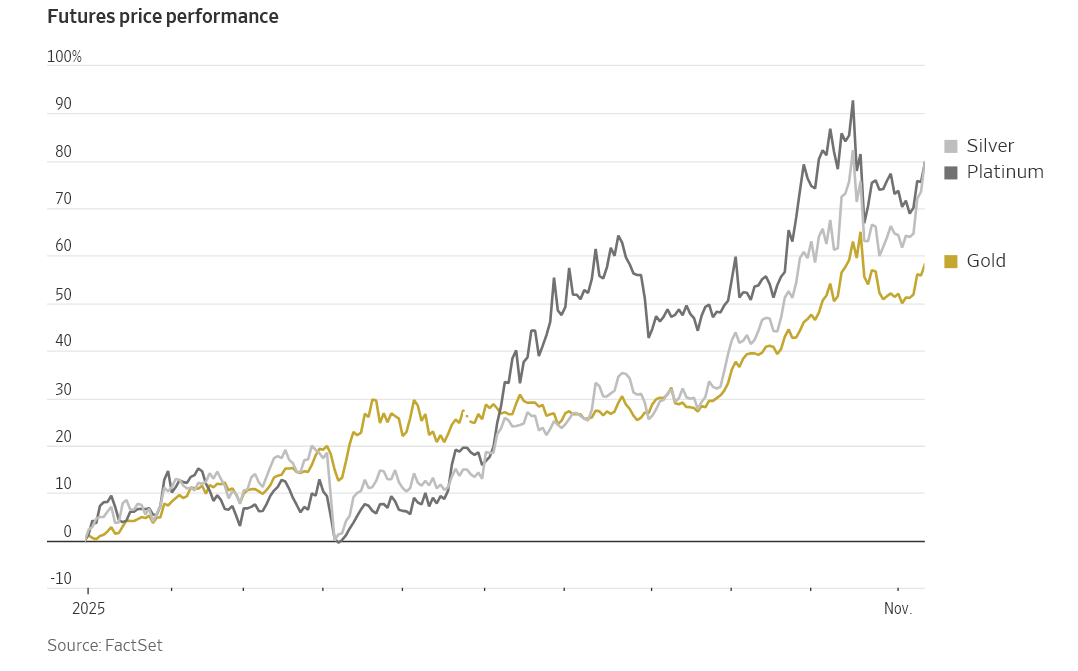

Silver Breaks $53 as Gold Crosses $4,200

Silver hit $53 for the first time, breaking a 45-year record. Gold back up at $4,200. Industrial buyers are competing with investors hedging against the dollar. Silver is up 78% percent this year.

Market Overview

Index Performance

Another Fun Chart For Us… (Precious Metals YTD)

Stock Spotlight

Advanced Micro Devices $AMD ( ▼ 1.58% )

rose after CEO Lisa Su said data center revenue will grow over eighty percent annually through 2030. AMD projects double-digit AI chip market share in what it estimates will be a $1 trillion market. The company also announced $45 billion in custom chip design revenue starting next year.

Oklo $OKLO ( ▼ 5.63% )

loss widened as the nuclear startup works toward its first commercial plant in 2027.

On Holding $ONON ( ▲ 2.92% )

raised guidance for the third straight quarter. The Swiss shoemaker said demand is strong enough that it doesn't need Black Friday promotions. That's pricing power.

IBM $IBM ( ▲ 0.34% )

unveiled its most advanced quantum processor called Quantum Nighthawk. The company says it will reach verified quantum advantage by 2026.

Big Name Updates

Alphabet $GOOGL ( ▲ 4.01% )

is building Turkey's first hyperscale data center with Turkcell. The partnership includes three network clusters by 2029 with Turkcell investing $1 billion.

Eli Lilly $LLY ( ▼ 1.34% )

got a Citi price target increase to $1,500. Citi lifted its FY26 oral GLP-1 sales forecast to $1.8 billion from $500 million, well above consensus.

Nvidia $NVDA ( ▲ 1.02% )

dropped after SoftBank sold its entire $5.8 billion stake to fund its OpenAI bet.

Other Notable Company News

Coinbase $COIN ( ▲ 3.26% )

killed its $2 billion stablecoin deal and announced it's leaving Delaware for Texas.

Circle $CRCL ( ▲ 1.78% )

beat estimates but shares dropped anyway.

BILL Holdings $BIL ( ▲ 0.03% )

L is exploring a sale after pressure from activist Starboard Value.

Clearwater Analytics $CWAN ( ▼ 0.13% )

is exploring a sale after getting takeover interest.

Bath & Body Works $BBWI ( ▲ 1.84% )

got downgraded on deeper discounting.

Tilray Brands $TLRY ( ▼ 1.77% )

and other cannabis stocks fell after the funding bill tightened hemp-derived THC rules.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields fell on shutdown resolution hopes. New York Fed President Williams said the central bank will soon restart bond purchases as pandemic liquidity drains out.

Treasury Secretary Bessent took a victory lap on this year's bond rally, noting six percent total returns, the best since 2020. Tomorrow: $22 billion 30-year auction.

Policy Watch

Government Shutdown

The House votes at 7pm tonight on the Senate bill. Flight cancellations dropped to the lowest rate in a week. The spending bill tightens hemp-derived THC rules, which is why cannabis stocks fell today.

The Fed

Atlanta Fed President Raphael Bostic is retiring in February. He was the first Black and openly gay regional Fed president.

Market pricing shows sixty-five percent odds of a rate cut December 9-10. Not a lock.

The Fed is split on December in a way we haven't seen under Powell. That's unusual.

Fiscal & Trade

Bessent told Fox News the administration will cut prices on coffee, bananas and other imported goods. Announcements coming in the next few days but he didn't say how. Coffee futures dropped on the news.

The Treasury struck its final penny today after 232 years. Existing pennies still work but they're done minting them.

International

Trump asked Israeli President Herzog to consider pardoning Netanyahu from corruption charges.

Taiwan's foreign minister said the government is weighing chip export controls as a diplomatic tool.

Colombia's President ordered security forces to stop cooperating with U.S. agencies until missile attacks on Caribbean boats end.

Today’s Sponsor

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Shares at $0.81 until Nov 20 — then the price moves. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

What To Watch

House Vote Tonight

The shutdown vote happens around 7pm. Assuming it passes, delayed economic data starts flowing next week. September jobs report could drop as soon as Monday. I'll be watching to see what the backlog reveals about the economy.

The Fed's Blind Spot

Without October's jobs and inflation data, the Fed's December 10th rate decision just got a lot harder. This is unprecedented. I'm watching for any official comments on how they plan to navigate this data blackout.

AMD's AI Push

The company projects tens of billions in data center revenue by 2027 and sees the market growing to $1 trillion by 2030. If AMD delivers even half of what they're projecting, Nvidia's monopoly starts to crack.

Thanks for reading 🙂

- John

Today’s Sponsor

All the news that matters to your career & life

Hyper-relevant news. Bite-sized stories. Written with personality. And games that’ll keep you coming back.

Morning Brew is the go-to newsletter for anyone who wants to stay on top of the world’s most pressing stories — in a quick, witty, and actually enjoyable way. If it impacts your career or life, you can bet it’s covered in the Brew — with a few puns sprinkled in to keep things interesting.

Join over 4 million people who read Morning Brew every day, and start your mornings with the news that matters most — minus the boring stuff.

Note: This newsletter is intended for informational purposes only.