- Pivot & Flow

- Posts

- Left to Rot Twice. Now Worth $40 Billion.

Left to Rot Twice. Now Worth $40 Billion.

Big Tech came for their lunch. These guys pivoted anyway.

"Necessity is the mother of invention."

The internet says this is Plato.

My flee market desk plaque says Confucius.

Either way, this quote kept popping into my head as I dug into Garmin's history.

The company's +63% stock being up in 2024 caught my attention, w/ market cap pushing $40B+. A 2025 correction has since pulled it back to ~$39B (the stock ran to $260 before a post-earnings crush), but the thesis still holds. Impressive resilience for a hardware company founded in 1989 that nearly got erased by Apple and Google. Twice.

Let's dig in…

The Near-Death Experience(s)

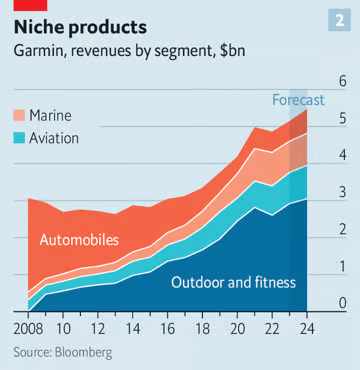

In 2008, Garmin was making ~70% of its $3B+ in sales from car GPS navigation devices. That business line got absolutely wrecked when the iPhone and Google Maps launched in consecutive years.

Then, just as Garmin was finding success with GPS-enabled running watches (growing from $0 to $1B between 2008 and 2014) → Apple took another dump in their front lawn by launching the Watch.

Garmin kept grinding. By 2018, sales were back to 2008 highs but with a completely different revenue mix: no longer a car navigation company, but an outdoor and fitness tracking company pushing $5B+ annually.

How?

The Founding

The story starts in 1989 when GPS was still a military technology just opening up to civilians.

Gary Burrell (electrical engineer from Kansas) and Min Kao (PhD from Taiwan) were both working at an avionics firm when they got to chatting about GPS consumer products over dinner.

"Gary and I began discussing its potential as the base technology for a wide array of consumer products," Kao recalled in a 2012 interview. "Our conversation became more animated when we envisioned creating products that would help guide pilots, boaters, drivers, and hikers."

They raised $4m from savings, family, and friends. It was the only outside money they ever needed because they came out the gate like gangbusters.

First product in 1990: GPS navigation for small boats and planes. Instant smash. The US Army bought their devices for use in the Gulf War. By 1995, they were doing $100m+ a year.

1) Gary Burrell and Min Kao

2) Handheld GPS 50 (1991)

3) StreetPilot Car Navigation (1998)

4) Forerunner, the world’s first GPS trainer (2003)

A name change to Garmin combined the co-founders' first names , signifying they were "personally invested in its success or failure." (Side note: definitely the right order. "MinGar" wouldn't have survived 6 months as a corporate entity.)

The DNA That Saved Them

Crucially, Kao and Burrell were hardcore technologists, not slick-backed hair MBAs. While Corporate America was going asset-light and outsourcing manufacturing, Garmin brought more business in-house.

They were engineering-first. Owned their distributors, warehouses, marketing, and customer support. Kept building factories in Kansas and Taiwan. Hired R&D talent obsessively.

This approach had costs and took time. But it allowed Garmin to move fast when new GPS opportunities emerged — from ocean (boats) to air (planes) to street (cars).

The Boom

In 1998, Garmin launched the StreetPilot — a portable car navigator that probably gave pizza delivery drivers everywhere a massive chub.

The device set Garmin up for an explosive decade. When President Clinton ordered the military to stop scrambling civilian GPS signals (making them far more accurate), Garmin was perfectly positioned.

They IPO'd in December 2000 and kicked off an 8-year run where revenue 10x'd from $346m to $3.5B. By 2008, Garmin was THE consumer brand for car GPS.

The Bust

Then the iPhone dropped in 2007. Google Maps followed a year later with a price point of $0, slightly more appealing to customers than $300+.

Over two years, Garmin's sales fell from $3.5B to $2.7B. Stock drawdown hit ~90% (market cap cratering to under $3B, with additional pain from the Great Financial Crisis).

But their salvation was already cooking internally.

The Pivot

Remember how I said Garmin invested heavily in R&D? Here's where it paid off.

The origin of their fitness business is beautiful. From Fortune:

"At Garmin, a group of running-obsessed employees applied their know-how to their hobby... They said, 'We do all these GPS things. Why don't we have a GPS product for runners?'"

In 2003… five years before the iPhone killed their car business, Garmin released the Forerunner 101, the world's first GPS-powered trainer.

By 2008, fitness had grown to $400m (10%+ of sales). Not enough to save them yet, but the foundation was there.

Garmin's first instinct to fight the iPhone was making their own phone. In 2008, they collaborated with Asus on the G60 Nuviphone, a GPS phone running Windows Mobile (lol) for $300. If you bought this instead of a subsidized iPhone, you needed to re-evaluate your entire life. Garmin discontinued it in 2010.

But the fitness segment kept grinding. Better form factors. More features. Activity tracking, training plans, sleep coaching, stored maps, longer battery life.

By 2015, the fitness segment crossed $1B.

Today’s Sponsor

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

The Napkin Math

I pulled Garmin's old 10-K filings and the R&D story shows clearly in the hard numbers:

Since 2000, R&D staff has averaged 26% of all employees (typical range for companies is 6-12%).

From 2000-2023, R&D spend averaged 12% of sales.

Here's the kicker: from 2000-2008, R&D was 7% of sales. After the iPhone/Google Maps gut punch, it jumped to 14%.

Garmin went hard when they realized their cash cow was toast. Instead of milking whatever was left and cutting costs, they went on offense.

By 2023, Garmin's R&D spend hit 17% of sales… significantly more than Apple (8%) and competitive with the big tech leaders: Meta (27%), Amazon (15%), Alphabet (14%), Nvidia (14%), Microsoft (12%).

The big G Playbook

When your cash cow dies, you have two choices: milk the corpse or invent something new.

Garmin chose invention. R&D jumped from 7% to 17% of sales… higher than Apple and they kept finding new markets before the old ones finished dying.

The Q3 2025 selloff (stock dropped from $260 to $200 on outdoor segment saturation fears) might spook some investors. But Garmin's been left for dead twice before. Both times, they invented their way out.

Co-founder Min Kao stepped back in 2013. He's now worth $7 billion.

As Confucius (Jeff Bezos) once said: "One of the only ways to get out of a tight box is to invent your way out."

Stay curious 🙂

- John