- Pivot & Flow

- Posts

- July 8th Market Overview

July 8th Market Overview

July 8th Market Overview (no fluff)

Happy Tuesday

Trump's playing hot and cold with his tariff timeline. Called the Aug. 1 deadline "not 100% firm" Monday night, then woke up Tuesday declaring "no extensions will be granted."

Copper just had its best day since Bush senior was president after Trump slapped it with a 50% import tariff. Solar stocks got obliterated on tighter tax credit rules.

Gotta love this market's ability to shrug off chaos and keep grinding higher. Resilience or denial? We'll find out Aug. 1.

Let's dig in...

Summary

Trump played hot and cold with his Aug. 1 tariff deadline - called it “not 100% firm” Monday night, then declared “no extensions will be granted” Tuesday morning

Copper hit record highs after Trump announced 50% import tariffs - futures exploded in the biggest single-day move since 1989, sending Freeport-McMoRan soaring

Solar stocks got crushed as Trump tightened clean energy tax credit rules, requiring “substantial construction” before claiming incentives

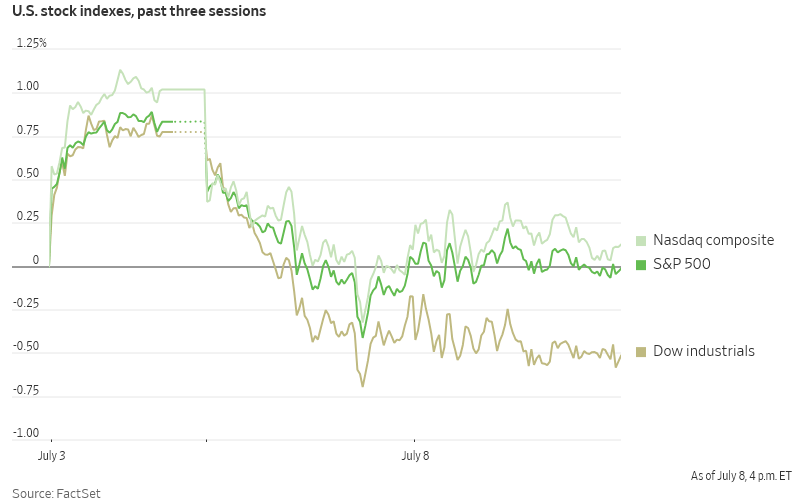

Banks fell hard on HSBC downgrades while the broader market showed remarkable resilience, with the $SPX down

Market Overview

Stock Spotlight

Nvidia $NVDA ( ▼ 4.17% ) bounced back after Monday's slide, continuing its march toward a $4 trillion market cap. Citi raised its price target to $190 from $180, boosting AI accelerator forecasts to $563B by 2028.

Datadog $DDOG ( ▼ 3.86% ) got slammed after Guggenheim's brutal downgrade to sell. The firm sees significant downside ahead as key customer OpenAI shifts to in-house solutions, creating second-half revenue risk.

Freeport-McMoRan $FCX ( ▼ 0.44% ) became today's tariff winner, surging as investors bet on domestic copper production advantages after Trump's tariff announcement.

Fair Isaac $FICO ( ▲ 1.51% ) crashed after FHFA said Fannie Mae $FNMA ( ▼ 3.1% ) and Freddie Mac $FMCC will allow Vantage 4.0 credit scores, threatening FICO's industry dominance.

Big Name Updates

Apple $AAPL ( ▼ 3.21% ) held steady despite Bloomberg reporting one of its AI executives jumped ship to Meta $META. Evercore ISI reiterated its outperform rating with a $250 target.

JPMorgan $JPM ( ▼ 1.9% ) CEO Jamie Dimon praised Trump's tax policy changes as an "important step" for growth, but shares still fell on HSBC's downgrade to hold.

Tesla $TSLA ( ▼ 1.49% ) made headlines when Elon Musk told Wedbush analyst Dan Ives to "shut up" after Ives proposed a board oversight plan for Musk's political activities and Tesla time commitment.

Bank of America $BAC also got hit by HSBC's "more cautious stance" on large banks, dropping despite the firm raising its price target to $51.

Other Notable Company News

Hershey $HSY ( ▲ 2.07% ) shares slid after announcing Wendy's $WEN ( ▼ 1.03% ) CEO Kirk Tanner will take over in August, replacing Michele Buck who led the company for eight years.

Capital One $COF ( ▼ 6.15% ) got upgraded to buy at TD Cowen with a $258 target, highlighting the rare advantage of owning an actual payment network through the Discover acquisition.

Chemours $CC ( ▲ 5.85% ) rallied after the EPA withdrew new chemical usage rules. Fellow chemical name Huntsman $HUN also gained.

Amazon $AMZN ( ▲ 1.0% ) kicked off its four-day Prime Day event with Wall Street expecting $12.9B in U.S. sales, but shares closed lower.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield up as investors priced in potential inflationary pressures from tariffs.

Fed's June meeting minutes due Wednesday could provide clarity on rate cut thinking

Inflation expectations returned to January levels in latest NY Fed survey

Policy Watch

Trump's tariff strategy is coming into sharper focus. Commerce Secretary Howard Lutnick said 15-20 more countries will receive tariff letters in coming days.

Key announcements:

50% tariffs on copper imports effective by Aug. 1

Up to 200% tariffs on pharmaceuticals with 1.5-year implementation timeline

Additional 10% levy on BRICS nations (Brazil, Russia, India, China, South Africa)

EU tariff letter potentially "about two days" away

The administration offered the EU a baseline 10% tariff deal with exceptions for aircraft and spirits, but Trump expressed displeasure with European tech policies.

What to Watch

Tariff Letter Barrage: Lutnick said 15-20 more countries get tariff letters in the next two days. Each announcement could create immediate sector winners and losers as markets price in supply chain disruptions.

Fed Minutes Wednesday: Could reveal if officials will pause rate cuts due to tariff-driven inflation concerns. Any hawkish shift would pressure rate-sensitive sectors like REITs and utilities.

EU Tariff Ultimatum: Trump said the EU gets its tariff letter "about two days" away. A 10% baseline rate is on the table, but European pushback could escalate tensions and hit multinational stocks.

Copper Supply Rush: With 50% tariffs hitting by Aug 1, expect companies to scramble for last-minute imports. Watch Freeport-McMoRan and other domestic producers for continued momentum.

Solar Sector Shakeout: Treasury has 45 days to issue tighter tax credit guidance. Companies with projects in limbo could see continued pressure until clarity emerges on the new "substantial construction" requirements.

Thanks for reading 🙂

- John

Today’s Sponsor

The Future of AI in Marketing. Your Shortcut to Smarter, Faster Marketing.

Unlock a focused set of AI strategies built to streamline your work and maximize impact. This guide delivers the practical tactics and tools marketers need to start seeing results right away:

7 high-impact AI strategies to accelerate your marketing performance

Practical use cases for content creation, lead gen, and personalization

Expert insights into how top marketers are using AI today

A framework to evaluate and implement AI tools efficiently

Stay ahead of the curve with these top strategies AI helped develop for marketers, built for real-world results.

Note: This newsletter is intended for informational purposes only.