- Pivot & Flow

- Posts

- July 25th Market Overview

July 25th Market Overview

July 25th Market Overview (no fluff)

Happy Friday

Five straight record closes for the S&P 500.

We haven't seen a streak like this in over a year, and it feels like these trade deals are actually giving markets something real to chew on instead of hope.

Perfect way to wrap up the week and enjoy some Tex-mex and possibly a margarita. I'm keeping one eye on Sunday's EU tariff meeting because that could set the tone for Monday/early next week action.

Let's dig in...

Market Summary

Trade Deal Breakthrough

Trump’s Japan agreement establishing reduced tariffs instead of threatened levels has markets pricing in similar outcomes globally. The deal includes $550 billion in US investment from Tokyo. Sunday’s EU meeting with von der Leyen could determine whether trade wars escalate or markets get their soft landing.

Earnings Keep Delivering

Corporate America continues beating expectations with 82% of reporting S&P 500 companies topping Wall Street estimates. Alphabet $GOOGL ( ▼ 2.53% ) led with accelerating search revenue despite AI disruption fears, while Verizon $VZ ( ▼ 1.68% ) posted strong subscriber growth.

Major Corporate Shake-ups

Intel $INTC ( ▲ 4.87% ) announced 15,000 job cuts despite beating revenue expectations, while Charter Communications $CHTR ( ▲ 3.4% ) suffered its worst day ever losing 117,000 broadband subscribers to wireless competition.

Fed Drama Ends

Trump’s Federal Reserve visit Thursday concluded peacefully. Trump indicated he won’t fire Powell, while the Fed expressed gratitude for presidential support. Markets expect steady rates next week.

Market Overview

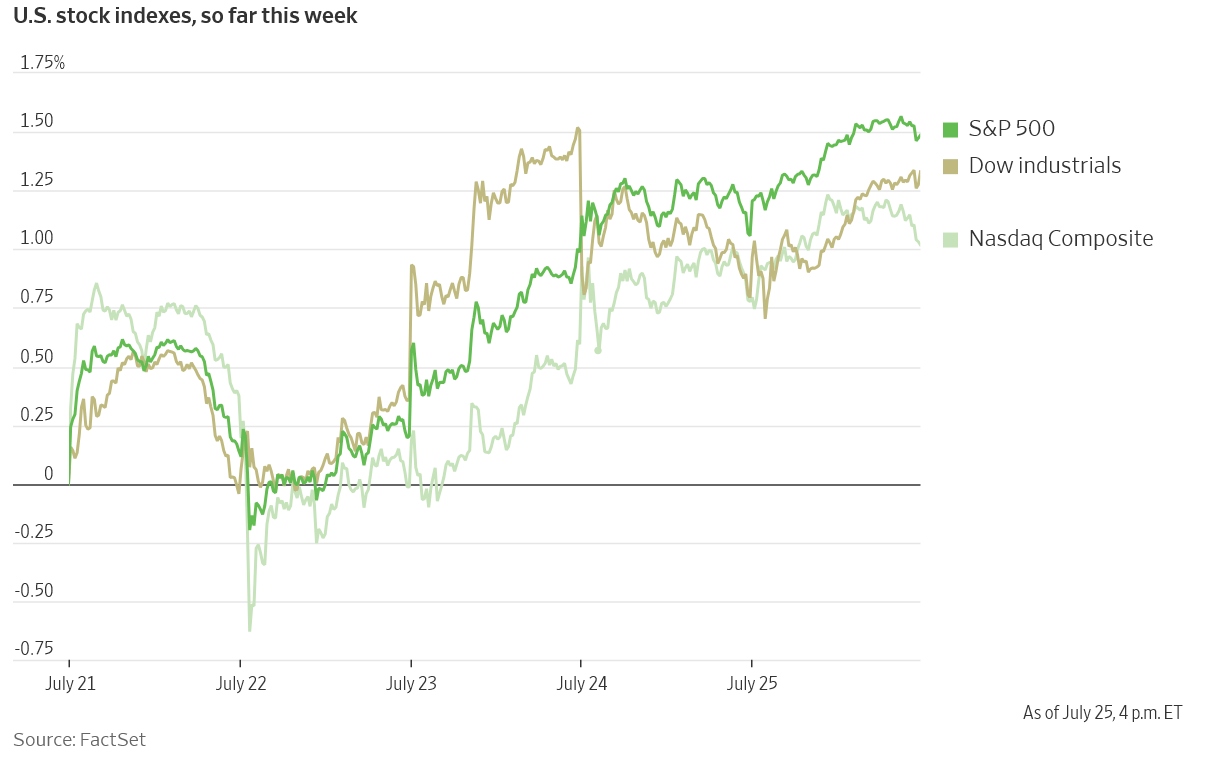

U.S. Stock Indexes, This Week so Far

Stock Spotlight

Intel $INTC ( ▲ 4.87% ) faced harsh reality despite beating Q2 revenue expectations. The company announced 15,000 job cuts and scrapped European factory plans as management admitted their AI strategy needs complete overhaul. Wall Street sees this as a multi-year turnaround with no clear path to AI relevance.

Tesla $TSLA ( ▲ 3.5% ) recovered after Thursday’s earnings miss, gaining on reports its robotaxi service could launch in San Francisco this weekend. Musk claimed a $20 trillion valuation remains possible with “extreme execution,” though EV tax credit expiration creates headwinds.

Deckers Outdoor Corporation $DECK ( ▲ 3.85% ) proved luxury demand stays strong, with Hoka running shoes and Ugg boots driving growth. International revenue jumped significantly as affluent consumers keep spending despite economic uncertainty.

Alphabet $GOOGL ( ▼ 2.53% ) showed AI investments are paying off, with AI Overviews serving 2 billion monthly users and driving longer search queries. The company raised capex guidance to $85 billion, signaling confidence in AI returns.

Big Name Updates

Palantir Technologies $PLTR ( ▲ 4.53% ) joined the top 20 most valuable S&P 500 companies after Piper Sandler initiated overweight coverage. The data analytics firm now surpasses Home Depot and Procter & Gamble in market value with shares doubling this year.

Volkswagen $VWAGY ( ▼ 0.33% ) quantified tariff damage for the first time, revealing $1.5 billion in first-half costs from Trump’s trade policies. The German automaker is considering manufacturing Audi models in the US to reduce exposure.

Boston Beer Company $SAM ( ▲ 3.38% ) showed strong operators can absorb tariff pressure, with profits helping offset trade costs better than expected. Management lowered tariff impact estimates from previous projections.

Other Notable Company News

The meme stock phenomenon returned this week. GoPro $GPRO ( ▲ 1.23% ) had its best week ever, while Krispy Kreme $DNUT ( ▲ 0.64% ) and Kohl’s $KSS ( ▲ 4.4% ) jumped as retail traders targeted heavily shorted names. S3 Partners data shows short sellers lost $355 billion since April’s market bottom.

AutoNation $AN ( ▲ 6.19% ) beat earnings with same-store revenue growth, showing auto demand remains steady.

Centene $CNC ( ▼ 3.66% ) disappointed with quarterly losses as Medicaid and Medicare membership declined.

Phillips 66 $PSX ( ▲ 2.18% ) demonstrated refining strength, beating profit estimates as higher margins and capacity utilization drove results.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury prices gained with the 10-year yield slipping to 4.388% after durable goods orders fell less than feared in June.

• Corporate credit spreads tightened as earnings strength reduces default concerns

• Yield curve remains inverted but flattened slightly on trade deal optimism

Policy Watch

Trade negotiations accelerate toward August 1 deadline. Trump estimates good odds for EU deal while acknowledging Canada talks have stalled. The European Union prepared over $100 billion in potential countermeasures.

• Federal Reserve meeting Tuesday-Wednesday expects no rate changes

• Powell’s dovish signals after Thursday’s White House visit suggest potential cuts later if trade tensions ease

Today’s Sponsor

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

What to Watch

EU-US Trade Meeting Sunday

Von der Leyen and Trump meet in Scotland with potential for breakthrough agreement. Success could set template for remaining negotiations and determine whether markets rally or face August 1 tariff shock.

Big Tech Earnings Flood

Over 150 S&P 500 companies report next week including Meta, Apple, Microsoft, and Amazon. Results will test whether AI spending generates real revenue growth or just inflates costs.

Fed Decision Wednesday

While rate cuts aren’t expected, Powell’s tone on inflation and trade impact could signal timing for future moves. Any hawkish shift would challenge current optimism.

August 1 Tariff Deadline

Countries without deals face reciprocal tariffs. India expects preferential treatment while Canada talks appear stalled. Final agreements will determine global economic impact for 2025.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.