- Pivot & Flow

- Posts

- July 24th Market Overview

July 24th Market Overview

July 24th Market Overview (no fluff)

In partnership with

Happy Thursday

Records again but it's pretty much just Google and EU trade deal hopes doing the heavy lifting. Tesla warned the next nine months will be rough and dropped dropped 8%. The Alphabet capex bump to $85B is the real story though, basically a massive bet that AI infrastructure spending isn't slowing down anytime soon.

Let's dig in...

P.S. Zillow’s co-founder has started a new company calling it a “big new idea” in the real estate space. Check it out!

Summary

Google’s $85B AI Infrastructure Bet

Alphabet $GOOGL ( ▼ 2.53% ) raised capex guidance to ~$85B from $75B, sending a massive signal across the AI and semiconductor ecosystem. This isn’t just about Google - it’s validation that the AI infrastructure buildout is accelerating, benefiting everyone from chip makers to data center operators.

EU Trade Deal Taking Shape

Officials are converging on a 15% tariff framework matching the Japan agreement. This removes a major tail risk that’s been hanging over European assets and global trade. The EU approved $100B+ in retaliatory tariffs as backup, but talks appear constructive.

Tesla’s Extended Weakness Warning

Elon Musk warned that weakness will likely continue from Q4 through Q2 2026 - essentially nine months of expected softness. This isn’t just a bad quarter, it’s a fundamental shift in the growth timeline that the market hasn’t fully digested.

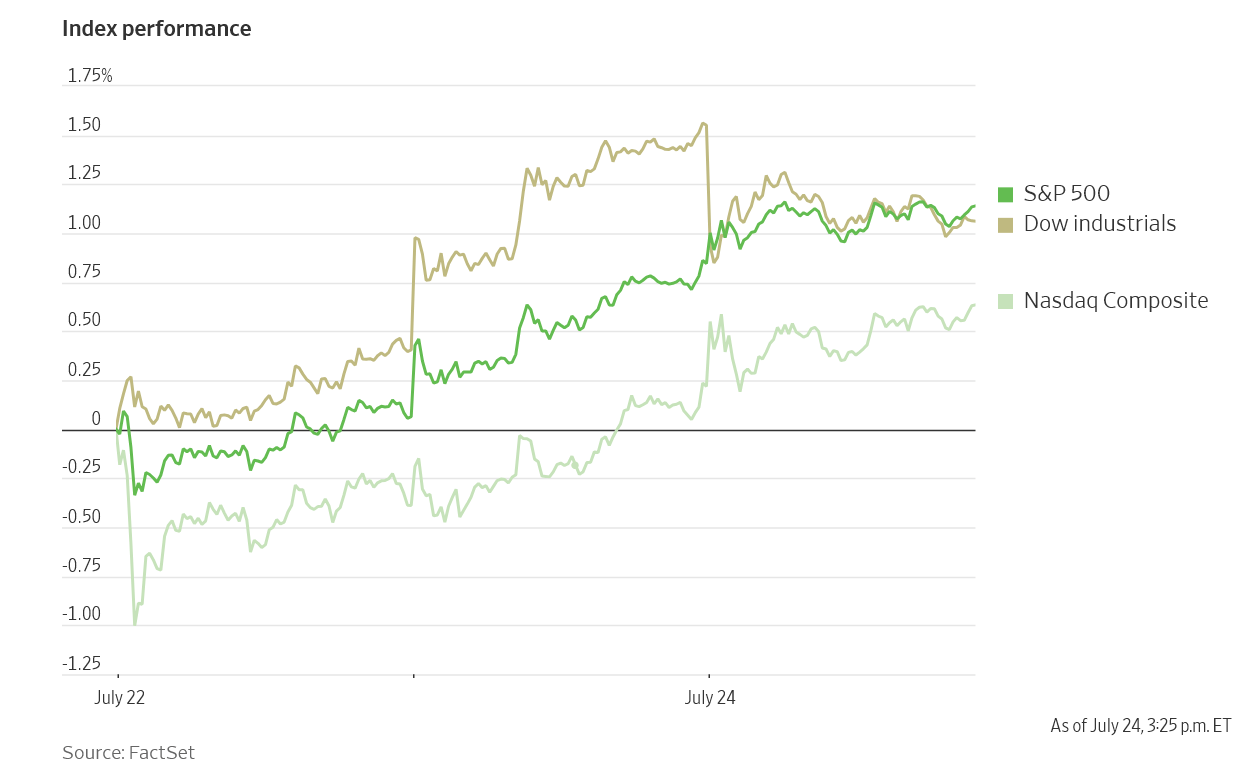

Records Hide Narrow Leadership

$SPX and $COMP hit fresh all-time highs while $DJIA fell, showing how selective this market has become.

38 $SPX names hit 52-week highs, but small caps struggled with $IWM down over 1%.

Market Overview

U.S. Stock Indexes, This Week so Far

Stock Spotlight

Alphabet $GOOGL ( ▼ 2.53% )

The search giant reminded everyone why it remains the AI infrastructure king. Revenue of $96.43B crushed estimates, but the real story was the capex increase to ~$85B. This massive bet on AI infrastructure benefits the entire semiconductor supply chain. Google Cloud revenue jumped with operating income more than doubling year-over-year.

Tesla $TSLA ( ▲ 3.5% )

Automotive revenue dropped while free cash flow collapsed to just $146M versus $760M estimates. But the real damage came from Musk’s own commentary warning that the next few quarters through Q2 2026 will likely remain weak. That’s a long runway of expected softness that the market hasn’t fully processed.

ServiceNow $NOW ( ▼ 1.84% )

The enterprise AI winner that’s actually converting hype into revenue. Revenue jumped to $3.22B with adjusted EPS soaring. Management’s confidence in hitting $1B in Now Assist ACV by 2026 shows genuine AI monetization momentum, raising full-year subscription revenue guidance.

IBM $IBM ( ▲ 3.12% )

While the company beat on EPS, software revenue missed estimates - a critical miss for a company trying to reinvent itself. The contrast with ServiceNow’s AI success highlights the execution gap in enterprise tech.

Chipotle $CMG ( ▲ 2.45% )

The burrito chain cut same-store sales growth guidance with traffic declining for a second straight quarter. The stock’s year-to-date decline reflects broader consumer spending concerns, though analysts still see a second-half recovery story.

Big Name Updates

American Airlines $AAL ( ▲ 7.56% ) delivered mixed results with record Q2 revenue and EPS beating estimates, but Q3 loss guidance missed expectations badly. The airline’s struggle reflects broader industry capacity pressures and shifting consumer spending patterns.

UnitedHealth $UNH ( ▲ 3.02% ) dropped after revealing DOJ compliance requests regarding Medicare billing practices. The healthcare giant’s decline this year continues as regulatory scrutiny intensifies around Medicare Advantage practices.

Dow $DOW ( ▲ 3.86% ) plunged after posting a larger loss than expected with revenue missing estimates. The chemical giant’s results reflect continued industrial demand weakness across key end markets.

Other Notable Company News

Railroad consolidation heated up as Union Pacific $UNP ( ▲ 0.47% ) confirmed advanced talks with Norfolk Southern $NSC ( ▲ 0.3% ) about a potential combination that would create the largest U.S. railroad. Regulatory hurdles remain significant.

American Eagle $AEO ( ▲ 2.9% ) surged on its Sydney Sweeney campaign announcement, while Opendoor $OPEN ( ▲ 3.83% ) jumped again as the meme stock carousel continues spinning.

Hyundai warned of bigger tariff impacts after profit dropped, highlighting real-world effects of the current trade environment on global manufacturers.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield climbed to 4.40% as trade deal optimism and continued economic resilience supported the selloff in bonds. European yields followed suit, with Germany’s 10-year reaching its highest levels as the ECB held rates steady while signaling a pause in aggressive cutting.

Policy Watch

Trump’s Fed Visit

Trump made an unprecedented visit to the Fed construction site today, escalating his pressure campaign against Chair Powell. This marks the first such presidential visit in nearly two decades and adds uncertainty about Fed independence. The focus on the $2.5B headquarters renovation comes alongside broader criticism of interest rate policies.

AI Executive Orders

The administration signed orders to accelerate AI development by reducing regulatory red tape and boosting data center construction. This provides regulatory tailwinds for the sector alongside Trump’s push to increase AI exports globally.

Economic Data

• Jobless claims fell to 217,000, below the 227,000 estimate, showing labor market strength

• New home sales disappointed at 627,000 versus 645,000 expected

• PMI data revealed a split economy - services surged to a seven-month high while manufacturing contracted to a seven-month low

What to Watch

Intel Earnings After Close Intel

$INTC ( ▲ 4.87% ) reports after the bell with all eyes on their AI strategy and whether they can compete with Nvidia in the data center chip race. After Google's massive capex increase today, investors want to know who benefits.

EU Trade Deal Timeline

With the August 1st deadline approaching, any official announcement on the 15% tariff framework could move European assets significantly. The framework is there, but details matter for individual sectors.

Trump's Fed Pressure Campaign

Today's unprecedented visit is just the beginning. Watch for any changes in Powell's tone or Fed communication strategy as political pressure intensifies ahead of future rate decisions.

Tesla's Extended Weakness Musk's warning about weakness through Q2 2026 needs to be taken seriously. Watch for any signs this spreads to other EV makers or if the disconnect between fundamentals and technicals continues.

Thanks for reading 🙂

- John

Today’s Sponsor

Wall Street Insiders Love This “Very Disruptive” Company

From his NFL days to exits totaling nearly $1B, Wall Street insider Jon Najarian knows how to reach the top. For $1.3T industry disruptor Pacaso, he had 3 words: “I love it.” He’s not alone. Maveron invested, too. Pacaso has $110M+ in gross profits to date. They even reserved the Nasdaq ticker PCSO.

This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals.

Note: This newsletter is intended for informational purposes only.