- Pivot & Flow

- Posts

- July 23rd Market Overview

July 23rd Market Overview

July 23rd Market Overview (no fluff)

Happy Monday

Markets are trading on actual progress instead of just headlines as the Japan trade deal gives us concrete numbers to work with. Small caps are finally showing some life, and when the Russell starts outpacing the S&P, that's usually a good underlying healthy market sign.

Let's dig in...

Summary

Trade Deal Framework Provides Certainty

The U.S.-Japan agreement featuring 15% tariffs and $550 billion in American investment replaced uncertainty with concrete terms. Reports of similar EU negotiations progressing toward the same 15% framework ahead of the August 1 deadline gave markets the clarity they’ve been seeking.

Small Cap Rotation Signals Broader Confidence

The Russell 2000 outperformed the S&P 500 by over two percentage points in July, marking the first sustained small-cap strength in months. This rotation beyond megacap safety trades often signals sustainable bull market phases and growing economic confidence.

Key Earnings Set Stage for Tech Leadership Test

General Electric Vernova $GEV delivered standout results while Texas Instruments $TXN disappointed with weak guidance. Tonight’s reports from Alphabet $GOOGL and Tesla $TSLA will determine whether megacap tech can justify recent leadership or if market rotation accelerates.

Market Anxiety Eases Substantially

The VIX dropped to 15.42, reflecting reduced fear as investors embraced trade deal progress over tariff war scenarios. This sentiment shift supported broad-based gains across multiple sectors.

Market Overview

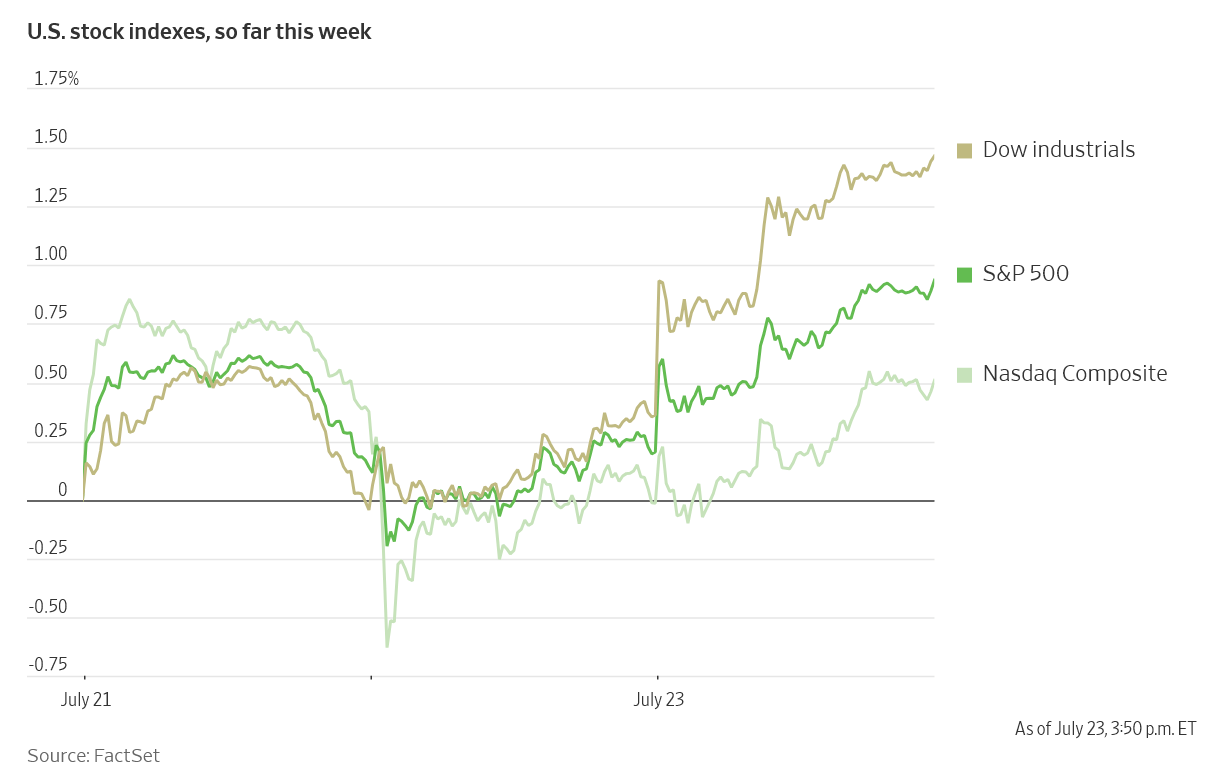

U.S. Stock Indexes, This Week so Far

Stock Spotlight

General Electric Vernova $GEV ( ▲ 5.67% ) delivered exceptional results that showcase the power infrastructure opportunity. Revenue of $9.11 billion beat the $8.80 billion estimate as management described an “investment supercycle in baseload power.”

Lamb Weston $LW ( ▲ 5.56% ) proved food companies can still deliver surprises. The french fry producer reported 87 cents per share versus 63 cents expected on $1.68 billion revenue. The company introduced a cost-savings program targeting $250 million in annualized savings by fiscal 2028.

GoPro $GPRO ( ▲ 1.23% ) and Krispy Kreme $DNUT ( ▲ 0.64% ) became the latest meme stock targets as retail traders identified potential short squeeze opportunities. Both names saw significant volume from Reddit’s WallStreetBets community..

Big Name Updates

Berkshire Hathaway $BRK.B ( ▲ 0.83% ) received a price target increase from UBS to $595, implying substantial upside. The upgrade centers on improved insurance fundamentals including better expense ratios at GEICO and lower catastrophe losses.

Hasbro $HAS ( ▼ 1.67% ) exceeded expectations with $1.30 adjusted earnings per share versus 78 cents expected. Revenue of $980.8 million beat the $880 million forecast. Management raised full-year guidance citing strength in the Wizards business, which includes Magic: The Gathering and Dungeons & Dragons.

Alphabet $GOOGL ( ▼ 2.53% ) and Tesla $TSLA ( ▲ 3.5% ) report earnings after the close today. These represent the first Magnificent Seven reports this season. Tesla enters at its highest level in a month while Alphabet looks to snap a 10-day winning streak.

Other Notable Company News

Honda Motor $HMC ( ▲ 4.62% ) and Toyota Motor $TM ( ▲ 2.96% ) benefited directly from the Japan trade agreement, with both seeing gains in U.S.-listed shares. The 15% tariff level provides pricing certainty while maintaining competitiveness with domestic alternatives.

AT&T $T ( ▼ 0.66% ) gained after reporting better-than-expected wireless and internet subscriber additions along with revenue that topped forecasts. The results show the telecom can compete effectively in increasingly competitive markets.

Enphase Energy $ENPH ( ▲ 5.35% ) fell after guiding third-quarter revenue to $330-370 million versus $368 million consensus. The solar company highlighted challenges from an expected 20% market decline in 2026 due to tax credit changes.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields climbed as trade optimism reduced safe-haven demand. The 10-year note reached 4.392%, reflecting both risk appetite and underlying inflation concerns from tariff policies. Japanese government bonds saw their 10-year yield hit 1.597%, the highest since July 2008, following the bilateral trade agreement.

Policy Watch

U.S.-EU Trade Progress

The European Union is reportedly nearing agreement on 15% baseline tariffs, following the Japan framework. EU officials are discussing terms with U.S. counterparts ahead of the August 1 deadline, when threatened 30% tariffs would otherwise take effect.

China Talks Scheduled

Trade discussions between the U.S. and China are set for July 27-30 in Sweden. Vice Premier He Lifeng will meet with U.S. counterparts as Treasury Secretary Bessent emphasized supply chain de-risking rather than economic decoupling.

AI Infrastructure Push

Trump administration plans executive orders today to boost AI exports and data center construction by reducing regulatory barriers. This support aligns with national competitiveness goals in artificial intelligence development.

Today’s Sponsor

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

What to Watch

Megacap Tech Earnings Test

Alphabet $GOOGL and Tesla $TSLA report after the close with significant implications for the Magnificent Seven leadership narrative. Google faces questions about AI monetization in search and cloud growth. Tesla must address tariff impacts on production costs and provide demand outlook clarity.

EU Trade Deal Finalization

Official announcements regarding U.S.-EU negotiations could remove significant market uncertainty. Success would establish the 15% bilateral framework as the template for resolving remaining trade tensions before the August deadline.

Small Cap Momentum Sustainability

The Russell 2000's recent outperformance needs confirmation through earnings and economic data. Small-cap companies typically have higher domestic revenue exposure, making them sensitive to trade policy outcomes and economic confidence levels.

Housing Market Pressure Points

Existing home sales fell 2.7% in June versus 0.7% expected, while median prices hit a record $435,300. This dynamic of slowing sales and rising prices points to continued housing market strain from undersupply and elevated mortgage rates.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.