- Pivot & Flow

- Posts

- July 18th Market Overview

July 18th Market Overview

July 18th Market Overview (no fluff)

Happy Friday

Chevron just won the biggest corporate arbitration battle of the year, clearing its $53 billion Hess deal after Exxon tried to block it. Earnings season is teaching us a hard lesson → Netflix and Amex both crushed estimates but their stocks still fell. The market's getting pickier about what deserves a celebration.

Let's dig in...

Summary

1. Chevron-Hess Deal Cleared

Arbitration panel dismissed Exxon Mobil’s claim, clearing Chevron’s $53 billion Hess acquisition. Guyana offshore fields could produce over 1 million barrels per day by 2030.

2. Earnings Beats Don’t Guarantee Wins

Netflix $NFLX ( ▲ 0.52% ) beat estimates and raised full-year revenue guidance to $44.8-45.2 billion but warned of margin compression. American Express $AXP ( ▼ 1.29% ) posted record card spending and beat EPS estimates yet both stocks fell.

3. Fed Chair Succession

Governor Christopher Waller said he would accept the Fed chair job if Trump offers it. Waller supports rate cuts, aligning with Trump’s pressure on Jerome Powell.

4. AI Action Plan July 23

Trump will announce new AI guidelines focused on easing regulations and expanding data center energy access.

Market Overview

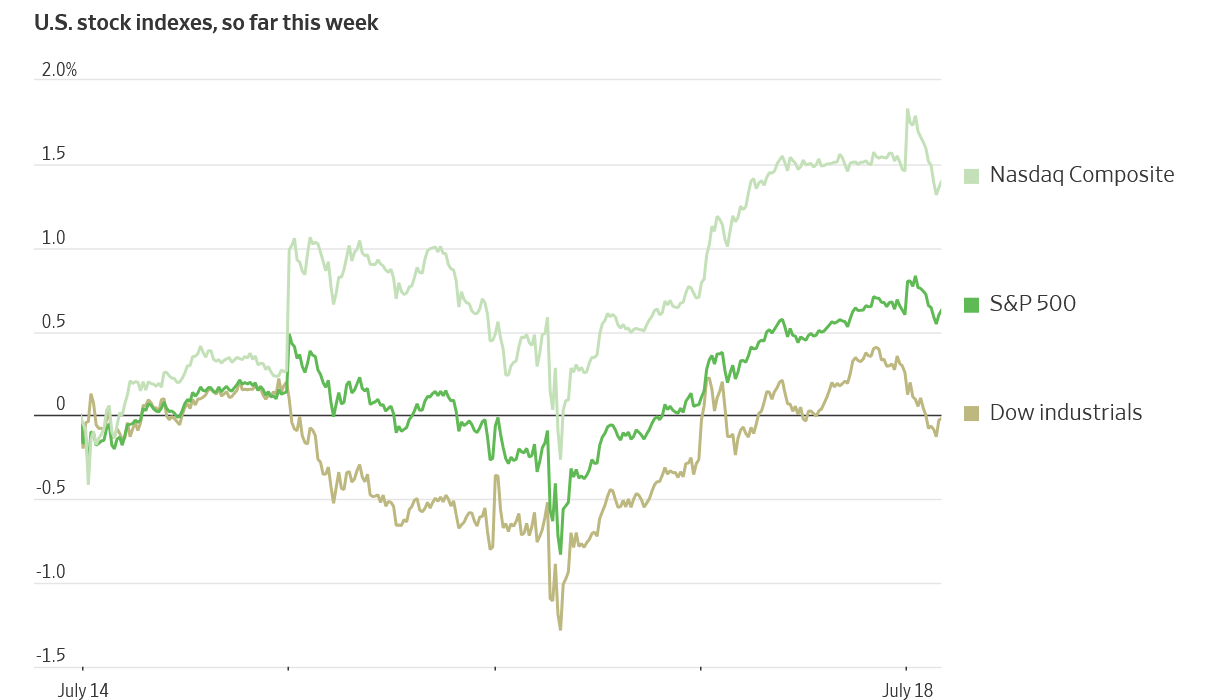

U.S. Stock Indexes, This Week so Far

past 3 sessions

Stock Spotlight

Chevron $CVX ( ▲ 2.08% ) won complete arbitration victory over Exxon’s blocking attempt. The company can now integrate Hess’s Guyana offshore oil fields.

Netflix $NFLX ( ▲ 0.52% ) raised guidance and expects ad revenue to roughly double year-over-year. Management warned margin compression stems from higher content amortization as the company expands into live events and gaming.

American Express $AXP ( ▼ 1.29% ) reported record card member spending of $416.3 billion, with particular strength in premium segments. The company reaffirmed EPS guidance despite market skepticism.

3M $MMM ( ▼ 2.91% ) beat earnings estimates and raised full-year guidance, demonstrating operational improvements across its diversified industrial portfolio.

Big Name Updates

Microsoft $MSFT ( ▲ 1.35% ) faces JPMorgan analysis warning OpenAI trades at 27x 2025 revenue with profitability years away.

Meta Platforms $META ( ▼ 1.07% ) declined to sign the European Commission’s Code of Practice for AI models, setting up potential regulatory friction.

Apple $AAPL ( ▼ 0.85% ) filed legal action against leaker Jon Prosser over iOS 26 information.

Tesla $TSLA ( ▼ 0.1% ) benefits from crypto-friendly policy signals as Trump prepares to sign cryptocurrency legislation.

Other Notable Company News

Eos Energy $EOSE ( ▼ 0.44% ) received BlackRock stake disclosure, validating the battery storage company.

AgEagle $UAVS ( ▲ 8.41% ) secured Blue UAS certification from the U.S. Defense Department for its eBee TAC drone, opening federal procurement opportunities.

Sarepta Therapeutics $SRPT ( ▲ 0.87% ) reported third death in gene therapy trials, creating regulatory approval concerns.

Kratos Defense $KTOS ( ▼ 4.03% ) received Cantor Fitzgerald overweight rating on X-58 drone program potential.

Intel $INTC ( ▲ 0.81% ) could see short squeeze according to Citi, despite remaining the most popular institutional short.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields fell with the 10-year moving lower as investors position for potential Federal Reserve rate cuts.

• Corporate credit spreads remained tight

• Investment-grade credit fundamentals stay strong

• Municipal bond demand elevated amid tax uncertainty

Policy Watch

Federal Reserve Chair succession heats up as Governor Waller says he would accept the top job. Waller supports rate cuts, aligning with Trump’s Fed pressure.

AI regulation awaits Trump’s July 23 announcement promising eased regulatory burden and expanded data center energy access.

• Cryptocurrency policy advances with Trump signing legislation opening 401(k) markets to crypto, gold, and private equity

• Trade policy focuses on August 1 tariff deadline with EU members favoring pre-deadline deal

• China issued 2025 rare earth quotas while tightening sector control

What to Watch

Technology Earnings

Magnificent Seven companies report next week. Netflix’s mixed reception sets tone for AI investment return expectations.

Trump’s AI Plan July 23

Could catalyze data center REITs and power generation companies while reshaping AI regulation.

Fed Chair Succession

Waller’s positioning creates monetary policy uncertainty. Rate cut expectations could shift based on succession speculation.

Energy M&A

Chevron-Hess victory could trigger more consolidation. Smaller independent oil companies become attractive targets.

Earnings Quality

Disconnect between beats and stock reactions shows increased investor selectivity. Focus on companies with pricing power and margin sustainability.

Thanks for reading 🙂

- John

Today’s Sponsor

Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

Note: This newsletter is intended for informational purposes only.