- Pivot & Flow

- Posts

- July 15th Market Overview

July 15th Market Overview

July 15th Market Overview (no fluff)

Happy Tuesday

Two different markets today. Tech caught some fuel after Nvidia got the green light for China chip sales, banks stumbled despite mostly beating earnings.

The Fed uncertainty is starting to become well…. certain.

Treasury Secretary Bessent just announced they're starting the hunt for a new Fed Chair to pick Powell successor.

Let's dig in...

Summary

Tech wins,(most) banks lose

The Nasdaq hit fresh highs on news that Nvidia $NVDA ( ▲ 0.16% ) can resume AI chip sales to China, while bank stocks declined despite mostly beating earnings. Wells Fargo $WFC ( ▼ 2.17% ) cut full-year guidance, and BlackRock missed revenue expectations despite reaching $12 trillion in assets.

Fed Chair uncertainty

Treasury Secretary Bessent announced the formal selection process for a new Fed Chair is starting, sending bond yields higher to 4.49%. This adds political pressure as Trump demands immediate rate cuts.

Inflation stays predictable

June CPI hit exactly on forecast, but the monthly acceleration signals tariff impacts are building. With August 1st EU tariffs approaching, price pressures point higher.

Supply chain reshuffling accelerates

$AAPL ( ▼ 0.85% ) struck a $500 million rare earth deal with MP Materials $MP, while Trump finalized the Indonesia trade pact eliminating tariffs on US exports.

Market Overview

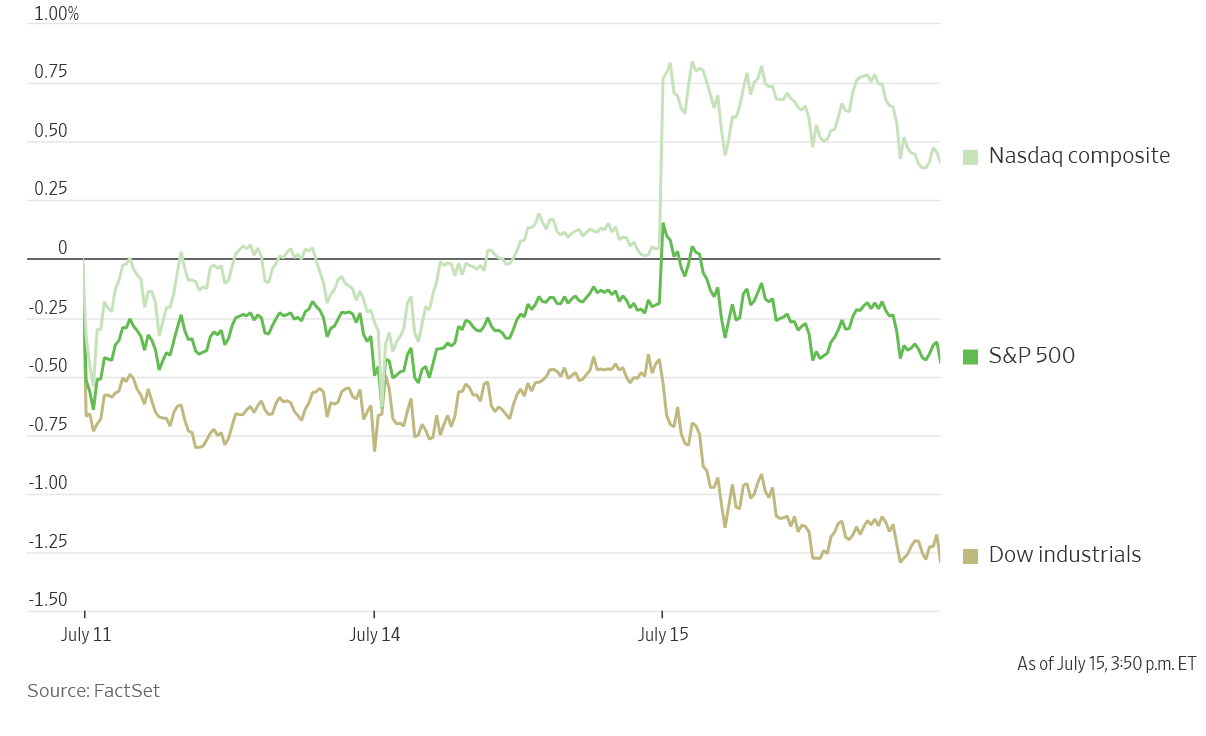

U.S. Stock Indexes, This Week so Far

Past 3 sessions

Stock Spotlight

Nvidia $NVDA ( ▲ 0.16% ) received White House assurance to resume H20 chip sales to China after CEO Jensen Huang’s meeting with Trump. Commerce Secretary Lutnick explained the strategy: keep China dependent on American technology while staying ahead of their capabilities. The news lifted the entire semiconductor sector.

Citigroup $C ( ▼ 2.13% ) delivered the banking sector’s standout performance, beating estimates with strong trading and banking revenue growth. The stock tracks toward its highest close since 2008, marking a remarkable turnaround story.

MP Materials $MP ( ▼ 5.08% ) secured a massive $500 million deal to supply Apple $AAPL with rare earth magnets manufactured in Texas. Combined with last week’s Pentagon equity investment, the miner now has both government and commercial backing for domestic supply chain efforts.

The Trade Desk $TTD ( ▲ 18.36% ) gained on S&P 500 inclusion news, effective Friday.

Big Name Updates

Apple $AAPL ( ▼ 0.85% ) continues supply chain diversification with the MP Materials deal for iPhone haptic engines and audio components. The Texas-made magnets use recycled materials, supporting environmental goals while reducing China dependence.

JPMorgan Chase $JPM ( ▼ 1.95% ) beat estimates with strong investment banking and trading revenue, but CEO Jamie Dimon’s defense of Fed independence on the earnings call sent a clear message about political interference risks.

Wells Fargo $WFC ( ▼ 2.17% ) disappointed investors by cutting net interest income guidance to flat for the year, down from previous expectations of growth. The forecast overshadowed an otherwise solid earnings beat.

BlackRock $BLK ( ▼ 1.36% ) hit the historic $12 trillion milestone but shares declined on revenue miss and fund outflows. CEO Larry Fink called himself a “huge buyer” at current prices during a CNBC interview.

Other Notable Company News

First Solar $FSLR ( ▼ 2.77% ) gained after Commerce Department launched Section 232 investigations into polysilicon imports, potentially leading to tariffs that would benefit domestic solar manufacturers.

Uber $UBER ( ▼ 1.58% ) partnered with Baidu $BIDU ( ▼ 0.88% ) to deploy robotaxis across Asia and the Middle East through a multi-year agreement using Baidu’s Apollo Go platform.

Southwest Airlines $LUV ( ▼ 6.89% ) was downgraded by Evercore to in-line from outperform, citing valuation concerns after recent gains have priced in the airline’s margin recovery initiatives.

Tesla $TSLA ( ▼ 0.1% ) opened its first Indian showroom in Mumbai, though Evercore remains cautious on the stock citing earnings revision trends and autonomous vehicle concerns.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield climbed to 4.49% following Bessent's Fed Chair selection announcement. Fixed income investors are pricing in leadership uncertainty at the central bank, particularly as Trump's public demands for immediate rate cuts intensify political pressure.

Policy Watch

Trade developments

Trump finalized the Indonesia deal with tariff-free US exports while charging Indonesia rates. The agreement includes Indonesian purchases of $15 billion in US energy, $4.5 billion in agriculture, and 50 Boeing $BA jets.

EU countermeasures

Reports suggest Europe is preparing retaliation targeting $78 billion in US exports including aircraft and bourbon if Trump’s threatened tariffs take effect August 1st.

Crypto setback

Several digital asset bills failed House procedural votes despite Trump’s support, weighing on crypto-linked stocks like Coinbase $COIN ( ▼ 1.54% )

What to Watch

Bank earnings momentum

Goldman Sachs and Morgan Stanley report later this week. Focus on trading revenue and deal pipelines as investment banking shows recovery signs.Fed Chair speculation intensifies

Watch for candidate names and bond market reaction to any perceived threats to central bank independence. Political pressure historically makes markets nervous.August tariff deadline

EU countermeasures are reportedly ready. Watch for negotiation signals as the August 1st deadline approaches for tariffs on European goods.

Thanks for reading 🙂

- John

Today’s Sponsor

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

Note: This newsletter is intended for informational purposes only.