- Pivot & Flow

- Posts

- July 11th Market Overview

July 11th Market Overview

July 11th Market Overview (no fluff)

Happy Friday

Well, Trump finally got the market's attention. After weeks of everyone shrugging off those trade letters, the jump to 35% on Canada and talk of 15-20% blanket tariffs actually moved things today. Nothing dramatic, but enough to pull us back from yesterday's all time highs.

Let's dig in...

Summary

1. Tariff escalation shook markets

Trump jumped Canadian tariffs to 35% and promised 15-20% blanket rates on remaining countries, up from the 10% baseline investors had grown comfortable with.

2. Bitcoin hit fresh records above $118,000

Driven by the biggest ETF inflow day of 2025 at $1.18 billion as institutional money continues pouring into crypto.

3. Defense contractors gained on drone directive

Pentagon ordered fast-track production after Defense Secretary Pete Hegseth removed deployment barriers.

4. Fed officials warned on inflation

Chicago Fed President Austan Goolsbee said escalating tariffs muddy the rate cut outlook by throwing “more dirt back in the air” on price stability.

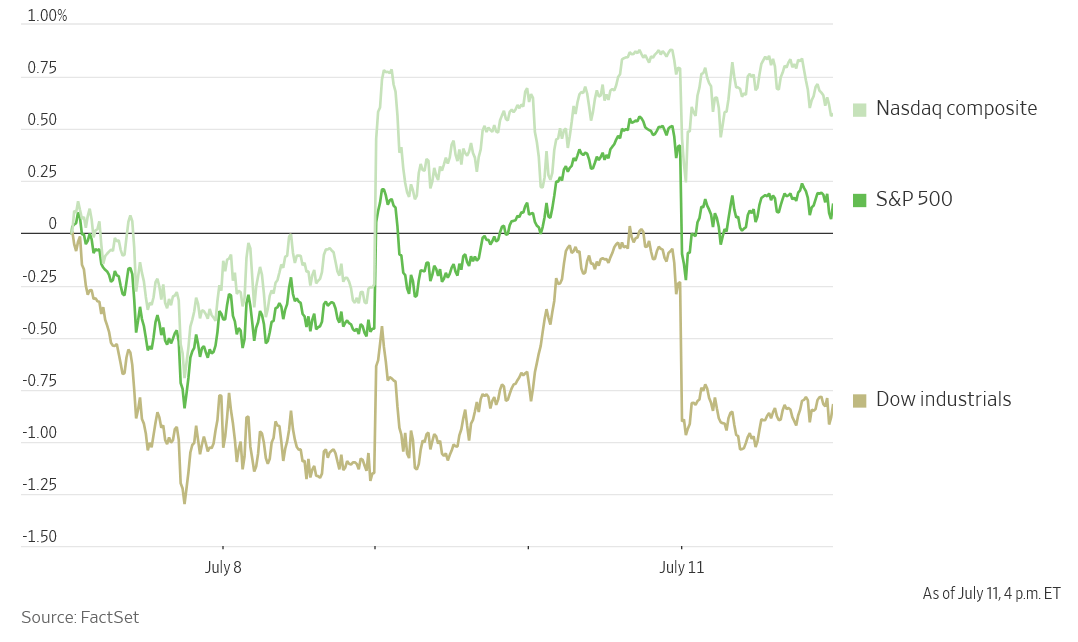

Market Overview

U.S. Stock Indexes, This Week so Far

Stock Spotlight

Levi Strauss $LEVI ( ▼ 1.77% ) delivered a clean beat with 22 cents per share versus 13 cents expected and revenue of $1.45 billion against $1.37 billion estimates. Management raised full-year guidance and hiked the dividend, showing confidence despite tariff costs ahead.

AMC Entertainment $AMC ( ▲ 1.75% ) gained after Wedbush upgraded to outperform, citing a stronger movie release slate and completion of the dilutive share issuances that had pressured the stock.

AeroVironment $AVAV ( ▼ 2.84% ) and Kratos Defense & Security Solutions $KTOS ( ▼ 6.47% ) S both advanced on the Pentagon’s drone fast-track order, which builds on Trump’s executive orders from last month to prioritize American-made defense products.

Big Name Updates

Kraft Heinz $KHC ( ▲ 0.16% ) moved higher on reports the consumer giant is weighing a breakup, potentially spinning its grocery business into a $20 billion entity. The company said it’s evaluating strategic transactions but wouldn’t comment further.

Freeport-McMoRan $FCX ( ▼ 0.44% ) got downgraded by UBS to neutral despite a raised $50 price target. Analysts said the copper miner’s tariff-driven rally has run its course after gaining 50% in three months.

Coinbase $COIN ( ▼ 2.88% ) touched new 52-week highs alongside Bitcoin’s $BTC record run, benefiting from the institutional crypto adoption wave.

Other Notable Company News

Penn Entertainment $PENN ( ▲ 6.83% ) dropped after weak regional gaming data from Iowa and Indiana. The company’s Iowa operations saw revenue fall 14% year-over-year, while Indiana declined 3.7%.

Regional banks continued outperforming their mega-cap peers, with the sector up 8.5% over the past month. Piper Sandler highlighted Citizens Financial $CFG ( ▼ 5.75% ) and KeyCorp $KEY ( ▼ 5.12% ) as regional favorites.

Tapestry $TPG, Dollar Tree $DLTR ( ▼ 0.37% ) , and GE Vernova $GEV all hit new 52-week highs during the session.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields climbed across the curve as tariff threats reignited inflation concerns. The 10-year hit 4.426%

• Bond market pricing in higher inflation risk from trade policies

• Complicates Fed’s path toward rate cuts this year

• Yield curve steepening as longer-term inflation expectations rise

Policy Watch

Twenty-three countries now hold tariff notification letters from Trump, with Canada facing 35% rates effective August 1. The president told NBC he’s planning 15-20% blanket tariffs on remaining partners.

• Canadian PM Mark Carney committed to securing trade deal by August 1 deadline

• Brazil hit with 50% copper tariffs, sending mining stocks higher earlier this week

• EU officials say they’re ready to finalize outline trade deal and waiting on White House response

• Trump cited fentanyl concerns and threatened higher Canada rates if they retaliate

What to Watch

Second-quarter earnings launch Tuesday:

JPMorgan Chase $JPM ( ▼ 1.9% ) leads major bank reporting that could set tone for the season amid economic uncertainty.June CPI data next week:

Labor Department inflation report will be scrutinized for early tariff impact signals, especially given Fed officials’ growing policy concerns.Canada trade deadline:

August 1 tariff implementation date approaching with negotiations ongoing - any breakthrough could move currencies and related sectors.Bitcoin momentum test:

After record ETF inflows, institutional adoption pace will determine if crypto can hold above $115,000 support level.

Thanks for reading 🙂

- John

Today’s Sponsor

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Note: This newsletter is intended for informational purposes only.