- Pivot & Flow

- Posts

- January 8th Market Overview

January 8th Market Overview

Jan. 8th Market Brief

Happy Thursday

Trump threatened defense contractors yesterday. Today he wants $1.5 trillion for them in proposed budget. Small caps hit a record. Tech sold off. The money is rotating here in 2026 with a ton of market narratives starting to take shape.

Let’s dig in...

Today's Big Picture

Trump Demands Massive Defense Hike

The President wants $1.5 trillion for defense in 2027. That's over $500 billion more than what Congress just approved. Yesterday's fears about cancelled contracts and buyback restrictions vanished overnight. Jefferies estimates this adds $5 billion or more to major contractors' annual revenue.

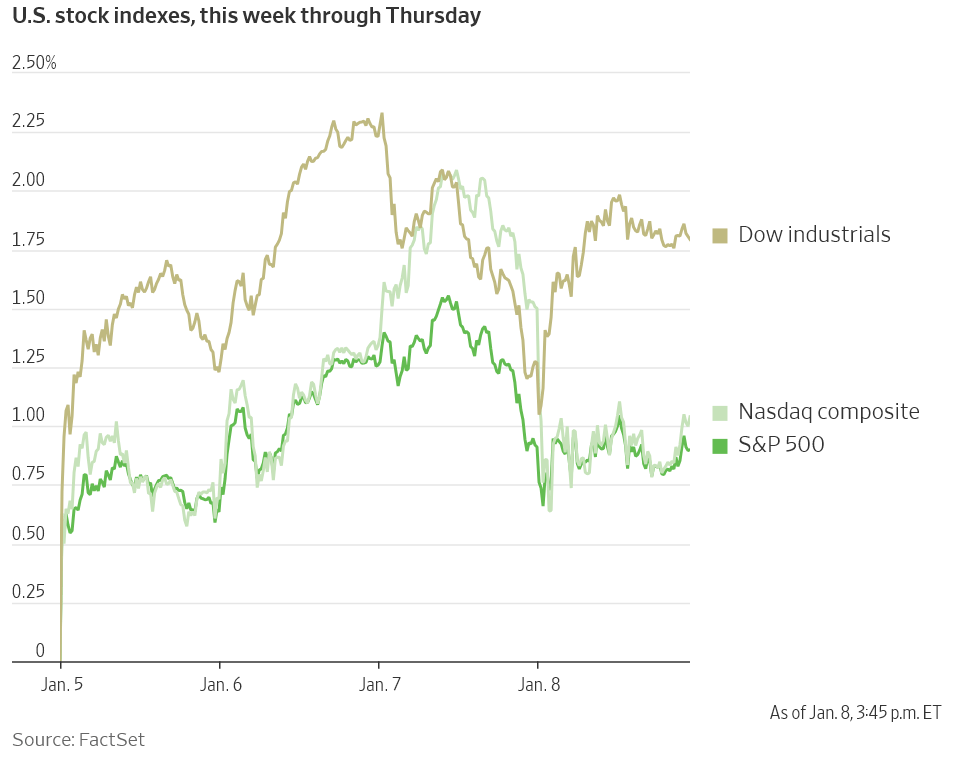

Small Caps Hit A Record As Tech Bleeds

The Russell 2000 made a new all-time high for the first time since mid-December. The Nasdaq fell while every other sector gained. Value is outperforming growth by a wide margin today.

Algo signaled this yesterday in The Market Health Dashboard

Treasury Unveils Auto Loan Tax Break

Secretary Bessent announced interest paid on U.S.-built vehicle loans is now tax deductible. Up to $10,000 annually through 2028. Ford $F and GM $GM both hit 52-week highs on the news. Only vehicles assembled in America qualify.

Market Overview

Index Performance

Stock Spotlight

Bloom Energy $BE ( ▲ 5.48% )

filed an AEP showing a $2.65 billion fuel cell deal with a 20-year offtake in Wyoming.

Serve Robotics $SERV ( ▲ 7.14% )

got a shoutout from Jensen Huang at CES. He showed the delivery robot and said "I love those guys."

Costco $COST ( ▼ 0.59% )

December sales hit $29.9 billion versus $27.5 billion last year. Solid Holiday shopping season.

Applied Digital $APLD ( ▼ 4.5% )

beat earnings with revenue roughly tripling. In talks with another hyperscaler.

Big Name Updates

Nvidia $NVDA ( ▲ 2.25% )

fell on the volume rotating out of chips . Also tightened HBM4 specs to 11+ Gbps, forcing memory makers to redesign samples.

Nike $NKE ( ▼ 1.08% )

downgraded by Needham. China weak, turnaround slower than expected.

Shell $SHEL ( ▲ 1.51% )

warned oil trading will drag earnings.

Alphabet $GOOGL ( ▲ 0.07% )

passed Apple $AAPL by market cap. First time since 2019. Gemini momentum while rest of tech sells off.

Other Notable Company News

Archer Aviation $ACHR ( ▼ 0.14% )

building its aviation AI on Nvidia's IGX Thor. This is a really cool company I’ve been watching the past year.

Roku $ROKU ( ▲ 5.52% )

upgraded at Evercore to outperform. $145 target citing World Cup and Olympics.

Generac $GNRC ( ▲ 0.85% )

upgraded at Citi. Quiet hurricane year doesn't change the story.

Tyson $TSN ( ▼ 2.14% )

upgraded at BMO on improving beef margins.

Today’s Sponsor (Me)

This bounce pattern has become disturbingly consistent

-6 signals. 6 bounces.

-100% hit rate in 2025.

The Market Health Dashboard caught every single one.

Why is this edge? Most folks don’t track breadth (how many stocks are up vs down), or the patterns within breadth.

I coded this for myself, something I’m very proud of and stand behind and use everyday.

Here's how I’m catching bounces

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields ticked higher after jobless claims came in lower than expected at 208K. The ten-year sits just under 4.2%. Strong productivity numbers are keeping labor costs in check. The trade deficit dropped to $29.4 billion in October, the lowest since 2009.

Policy Watch

Defense Spending

Trump wants $1.5 trillion for defense in 2027. That's a massive jump from the $901 billion Congress approved for 2026. Yesterday he threatened to cancel contracts. Today he's promising the biggest military budget in history. Contractors are along for the ride.

Fed Pressure

Bessent is pushing the Fed hard. He called rate cuts "the only ingredient missing" for growth. The White House wants cheaper money and they're saying it out loud.

Auto Stimulus

New tax break for American car buyers:

Interest on vehicle loans now deductible

Up to $10,000 per year

Only U.S.-built vehicles qualify

Runs through 2028

Venezuela

Energy Secretary Chris Wright says the U.S. will control Venezuelan oil sales indefinitely. Investor interest is "tremendous." The White House thinks this eventually gets crude to $50.

Rare Earths

China is restricting rare earth exports to Japan after Taiwan comments. Heavy rare earths and magnet shipments are getting held up across industries. Japan markets sold off overnight on the news.

What to Watch

December Jobs Report

Friday morning. Consensus: 150K jobs, 4.5% unemployment.

The setup is bullish. Jobless claims at 208K (lowest in weeks), layoffs at a 17-month low, productivity up, labor costs down.

Defense Budget Politics

Defense stocks are priced for $1.5 trillion. Congress approved $901 billion for 2026. That gap requires votes that don't exist yet.

Nvidia Memory Squeeze

Nvidia tightened HBM4 specs to 11+ Gbps. SK hynix, Samsung, and Micron have to redesign and resubmit.

Watch for guidance revisions from the memory names.

Venezuela Oil Math

U.S. expects 30-50 million barrels. America burns 20 million per day. That's a couple days of supply, not a flood.

Crude bounced today. If it holds $60 into Friday, supply fears are noise. If it breaks, more barrels are getting priced in.

Thanks for reading - you are now the more informed 🙂

- John

Today’s Sponsor

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Note: This newsletter is intended for informational purposes only.