- Pivot & Flow

- Posts

- January 7th Market Overview

January 7th Market Overview

Jan. 7th Market Brief

Happy Wednesday

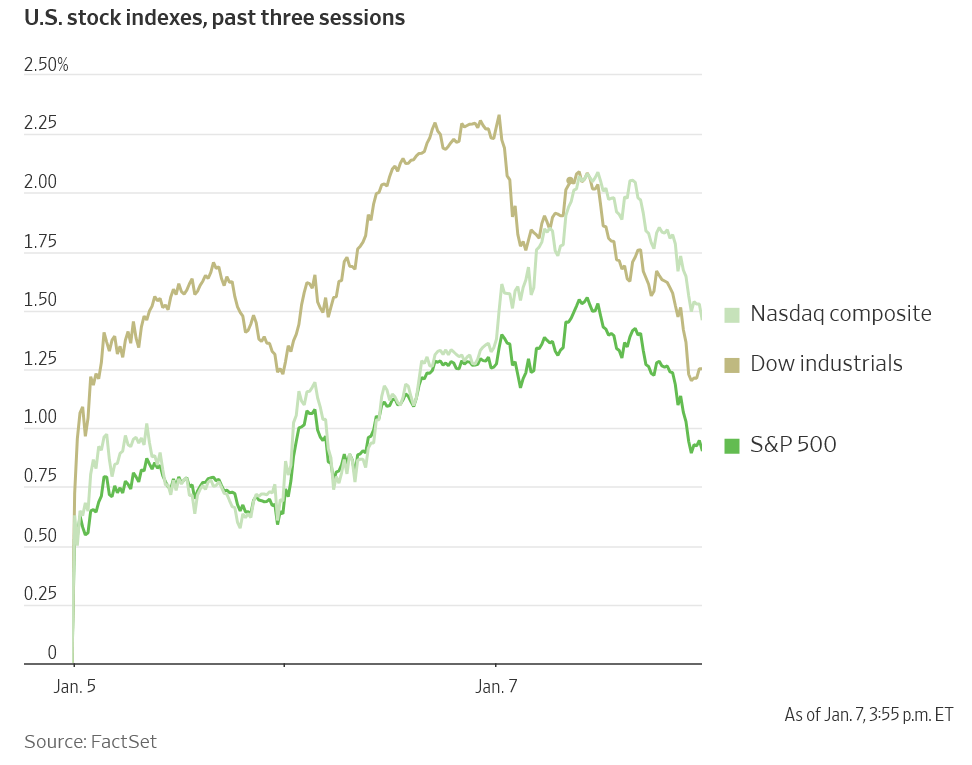

Weird one today. Hit records this morning then Trump came out swinging at corporate landlords and defense contractors in the same afternoon. Markets didn't know which way to run.

For what it's worth, I'm against Wall Street buying up starter homes. Apartment complexes are different. But single-family housing shouldn't be a yield product for investment banks.

Let’s dig in...

Today's Big Picture

Trump Targets Corporate Landlords

The President wants to ban big investors from buying single-family homes. Invitation Homes $INVH and AMH $AMH sold off immediately.

If Congress codifies this, it's a structural shift for single-family rental. I'm skeptical it survives legal challenges but am in support of getting corporate out of residential homes.

Labor Market Keeps Cooling

Job openings fell to 7.15 million in November, lowest since September 2024. ADP payrolls came in light at 41,000 versus 48,000 expected. Not alarming yet, but the trend is much clearer heading into Friday.

Venezuelan Oil Returns to Market

Maduro is out and the oil is flowing again. Trump says the U.S. will receive up to 50 million barrels and he's meeting energy execs Friday to talk investment. Crude dropped on the supply news. Politics is driving oil prices more than fundamentals right now.

Market Overview

Index Performance

Today’s Sponsor (Me)

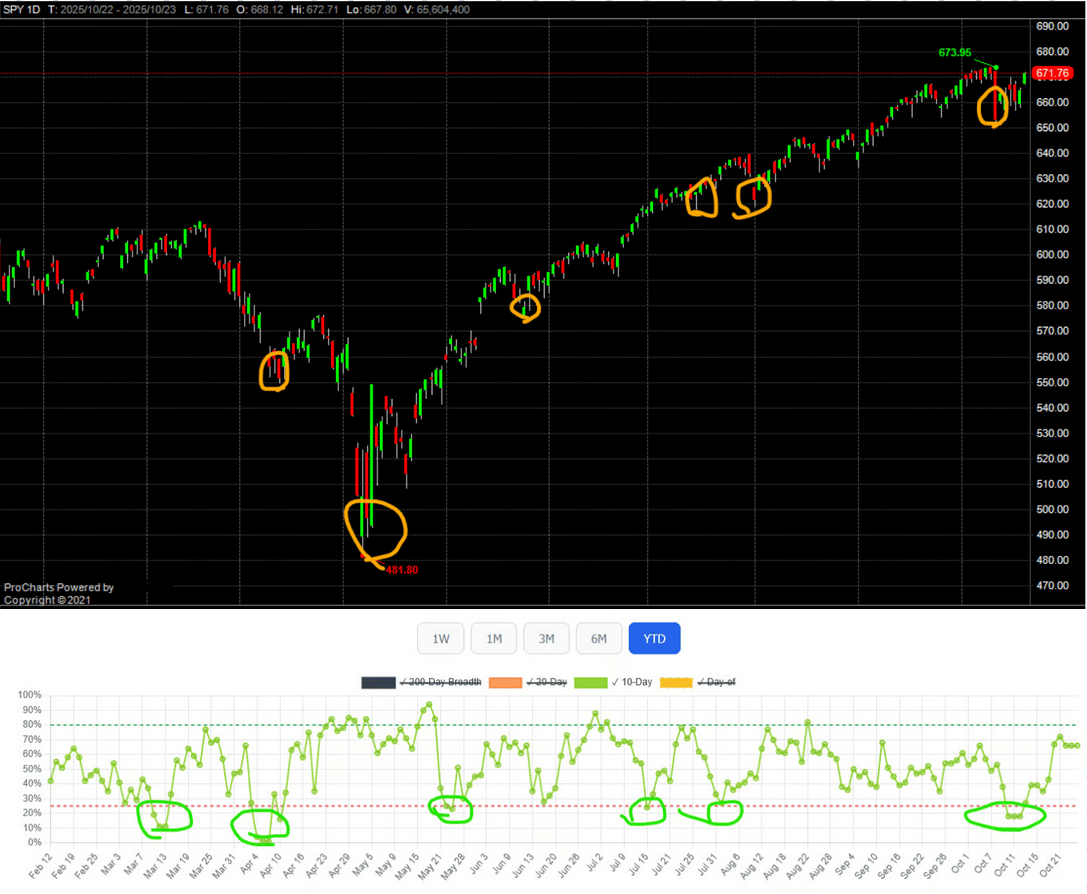

This bounce pattern has become disturbingly consistent

-6 signals. 6 bounces.

-100% hit rate in 2025.

Quick fact: Each time fewer than 25% of S&P 500 stocks were above their 10- and 20-day moving averages this year, the market bounced within 3 trading days.

The Market Health Dashboard caught every single one.

Why is this edge? Most folks don’t track breadth, or the patterns inside breadth.

If you need to deploy capital in the markets, these are all relatively great times to do just that and that’s what this indicator helps with.

I coded this for myself, something I’m very proud of and stand behind and use everyday.

Stock Spotlight

Mobileye $MBLY ( ▼ 0.06% )

is acquiring humanoid robot maker Mentee Robotics for $900 million. Betting on physical AI to expand beyond driving assist systems.

Eli Lilly $LLY ( ▼ 0.81% )

is reportedly in advanced talks to buy Ventyx Biosciences $VTYX for over $1 billion. UBS also raised their target to $1,250 ahead of the oral weight loss pill launch.

Valero Energy $VLO ( ▼ 0.94% )

and Marathon Petroleum $MPC rose after sources told CNBC Venezuelan oil sales will continue indefinitely with reduced sanctions. Refiners win when crude supply increases.

Nvidia $NVDA ( ▲ 2.26% )

CEO Jensen Huang confirmed "very high" demand in China for H200 AI chips. Supply chains are active and export licenses are being finalized.

Big Name Updates

Alphabet $GOOGL ( ▼ 0.04% )

is rallying to challenge Apple $AAPL as the second-most valuable US company. First time since 2019 that Google has been larger. JPMorgan raised expectations for their AI processing units on strong demand.

Boeing $BA ( ▼ 1.28% )

secured a win as Alaska Air $ALK agreed to buy over 100 new aircraft. A vote of confidence after a difficult year of production delays.

Warner Bros. Discovery $WBD ( ▼ 0.6% )

rejected the hostile bid from Paramount $PSKY. The board says their existing merger with Netflix $NFLX offers better long-term value.

GameStop $GME ( ▲ 0.76% )

approved a new compensation package for CEO Ryan Cohen with targets to grow to a $100 billion valuation. I'll believe that when I see it.

Other Notable Company News

Amgen $AMGN ( ▲ 0.23% )

acquired UK biotech Dark Blue Therapeutics for $840 million. Focus is protein degraders for oncology.

Regeneron $REGN ( ▲ 1.18% )

got a double upgrade to buy from BofA with a target of $860. Multiple catalysts cited for 2026.

CSX $CSX ( ▼ 0.35% )

laid off roughly 5% of management staff to cut costs amid shifting freight demand.

Strategy $MSTR ( ▲ 8.84% )

moved higher after MSCI said it would not exclude crypto-holding companies from its indexes.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

10-year held steady around 4.17%. Dollar barely moved.

Policy Watch

Defense Dividends Blocked

Trump said he won't allow dividends or buybacks for defense contractors until they speed up production and build new plants. Northrop Grumman $NOC fell over 5%. Executive compensation caps also on the table. This came out of nowhere.

Greenland

The White House is openly discussing acquisition options including military force. Rubio meets with Danish officials next week.

European defense stocks are ripping on the rhetoric

Prediction markets put U.S. control odds at 38%

Probably noise, but markets are pricing in real risk

Venezuela Pivot

Maduro is out and the U.S. is accepting Venezuelan oil again. Trump meets energy execs Friday to discuss investment.

Mark Mobius called the country "investable" for the first time since Chavez

Downward pressure on crude prices

Refiners benefit, drillers don't

Economic Data

ISM services hit 54.4 in December, best reading of the year. New orders and employment both improved. The prices index fell to its lowest since March 2025, just before "liberation day" tariffs. Mixed signals everywhere.

What to Watch

Friday Jobs Report

"ADP and JOLTS both came in soft. If Friday's official number confirms a hiring slowdown, expect bond yields to drop further as recession concerns return.

Eli Lilly Oral GLP-1 Orforglipron FDA approval expected in Q1. Direct competition with Novo Nordisk's $NVO Wegovy pill that launched earlier this month. This is the next battleground in weight loss.

Prediction Markets

Kalshi odds on Panama Canal seizure above 35%. Greenland control at 38%. Worth monitoring as a sentiment gauge for geopolitical risk appetite.

Thanks for reading, you are now more informed 🙂

- John

Today’s Sponsor

Someone just spent $236,000,000 on a painting. Here’s why it matters for your wallet.

The WSJ just reported the highest price ever paid for modern art at auction.

While equities, gold, bitcoin hover near highs, the art market is showing signs of early recovery after one of the longest downturns since the 1990s.

Here’s where it gets interesting→

Each investing environment is unique, but after the dot com crash, contemporary and post-war art grew ~24% a year for a decade, and after 2008, it grew ~11% annually for 12 years.*

Overall, the segment has outpaced the S&P by 15 percent with near-zero correlation from 1995 to 2025.

Now, Masterworks lets you invest in shares of artworks featuring legends like Banksy, Basquiat, and Picasso. Since 2019, investors have deployed $1.25 billion across 500+ artworks.

Masterworks has sold 25 works with net annualized returns like 14.6%, 17.6%, and 17.8%.

Shares can sell quickly, but my subscribers skip the waitlist:

*Per Masterworks data. Investing involves risk. Past performance not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

Note: This newsletter is intended for informational purposes only.