- Pivot & Flow

- Posts

- January 20th Market Overview

January 20th Market Overview

Jan. 20th Market Brief

Happy Monday

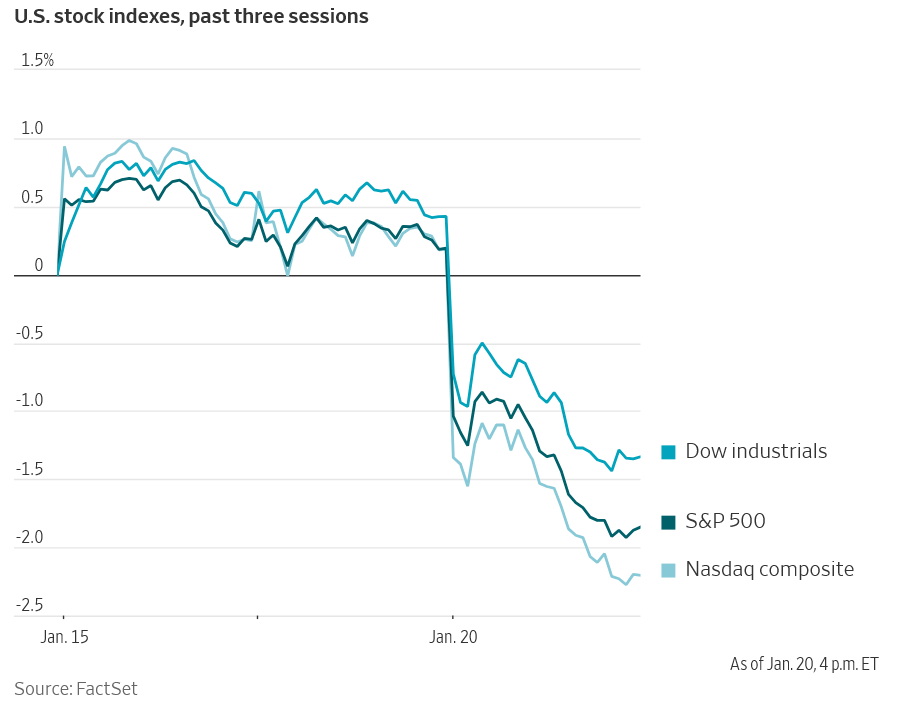

Red everywhere. The "Greenland trade" is now a portfolio risk and a weird one. Tariffs weaponized for territory instead of economics breaks the standard playbook. Trade war models assume negotiations over deficits and market access. A deal is always the endpoint. This has no economic endpoint. You get the island or you don't. There's no tariff level where Denmark says "fine, take it."

How do you price that?

Premium members, pay close attention to the Market Health Dashboard this week.

There will be signs of the underlying structure breaking down. This is why I built the thing.

Let’s dig in...

Today's Big Picture

Trump's Greenland Ultimatum

Trump threatened tariffs on eight NATO nations blocking his Greenland purchase. Starts at 10% Feb 1, rises to 25% by June. Threw in 200% on French wine after Macron refused his Gaza "Board of Peace" invite. Greenland's PM said they must prepare for possible US military force. Trade penalties for territory. That's new.

The 'Sell America' Trade

Stocks, bonds, and the dollar all sold off together. Not normal risk-off behavior. Gold hit $4,759 and silver topped $94, both records.

Foreign Money Starts Leaving

Danish pension fund AkademikerPension is dumping $100 million in Treasurys by month-end, citing "poor government finances." Small in absolute terms. But a NATO ally's institutional money fleeing US debt during a US-Denmark standoff? People notice. 10-year yield hit its highest since September.

P.S. Don’t put off learning about AI, its scary but it’s also exciting and can be helpful and ethically utilized.

Some Friends at Outskill are putting on a free learning workshop this weekend. Check it out and learn some useful new skills.

Market Overview

Index Performance

Stock Spotlight

nLight $LASR ( ▲ 10.91% )

moved higher after Stifel raised its price target to $60. Pentagon named directed energy weapons a top six tech priority in November. Defense theme with legs.

3M $MMM ( ▲ 4.59% )

fell after its CEO warned Trump's European tariffs could cost them $30-40 million this year. They import about $250 million annually from Europe.

Walmart $WMT ( ▲ 3.34% )

hit an all-time high while everything else bled. Investors hiding in names that sell necessities. Procter & Gamble $PG did the same.

Big Name Updates

Nvidia $NVDA ( ▲ 7.87% )

led tech lower. All seven Mag 7 stocks fell at least 1% for the first time since October. Supply chains hate tariff talk.

Amazon $AMZN ( ▼ 5.56% )

slid with the broader tech cohort. High-valuation names suffer when yields rise and uncertainty spikes.

Netflix $NFLX ( ▲ 1.65% )

held up better than most ahead of earnings. Warner Bros. Discovery $WBD approved Netflix's cash bid, adding context to the print.

Intel $INTC ( ▲ 4.87% )

rose on analyst upgrades. Shares have more than doubled in the past year. Sometimes the unloved stop being unloved.

Other Notable Company News

J.B. Hunt $JBHT ( ▲ 1.38% )

fell after reporting a revenue decline. Management cited soft demand across end markets.

Novavax $NVAX ( ▲ 4.83% )

licensed a vaccine component to Pfizer $PFE for $30 million upfront plus up to $500 million in milestones.

Solstice Advanced Materials $SOL ( ▲ 0.26% )

S hit highs after RBC raised its target to $75. Advantage in HFO refrigerants.

Union Pacific $UNP ( ▲ 0.47% )

and Norfolk Southern $NSC both dropped after a regulator called their $71.5 billion merger application incomplete.

Micron $MU ( ▲ 3.08% )

signed a letter to buy Powerchip Semiconductor's Taiwan fab for $1.8 billion cash.

Today’s Sponsor

Want to actually get good at AI this year?

Outskill is running a free 2-day live workshop this weekend. It’s practical hands-on training on building AI agents, automating workflows, and using tools most people haven't touched yet.

This isn't a webinar where someone reads slides at you. You'll build actual systems —> AI agents that handle tasks, automation’s connecting your tools, workflows you can use immediately.

Trustpilot rating: 9.8/10

Normally $395 — free this weekend.

No more "I'll learn AI eventually."

Grab your seat here for $0

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Yields pushed higher across the curve. The 10-year touched 4.30%, highest since September. Japan's 40-year yield also hit a record on fiscal concerns there, adding to selling pressure globally. Mortgage rates reversing course and heading back up. Ray Dalio warned at Davos about "capital wars" and foreign buyers losing appetite to fund US debt.

Policy Watch

Greenland & Trade

Trump said he had a "very good" call with NATO chief Mark Rutte and agreed to meet in Davos. Asked how far he's willing to go: "You'll find out." European leaders discussing countermeasures including the EU's "Anti-Coercion Instrument." Treasury Secretary Bessent defended the push: "That will stop any kind of kinetic war, so why not pre-empt the problem?"

Finland's president hopes to defuse the situation by week's end

Denmark sent more troops to Greenland for military exercises

EU chief von der Leyen called Greenland sovereignty "non-negotiable"

Fed Chair Drama

Bessent delivered his sharpest public criticism of Powell yet. Called it inappropriate for Powell to attend tomorrow's Supreme Court arguments in the Lisa Cook case. Blamed him for Fed losses from pandemic-era asset purchases.

Said if senior officials resigning over compliance issues happened at a Wall Street firm, "the CEO would be out." Decision possibly next week.

Panama Canal

Trump said taking control of the canal is "sort of on the table." He laughed. Markets rarely find ambiguity funny.

What to Watch

Trump's Davos Address

Wednesday. Expect direct comments on Greenland and trade. European leaders already there. Could escalate or de-escalate quickly.

European Institutional Flows

Market is underpricing how weird this gets. US president threatening military force on a NATO ally while flying to meet those same NATO leaders. Danish pension fund dumps Treasurys the same week Trump threatens Denmark. That's not coincidence. Watch if more European money follows.

Fed Chair Nomination

Bessent says decision could come next week. Removes one uncertainty, introduces another depending on the pick.

Natural Gas

February futures had their biggest one-day gain since Russia invaded Ukraine. Cold weather hitting, hedge funds caught massively short. Forecasts show even colder temperatures ahead.

Thanks for reading - you are now the more informed 🙂

- John

Today’s Sponsor

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Note: This newsletter is intended for informational purposes only.