- Pivot & Flow

- Posts

- January 1st Market Overview

January 1st Market Overview

Jan. 1st Market Brief

Happy Friday

First trading day of 2026 and the 2025 playbook is already working. Chips making new highs, Tesla losing its crown to Chinese EV tech, gold correcting after its best year ever.

I'm breaking down the themes that matter for this year on Sunday.

Let’s dig in...

Today's Big Picture

Chips Start 2026 Hot Micron

$MU hit all-time highs. Memory supply is still tight heading into the new year. Google is reportedly cutting its own chip production after losing capacity to Nvidia at TSMC.

Tesla Falls to Second Place

$TSLA delivered 1.64 million vehicles last year. BYD sold 2.26 million EVs and took the crown. December was brutal in Europe with France and Sweden registrations collapsing. The demand problem is real.

Gold Posts Record Weekly Drop

Gold futures fell $220 this week to $4,314. Largest weekly drop ever in dollar terms. After the best year in history, a correction was overdue.

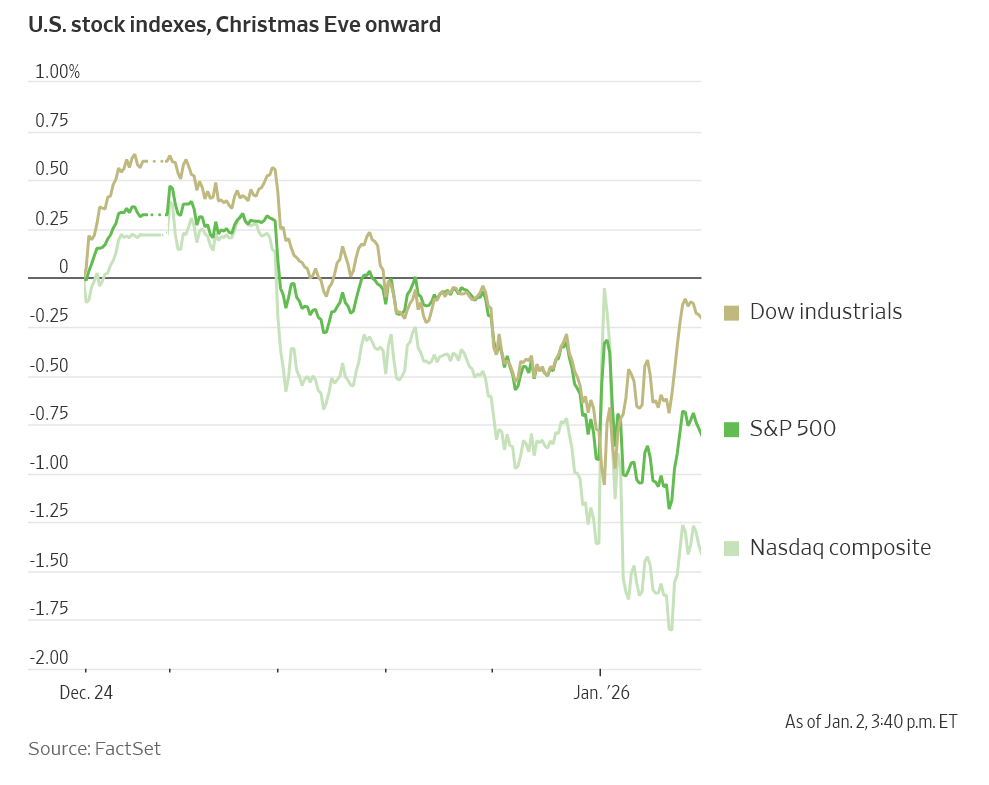

Market Overview

Index Performance

Stock Spotlight

Micron Technology $MU ( ▲ 2.59% )

hit all-time highs. AI demand is keeping memory tight with pricing power intact.

Vertiv $VRT ( ▲ 0.28% )

got upgraded to overweight at Barclays with a $200 target. Stock pulled back from its $200 high and they're calling it a buying opportunity.

Baidu $BIDU ( ▼ 0.91% )

will spin off its chip unit Kunlunxin via Hong Kong IPO. AI chip listings are hot there right now.

Sable Offshore $SOC ( ▲ 0.22% )

rallied after a federal court denied environmentalists' request to halt its California pipeline restart.

Big Name Updates

Alphabet $GOOGL ( ▲ 4.01% )

reportedly cut its 2026 TPU production target from 4 million to 3 million units. Lost out to Nvidia $NVDA in the fight for TSMC's advanced packaging capacity.

ASML $ASML ( ▲ 0.73% )

got a double upgrade to buy from sell at Aletheia. Target doubled from 750 to 1500. They see TSMC alone needing 40-45 EUV tools as it expands advanced capacity.

Apple $AAPL ( ▲ 1.54% )

got a Market Perform from Raymond James on coverage resumption. They say —> fair value, limited upside from here.

Other Notable Company News

Super Micro $SMCI ( ▲ 0.81% )

launched new liquid-cooled 6U servers powered by Intel Xeon 6900 chips.

Coinbase $COIN ( ▲ 3.26% )

CEO Armstrong said 2026 is about stablecoins and expanding into stocks and prediction markets alongside crypto.

Nio $NIO ( ▲ 2.84% )

posted record December car deliveries of 48,135 units. Q4 hit 124,807, near the top of guidance.

Under Armour $UAA ( ▲ 5.58% )

got reiterated at buy from UBS with an $8 target….implies the stock roughly doubles from here.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Yields were quiet on day one. The 10-year held around 4.19 as traders wait for next week's employment data. Manufacturing PMI came in at 51.8 for December, slightly below November but still in expansion. Dollar index stayed near 96.

Policy Watch

Tariff Relief

Trump delayed planned tariff hikes on upholstered furniture, kitchen cabinets, and vanities for one year. The current 25 duty stays, but higher rates won't kick in until 2027.

Wayfair $W, RH $RH, and Williams-Sonoma $WSM all moved higher.

Lumber

The White House adjusted import rules on timber and lumber products. Worth watching if tracking construction and housing costs.

Today’s Sponsor

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

What to Watch

CES Conference

The massive tech show kicks off next week in Las Vegas. Watch for real product demos rather than AI buzzwords.

Tesla Earnings January 28

After the delivery miss and BYD headline, all eyes on the call. Wedbush still has a $600 target and thinks the robotaxi roadmap could push Tesla to $2 trillion.

Small Cap Momentum

Russell 2000 outperformed on day one. After lagging all of 2025, small caps could benefit from lower rates and cheaper financing. Infrastructure Capital's Hatfield sees regional banks working this year.

Thanks for reading. 🙂

- John

Today’s Sponsor

Build real AI and tech skills, faster

Udacity helps you build the AI and tech skills employers actually need—fast. Learn from industry experts through hands-on projects designed to mirror real-world work, not just theory.

Whether you’re advancing in your current role or preparing for what’s next, Udacity’s flexible, fully online courses let you learn on your schedule and apply new skills immediately. From AI and machine learning to data, programming, and cloud technologies, you’ll gain practical experience you can show, not just list on a résumé.

Build confidence, stay competitive, and move your career forward with AI and tech skills that are in demand.

Note: This newsletter is intended for informational purposes only.