- Pivot & Flow

- Posts

- January 16th Market Overview

January 16th Market Overview

Jan. 16th Market Brief

Happy Friday

Trump threw a curveball this morning - told Hassett on camera he wants to keep him at NEC. Bonds sold off immediately betting the other Kevin (Warsh) gets the Fed chair and keeps rates higher for longer. Stocks finished flat trying to figure out what it means.

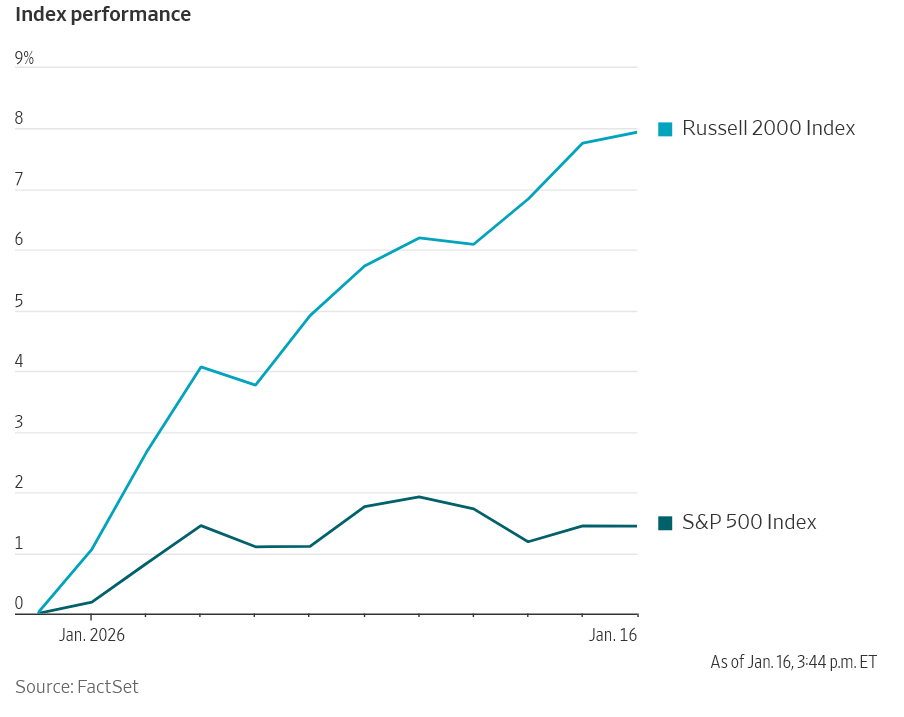

Worth noting: small caps keep quietly winning. The Russell's beaten the S&P for 11 straight days, longest streak since 2008. That rotation is the real story underneath all the Fed noise.

Let’s dig in...

P.S. Saturday, I go deeper with a smaller group. Specific charts. Specific names. The opinions that are too pointed for the daily market overview. This is where I actually tell you what I'm watching and why.

Premium members that drops tomorrow, please feel free to send me charts or thematic ideas at any time for discussion.

Today's Big Picture

Trump Shuffles the Fed Deck

Trump told Hassett at a White House event he wants to keep him director of National Economic Council. Prediction markets immediately pushed Kevin Warsh into the lead for Fed Chair. The bond market sold off because Warsh is viewed as less likely to cut rates aggressively.

Treasury Yields Break Out

The 10-year yield cleared its four-month trading range for the first time since September. Higher risk-free rates pressure equity valuations. Market is repricing how cheap money will actually be in 2026.

Taiwan Strikes a Real Deal

Taipei pledged $250B in U.S. tech investment plus $250B in credit guarantees to avoid higher tariffs. Chip stocks reacted well to the clarity. This is the template for how future semiconductor trade deals might look.

Market Overview

Index Performance

Stock Spotlight

Novo Nordisk $NVO ( ▲ 0.83% )

oral Wegovy pill logged 3,000 scripts in its first four days. That's a solid start. UK also cleared a higher dose of the injectable.

Micron $MU ( ▲ 0.07% )

saw its first insider buying since 2022. A director bought 23,200 shares at 337. When insiders buy, pay attention.

Rocket Lab $RKLB ( ▲ 2.71% )

got upgraded to overweight by Morgan Stanley with a 105 target. The SDA Tracking Layer contract sealed the deal.

Big Name Updates

3M $MMM ( ▼ 2.34% )

cut to neutral by JPMorgan. The easy wins from cost-cutting are behind them now. Innovation turnaround will take longer.

Nvidia $NVDA ( ▲ 2.99% )

got a bump from Jefferies, who raised their target to 275. Blackwell demand and the Rubin ramp are doing the heavy lifting.

ConocoPhillips $COP ( ▲ 4.21% )

downgraded by BofA. Breakeven at $53 WTI is higher than peers, which leaves less room for error if oil stays choppy.

Other Notable Company News

J.B. Hunt $JBHT ( ▼ 0.57% )

beat on earnings but fell anyway. Management sounded cautious on pricing. Freight recession still has legs.

PNC Financial $PNC ( ▲ 0.89% )

beat estimates on strong loan growth. Guiding for solid revenue gains through 2026.

Dave & Buster's $PLAY ( ▼ 3.26% )

upgraded by Benchmark. Same-store sales might finally turn positive after years of declines.

Mosaic $MOS ( ▼ 1.19% )

dropped hard. Farmers are buying less fertilizer because grain prices aren't covering their costs.

Equinor $EQNR ( ▲ 7.51% )

got the green light from a federal judge to restart Empire Wind.

AST SpaceMobile $ASTS ( ▲ 9.76% )

made the Missile Defense Agency's SHIELD award list.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year settled above 4.2% for the first time since September. Markets are betting a Warsh-led Fed keeps rates elevated longer than Hassett would have.

If this level holds, rate-sensitive names will feel it - growth stocks, housing, anything priced for easy money.

Policy Watch

Fed

Bowman said it's too soon to signal rates are on hold. She sees labor market fragility and wants room to cut if unemployment ticks up. Several Fed officials also defended Powell this week amid the DOJ probe:

Goolsbee: "first-ballot Hall of Fame Fed chair"

Kashkari: says the probe is part of the White House pressure campaign

Williams: described Powell as having "impeccable integrity"

Supreme Court hears arguments Wednesday on whether Trump can remove Fed governor Lisa Cook. That case sets the precedent for how much control the White House actually has over the Fed.

Trade

Trump threatened tariffs on any country opposing his Greenland bid. Called out France and Germany by name. Separately, Hassett confirmed there's a backup plan if the Supreme Court strikes down current tariffs - they can reimpose 10% immediately and backfill with other authorities later.

Credit Cards

White House is backing off the hard rate cap. Hassett floated voluntary "Trump Cards" from banks instead of legislation. Banks caught a bid on the news.

Japan

Finance minister warned of "decisive action" if yen weakens further. Translation: intervention risk is back. Watch USD/JPY.

Today’s Sponsor

Here’s an un-boring way to invest that billionaires have quietly leveraged for decades

If you have enough money that you think about buckets for your capital…

Ever invest in something you know will have low returns—just for the sake of diversifying?

CDs… Bonds… REITs… :(

Sure, these “boring” investments have some merits. But you probably overlooked one historically exclusive asset class:

It’s been famously leveraged by billionaires like Bezos and Gates, but just never been widely accessible until now.

It outpaced the S&P 500 (!) overall WITH low correlation to stocks, 1995 to 2025.*

It’s not private equity or real estate. Surprisingly, it’s postwar and contemporary art.

And since 2019, over 70,000 people have started investing in SHARES of artworks featuring legends like Banksy, Basquiat, and Picasso through a platform called Masterworks.

23 exits to date

$1,245,000,000+ invested

Annualized net returns like 17.6%, 17.8%, and 21.5%

My subscribers can SKIP their waitlist and invest in blue-chip art.

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

What to Watch

Monday

Markets closed for MLK Day.

Davos (Tuesday-Friday)

The World Economic Forum is where global leaders and CEOs say things that move markets. Trump speaks Wednesday and tends to make news when he's on a world stage. Jensen Huang from Nvidia $NVDA also speaks - anything he says about AI demand will move chips.

Supreme Court Wednesday

This one matters more than people realize. The court hears arguments on whether Trump can fire Fed governor Lisa Cook. If he wins, the precedent lets him remove any Fed official he wants. That's a different Fed than the one markets have priced in.

Earnings

Netflix $NFLX Tuesday. The Warner Bros deal chatter is the story - see if they address it. Intel $INTC Thursday - they need to show the turnaround is real. Procter & Gamble $PG Thursday gives you a read on the consumer.

Economic Data

PCE inflation Thursday. This is the number the Fed actually watches. If it runs hot, rate cut bets get repriced fast.

Thanks for reading - you are now the more informed 🙂

- John

Today’s Sponsor

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Note: This newsletter is intended for informational purposes only.