- Pivot & Flow

- Posts

- January 12th Market Overview

January 12th Market Overview

Jan. 12th Market Brief

Happy Monday

Full whiplash today.

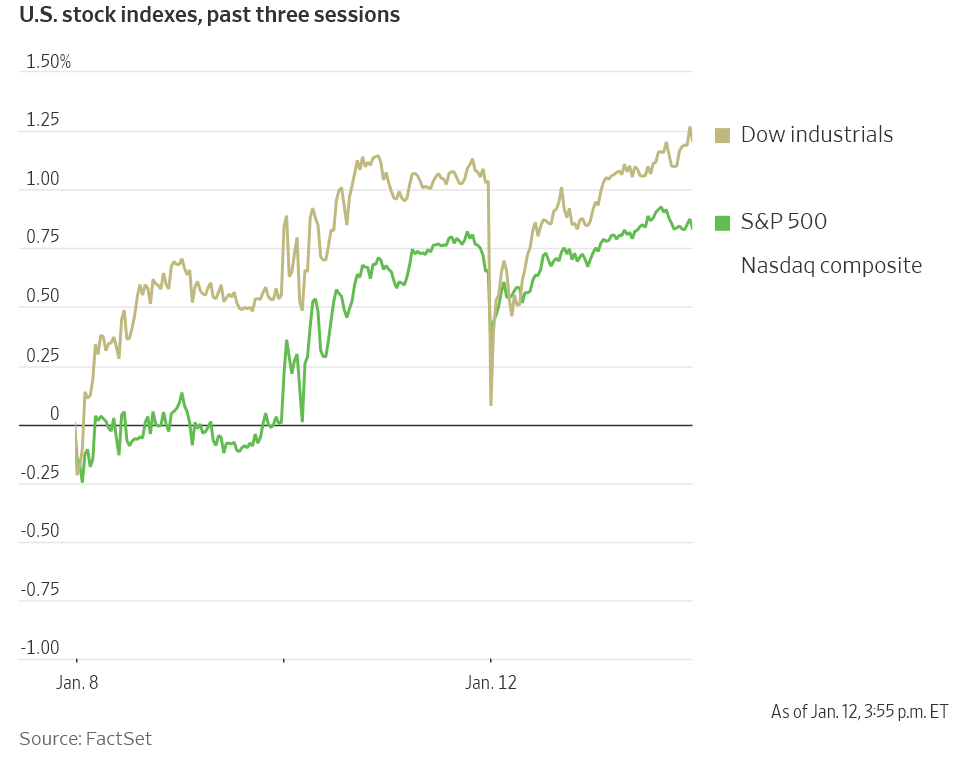

Dow dropped 500 points at the open on news the Fed Chair is under criminal investigation. By afternoon, new highs. Gold broke $4,600 for the first time. Investors want growth but don't trust the dollar. Markets can ignore the political circus for only so long.

Let’s dig in...

Today's Big Picture

The Fed vs. The White House

Jerome Powell released a video saying the DOJ is threatening a criminal indictment over building renovations. He called it a pretext to force rate cuts. The dollar weakened and gold hit a record as trust in central bank independence took a hit. Two Republican senators announced they'll block Fed nominees until the investigation is resolved.

Credit Card Rate Cap Proposal

Trump called for a temporary 10% cap on credit card interest rates. Bank stocks sold off hard. Analysts warned the move could backfire by forcing lenders to cut off credit access for lower-income borrowers entirely. The industry estimates $250 billion in subprime balances would get eliminated.

Stocks Ignore the Noise

The S&P 500 and Nasdaq hit fresh all-time highs intraday despite the chaos. The Dow was down nearly 500 points at the open and recovered. Alphabet crossed $4 trillion on news of an Apple AI partnership. Currency and bonds are flashing caution, but equity investors are still buying.

P.S. Don’t put off learning about AI, its scary but it’s also exciting and can be helpful and ethically utilized.

Some Friends at Outskill are putting on a free learning workshop this weekend. Check it out and learn some useful new skills.

Market Overview

Index Performance

Stock Spotlight

Alphabet $GOOGL ( ▲ 1.43% )

joined the $4 trillion club after Apple $AAPL announced it will use Google's Gemini model to power Siri. Only Nvidia sits at a higher valuation.

Walmart $WMT ( ▲ 2.84% )

is joining the Nasdaq-100 on January 20, replacing AstraZeneca $AZN. ETFs tracking the index will be forced buyers.

Palantir $PLTR ( ▲ 0.92% )

got upgraded to Buy at Citi on accelerating defense budgets. The bank sees a government supercycle driving 70-80% revenue growth this year.

Big Name Updates

JPMorgan Chase $JPM ( ▼ 1.9% )

reports tomorrow to kick off bank earnings. Listen for Jamie Dimon's take on the credit card cap proposal and consumer health.

Capital One $COF ( ▼ 6.15% )

led financial decliners on the rate cap news. The bank also agreed to pay $425

Duolingo $DUOL ( ▼ 14.01% )

fell after announcing its CFO is stepping down after nearly six years. Board member Gillian Munson takes over.

Other Notable Company News

Five Below $FIVE ( ▼ 0.71% )

raised full-year guidance after holiday comps came in above 14%.

Lululemon $LULU ( ▼ 0.5% )

said holiday performance is tracking toward the high end of Q4 guidance.

Affirm $AFRM ( ▼ 6.82% )

rallied on bets that a credit card cap would push borrowers toward buy-now-pay-later (yuck)

Dexcom $DXCM ( ▼ 1.28% )

beat preliminary Q4 revenue estimates with U.S. sales up 11% and international up 18%.

Today’s Sponsor

Want to actually get good at AI this year?

Outskill is running a free 2-day live workshop this weekend. It’s practical hands-on training on building AI agents, automating workflows, and using tools most people haven't touched yet.

This isn't a webinar where someone reads slides at you. You'll build actual systems —> AI agents that handle tasks, automations connecting your tools, workflows you can use immediately.

Trustpilot rating: 9.8/10. Normally $395 — free this weekend.

No more "I'll learn AI eventually."

Grab your seat here for $0

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 30-year yield rose as Fed independence concerns hit. Investors who worry about political influence on the Fed sell long-dated debt first. Bigger story is the dollar weakening against the euro, pound, and Swiss franc.

Tomorrow's CPI matters more than the Powell headlines for near-term rate expectations.

Policy Watch

Fed Fight

Powell's video statement denied wrongdoing and framed the investigation as retaliation for not cutting rates. Kevin Hassett tried to calm markets by calling Powell "a good person" while defending the probe as accountability.

Republican Senators Lisa Murkowski and Thom Tillis announced they'll block Fed nominees until the investigation is resolved

Three Fed presidents speak today: Williams, Bostic, and Barkin

Powell's term as chair ends in May

Trade

Trump warned a Supreme Court ruling against his tariffs would be a "complete mess" requiring hundreds of billions in paybacks. The court heard arguments late last year and could rule as soon as this week.

International

Trump said he's reviewing military options against Iran. European defense names like BAE Systems and Saab rallied. Exxon fell after Trump threatened to block their Venezuela drilling because the CEO called the country "uninvestible."

What to Watch

CPI Tomorrow

December inflation data drops in the morning. This is the last major print before the Fed meets later this month. Watch core services.

Bank Earnings

JPMorgan Tuesday. Bank of America, Citi, and Wells Fargo Wednesday. Goldman and Morgan Stanley Thursday. Consumer health and rate cap commentary will drive the headlines.

TSMC Results

Taiwan Semiconductor reports later this week. This is the real pulse check on whether AI chip demand is holding up.

Thanks for reading - you are now the more informed 🙂

- John

Today’s Sponsor

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Note: This newsletter is intended for informational purposes only.