- Pivot & Flow

- Posts

- February 6th Market Overview

February 6th Market Overview

Feb. 6th Market Brief

Happy Friday

66 stocks in the S&P hit 52-week highs today. Coca-Cola hit an all-time high. Salesforce hit its lowest price since 2023. Same market, two completely different stories playing out. That’s the theme this week, rotation…. will be discussing with all premium members in detail tomorrow.

Let’s dig in...

Today's Big Picture

Dow 50,000 Is A Value Story, Not A Growth Story

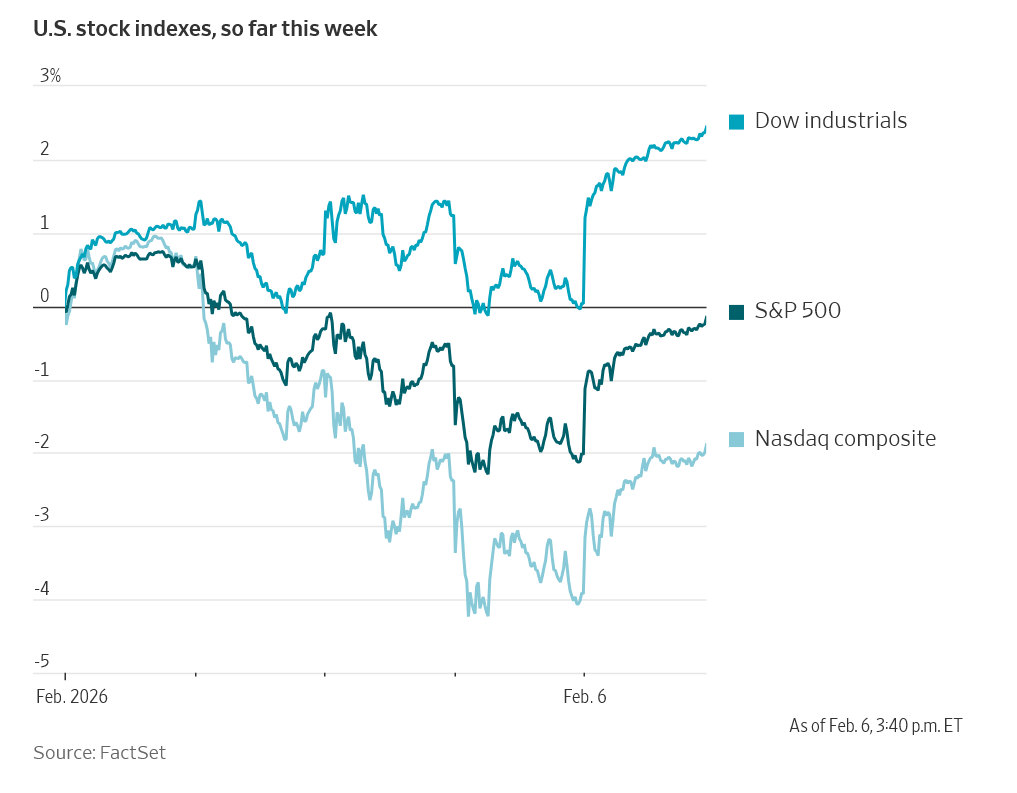

The Dow crossed 50,000 and it wasn't tech that got us there. Caterpillar, Goldman Sachs, and 3M did the heavy lifting while software kept bleeding. Small caps ripped too, Russell 2000 posted its best day since August. Money is rotating out of growth and into the boring stuff. I want to see if that holds next week.

Amazon Is Now Spending More Than It Makes Amazon

$AMZN guided $200 billion in capex this year, mostly AI infrastructure. That will likely exceed their operating cash flow for 2026. AWS beat growth expectations so the quarter was fine. But when spending outpaces what you bring in, the market gets nervous. Goldman cut its target to $280 from $300.

Bitcoin Lost Half Its Value In Four Months

Bitcoin touched below $61,000 overnight, roughly half its $126,000 record from October. Bounced to $70,000 Friday but still down hard on the week. China banned domestic entities from issuing virtual currencies, which didn't help. The VIX fell back below 20 but I wouldn't call this calm. Four months ago this coin was at all-time highs.

Market Overview

Index Performance

Stock Spotlight

Nvidia $NVDA ( ▲ 7.89% ) and Broadcom $AVGO ( ▲ 7.08% )

led the chip bounce after getting hammered all week. The VanEck Semiconductor ETF was still down on the week despite Friday's recovery.

Reddit $RDDT ( ▼ 6.98% )

beat on ad revenue and announced a $1 billion buyback. Needham named it a top pick for 2026, citing its moat of human-created content in a world flooding with AI slop.

Monolithic Power Systems $MPWR ( ▲ 6.03% )

posted revenue of $751 million on AI data center demand. Raised its dividend to $2 from $1.56. Oppenheimer has a $1,300 target.

Once Upon a Farm $OFRM ( ▲ 17.0% )

debuted on the NYSE. Jennifer Garner's kids' food brand priced at $18 and traded as high as $21.41.

Big Name Updates

Amazon $AMZN ( ▼ 5.49% )

missed earnings slightly, $1.95 vs $1.97 consensus. But the real story is the $200 billion capex guide. The company cut another 16,000 staff in the same breath. CEO Andy Jassy called this "an extraordinarily unusual opportunity to forever change the size of AWS."

Stellantis $STLA ( ▼ 23.64% )

posted the largest single-day drop in company history. They're cutting costs across the board and rethinking the entire EV transition after years of overinvestment.

Estee Lauder $EL ( ▲ 3.14% )

got upgraded to buy by Citi one day after crashing on a $100 million tariff hit. Citi sees improving trends in China and the US. Dip buyers showed up Friday.

Other Notable Company News

Molina Healthcare $MOH ( ▼ 25.72% )

posted an adjusted loss of $2.75 per share and guided revenue well below consensus. Medicaid cost pressures keep getting worse.

Hims & Hers $HIMS ( ▼ 2.07% )

fell after Novo Nordisk threatened legal action over a copycat weight loss pill. Novo called it "illegal."

Roblox $RBLX ( ▲ 10.05% )

guided for revenue growth up to 29 percent this year on higher bookings and daily active users.

Vistra $VST ( ▲ 5.01% )

was upgraded to buy by Goldman with a $205 target.

Hub Group $HUBG ( ▼ 16.93% )

found an accounting error that understated costs by $77 million over nine months, forcing a restatement.

Snowflake $SNOW ( ▲ 7.48% )

got a reiterated buy and top pick from Jefferies at $300. They're calling the selloff misplaced.

Today’s Sponsor

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, I break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Yields held steady as the fear trade unwound. No jobs report today, shutdown pushed it to Wednesday Feb 11. Economists expect 60,000 jobs added with unemployment holding steady.

India pushed back on rumors they're dumping US Treasuries. RBI governor called it normal reserve management while defending the rupee. I'd keep watching this one.

Policy Watch

Consumer Sentiment

UMich survey came in at 57.3, above the 55.0 consensus. Inflation expectations dropped to the lowest since January 2025.

The catch: sentiment only improved for people with big stock portfolios. Everyone else is still miserable.

Geopolitics

US and Iran met, agreed to keep talking. Iran won't budge on nuclear enrichment.

Another round expected in the coming days. Oil settled slightly higher.

Crypto

China banned domestic entities from issuing virtual currencies without approval. Reaffirmed crypto is not legal tender.

What to Watch

January Jobs Report, Wednesday Feb 11

The week's real macro event, just delayed. A miss in either direction moves bonds and rate expectations. ADP and Indeed data are getting extra attention because of the shutdown delays.

Software Carnage

The iShares Software ETF $IGV has been crushed in 2026. Anthropic's Claude Cowork announcement this week made it worse. ServiceNow $NOW hit lows not seen since May 2023. Salesforce $CRM back to March 2023 levels. If you're looking for a contrarian entry, the risk-reward is getting interesting. But catching knives hurts.

Thanks for reading - you are now the more informed 🙂

- John

Today’s Sponsor

AI won't replace you, but someone using AI will.

This is the harsh truth of the AI era. Not tomorrow. Right now.

AI isn’t coming for your job, but people who know how to use it are already pulling ahead.

Forward Future helps you understand what matters in AI, how it’s actually being used, and where the real advantages are emerging. No hype. No fear-mongering. Just clear, useful insight designed to help you keep your edge.

Note: This newsletter is intended for informational purposes only.