- Pivot & Flow

- Posts

- February 5th Market Overview

February 5th Market Overview

Feb. 5th Market Brief

Happy Thursday

Three labor reports landed this morning and all of them were bad. Layoffs hit a 2009 high, job openings fell to a post-Covid low, and claims came in above expectations. Alphabet also told investors AI might cost $185 billion this year. Big Tech is writing enormous checks while the rest of the economy sheds jobs.

I’m watching breadth sentiment very closely and will put risk back on once we are in a structurally healthier market.

This is how I check the market health every day. Don’t get blindsided.

Let’s dig in...

Today's Big Picture

1. The Bill For AI Comes Due

$GOOGL beat on revenue and earnings, posting nearly $114 billion in sales and $34.5 billion in net income. Then they guided for up to $185 billion in capital expenditures this year, roughly double 2025. Revenue is growing but so is the bill.

2. Labor Market Shows Real Cracks

Job openings fell to 6.54 million in December, the lowest since September 2020. Challenger reported 108,435 layoffs in January, the worst since 2009. Jobless claims came in at 231,000 versus 212,000 expected. The BLS jobs report got pushed to next week by the shutdown, but every alternative data source is pointing the same direction.

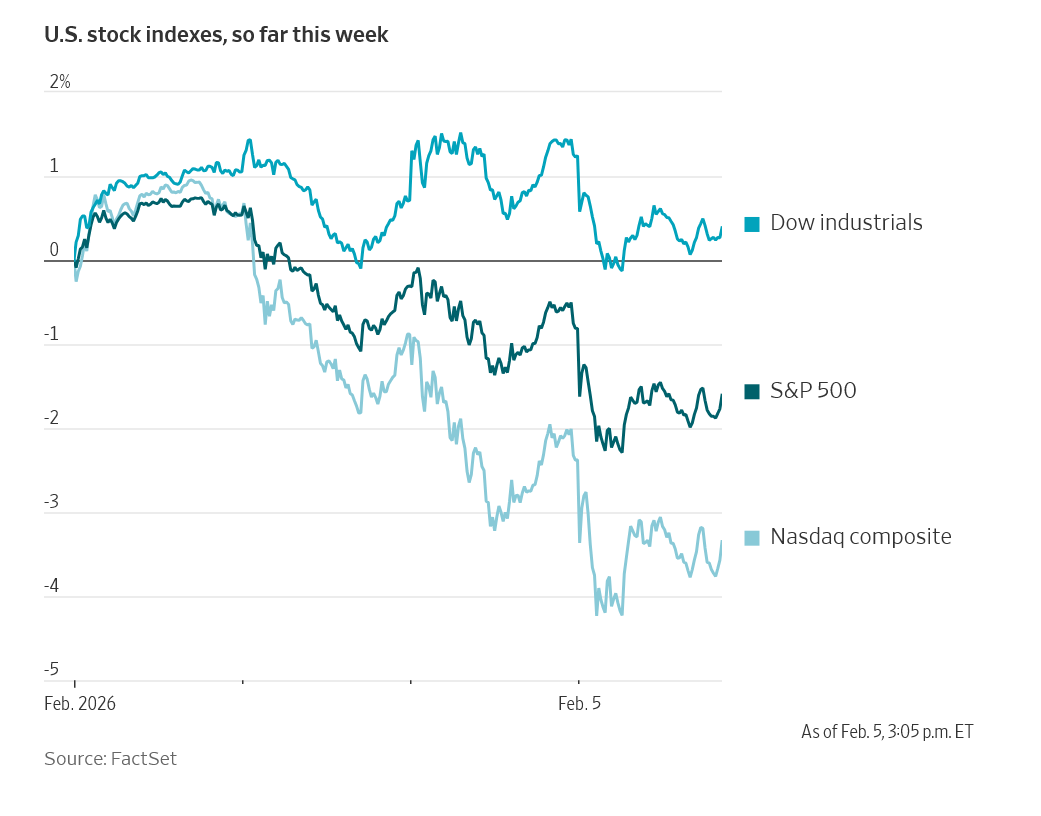

3. Risk Appetite Evaporates

Bitcoin fell below $67,000, erasing all gains since the Trump election in November 2024. Silver swung from nearly $90 to under $73.50 in a single session. The VIX hit its highest level since November and the momentum trade is unwinding fast.

Market Overview

Index Performance

Stock Spotlight

Qualcomm $QCOM ( ▼ 8.43% )

dropped after guiding for weak sales, blaming an industry-wide memory shortage. AI data centers are eating up supply meant for handsets and Bank of America downgraded the stock to neutral.

Arm Holdings $ARM ( ▲ 5.59% )

reversed a premarket drop and finished higher. The chip designer guided for slower revenue growth but the market took it as relief it wasn't worse.

Estée Lauder $EL ( ▼ 19.21% )

sold off hard despite raising its full-year earnings outlook. The company still expects a roughly $100 million tariff hit, and that's what investors focused on.

Hims & Hers $HIMS ( ▼ 5.29% )

launched a $49 version of Novo Nordisk's Wegovy pill, undercutting the $149 branded price. Shares of Novo Nordisk $NVO and Eli Lilly $LLY both dropped on the news.

Big Name Updates

Peloton $PTON ( ▼ 27.24% )

missed on revenue and earnings in the holiday quarter. The new AI product line didn't move consumers and guidance came in soft.

Strategy $MSTR ( ▼ 18.36% )

fell alongside bitcoin as the crypto selloff deepened. Michael Saylor posted "HODL" in response.

Corpay $CPAY ( ▲ 11.28% )

beat on earnings and guidance. Wolfe Research called it "a port in the storm" and reiterated a $375 price target.

Other Notable Company News

Ciena $CIEN ( ▼ 0.34% )

joins the S&P 500 on Monday, replacing Dayforce after Thoma Bravo's take-private.

Linde $LIN ( ▼ 2.71% )

CEO said he's building a "billion-dollar business" supplying gases for rocket launches near SpaceX.

Hershey $HSY ( ▲ 8.91% )

rallied on a strong 2026 outlook despite new food stamp restrictions on candy in some states.

Thomson Reuters $TRI ( ▼ 7.79% )

told analysts its proprietary data protects it from AI disruption. Intercontinental Exchange $ICE made the same argument.

Today’s Sponsor

Men, Say Goodbye to Eyebags, Dark Spots & Wrinkles

Reduce eyebags, dark spots and wrinkles with the first of its kind anti-aging solution for men.

Based on advanced dermatological research, Particle Face Cream helps keep your skin healthy and youthful, ensuring you look and feel your best every day.

Get 20% off and free shipping now with the exclusive promo code BH20!

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Bonds yawned while everything else panicked. The 10-year settled around 4.21 as weak labor data gave Treasuries a bid. Dollar barely moved at 95.20. Tomorrow brings the 30-year auction.

Policy Watch

Fed

Governor Lisa Cook said inflation progress "essentially stalled" in 2025 with core PCE estimated at 3.0 for the year. She pointed to tariffs as the main driver but expects the impact to be one-time. European central bankers congratulated Kevin Warsh on his Fed nomination.

Chip War Nvidia

$NVDA warned the administration that new H200 export rules for China are too strict and would destroy demand.

The regulations look a lot like Biden-era rules Trump already revoked

Nvidia argues the restrictions could end up helping Huawei

China approved an initial batch of H200 orders but is waiting on final U.S. sign-off

In Washington

Trump told NBC he'll leave the Netflix / Warner Bros. Discovery deal review to the DOJ, walking back earlier comments about personal involvement.

In London

The Epstein scandal is rattling U.K. markets.

The pound fell and gilt yields rose as pressure built on PM Starmer over former ambassador Peter Mandelson's Epstein ties

British media is openly asking whether Starmer survives this

What to Watch

Amazon Earnings

Reports after the close today. After Alphabet's capex shock and Microsoft's cloud miss, this is the last big read on Big Tech for the week.

Jobs Report

The BLS January report got pushed to next week by the shutdown. It's now the single most important data point for anyone trying to read the Fed's next move.

Fed Rate Cut Timing

Three labor reports all came in weak on the same day. If the BLS number confirms the trend, March or April cuts become a real conversation.

Thanks for reading - you are now the more informed 🙂

- John

Today’s Sponsor

Privacy-first email. Built for real protection.

End-to-end encrypted, ad-free, and open-source. Proton Mail protects your inbox with zero data tracking.

Note: This newsletter is intended for informational purposes only.