- Pivot & Flow

- Posts

- February 4th Market Overview

February 4th Market Overview

Feb. 4th Market Brief

Happy Wednesday

Strange day.

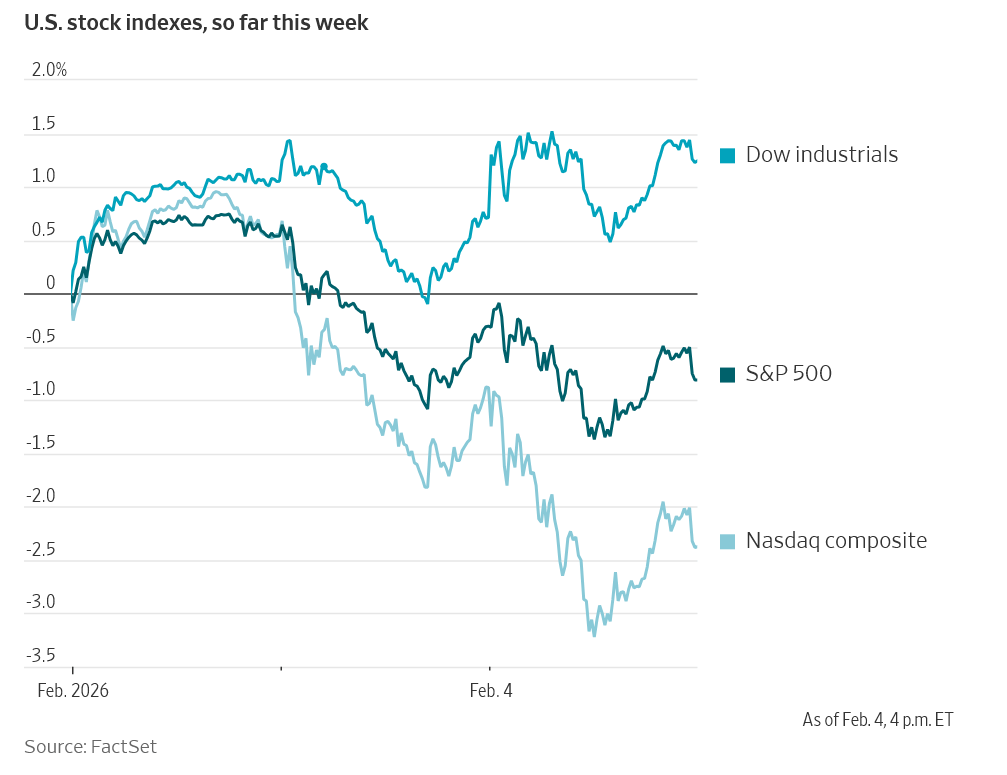

Nasdaq down over a point, but 82 S&P stocks hit 52-week highs. Most since November. Tech money is moving into industrials and it's not slowing down. Alphabet beat earnings after the bell and still went no where. If that doesn't make you check your positioning, I don't know what will.

It’s a deep reminder why I pay such close attention to company moats/value.

Let’s dig in...

Today's Big Picture

AMD Disappoints the Optimists

Advanced Micro Devices $AMD beat revenue estimates but posted its worst day since 2017. Operating expenses came in $200 million higher than guided, and part of the Q4 strength came from one-time China chip sales. The AI trade demands perfection and margin expansion. AMD delivered neither.

Old School Value Returns

While the Nasdaq fell, 82 S&P 500 stocks hit 52-week highs—> the most since November 2024. Industrials led with names like Caterpillar $CAT and GE Vernova $GEV. This is the biggest single-day performance gap between the Dow and Nasdaq since last April's tariff selloff. Money isn't leaving the market—it's just moving houses.

Software Selloff Hits Credit Markets

Anthropic released new AI legal tools and software stocks tanked globally… Salesforce, Oracle, Fujitsu, Infosys. Larry Ellison has lost nearly $40 billion in paper wealth this year. The real tell: $25 billion in software loans now trade at distressed levels, up from $11 billion a month ago. Credit is repricing, that's structural, not sentiment.

Market Overview

Index Performance

Stock Spotlight

Eli Lilly $LLY ( ▼ 8.82% )

crushed earnings on massive demand for Zepbound and Mounjaro. They raised full-year guidance while rival Novo Nordisk $NVO warned on sales the same day.

Super Micro Computer $SMCI ( ▼ 8.03% )

rallied after reporting sales doubled. They raised annual revenue forecast to at least $40 billion.

Texas Instruments $TXN ( ▲ 1.23% )

agreed to buy Silicon Laboratories $SLAB for $7.5 billion. Semiconductor consolidation continues.

Enphase Energy $ENPH ( ▼ 5.78% )

beat estimates and guided higher than expected. Best day for the stock in months.

Big Name Updates

Alphabet $GOOGL ( ▼ 1.08% )

beat on both lines after the bell—EPS $2.82 vs $2.63 expected, revenue $113.83B vs $111.43B expected. Stock fell anyway in after-hours trading. When a $2B revenue beat gets sold, the market is worried about something else.

Walt Disney $DIS ( ▼ 1.37% )

named Josh D'Amaro as its next CEO, replacing Bob Iger effective March 18. Analysts call this a best-case scenario.

Chipotle Mexican Grill $CMG ( ▼ 3.61% )

fell after predicting flat same-store sales for the year. Traffic dropped for the fourth straight quarter.

Nvidia $NVDA ( ▼ 0.86% )

CEO Jensen Huang called the idea that AI will replace software "the most illogical thing in the world." Stock still got dragged down.

Other Notable Company News

PayPal $PYPL ( ▼ 3.02% )

saw retail investors pile in after yesterday's bloodbath. Nearly $80 million in net buying according to VandaTrack…. still closed red

UBS Group $UBS ( ▼ 2.1% )

fell after reporting $14.5 billion in Americas outflows. Around 200 advisers left after comp structure changes.

New York Times $NYT ( ▲ 1.86% )

dropped after news-only subscription revenue declined. Bundle sales growing but the core product is softening.

Berkshire Hathaway $BRK.B ( ▲ 0.16% )

turned positive for the year while the market struggled. Quiet start to Greg Abel's first year as CEO.

Today’s Sponsor

Privacy-first email. Built for real protection.

End-to-end encrypted, ad-free, and open-source. Proton Mail protects your inbox with zero data tracking.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields ticked higher after the government announced no changes to auction sizes for "at least the next several quarters." The 10-year sits near 4.28 as traders wait on inflation data. Volatility here remains low compared to equities.

Policy Watch

Labor Market

ADP reported just 22,000 private payrolls in January versus 45,000 expected. Education and healthcare carried the entire number with 74,000 hires—everything else went negative.

Manufacturing shed workers

Professional services shed workers

Fed has ammunition to stay patient

Washington

Government shutdown ended Tuesday. Key dates:

Jobs report delayed to February 11

JOLTS data released Thursday (was scheduled for Tuesday)

Trade

U.S. exploring price floors for critical minerals with Mexico, EU, and Japan. Domestic rare earth producers sold off on the news:

What to Watch

Amazon Earnings Thursday

AWS growth will tell us if the software fear is overblown or just getting started.

Jobs Report February 11

The January employment data finally arrives next week, five days late thanks to the shutdown. Until then, ADP and vibes.

Bitcoin $73,000 Level

Bitcoin broke below $73,000 today and has now erased all gains since the election. If this level doesn't hold, the crypto narrative could shift from institutional adoption to speculative unwind.

Thanks for reading - you are now the more informed 🙂

- John

Today’s Sponsor

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Note: This newsletter is intended for informational purposes only.