- Pivot & Flow

- Posts

- February 20th Market Overview

February 20th Market Overview

Feb. 20th Market Brief

Happy Friday

The Supreme Court struck down the tariffs. The White House announced replacements two hours later. GDP missed badly. Traders bought all of it. I am remaining very cautious into this rally with Iran tensions over the weekend but happy to see some green.

Let’s dig in...

Today's Big Picture

Supreme Court Kills Emergency Tariffs, White House Pivots Immediately

The justices ruled 6-3 that the president's use of emergency powers for tariffs was illegal. Barrett and Gorsuch, both Trump appointees, voted against him. Within two hours the administration announced a replacement 10 percent global tariff under Section 122 of the Trade Act of 1974. That authority only lasts 150 days. They're also launching Section 301 investigations to build something permanent, but that process takes time. The trade war isn't over, it just got downgraded.

Growth Slows as the Shutdown Bites

Q4 GDP came in at 1.4 against a 2.5 consensus. The Commerce Department pointed to the record-long government shutdown, estimating it shaved a full point off growth. Federal spending fell at a 16.6 annual rate. Core PCE held at 3, still well above the Fed's 2 target. Slowing growth and sticky inflation in the same print is not a great combo.

$133 Billion in Tariff Refunds Stuck in Limbo

The Court said nothing about what happens to money already collected. The president said refunds will "end up in court for the next five years." Customs hasn't even told importers the old tariffs are dead yet. Hedge funds are already buying refund claims at near par value, betting on eventual payouts.

For smaller importers who absorbed these costs for over a year, getting that capital back is survival money.

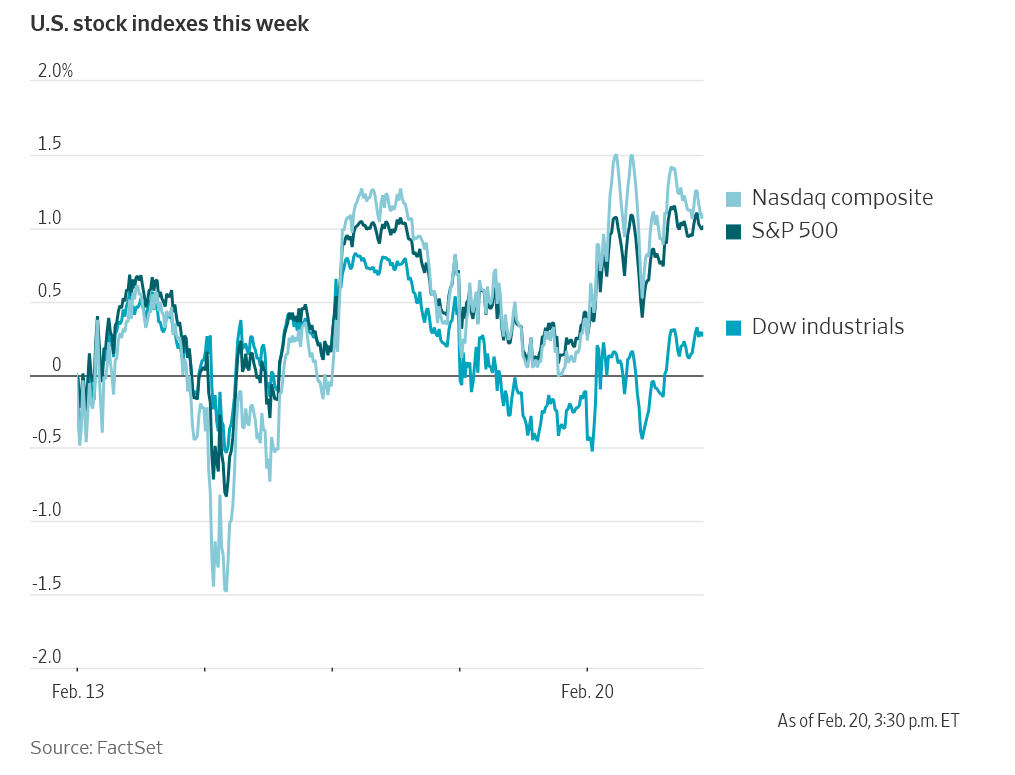

Market Overview

Index Performance

Stock Spotlight

Amazon $AMZN ( ▲ 2.42% )

officially overtook Walmart as the largest American company by revenue, posting $716.9 billion versus Walmart's $713.2 billion. They also source roughly 70 percent of goods from China per Wedbush, making them a prime beneficiary of today's ruling.

Opendoor Technologies $OPEN ( ▲ 8.07% )

posted a strong earnings beat with revenue of $736 million against a $549 million estimate. The CEO said the October cohort is on track to be their most profitable ever and is targeting adjusted EBITDA profitability by Q2.

Tesla $TSLA ( ▼ 0.43% )

quietly cut Cybertruck pricing. The Cyberbeast dropped to $99,990 from $114,990 and they launched a new Dual Motor AWD trim at $59,990.

Big Name Updates

Nvidia $NVDA ( ▲ 0.81% )

is reportedly looking to invest $30 billion into the new OpenAI funding round, per the Financial Times.

Deere $DE ( ▲ 0.29% )

had roughly $600 million in expense exposure riding on today's ruling. About half their $1.2 billion in expected levy costs this year were tied to the emergency tariffs.

JPMorgan $JPM ( ▲ 0.72% )

chief Jamie Dimon sold another $21 million in stock. He held his shares for two decades before starting this recent wave of selling in late 2023. I always pay attention when the smartest guy in banking takes chips off the table.

Other Notable Company News

Grail $GRAL ( ▼ 50.62% )

lost half its value after a 142,000-person UK study showed its Galleri cancer-screening blood test failed to significantly reduce late-stage cancer detection. This puts both UK reimbursement and US regulatory approval at risk.

Blue Owl Capital $OWL ( ▼ 3.96% )

permanently restricted retail withdrawals on a major private debt fund after selling $1.4 billion in loans. The private credit space is facing a real stress test.

Akamai Technologies $AKAM ( ▼ 13.89% )

dropped after guiding Q1 earnings to $1.50-$1.67 per share against a $1.75 consensus.

GE Aerospace $GE ( ▲ 2.41% )

got a street-high $425 price target from Morgan Stanley at initiation. Stock is up 142 percent since becoming a standalone company.

Today’s Sponsor

Billionaire investors just set 2 all-time records. An asset class most investors never even considered.

How have 70,679 everyday investors joined in on the billionaire’s asset class?

A Klimt painting sold for $236 million—the most expensive modern artwork ever sold at auction.

A Kahlo broke the auction record for a female artist at $54 million.

Obvious outliers, sure, but the 2025 fall auction season signaled the postwar and contemporary art market could be entering a bull run.

Why?

Outpaced the S&P 500 overall with low correlation since ‘95*

Can trade in any global currency

Natural scarcity

Of course, who can afford to spend millions on a painting, right?

But now it’s easy to fractionally invest in art by legends like Banksy and more, thanks to Masterworks.

They acquire it, securitize it, offer shares, and eventually look to sell it.

Net annualized returns like 14.6%, 17.6%, and 17.8% for works held over a year.

See why members have allocated $1.3 billion across 500+ works:

*According to Masterworks data. Investing involves risk. Past performance not indicative of future returns. See important disclosures at masterworks.com/cd.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year yield edged higher after the tariff decision. Bond traders are clearly worried that losing tariff revenue will widen the deficit further. The Fed is not cutting anytime soon.

Policy Watch

The Supreme Court took away the president's fastest path to tariffs. What he's left with is slower and weaker.

The replacement comes under a 1974 trade law that caps out at 150 days. That clock runs to roughly mid-July. To make anything stick longer, the administration is opening Section 301 investigations, the same tool used against China back in 2018. Those take months and require the government to formally prove unfair trade practices before tariffs can go into effect. I think Wall Street is reading this right. The tariff threat just got a lot less scary.

The ruling also changes who benefits from global trade. Under the old tariffs, goods from Mexico and Canada that followed trade agreement rules got in duty-free. That was a massive advantage over competitors in Europe and Japan. Now that advantage is gone. This will matter a lot when the US-Mexico-Canada trade deal comes up for review this summer.

Customs and Border Protection still hasn't officially told importers the old tariffs are lifted. Trade specialists say it could take weeks.

Oil is near six-month highs. The administration signaled a decision on military strikes against Iran within 10 days. If that happens, tariffs become a footnote. I think this is the most under-covered story of the week.

The partial government shutdown enters Day 7 with no resolution in sight.

What to Watch

Nvidia Earnings Next Week

Most important report left this season. After the $30 billion OpenAI investment headline and ongoing AI capex debates, the guide will set the tone for tech into March.

The Tariff Refund Chaos

Hedge funds are already buying up refund claims from importers. Watch how quickly the Treasury sets up a legal framework to return this capital. Billions are tied up and the process could take years.

Iran Decision Window

The president said 10 days. That puts us at early March. Any military action would send oil well above current levels and change the risk conversation entirely.

Retail Investor Sentiment

VandaTrack flagged this week as one of the weakest for retail flows in recent years. Everyday traders completely sat out this bounce.

Thanks for reading - you are now the more informed 🙂

- John

Today’s Sponsor

Ship the message as fast as you think

Founders spend too much time drafting the same kinds of messages. Wispr Flow turns spoken thinking into final-draft writing so you can record investor updates, product briefs, and run-of-the-mill status notes by voice. Use saved snippets for recurring intros, insert calendar links by voice, and keep comms consistent across the team. It preserves your tone, fixes punctuation, and formats lists so you send confident messages fast. Works on Mac, Windows, and iPhone. Try Wispr Flow for founders.

Note: This newsletter is intended for informational purposes only.