- Pivot & Flow

- Posts

- February 10th Market Overview

February 10th Market Overview

Feb. 10th Market Brief

Happy Tuesday

The Dow broke above the big 50,000 again but nothing else could keep up. December retail sales came in flat, and AI started eating wealth management stocks today. Messy day all around.

Let’s dig in...

Today's Big Picture

The Consumer Blinked

December retail sales came in flat. Wall Street expected growth. The Atlanta Fed cut its Q4 GDP estimate to 3.7 from over five, and Goldman is tracking even lower at 1.6. If the jobs report misses tomorrow, the soft landing story falls apart.

AI Comes For The Advisors

Altruist launched an AI tax planning tool that reads financial documents without manual entry, and wealth management stocks got wrecked. LPL Financial $LPLA, Charles Schwab $SCHW, and Raymond James $RJF all had their worst days in years. Raymond James saw its biggest drop since the COVID crash. Second week in a row that AI fears have rotated into a new sector, after Anthropic crushed data and software stocks last week. The moats around high-touch finance are looking shallow.

Fed Patience

Cleveland's Hammack and Dallas's Logan both said rates should hold where they are. Hammack wants to stay on hold "for quite some time." Both vote on policy this year, and both think inflation is still too sticky despite the weak consumer data. A cut before May looks increasingly unlikely.

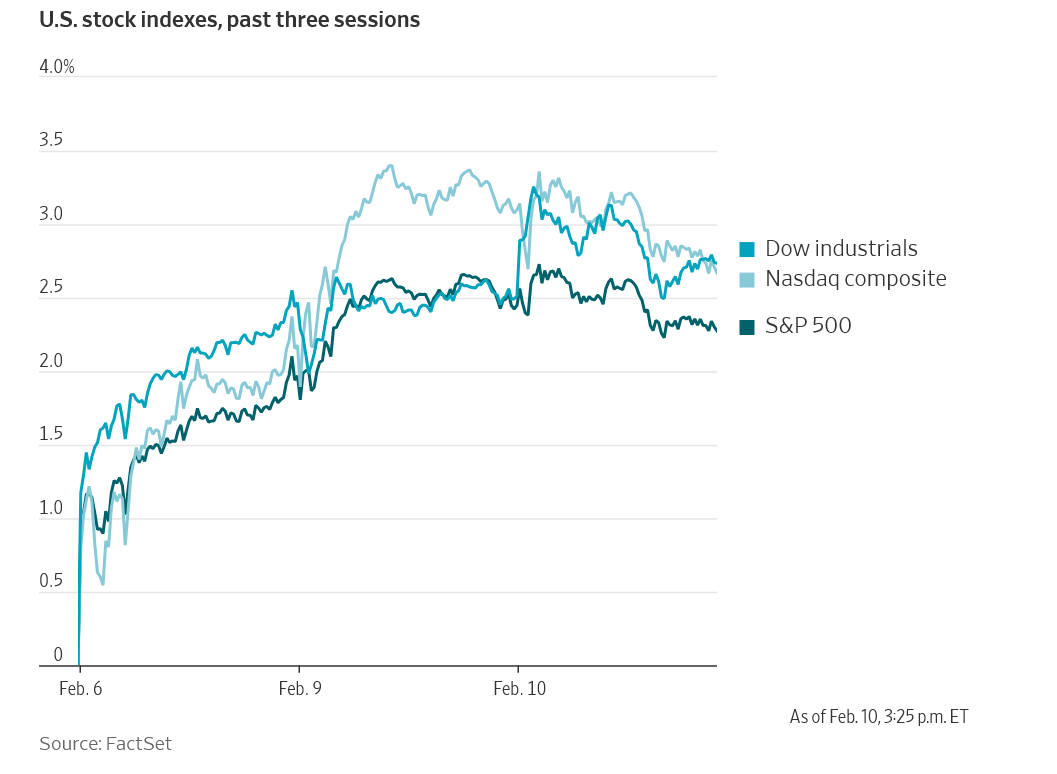

Market Overview

Index Performance

Stock Spotlight

Spotify $SPOT ( ▲ 15.14% )

added a record 38 million monthly users in Q4, bringing the total to 751 million. Premium subscribers hit 290 million. EPS came in way above estimates. Pricing power is real here.

Credo Technology $CRDO ( ▲ 9.09% )

raised its revenue outlook far above prior guidance and said it's on pace for over 200 percent year-over-year revenue growth this fiscal year. Astera Labs $ALAB moved in sympathy ahead of its own report tonight.

Coca-Cola $KO ( ▼ 1.54% )

missed revenue estimates for the first time in five years. North American concentrate sales grew just one percent, lagging every other region. Guided for organic revenue growth of four to five percent in 2026.

Big Name Updates

Alphabet $GOOGL ( ▼ 1.48% )

raised $31.5 billion in bonds this week across dollar, sterling, and Swiss franc markets. The initial $20 billion dollar deal drew over $100 billion in demand. All of it goes toward AI infrastructure. As recently as last March, Alphabet had less than $11 billion in total long-term debt. That's a wild ramp.

S&P Global $SPGI ( ▼ 9.65% )

gave a weaker earnings outlook than the Street expected and got punished. Moody's $MCO fell in sympathy. AI disruption fears have now spread to the financial data providers too.

Walmart $WMT ( ▼ 1.57% )

is trading at nearly 44 times forward earnings after a strong run. Wells Fargo says even a beat on Feb. 19 might not move the stock much higher. At this valuation you need perfection, and flat retail sales aren't helping.

Other Notable Company News

Taiwan Semiconductor $TSM ( ▲ 2.01% )

posted record January revenue, running well ahead of its full-year growth outlook. AI chip demand isn't slowing down.

CVS Health $CVS ( ▲ 0.01% )

beat Q4 earnings estimates but held revenue guidance below what the Street wanted. Also cut its full-year cash flow forecast. Mixed.

BP $BP ( ▼ 5.6% )

suspended its quarterly buyback and is speeding up cost cuts. Targeting $20 billion in asset sales by 2027.

Shopify $SHOP ( ▲ 7.37% )

got upgraded to Buy at MoffettNathanson. The argument: the AI-driven software selloff unfairly punished Shopify because it's not really a traditional software company. New target of $150.

Take-Two $TTWO ( ▲ 2.71% )

upgraded to Strong Buy at Raymond James. The thesis is that AI world models complement game engines, they don't replace them.

Unity $U ( ▲ 3.67% )

upgraded to Outperform at Oppenheimer. The analyst says fears about Google's Project Genie replacing game engines are overblown.

Today’s Sponsor

Step Into 2026 With The Complete Intranet Buyer’s Guide

If your employees waste time searching for information or juggling disconnected tools, it’s time for a better approach. Haystack’s 2026 Intranet Buyer’s Guide shows you exactly what to look for in a modern platform, so you can streamline comms and empower your teams.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields dipped after the flat retail sales print gave bonds a small bid. The 10-year settled around 4.15.

Tomorrow's jobs report and Friday's CPI will matter far more than anything that happened in the bond market today.

Policy Watch

Fed

Waller noted crypto clarity appears stalled in Congress

Wall Street is pricing roughly coin-flip odds of a cut before May, but today's speeches pushed the needle toward hold

Trump told Fox Business the economy could grow fifteen percent under Warsh. Not a real number, but it signals where the White House pressure is headed.

Domestic

The White House is pressing Congress to ban large investors from buying single-family homes. Republicans are pushing back.

International

Japan's Nikkei hit a fresh record after PM Takaichi's decisive election win this weekend. Investors are rotating into international markets after years of U.S. overweighting.

China's Xi called for the renminbi to achieve global reserve currency status. Ambitious, but capital controls make that a very long road.

BofA raised its Taiwan 2026 GDP forecast to eight percent from four and a half, driven entirely by AI hardware demand.

What to Watch

January Jobs Report

Due Wednesday. Healthcare has been carrying nearly all job growth. If this misses like retail sales did, the recession conversation comes back fast.

Consumer Price Index

Lands Friday with both Fed speakers today calling inflation "stubbornly high." A hot print would kill any remaining rate cut hopes for the first half of 2026.

Walmart $WMT Earnings

Reports next week Feb. 19. The ultimate consumer bellwether at 44 times earnings with flat retail sales in the rearview. The bar is very high.

Thanks for reading - you are now the more informed 🙂

- John

Today’s Sponsor

Ship the message as fast as you think

Founders spend too much time drafting the same kinds of messages. Wispr Flow turns spoken thinking into final-draft writing so you can record investor updates, product briefs, and run-of-the-mill status notes by voice. Use saved snippets for recurring intros, insert calendar links by voice, and keep comms consistent across the team. It preserves your tone, fixes punctuation, and formats lists so you send confident messages fast. Works on Mac, Windows, and iPhone. Try Wispr Flow for founders.

Note: This newsletter is intended for informational purposes only.