- Pivot & Flow

- Posts

- Everyone Says Small Caps Outperform.

Everyone Says Small Caps Outperform.

The Last 40 Years Say Otherwise.

Happy Sunday

I truly hope you had a great holiday with loved ones and too much food. Wanted to keep this one light but still give you something practical to chew on.

let’s dig in…

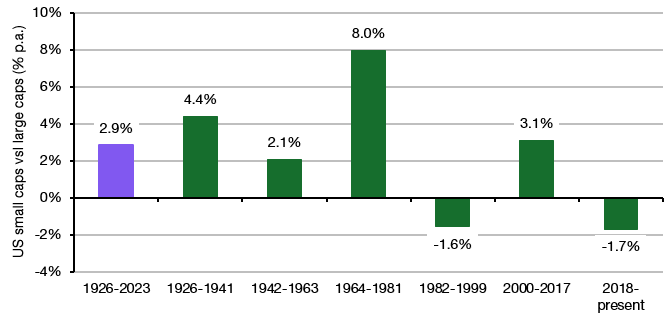

The case for small-cap investing is simple, smaller companies have more room to grow, so they should deliver higher returns over time. And if you look at the last 100 years of data, that's exactly what happened…small caps beat large caps.

Here's what that century long avg’s hides: almost all of the out performance came from one era. The 1930s through the 1970s.

Since then? If you'd put money into small caps 40 years ago expecting them to outperform, you'd still be waiting. They've basically just matched large-cap returns.

Source: McQuarrie (2025).

Small caps crushed it from the '30s through the '70s. Then it stopped. The '80s and '90s? Under performance. 2018 to present? Under performance again.

So yes, "in the long run" small caps outperform. But how long is that long run? Most people don't have 40-year time horizons. They check out. They sell. They move on.

Here's where it gets uncomfortable.

In the early '90s, two academics named Fama and French published research that became gospel: small caps outperform. A generation of investors built their portfolios around it.

Look at the shaded region in this chart. That's the slice of history they used to prove their point, and the chart shows an extreme comparison: the priciest large-cap stocks vs. the cheapest small-cap stocks.

Source: McQuarrie (2025).

Their data came from a window when expensive large caps got destroyed. It's actually kind of an anomaly in the broader 100-year picture.

Since they published? The relationship has basically flipped. Expensive large caps have beaten cheap small caps almost continuously.

Today’s Sponsor

Here’s an un-boring way to invest that billionaires have quietly leveraged for decades

If you have enough money that you think about buckets for your capital…

Ever invest in something you know will have low returns—just for the sake of diversifying?

CDs… Bonds… REITs… :(

Sure, these “boring” investments have some merits. But you probably overlooked one historically exclusive asset class:

It’s been famously leveraged by billionaires like Bezos and Gates, but just never been widely accessible until now.

It outpaced the S&P 500 (!) overall WITH low correlation to stocks, 1995 to 2025.*

It’s not private equity or real estate. Surprisingly, it’s postwar and contemporary art.

And since 2019, over 70,000 people have started investing in SHARES of artworks featuring legends like Banksy, Basquiat, and Picasso through a platform called Masterworks.

23 exits to date

$1,245,000,000+ invested

Annualized net returns like 17.6%, 17.8%, and 21.5%

My subscribers can SKIP their waitlist and invest in blue-chip art.

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

The uncomfortable implication I’m pulling here: The research that shaped how a generation invests may have been based on a market environment that no longer exists.

An economics professor in 2013 told me something I never forgot: "There's no practical difference between 'never' and 'not in your lifetime.”

If you started buying small caps at 30, you'd be 70 before the thesis played out to even see if you were correct. That's not practical strategy in my honest opinion.

So here's the question I keep coming back to, If we saw this data for the first time today no textbooks, no conventional wisdom, would we still conclude small caps win in the long run?

Looking at these charts fresh, what's your take?

Stay curious 🙂

- John

Today’s Sponsor

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.