- Pivot & Flow

- Posts

- December 3rd Market Overview

December 3rd Market Overview

Dec. 3rd Market Overview (no fluff)

Happy Wednesday

Private payrolls dropped 32,000 in November when everyone expected growth. Markets loved it because weak jobs data locks in a Fed rate cut next week.

I'm not convinced celebrating job losses is smart, even if it means cheaper money.

Let's dig in...

P.S. Premium members - I'm breaking down the cash-generating companies sitting under their 200-day averages this week. I'm hunting what actually works when the Fed cuts and volatility returns.

Today's Big Picture

Private Payrolls Contract

ADP reported private payrolls fell 32,000 in November. Small businesses cut 120,000 jobs while large companies added 90,000. Rate cut odds jumped to 89% for next week.

Copper Breaks Records

Copper hit $11,487 per ton, up 30% this year. Traders are rushing shipments into the U.S. ahead of potential tariffs. Smelters are paying miners minus $60 per ton to process ore, which can't last.

IBM CEO Calls Out AI Economics

IBM's CEO said a 1 GW AI data center costs $80 billion to build. With 100 GW announced, that's $8 trillion with "no way you're going to get a return." You'd need $800 billion in profit just to cover interest. Microsoft $MSFT reportedly cut AI sales quotas. Marvell $MRVL and CrowdStrike $CRWD showed the opposite with accelerating demand.

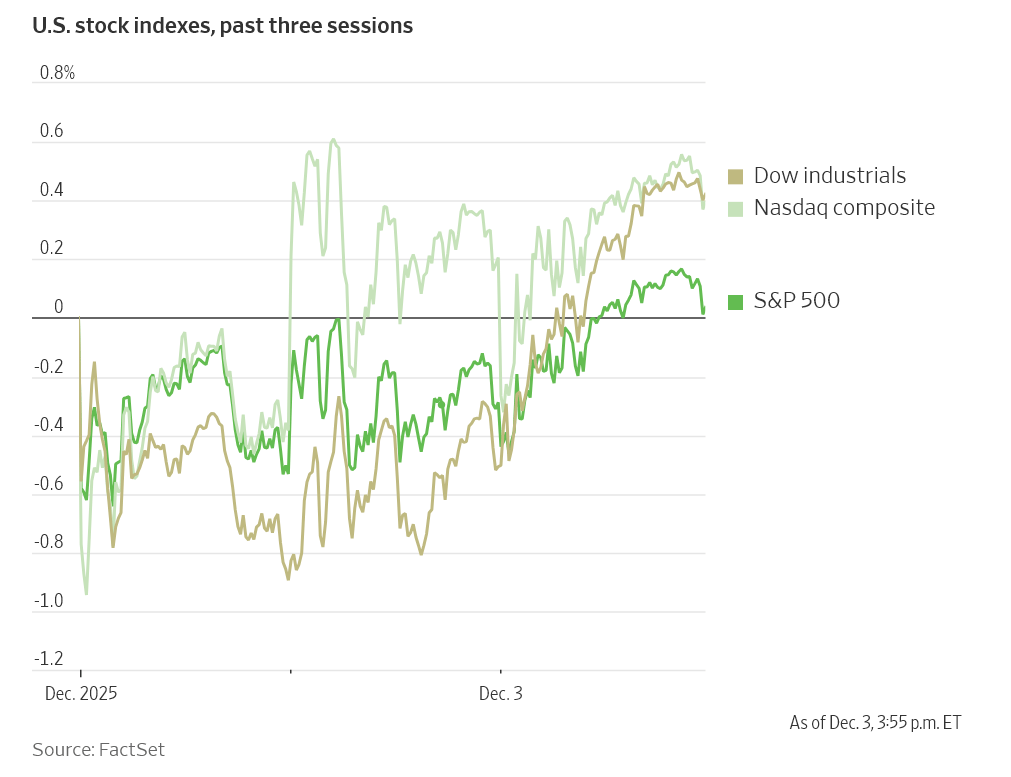

Market Overview

Index Performance

Stock Spotlight

Marvell Technology $MRVL ( ▼ 3.09% )

closed a $3.25 billion deal for Celestial AI's photonic tech. They see 40% growth possible in fiscal 2028 as custom ASIC revenue doubles, implying major Trainium4 orders from Amazon $AMZN.

CrowdStrike $CRWD ( ▲ 4.53% )

posted net new ARR of $265 million, up 73% year-over-year, pushing ending ARR to $4.9 billion. AI demand is driving pipeline to record highs.

American Eagle Outfitters $AEO ( ▼ 13.9% )

beat estimates and raised Q4 outlook. CEO credited Sydney Sweeney and Travis Kelce campaigns for driving traffic.

Macy's $M ( ▼ 0.1% )

raised full-year guidance after beating estimates but the stock fell because the raise was smaller than expected. Upper and middle-income customers keep spending while lower-income shoppers pull back.

Big Name Updates

Apple $AAPL ( ▼ 0.85% )

will ship 247 million iPhones in 2025 per IDC, a record that pushes iPhone revenue near $261 billion.

Netflix $NFLX ( ▲ 0.52% )

opened Stranger Things 5 with 59.6 million views in its first five days, the biggest English language TV debut ever. Stock dropped as investors wait on its Warner Bros Discovery $WBD bid.

Microsoft $MSFT ( ▲ 1.35% )

fell after reports it cut AI software sales quotas then recovered some after the company denied it. Nvidia $NVDA and Broadcom $AVGO fell in sympathy.

Salesforce $CRM ( ▲ 4.3% )

beat on earnings and guided Q4 revenue well above estimates. EPS hit $3.25 versus $2.86 expected. Q4 revenue guidance of $11.13 billion to $11.23 billion crushed the $10.9 billion estimate.

Stock up after-hours but still down 29% on the year.

Other Notable Company News

MicroStrategy $MSTR ( ▼ 4.53% )

is in discussions with MSCI as the index provider considers removing firms that primarily buy cryptocurrencies. MSCI decides by January 15.

Oracle $ORCL ( ▲ 1.59% )

got initiated at overweight with a $280 target. The cost of protecting Oracle's debt hit the highest since 2009, more than triple June levels.

Bristol-Myers Squibb $BMY ( ▼ 2.55% )

rallied after delaying Alzheimer's drug study results. The study tests Cobenfy for psychosis in Alzheimer's patients.

Delta Air Lines $DAL ( ▼ 3.95% )

expects a $200 million Q4 profit hit from the shutdown. Bookings recovered after November softness.

General Motors $GM ( ▼ 3.05% )

CEO Mary Barra said the automaker will keep improving fuel efficiency and emissions even as Trump loosens requirements.

Uber $UBER ( ▼ 1.58% )

CEO visiting Taiwan and Hong Kong next week for the first time.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields fell after weak jobs data. The 10-year sits at 4.065%. Traders now see an 89% chance of a cut next Wednesday.

The dollar is on its worst seven-day slide since July 2020. Hassett favors lower rates and looks set to lead the Fed.

Policy Watch

Fed Chair

Trump canceled interviews scheduled this week with VP Vance

He'll name the next chair in early 2026 with Hassett as the frontrunner

Treasury & Tariffs

Bessent flipped on tariffs, now saying "The president has been right" after previously calling them inflationary. He claims they can implement tariffs regardless of the Supreme Court ruling using alternative legal pathways.

Tax refunds coming Q1 2026

Lutnick blamed weak payrolls on the shutdown and deportations, not tariffs

International

Taiwan's President is seeking $40 billion for military spending as China intensifies drills.

India's rupee hit a record low crossing 90 after the U.S. slapped 50% tariffs. The trade deal remains stuck.

Energy

Natural gas broke $5 per million BTU, first time since December 2022

Energy Secretary Wright says backup generators at data centers could unlock 35 GW of power

Today’s Sponsor

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

What to Watch

November Jobs Report Delayed

The official BLS jobs report won't drop until December 16. The Fed decides next Wednesday with only today's ADP print and Thursday's jobless claims.

Copper Treatment Fees

Smelters are paying miners minus $60 per ton to process ore. That can't last. Either copper stays elevated or supply gets cut. Chinese smelters already reducing output.

PCE Friday

September's PCE hits Friday at 10 a.m. Last inflation read before the Fed's December 10 decision. Any upside kills the cut narrative.

Dollar General Thursday Dollar General $DG

reports Thursday morning, Ulta Beauty $ULTA after close. Confirms if the consumer spending split is real or just Macy's $M talking.

Thanks for reading 🙂

- John

Today’s Sponsor

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Note: This newsletter is intended for informational purposes only.