- Pivot & Flow

- Posts

- December 31st Market Overview

December 31st Market Overview

Dec. 31st Market Overview (no fluff)

Happy Wednesday 🎉

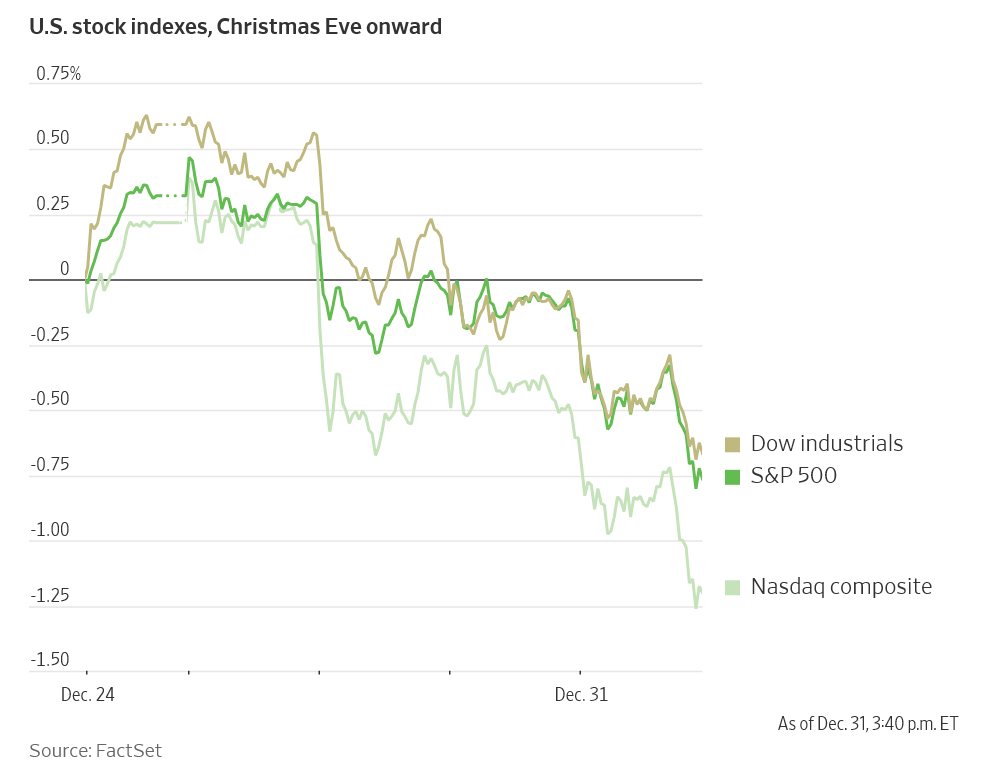

2025 is ending with a bit of a whimper, not a bang.

Stocks sliding on the final trading day despite solid annual gains. I prefer boring finishes to volatile surprises. We had a lot of themes start to play out this year, I’ll make sure to cover that in this weeks Sunday write up. Stay safe tonight and eat some good food!

Let’s dig in...

Today's Big Picture (This Year’s wrap up)

Three Years of Gains, Four Days of Selling

The S&P 500 finished its third straight year of double-digit gains. All eleven sectors closed red today though. Eight winning months in a row… the longest streak since 2017.

Profit-taking before the ball drops.

Precious Metals Had Their Best Year Since 1979

Gold and silver put up numbers not seen since the late seventies. CME raised margin requirements twice this week and prices swung hard. Ken Griffin nailed it earlier this year: investors now treat gold as the safe harbor the dollar used to be. This looks structural, not speculative.

Dollar Posts Worst Year Since 2017

The dollar had its steepest annual drop in eight years. The euro's best year against it since 2017. Goldman expects more weakness in 2026 as German infrastructure spending ramps up. I really think this story is flying under the radar.

Market Overview

Index Performance

Stock Spotlight

Nike $NKE ( ▼ 0.32% )

rose after insiders bought heavily. CEO Elliott Hill and board members Tim Cook and Robert Swan all increased their stakes. Insider buying is the only signal I truly trust.

Western Digital $WDC ( ▲ 0.3% )

finished as the S&P 500's top gainer for 2025. AI storage demand drove hard-drive makers back into favor.

Trade Desk $TTD ( ▼ 0.56% )

earned the unwanted title of S&P 500's biggest loser this year. Missed revenue estimates in February and analyst downgrades sealed it.

Big Name Updates

Alphabet $GOOGL ( ▲ 4.01% )

led the Mag 7 this year. Citizens raised its price target to $385 heading into 2026.

Intel $INTC ( ▼ 1.14% )

ticked higher after Nvidia $NVDA completed a $5 billion equity investment.

Taiwan Semiconductor $TSM ( ▲ 2.82% )

gained after Reuters reported Nvidia asked them to boost H200 production. Chinese orders for 2026 reportedly exceed two million units.

Amazon $AMZN ( ▲ 2.56% )

was the laggard among the megacaps. Single-digit (4.8% YTD) gains while peers ran all year.

Other Notable Company News

Corcept Therapeutics $CORT ( ▲ 1.69% )

fell after the FDA rejected relacorilant for hypercortisolism.

Berkshire Hathaway $BRK.B ( ▲ 0.25% )

marked Warren Buffett's official retirement today. The $300 billion portfolio succession remains unclear.

MicroStrategy $MSTR ( ▲ 1.24% )

finished as Nasdaq's biggest loser despite bitcoin-accumulation moves.

Molina Healthcare $MOH ( ▲ 1.86% )

rose for a fourth straight session after Michael Burry highlighted it.

Clorox $CLX ( ▲ 1.13% )

capped its worst annual decline since 1974.

Constellation Brands $STZ ( ▲ 1.15% )

finished its worst year since 1987.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Jobless claims came in at 199,000 - well below the 220,000 estimate. Claims dropped every week this month. Yields ticked up on the news. The labor market stays stuck in low-hire, low-fire mode, which makes the Fed's job harder heading into 2026. Bond markets closed early at 2pm.

Policy Watch

Trump, Powell, and the Fed

Nominee expected in January

Term ends in May

Watch the 2-year yield for any signs the market thinks Fed independence is actually at risk

So far, bonds don't seem worried.

Yuan Breaks Through 7

China let the yuan strengthen past 7 per dollar for the first time since 2023.

Stronger yuan = cheaper imports for them, pricier exports for us

Could ease some trade friction

More interesting is what it says about Beijing's priorities. They're trying to get their own consumers spending again.

Electricity and the AI Buildout

Power bills rose five points this year. Another four expected in 2026.

Data centers are eating grid capacity

Showing up in utility stock valuations

Already a political liability - played well for candidates in New Jersey and Virginia

The AI boom has a cost and ratepayers are starting to notice.

Today’s Sponsor

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

What to Watch

Manufacturing PMIs

S&P Global releases data Friday. First real data point of 2026 - watch for industrial activity signals.

OPEC+ Meeting

Eight oil exporters meet Sunday to set production levels. Crude had its worst year since 2020 and supply decisions will set the tone for 2026.

Berkshire Succession

With Buffett officially out, watch for signals on who manages the stock portfolio. Some analysts expect Berkshire to scale back active picking given the size and concentration.

That's 2025. See you on the other side. 🙂

- John

Today’s Sponsor

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Note: This newsletter is intended for informational purposes only.