- Pivot & Flow

- Posts

- December 30th Market Overview

December 30th Market Overview

Dec. 30th Market Overview (no fluff)

Happy Tuesday

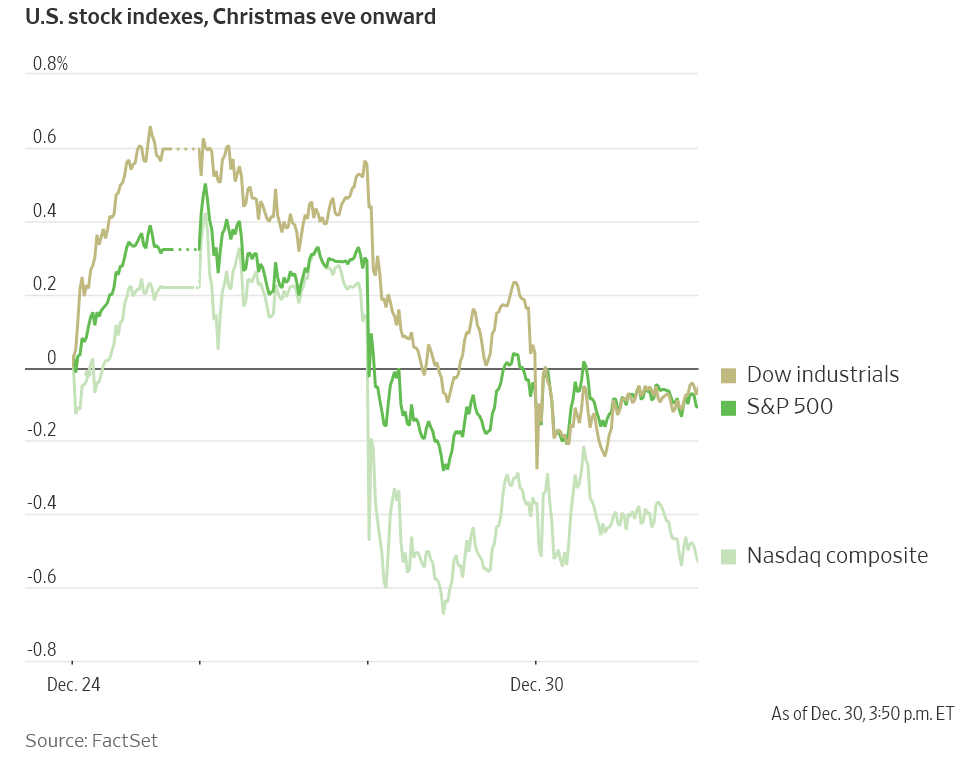

Markets sideways today while the Fed remains fractured on what the heck they want to do next year on rate cuts.

Silver swung wildly again. Precious metals are screaming something about currency confidence that equity markets keep ignoring.

The reality is central banks globally have been buying the shit out of gold all year and I think we're starting to see a real supply squeeze leak into the other precious metals.

Let’s dig in...

Today's Big Picture

The Fed Is More Divided Than the Vote Showed

Three dissents on the December cut… thats the most since Covid in 2019. Several yes votes called the decision "finely balanced." Some want rates frozen "for some time." If you're positioned for more cuts in early 2026, that bet just got riskier.

Silver Is Trading Like a Meme Stock

Biggest one day gain since 2009 after its steepest loss in five years. CME raised margin requirements to cool speculation causing a deleverage yesterday. Same style of move that killed the 2021 Reddit mania. Precious metals are pricing in currency fears that equities are ignoring. One of these markets is wrong.

Copper Signals AI Power Demand Is Structural

London copper hit record highs this month on data center build out and supply disruptions. Generator makers are outperforming the S&P three-to-one selling power equipment to AI infrastructure. The AI trade has expanded beyond chips into industrial metals, utilities, and anything that keeps the lights on. We talked about buying the “shuffles” of the AI infra structure about 5 months ago.

Market Overview

Index Performance

Stock Spotlight

Meta Platforms $META ( ▲ 1.69% )

acquired Singapore-based Manus for over $2 billion. The startup builds general purpose AI agents—Zuckerberg is buying the talent before competitors can.

Applied Digital $APLD ( ▼ 7.9% )

is spinning off its cloud business to merge with Ekso Bionics $EKSO. The market rewards pure-play stories and this separates AI infrastructure from the noise.

Boeing $BA ( ▼ 0.72% )

won an $8.6 billion contract supplying F-15 jets to Israel. Defense revenue remains the one line item immune to economic cycles.

Caterpillar $CAT ( ▼ 0.1% )

is quietly becoming a data center play. Generator sales to power-hungry AI projects are now its fastest-growing segment.

Big Name Updates

Tesla $TSLA ( ▲ 0.03% )

expected to deliver around 422,850 vehicles this quarter versus 495,000 a year ago. The narrative has shifted entirely from car sales to when robotaxis actually arrive.

Eli Lilly $LLY ( ▼ 1.34% )

is targeting early 2026 for its oral weight-loss pill. A pill is infinitely more scalable than a refrigerated injection, which is why the stock holds its valuation.

Berkshire Hathaway $BRK.B ( ▲ 0.25% )

enters 2026 with Warren Buffett stepping down as CEO at year end. Greg Abel takes the wheel.

Exxon Mobil $XOM ( ▼ 2.44% )

touched highs not seen since late 2024. While everyone chases AI, old energy quietly compounds.

Other Notable Company News

Micron $MU ( ▲ 2.59% )

hit all-time highs dating back to its 1984 IPO.

Citigroup $C ( ▲ 0.39% )

got board approval to sell its remaining Russian operations to Renaissance Capital.

Newmont $NEM ( ▼ 2.61% )

rallied hard alongside the metals rebound.

Pool Corp $POOL ( ▲ 1.49% )

was the only S&P 500 stock hitting new 52-week lows today.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Yields held steady even after the contentious Fed minutes dropped. The bond market won't place big bets when the central bank is openly divided. Trading desks close early tomorrow for New Year's Eve… I’m expecting liquidity to vanish by lunch.

Policy Watch

Trump and Powell

Trump called Powell a fool yesterday and confirmed he's interviewing replacements with Bessent. Nominee coming in January, term ends in May. I'd watch the 2-year yield for any signs the market thinks Fed independence is actually at risk. So far, bonds don't seem worried.

Yuan Breaking Through 7

China let the yuan strengthen past 7 per dollar for the first time since 2023. Stronger yuan means cheaper imports for them, pricier exports for us. Could ease some trade friction, but more interesting is what it says about Beijing's priorities—> they're trying to get their own consumers spending again. That's a shift worth watching.

Electricity and the AI Buildout

Power bills rose five points this year, another four expected in 2026. Data centers are eating grid capacity. This is showing up in utility stock valuations and it's becoming a political liability…played well for candidates in New Jersey and Virginia already.

The AI boom has a cost and ratepayers are starting to notice.

Today’s Sponsor

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

What to Watch

Jobless Claims Wednesday

8:30 AM ET. The Fed is laser-focused on labor right now. Any uptick kills the argument for holding rates steady.

Holiday Liquidity Drain

Bond markets close early tomorrow. Volume dries up fast after noon, which usually means jagged, meaningless price action. Don't overreact to afternoon moves.

OPEC+ Meeting Sunday

Eight oil exporters setting 2026 production levels. Crude has been quiet but any surprise cuts would reignite inflation fears right as the new year opens.

Thanks for reading 🙂

- John

Today’s Sponsor

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Note: This newsletter is intended for informational purposes only.