- Pivot & Flow

- Posts

- December 19th Market Overview

December 19th Market Overview

Dec. 19th Market Overview (no fluff)

Happy Friday

Is the Santa Claus rally coming down the chimney?

TikTok threw Oracle an ownership lifeline after a brutal six weeks. Japan just made the most important rate decision in 30 years and the market shrugged. Venezuela and Washington's war drums are legitimately heating up so I'm holding VIX into the weekend because these things can blow up when everyone's checked out for the holidays.

Let’s dig in...

Today's Big Picture

1. Oracle Gets TikTok Deal But Debt Problem Remains

Oracle $ORCL joined the investor group buying TikTok's U.S. operations after getting cut in half over six weeks on concerns about financing its AI buildout with high-interest debt. This locks in a massive cloud customer. But Blue Owl Capital just pulled out of Oracle's $10 billion data center project over those same debt concerns.

2. Japan Ends the Era of Free Money

Bank of Japan raised rates to the highest level in 30 years. Their 10-year yield broke two percent for the first time since 1999. Japanese capital that funded U.S. markets for decades is now reversing course.

3. Nike Shows the Real Cost of Tariffs

Nike $NKE dropped hard forecasting a sales decline as China demand weakens and tariffs compress margins. This is the warning shot for every consumer company importing from Asia.

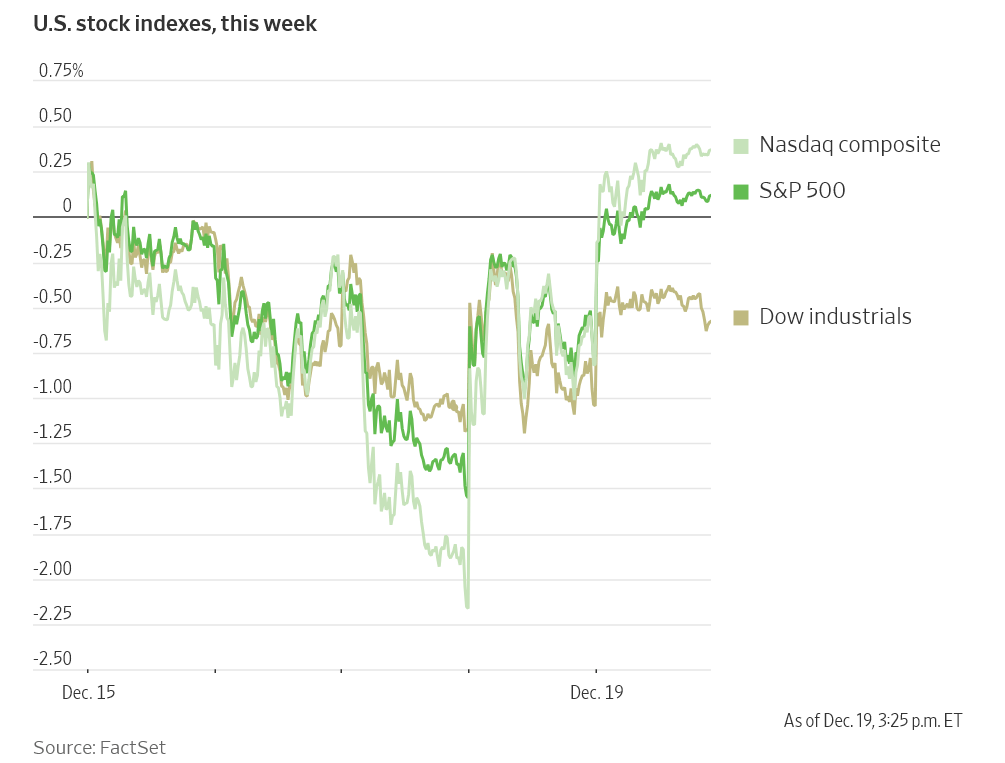

Market Overview

Index Performance

Stock Spotlight

Trump Media & Technology Group $DJT ( ▲ 5.14% )

extended its rally after announcing a merger with nuclear fusion company TAE Technologies valued at $6 billion. It's the Trump family's biggest move into mainstream finance since returning to the White House.

Micron Technology $MU ( ▲ 3.08% )

continued rising after strong revenue guidance. Memory chip supply is constrained while AI demand keeps climbing, pushing prices higher. That's good for Micron but bad for PC and smartphone makers watching build costs surge.

FedEx $FDX ( ▲ 1.45% )

beat estimates but fell anyway. The freight unit is struggling and the company's MD-11 fleet remains grounded after the UPS cargo crash.

Big Name Updates

CoreWeave $CRWV ( ▲ 20.5% )

rallied after joining the Department of Energy's AI research initiative. The stock was cut in half over six weeks on AI bubble fears.

Carnival Corporation $CCL ( ▲ 8.08% )

jumped on record booking volumes for 2026 and 2027 sailings. Consumers keep saying they're worried about the economy then book cruises two years out.

Intuitive Machines $LUNR ( ▲ 18.46% )

climbed after KeyBanc initiated coverage with a bullish target. The space logistics company has been volatile but analyst interest is building.

Other Notable Company News

DraftKings $DKNG ( ▲ 4.31% )

launched prediction markets across 38 states, competing with Kalshi and others in the event-betting space.

Generac $GNRC ( ▲ 6.47% )

upgraded at Wells Fargo on accelerating demand for diesel backup generators at AI data centers. Power infrastructure can't keep up with AI's electricity needs.

Conagra Brands $CAG ( ▼ 1.02% )

said lower gas prices boosted convenience store traffic this year, helping Slim Jim sales. When gas is expensive, drivers fill up and leave. When it's cheap, they go inside for snacks.

Scholastic $SCHL ( ▲ 0.15% )

beat on profit from back-to-school book fairs but shares fell. Market didn't buy the guidance.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury hit 4.15% as Japan's rate hike rippled through global markets. Gold near highs again as currency trust keeps eroding. Today was a record quadruple witching day with $7.1 trillion in options expiring volatility staying kinda calm.

Policy Watch

Fed

New York Fed President Williams said November's inflation report was distorted by the government shutdown - probably pushed CPI down a tenth of a point. The Fed isn't rushing to cut rates. Inflation's still above two percent and they see no urgency.

Drug Pricing

Nine pharma companies including Merck $MRK and GSK $GSK agreed to lower U.S. drug prices to match other wealthy countries. Applies to Medicaid, TrumpRx, and new drug launches. They chose deals over fighting the White House.

Venezuela

The U.S. deployed military forces near Venezuela's coast in November under "Operation Southern Spear." Venezuela responded with nationwide military exercises and cut off gas agreements with neighbors.

This isn't posturing anymore:

Trump doubled the bounty on Maduro to $50 million in August

CIA operations authorized inside Venezuela in October

Venezuela mobilizing troops near the oil-rich Essequibo border with Guyana

Regional leaders warning conflict is imminent

Guyana says the "Zone of Peace is in peril." I'm holding some VIX over the weekend.

International

Central banks are splitting. ECB held rates. Bank of England cut. Russia cut to 16% but called policy restrictive. Mexico cut but signaled a pause. The coordinated policy era is over, everyone's on their own path now.

Today’s Sponsor

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

What to Watch

Third Quarter GDP

Delayed Q3 growth data drops Tuesday. It's ancient history but any big surprise could move markets.

Consumer Confidence

Conference Board index Tuesday. University of Michigan already showed over 60 percent of consumers expect unemployment to keep rising. That's not rally fuel.

Jobs vs Inflation

Watch how markets react to any employment weakness. Unemployment hit a four-year high in November. If the narrative shifts from inflation fears to job loss fears, everything changes.

Santa Claus Rally

The seasonal pattern says stocks rise in the last five trading days of the year plus the first two of January. We're almost in that window. Question is whether this rally survives past the calendar or dies when the seasonal bid disappears.

Thanks for reading 🙂

- John

Today’s Sponsor

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Note: This newsletter is intended for informational purposes only.