- Pivot & Flow

- Posts

- December 17th Market Overview

December 17th Market Overview

Dec. 17th Market Overview (no fluff)

Happy Wednesday

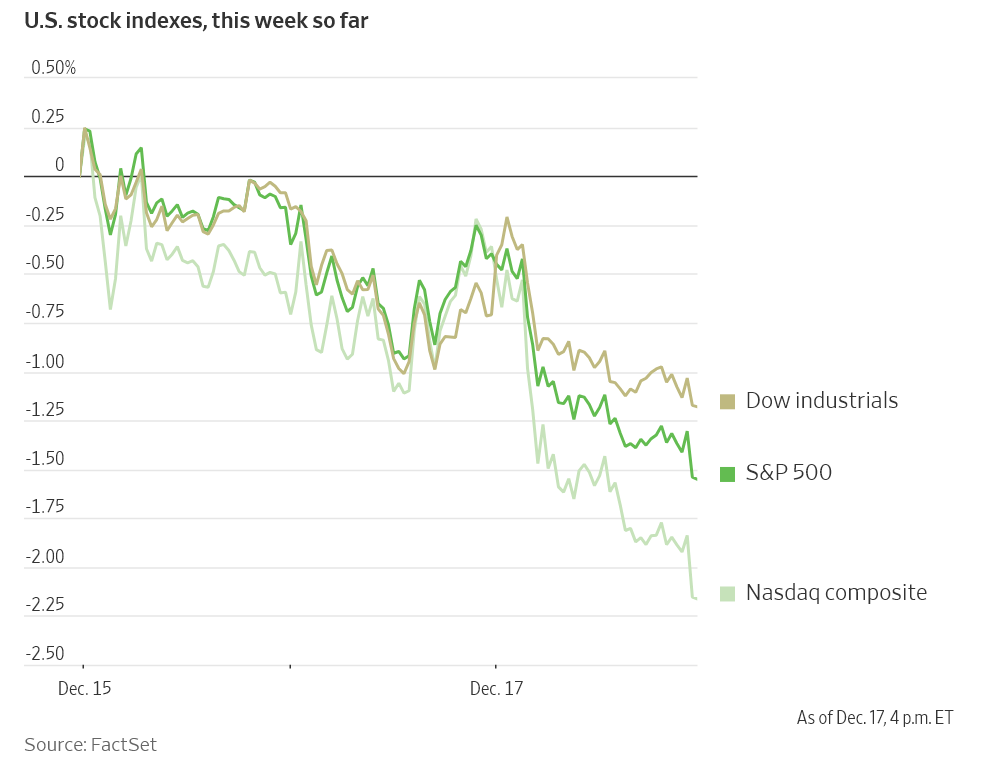

Tech took a beating while oil bounced hard off four-year lows. Oracle financing concerns spread across AI names but honestly that's not what I'm focused on right now.

The president ordered a naval blockade of Venezuelan tankers. This puts 590,000 barrels per day at risk, most flowing to China. A blockade can be considered an act of war under international law and this is now the #1 thing on my radar for my portfolio this week. Markets seem oddly calm but I'm not sure they've fully processed what this means.

Let’s dig in...

Today's Big Picture

Oracle Financing Drama Spreads Across AI Stocks

Oracle dropped after Blue Owl Capital reportedly pulled financing for a $10 billion Michigan data center, citing concerns about Oracle's debt and spending. Oracle disputes it but Broadcom fell in sympathy while Nvidia dropped.

Who actually profits from these infrastructure builds?

Trump Orders Venezuela Tanker Blockade

President Trump ordered a blockade of sanctioned tankers entering and exiting Venezuela, putting roughly 590,000 barrels per day at risk. Most of that oil flows to China. Brent crude topped $60 while WTI traded around $56.50, bouncing from Tuesday's four-year lows. BP and Shell rallied.

Medline Raises $6.3 Billion in Biggest IPO Since 2021

Medline $MDLN priced at $29 and rose in its debut, raising $6.26 billion in the largest U.S. IPO since Rivian. The Blackstone and Carlyle backed medical supplies distributor is valued at $50 billion. First real test of investor appetite for tariff-exposed companies. If it holds, SpaceX and others planning 2026 listings get the green light.

I'm watching Market health closely this week. If you want the same real time structural health signals I'm using, sign up here.

Market Overview

Index Performance

Stock Spotlight

Amazon $AMZN ( ▼ 5.56% )

is in early talks to invest at least $10 billion in OpenAI at a valuation north of $500 billion. Another massive check being written for AI infrastructure.

Tesla $TSLA ( ▲ 3.5% )

got hit by California regulators who gave the company 90 days to change its advertising after a judge found it deceived consumers about Autopilot and Full Self-Driving.

Lockheed Martin $LMT ( ▲ 2.36% )

fell on reports that Trump is weighing an executive order to limit stock buybacks and dividends. The administration wants cash spent on factories and weapons production instead of shareholders.

Warner Bros. Discovery $WBD ( ▲ 2.24% )

board unanimously recommended shareholders reject Paramount Skydance $PSKY hostile bid, calling the Netflix $NFLX deal better.

Hut 8 $HUT ( ▲ 19.29% )

partnered with Fluidstack to build AI data centers for Anthropic, backed by a $7 billion lease starting with 245 MW of capacity in Louisiana.

Big Name Updates

Lennar $LEN ( ▼ 1.17% )

missed earnings as high mortgage rates continue choking homebuilders. Guided for 17,000 to 18,000 Q1 deliveries, below estimates.

Micron Technology $MU ( ▲ 3.08% )

reports after the close today. The memory chip maker's results matter because investors want proof that AI demand translates to actual pricing power.

General Mills $GIS ( ▼ 1.03% )

beat on price cuts to attract budget-conscious shoppers.

UPS $UPS ( ▲ 0.68% )

got access back to the Postal Service's last-mile delivery network. The reversal fixes a 2024 policy that had crushed economics on lightweight residential packages.

Other Notable Company News

Gap $GAP ( ▲ 3.3% )

upgraded to Outperform by Baird, price target $33. Old Navy and Gap brands turned around with seven straight quarters of sales growth.

Ally Financial $ALLY ( ▲ 0.43% )

upgraded to Overweight by Wells Fargo. Auto credit improving, net interest margin expanding, buybacks coming. Reserve release expected in 2026.

QuantumScape $QS ( ▲ 9.15% )

signed a joint development deal with a top 10 global automaker.

Airbnb $ABNB ( ▲ 0.75% )

upgraded to Outperform by RBC, price target $170. The hotel booking expansion should drive more bookings.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year auction cleared without drama, the first since the shutdown. Yields stayed flat on the $39 billion sale. The dollar hit its highest level since August while the pound dropped after UK inflation came in below forecasts. Bank of England cuts rates Thursday.

Tomorrow: delayed November CPI and a $22 billion 30-year auction.

Policy Watch

Fed

Governor Christopher Waller interviewed with Trump today for the Fed chair job. Key points:

Wants more rate cuts, sees room for another full percentage point

Told Trump he'd defend Fed independence

Trump also interviewing Kevin Hassett and Kevin Warsh

White House

Trump ordered a naval blockade of Venezuelan tankers. This puts 590,000 barrels per day at risk, most flowing to China. A blockade is an act of war under international law.

Separately, Trump drafting an executive order to force defense contractors to:

Cut buybacks and dividends

Spend cash on factories and weapons instead

International

Germany approved €50 billion in defense contracts, part of €650 billion through 2030

Google $GOOGL DeepMind CEO Demis Hassabis said AI startups are raising at "tens of billions" valuations before building anything. Called it "bubbles" and warned of a correction coming. I think he's right.

Today’s Sponsor

The Next Gold Rush

Lithium demand’s fueling a modern-day gold rush. Essential for EVs, robots, and AI, Elon Musk said it best: “Do you like minting money? Well, the lithium business is for you.” Enter EnergyX. Their tech can recover up to 3X more lithium than traditional methods. They’ve secured a strategic investment from General Motors, raised $150M+, and earned a $5M DoE grant. Join 40k+ people as an EnergyX investor.

Energy Exploration Technologies, Inc. (“EnergyX”) has engaged Nice News to publish this communication in connection with EnergyX’s ongoing Regulation A offering. Nice News has been paid in cash and may receive additional compensation. Nice News and/or its affiliates do not currently hold securities of EnergyX.

This compensation and any current or future ownership interest could create a conflict of interest. Please consider this disclosure alongside EnergyX’s offering materials. EnergyX’s Regulation A offering has been qualified by the SEC. Offers and sales may be made only by means of the qualified offering circular. Before investing, carefully review the offering circular, including the risk factors. The offering circular is available at invest.energyx.com/.

What to Watch

November CPI Thursday

Delayed inflation data finally drops. If it runs hot, Fed rate cuts get priced out. If it cools, cuts stay on the table.

Venezuela Blockade

Trump ordered a blockade of sanctioned tankers entering and exiting Venezuela. Puts 590,000 barrels per day at risk, most headed to China. Watch for Chinese response and whether this escalates further.

2026 IPO Calendar

Medline's performance sets the tone. SpaceX and Anthropic are watching. A flop kills momentum. Success brings the flood.

Thanks for reading 🙂

- John

Today’s Sponsor

Turn AI Into Extra Income

You don’t need to be a coder to make AI work for you. Subscribe to Mindstream and get 200+ proven ideas showing how real people are using ChatGPT, Midjourney, and other tools to earn on the side.

From small wins to full-on ventures, this guide helps you turn AI skills into real results, without the overwhelm.

Note: This newsletter is intended for informational purposes only.