- Pivot & Flow

- Posts

- December 11th Market Overview

December 11th Market Overview

Dec. 11th Market Overview (no fluff)

Happy Thursday

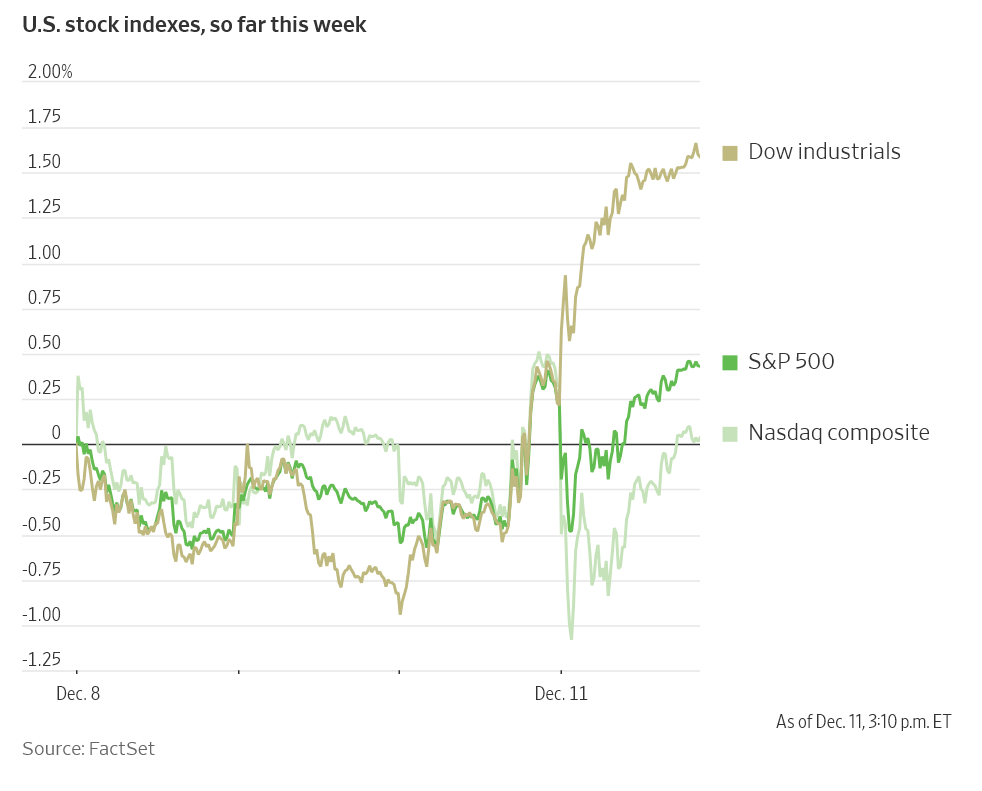

Oracle spooked tech investors while the Dow hit new records. I think we're watching the AI trade's first real rotation with money flowing into some “safety” names. No, I do not think the AI trade is over or close to it.

Right now more then ever, I’m paying attention to fundamentals.

Catch obvious flags by running your top holding through the Equity Research Terminal tonight I personally built.

Don’t get caught in any surprises. That’s exactly why I built this.

Let’s dig in...

Today's Big Picture

Oracle Scares the Tech Trade

Oracle raised full-year capex to $50 billion, up $15 billion from prior guidance. Larry Ellison lost $34 billion on paper. Investors are worried that the AI bill is coming due before the profits arrive.

Old Economy Strikes Back

The Dow and Russell 2000 hit new all-time highs while Nasdaq fell. Money rotated into banks, industrials, and small caps. Visa $V ( ▲ 1.47% ) jumped after Bank of America called it "a great business on sale." The rotation looks real w/ real money behind it today.

Disney Bets Big on AI

Disney invested $1 billion in OpenAI and licensed over 200 characters for ChatGPT and Sora videos. Same day, Disney sued Google for massive copyright infringement. Hollywood is making peace with AI on its own terms.

Market Overview

Index Performance

Stock Spotlight

Oracle $ORCL ( ▼ 2.19% )

revenue miss wasn't the problem. Raising capex to $50 billion for data centers was. Markets are asking if any of this spending pays off.

Eli Lilly $LLY ( ▲ 0.03% )

reported Phase 3 results for its next-gen obesity drug. Patients on 12mg lost 28.7% body weight over 68 weeks - roughly 71 pounds. Knee pain dropped 76% versus 40% on placebo.

General Motors $GM ( ▲ 1.6% )

hit all-time highs dating back to its 2010 IPO.

Cisco $CSCO ( ▼ 0.67% )

broke its March 2000 price record after 25 years. AI data centers need better plumbing.

Big Name Updates

Visa $V ( ▲ 1.47% )

got upgraded to buy at Bank of America. Trading at its lowest relative multiple in 10 years.

Nvidia $NVDA ( ▲ 0.52% )

fell with other AI names despite CEO saying demand climbed meaningfully. He confirmed involvement in xAI's financing. Markets ignored it.

Meta $META ( ▲ 10.41% )

saw Instagram U.S. time spent up over 20% for October and November. Stock fell anyway on the AI rotation.

Adobe $ADBE ( ▼ 2.65% )

beat expectations and guided for double-digit revenue growth in 2026. Stock barely moved.

Other Notable Company News

Disney $DIS ( ▲ 1.84% )

invested $1 billion in OpenAI. Disney characters can now appear in Sora videos.

Alphabet $GOOGL ( ▲ 0.67% )

fell over 2%, worst among Mag-Seven. Disney sued them for copyright infringement the same day Disney announced the OpenAI deal.

Ciena $CIEN ( ▼ 1.47% )

crushed earnings. Revenue hit $1.35 billion versus $1.29 billion expected. Guided 2026 revenue to $5.7-6.1 billion versus $5.53 billion consensus.

Coca-Cola $KO ( ▲ 0.51% )

CEO James Quincey stepping down in March. COO Henrique Braun takes over.

Rivian $RIVN ( ▼ 0.2% )

dropped after shareholders weren't impressed by Autonomy & AI Day.

Ford $F ( ▲ 1.3% )

ending battery partnership with SK On. SK takes Tennessee. Ford takes Kentucky.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year yield dropped to 4.11% from 4.16% Wednesday. Two days of relief rallies after the Fed cut. Treasury buyers believe Powell's jobs concerns more than they believe in rate hikes.

Policy Watch

Fed

Powell said Wednesday that job growth might actually be negative in recent months. Three officials dissented on the rate cut - most since September 2019. Chicago's Goolsbee wanted to hold steady. New Governor Miran wanted a half-point cut.

Jobless claims spiked to 236,000 for week ended Dec 6, up 44,000 from prior week

California, Illinois, and New York saw biggest jumps

Continuing claims fell sharply to 1.84 million

Fiscal & Trade

Treasury Secretary Bessent proposing major changes to Financial Stability Oversight Council. New approach pushes for looser regulation instead of the tightening stance of recent years.

Trump said the rate cut "was a small number that could have been more."

U.S. trade deficit fell to $52.8 billion in September, lowest monthly level in five years.

International

Mexico approved tariffs of 5%-50% on 1,400+ products from Asian countries without trade deals. Chinese cars face the 50% rate starting next year. This matters as Mexico prepares for free-trade deal review with U.S. and Canada.

Swiss National Bank held rates at 0% but signaled openness to cuts that would push rates below zero. Turkey cut rates less than expected despite inflation above 30%.

Trump "Gold Card" launched, offering U.S. residency for $1 million.

Today’s Sponsor

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

What to Watch

Broadcom Earnings Tonight This determines if Oracle's weakness is company-specific or sector-wide. Guidance matters.

Costco Results After Close Any weakness would matter heading into holidays. Watch membership renewal rates.

Gold Breaking Records Gold back up above $4k . Citadel's Ken Griffin said investors now view gold as the safe-harbor the dollar used to be. I think this is structural.

Small Caps Breaking Out Russell 2000 scored second straight record. These names finally have momentum.

Thanks for reading 🙂

- John

Today’s Sponsor

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Note: This newsletter is intended for informational purposes only.