- Pivot & Flow

- Posts

- December 10th Market Overview

December 10th Market Overview

Dec. 10th Market Overview (no fluff)

Happy Wednesday

The Fed cut rates again as we all expected, but three officials voted no. Most internal division in six years. Powell said they've reached 'neutral' territory, which means the autopilot cuts are over. Indices pushing into new high’s td off confirmed fed cut.

Maybe the Santa rally is on? I’m paying close attention to the Market Health Dashboards breadth section.

Let’s dig in...

Today's Big Picture

Fed Cuts With Three-Way Split

The 9-3 vote is the headline. Chicago's Goolsbee and Kansas City's Schmid wanted to hold. Fed governor Stephen Miran pushed for a half-point cut. First three-way dissent in six years. Powell said rates hit "neutral" aka they're done cutting unless something breaks.

Power Infrastructure Boom Continues

GE Vernova $GEV doubled its dividend and raised 2028 guidance to $52 billion. Sitting on 80 gigawatts of turbine orders. Data centers need power right now, but turbines take years to install/buildout. This manufacturing lag is likely the target for Bezos's new company, Project Prometheus.

Trump Picking Next Fed Chair

Trump interviewing final candidates this week. Kevin Warsh met Wednesday. Kevin Hassett is the favorite. Hassett said he won't bend to political pressure on rates. Powell's term ends May.

Market Overview

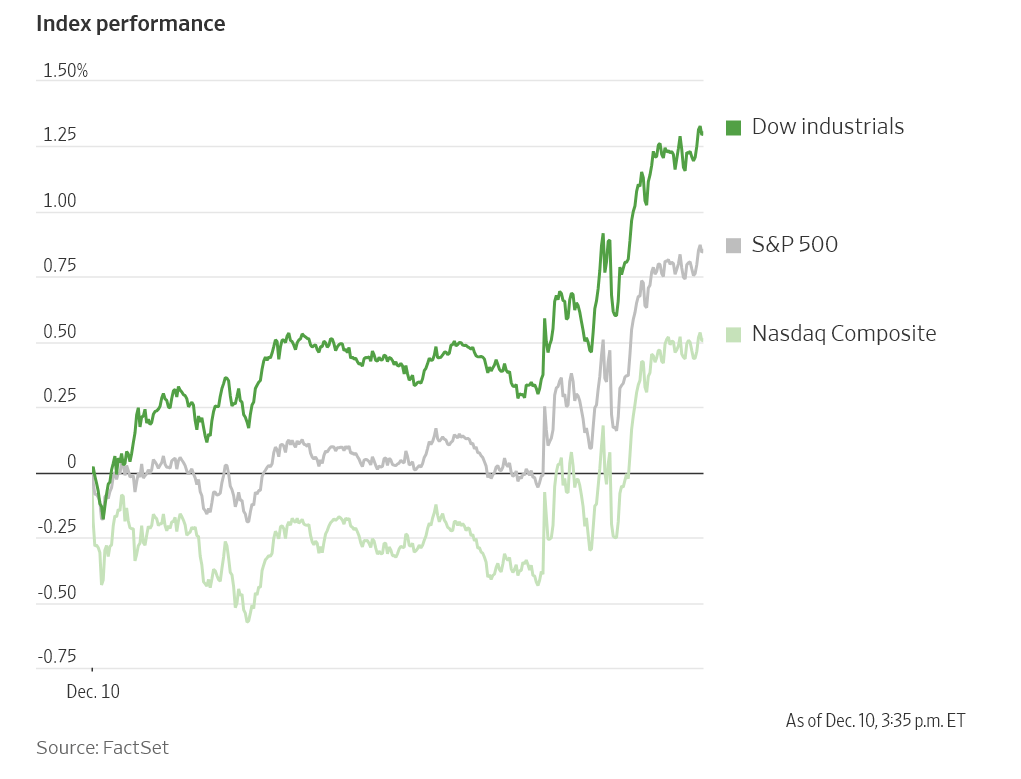

Index Performance

Stock Spotlight

EchoStar $SATS ( ▼ 11.39% )

rallied on news it's selling spectrum licenses to SpaceX for space-based AI data centers. Morgan Stanley upgraded to overweight, $110 target. As a pure seller, EchoStar wins from wireless competition without carrier downside.

Palantir $PLTR ( ▼ 4.47% )

landed a $448 million Navy contract to manage nuclear submarine supply chains through ShipOS. Defense infrastructure getting deeper.

AeroVironment $AVAV ( ▼ 5.95% )

revenue up 151% year over year, mostly from a recent acquisition. Margins took a hit, but book-to-bill sits at 2.9x.

Big Name Updates

Oracle $ORCL ( ▼ 4.38% )

reports after the close. Debt-fueled AI spending spree continues. Larry Ellison is backing his son David's hostile takeover bid for Warner Bros Discovery $WBD.

Nvidia $NVDA ( ▼ 0.56% )

built location verification software for its chips to track which country they're operating in. Aims to stop China smuggling. Chinese tech firms like Alibaba $BABA want H200 supply and clarity on orders.

Amazon $AMZN ( ▼ 1.59% )

investing $35 billion in India by 2030 for AI infrastructure, logistics and exports. Already spent $40 billion since 2010. Microsoft $MSFT put $17.5 billion into India yesterday.

Other Notable Company News

Roche $RHHBY ( ▲ 5.24% )

reported positive Phase 3 results for a breast cancer pill that cut death or disease risk by 30%.

GameStop $GME ( ▼ 2.96% )

quarterly revenue fell across hardware, accessories and software.

Chewy $CHWY ( ▼ 2.35% )

posted mixed results and weak sales guidance.

Uber $UBER ( ▲ 2.08% )

rolling out ride-booking kiosks at airports without needing the app. First one at LaGuardia Terminal C.

Salesforce $CRM ( ▼ 7.04% )

Argus raised earnings estimates, kept buy rating and $360 target.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year yield rose to 4.19% despite the Fed cutting rates. $22 billion 30-year auction tomorrow. Dollar hit its highest level since August.

Policy Watch

Federal Reserve

Powell said they're at "neutral" and can wait. The dot plot shows one more cut in 2026. Futures markets say two or more, 68% probability. Someone's wrong.

Powell blamed tariffs for sticky inflation, calling it a "one-time price level shift." Fed's job is stopping one-time jumps from becoming permanent problems.

The Fed starts buying $40 billion in Treasury bills Friday. Reserve management, not stimulus.

Trade

U.S. Trade Rep Jamieson Greer wants Congress to legislate tariff increases permanently. He said lawmakers like the revenue. Called it "real money."

On USMCA renegotiation: U.S. could exit entirely, split into two separate deals, or add side agreements. Everything's on the table.

International

China inflation split: consumers up 0.7%, producers down 2.2%. Consumers barely escaped deflation while factories get crushed.

Bank of England likely cuts next week. ECB probably holds. Bank of Japan might hike to 0.75%.

Today’s Sponsor

The Biggest Real Estate Reset Since 2008

Commercial real estate hasn’t been this discounted in over a decade.

Commercial properties are now selling for up to 40% below recent values. It’s the perfect storm of higher interest rates and $4.7T in debt coming due.

And it’s creating a rare opening for investors who know how to move fast.

With 20 years of experience and $2.75B in real estate volume, they’re buying income-producing assets at deep discounts.

You can share in this opportunity too. AARE plans to pay out at least 90% of their REIT income to investors in dividends*, plus you can get up to 15% bonus stock in AARE by investing today.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

What to Watch

Broadcom Thursday

Broadcom $AVGO reports after the close. Watch data center revenue. The company is moving into Nvidia $NVDA's AI territory. Guidance matters more than the quarter.

Adobe Tonight

Adobe $ADBE reports after the close. Just added three apps to ChatGPT. Does AI integration actually drive subscriptions or is it defensive?

CPI Next Week

Inflation data decides the January Fed meeting. Sticky prints lock in a pause. Softer prints reopen the door.

Thanks for reading 🙂

- John

Today’s Sponsor

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Note: This newsletter is intended for informational purposes only.