- Pivot & Flow

- Posts

- Dec. 2nd Market Overview

Dec. 2nd Market Overview

December 2nd Market Overview (no fluff)

Happy Tuesday

The panic didn’t last. Tech has rallied, and rate cut odds for December 10 jumped to 89% from 30% two weeks ago with no major data change between.

Feels like investors are more scared of missing a year-end santa rally than managing actual risk. All it takes is Nvidia up and everyone forgets risk exists.

Let's dig in...

P.S. Premium members - I'm breaking down the cash-generating companies sitting under their 200-day averages this week. I'm hunting what actually works when the Fed cuts and volatility returns.

Today's Big Picture

AI Infrastructure Demand Accelerating

Credo Technology $CRDO posted revenue of $268 million, up 272% and beating estimates by 14%. The company makes chips and cables connecting AI training clusters. Next quarter guidance beat by a similar margin. AI capex is showing up in actual earnings, not conference slides.

Fed Rate Cut Now 89% Likely

Rate cut odds for December 10 jumped from 30% in mid-November to 89% today with no major data change between. Insurance cuts worked in 1995 and 2019 but preceded disasters in 2001 and 2007. The difference: are we avoiding a recession or already entering one?

Bitcoin Rebounds But Volatility Returns

Alternative assets are important to pay attention too.

Bitcoin climbed back above $90,000 after its worst day since March. Eric Trump-backed American Bitcoin Corp crashed as insider shares unlocked. The token is still down over 20% from recent highs. When bitcoin and stocks sell off together then rally together, that's deleveraging and short covering, not demand.

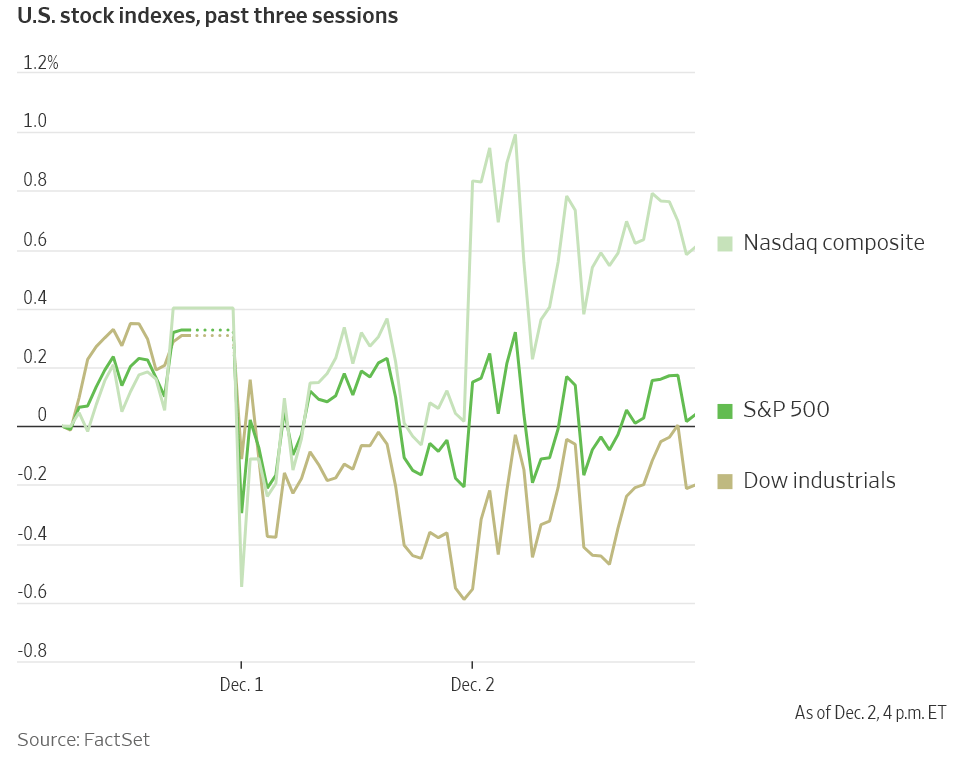

Market Overview

Index Performance

Stock Spotlight

MongoDB $MDB ( ▲ 6.42% )

jumped after beating earnings and raising full-year guidance. Earned $1.32 per share versus expectations of 80 cents. AI demand showing up beyond chips.

Boeing $BA ( ▼ 2.31% )

had its best day since April. CFO said the company expects positive free cash flow in 2026 and will deliver more jets next year from production, not old inventory.

Warner Bros Discovery $WBD ( ▲ 0.18% )

gained after second-round bids came in from Comcast $CMCSA, Netflix $NFLX, and Paramount $PSKY for its assets.

Procter & Gamble $PG ( ▼ 2.72% )

hit two-year lows after CFO warned the U.S. consumer is getting more volatile. Government shutdown and SNAP benefit cuts are hitting wallets.

Big Name Updates

Tesla $TSLA ( ▼ 0.1% )

shipped 86,700 vehicles from Shanghai in November, the second-highest monthly total this year. The company also hired a former Apple robotics scientist for its Optimus team.

Apple $AAPL ( ▼ 0.85% )

hit all-time highs. John Giannandrea, head of Machine Learning and AI Strategy, is retiring in spring 2026.

Alphabet $GOOGL ( ▼ 0.74% )

watched OpenAI CEO Sam Altman declare code red on ChatGPT quality. Google's Gemini AI model has leapfrogged rivals on benchmark tests.

Nvidia $NVDA ( ▲ 0.16% )

invested $2 billion in Synopsys $SNPS for chip design tools. CEO Jensen Huang confirmed AI computing demand has climbed meaningfully over the past six months.

Other Notable Company News

Maplebear $CART ( ▲ 0.49% )

fell after Amazon $AMZN ( ▲ 0.98% ) announced ultra-fast grocery delivery tests in Seattle and Philadelphia. Deliveries in 30 minutes or less.

Beta Technologies $BETA ( ▼ 4.75% )

rose after Eve Air Mobility announced a deal worth up to $1 billion over 10 years to buy motors. Eve has a backlog of 2,800 vehicles.

Scholastic $SCHL ( ▲ 1.93% )

agreed to sell its New York headquarters to Empire State Realty Trust $ESRT for $386 million.

XPO $XPO ( ▼ 3.85% )

fell after November tonnage dropped with shipments also down. Freight data keeps flashing yellow.

Cloudflare $NET ( ▲ 3.45% )

gained after Barclays initiated coverage with an overweight rating on its network dominance.rose after Morgan Stanley initiated with overweight. Generation equipment secured through 2028.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The Fed ended Quantitative Tightening today after draining reserves since mid-2022. The Standing Repo Facility saw $26 billion in usage on December 1st - second highest since COVID. Banks paying above market rates for reserves means the Fed drained liquidity too far.

The 10-year yield finished at 4.087%. Japanese 30-year bond yields hit record highs before retreating after a solid auction.

Policy Watch

Fed

Rate cut odds for December 10 sit at 89%, up from 30% in mid-November despite no major data change. Powell faces a divided group: four favor a cut, five lean against, three unclear.

Quantitative Tightening

QT ended today. Standing Repo Facility usage hit $26 billion - banks are scrambling for reserves the Fed drained too aggressively.

Trump Administration

Trump announced "Trump Accounts" - $1,000 Treasury deposits for kids born 2025-2028. Michael and Susan Dell pledged $6.25 billion to expand the program, adding $250 for kids 10 and under born before 2025. Parents can contribute up to $5,000 annually, employers can add $2,500 tax-free. Kids access the money at 18.

Tariffs & Trade

South Korea gets tariff cut to 15% from 25%, retroactive to early November

Hyundai and Kia rallied on the news

Companies warning delayed tariff impacts could force 2026 headcount cuts

China expanded rare earth export licenses after U.S. trade truce

International

Bank of England cut capital requirements for UK banks from 14% to 13%. First real easing of post-2008 crisis buffers.

Today’s Sponsor

8 Weeks to Real Estate Investment Confidence

Join a global network of 5,000+ professionals in the Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate.

In just 8 weeks, learn from top firms, collaborate on real-world case studies, and gain skills that last.

Save $300 with code SAVE300 + $200 with early enrollment by January 12.

What to Watch

Fed Decision December 10 Markets pricing 89% odds of a cut. The question isn't if they cut, it's what Powell says about January. Door open for another cut means rally. Signal a pause means tech stumbles.

Salesforce Earnings This Week

CRM $CRM reports later this week. Watch for commentary on enterprise software spending into 2026.

Japan Rate Hike

Bank of Japan governor said another rate hike could come this month. Japan raising while the Fed cuts creates divergence that hits currency markets and carry trades.

November Jobs Report December 16

Data will show if the labor market is softening or stabilizing heading into year-end.

Thanks for reading 🙂

- John

Today’s Sponsor

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Note: This newsletter is intended for informational purposes only.